Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.19%

(0% / flat from this time last week, 30-yr mortgage)

This week, we’re talkin’ 2026 predictions! My favorite article of the year to write.

Home prices? Interest rates? Inflation? Softening labor market? Economic Collapse? I have thoughts. No crystal ball needed, I take a gander at the data, what’s likely ahead and tell you what I’m prepping for and what to be skeptical of.

Plus, a few spicy hot takes you won’t want to miss.

Let’s get into it.

The Weekly 3 in News:

The home insurance shock isn’t over yet. Forecastors are pricing in another +8% in 2026, followed by +8% increase in 2027 (ResiClub).

Housing construction costs are starting to decrease. “Direct construction costs in the fourth quarter decreased by approximately -2% from Q3 [2025] and -5% year-over-year. This downward trend will continue as we move into the first quarter of 2026 (Lennar co-CEO Jon Jaffe/ResiClub).”

Gas prices are below $2.75 in half of US states, and below $2 in 10 states. Anecdote from my trip this weekend:

Welcome to 2026!

I was on a long roadtrip the past 4 days, what did I miss…. Holy hell!

Gas prices have hit terminal velocity, gold is trading like bitcoin, a ‘democratic socialist’ is running the world’s financial hub, the Japanese stock market is actually investible, there is a child care fraud in the Minnesota Somali community that is…. checks notes… larger than the GDP of Somalia, and we snatched a South American dictator in his jammies.

“Are you not entertained!?”

Wow, what a start to the year.

So what’s next for the world in 2026?

Never fear; I have thoughts.

2026: It’s Going to be a Banger.

It’s the first week of 2026, and once again, I’m giving out my solicited advice for you lucky Skeptical Investors.

Don’t worry, I’ll keep it concise so you can get back to it.

A Tale of 2 Everything

So without further ado, here are my predictions for the year (as well as a few other thoughts slamming around in my noggin).

Home prices stagnate for the first half as the final wave of apartment housing supply comes on the market. As you can see below, much of the supply growth we saw as a result of 2020 Zero Interest Rate Policy will soon be done.👇

Rents will lag 6 months behind, meaning 2026 will be a “lost year” for landlords (flat rates) and a boon for renters (no rent increases). However, starting in January 2027, rents will rise, marking a sharp upward trend, driven by positive economic tailwinds and fewer housing units coming on the market. Some “early rebounds” will likely be seen in higher-supplied markets like: Houston, Portland, Minneapolis, Dallas, San Antonio, Denver, and Nashville, which all peaked below 2017-19 supply averages last year (Parsons).

Inflation hits the Fed’s 2% target. The Fed finally gets religion, admitting that inflation is at its target of 2% and no longer the primary economic threat. This will take 6-9 months to come to realize, so forget a January interest rate cut. Frankly, we are already at target. Inflation is skewed by housing costs, with a 35% weight, and virtually all private housing analytics companies are showing rents decreasing, not increasing 3% as the government’s lagging BLS data is still showing. This is not accurate, as I wrote about the other week. So I don’t see the Fed cutting rates until after Powell is out the door in May. Further, it is now clear to me that tariff policy is/was not inflationary, despite “one-time price” events on many goods, as the Fed now admits. Any lingering effects should be through the economy by mid-2026, further boosting economic growth.

Mortgage interest rates fall below 6%! Yay! But, not until after Fed Chair Jerome Powell is out in May. Booooo! The bond market won’t come to the rescue either, as investors wait to buy long bonds until after inflation is “officially” quelled and we are in the worand final tightening of interest rate spreads. Longer term rates are likely settle around 5.25%-5.5%, so if you are waiting for that 3% or 4% mortgage, well don’t. We are close to the terminal rate, so adjust your numbers accordingly as you underwrite your next real estate deal.

Mortgage applications pick up, as more and more folks become ok with a mortgage that starts with a 6 handle. After 3 years of higher interest rates, we now have more people with rates higher than 6%, than a 3% mortgage. ~6% is the new normal, and this will finally normalize in prospective homebuyers’ minds. Caveat: If we get under 6%, all these numbers accelerate. We are already seeing this in the numbers. Hot Tip: Housing economist Logan Mohtashami is my north star here, highly recommend a follow.

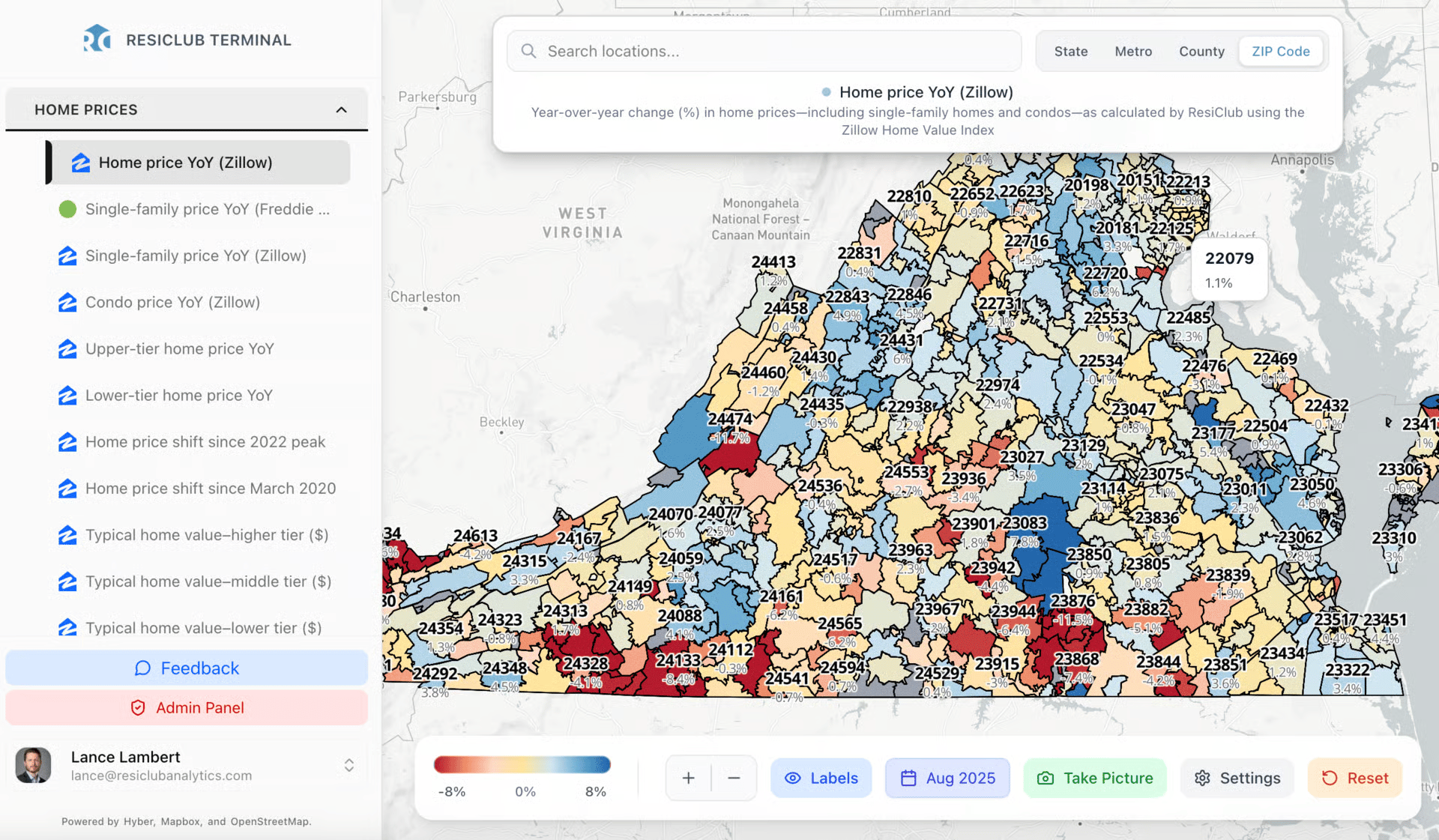

A Quick Ad Break….ResiClub Housing Analytics

Want the best housing data? Look no further than the new ResiClub Terminal. It’s the Bloomberg Terminal, for real estate professionals.

ResiClub is proud to introduce the ResiClub Terminal—a powerful new platform that brings together housing market data, analytics, and insights at the metro, county, and ZIP Code level—alongside our housing reporting and research.

Whether you’re evaluating a new land deal, modeling housing demand, tracking investor activity, or advising clients, the ResiClub Terminal helps you make better, faster, and more informed decisions.

And this is just the start—we’ll add much more analysis, data, and tools over time.

The ResiClub Terminal isn’t just a data platform—it’s the foundation for everything we’re building next. Future tools designed for this audience—like local market scorecards, forecasting dashboards, and interactive reports—will all live within the ResiClub Terminal environment.

Our goal is simple: to give housing investors, professionals, and executives the data and clarity they need to prepare for 2026, 2027, and beyond.

You can check out the ResiClub Terminal here!

Want to advertise to the more than 30,000+ weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

2026 Outlook Continued

Mortgage Refinancing UP. It may be obvious, but bears mentioning. Massive home price appreciation + 3 years of high interest rates means a LOT of homeowners are waiting to cash in. Aggregate home equity is at an all-time high; mortgage holders ended 2025 with more than $17.3 trillion in home equity, of which $11.2 trillion is tappable. WOW. With interest rates normalizing, 2026 will be the Year of the Refinance, as folks cash-out some of that tax-free money. Plus, those who purchased in the last 3 years likely have a mortgage rate at or above 7%, meaning it now makes sense for 1.7 million homeowners to refinance to a lower rate. Every day, this number increases. Hot Tip: the math makes financial sense to refinance if you can reduce your mortgage rate by at least .75% (ICE).

According to ice. Mortgage monitor. 1.7 million more mortgages are in the money meaning it would be financially beneficial to refinance now to a lower rate y at least .75 percent

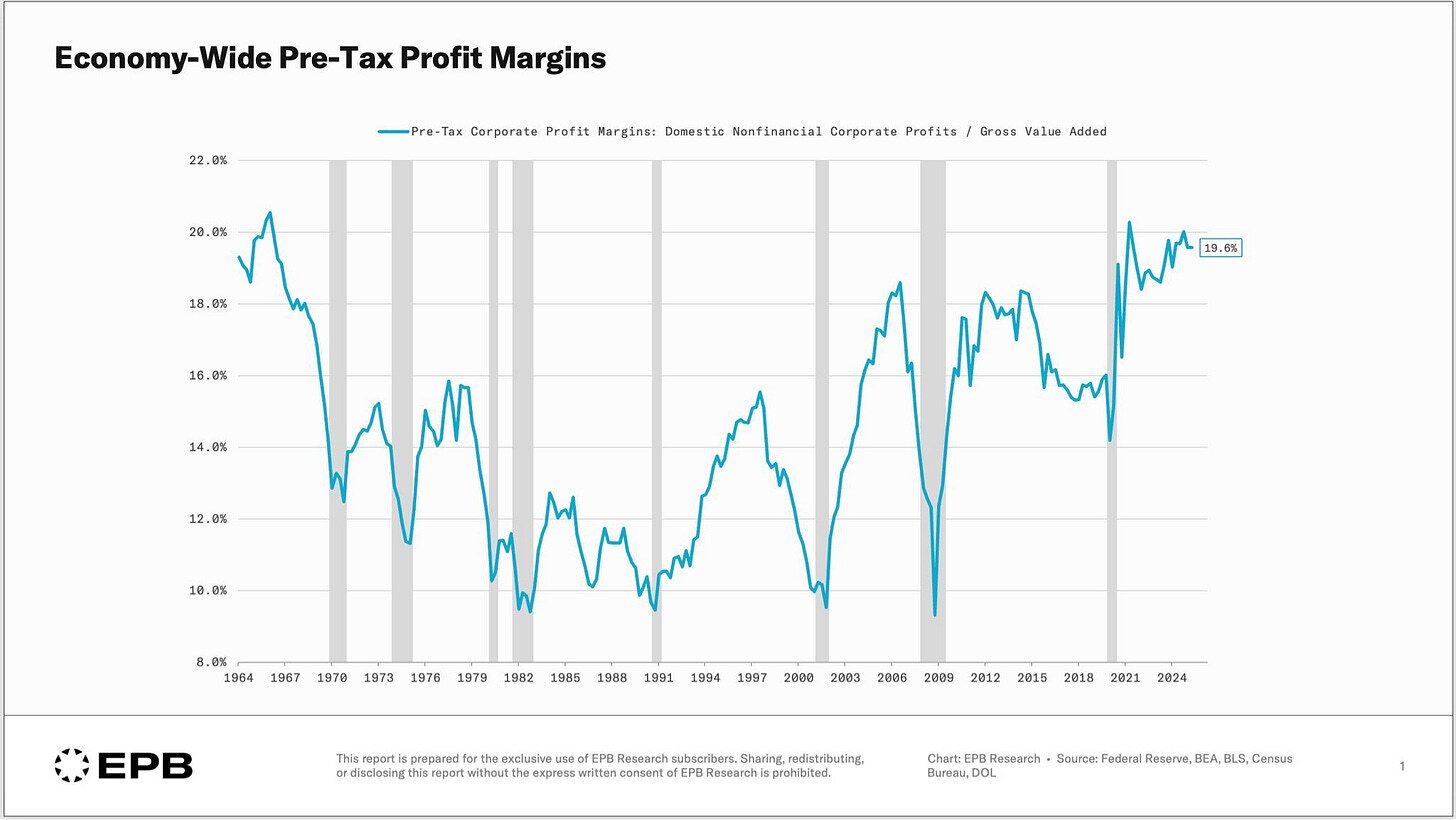

Labor Market: “No Hire No Fire.” 2026 will NOT be a year of mass firings from AI, as the talking heads can’t stop proclaiming. However, we will see a continued weakness in hiring, especially for educated “to be” white-collar workers. So far, that data supports this trend. Unemployment will tick up, but this will be a normalizing, not a softening trend, back to 5-5.5%, which historically is considered Full Employment. Better pick up a hammer boys; my subcontractors are some of the richest young folks I know. Great chart by EPB Research.

Hot Take on Jobs: I’m skeptical of the “soft market softening” talk. Much of the labor market reductions were more likely companies using AI as a smoke screen scapegoat to cull or freeze headcount, as a result of overzealous overhiring during the Zero Interest Rate Policy COVID. We have been at historically low unemployment for just too long for this to be normal. True, hiring has been “soft” but so far, we have no large reductions, except for federal government workers, which ballooned in October as many federal workers took advantage of buyout offers to retire.

GDP is going to go Boom. The AI industrial revolution continues and accelerates in 20206 with massive capital investments by all the big players, further improving economic productivity. Company profit margins continue at an all-time high (EPB). Come April, expected corporate and unexpected lower-end taxpayer tax refunds will be spent back into the economy as companies take advantage of new tax capital-intensive industrial investment tax depreciation and consumers spend that money burning a hole in their pocket. Hold on to your hats. In the second half of 2026, we will enter an economic slipstream.

Anecdote: AI is starting to do real-world work. Much like the industrial revolution did with mechanization, factories are accelerating their mechanized productivity, this time, via autonomous robots. This past week, Boston Dynamics showed off its new Atlas humanoid robot working inside Hyundai's car factory, sorting roof racks, picking up heavy objects, and doing real work. Autonomously. It’s starting to get real (60 Minutes).

A Quick Ad Break….RentRedi

Ready to Take Your Property Management to the Next Level?

Enter RentRedi. Built by landlords, for landlords

Inspired by people like you, RentRedi makes managing properties smarter, simpler, and more human. Many members of our team also own and manage rental properties.

Plus, The Skeptical Investor readers get $100 off. Click this referral link and take it for a test drive today.

My Skeptical Take:

Sponsored

Money Masters

Money Masters Is Your Source For Money News.

As I said earlier, I was on a long road trip back home this past weekend and listened to a lot of real estate-related podcasts, interviews, news articles, and AI summaries (still not that great but trending better).

And I mean a lot.

The messaging was clear and obvious:

“Prices are too high.”

“This can’t last.”

“This market has to go down.”

“This is not sustainable.”

It’s clear everyone is reeling from price shock, mixed with higher interest rates.

There’s one problem.

I was exclusively listening to discussions from 2019.

That’s right. I wanted some context for what they heard was thinking today, and it is dead on what folks are complaining about today.

Absolutely eerie.

I continued.

I picked a few more to listen to from 2018, 2017, and 2016.

And guess what?

Same damn complaint.

In fact, I couldn’t find anyone talking about how easy and affordable housing was.

Ever.

Maybe it was in our grandparents’ lives, but not in this generation.

Affordability difficulties are as old as time.

And its always been a tale of two cities, half can afford and half can’t. Everyone complains. Hell I do, and I’m not hurtin.

And remember what happened post-2019?

Prices went up 50% more!

So what’s the moral of the story?

Yes it’s true prices are “high.” But, it will be the same story in the medium/long term.

So don’t let the perfect be the enemy of the good.

Get a pencil and paper and write out an investment plan with a deadline and goals right now. Don’t wait.

Most people spend more time planning their next vacation than they do their life, let alone the next year.

You know it’s true. And because people need to be reminded more than tought, here is your reminder for 2026.

Start making moves. Put that money to work. Invest.

I choose real estate.

Because what you don’t change, you choose.

Choose to change in 2026.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. If you need a little push, here is my new book! It is a MUST for all real estate investors. The 5 Ways Real Estate Investors Make Money and Build Wealth: Anyone can create wealth through real estate. Including You! (yes yes, it’s a shameless plug, but we authors make ~$1/book, FYI. This is about education!). So pick your copy up today!

Please Share this Article!

We have passed 40,000 subs! Thank you for your support, next stop, 50,000!

Please help grow the community!

It takes me several hours to write this weekly article, and they will always remain free (but you get some pretty cool perks with premium, including a one-on-one with yours truly :). All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you want, a cookie? 😅

Subscribe Today! (and get some amazing perks)

Paid subscribers get the best stuff! Join the Skeptical Investor Community to access:

Premium content and NO paywall,

Every article we have published - a treasure trove of information and education,

Conversations with other investors in the Skeptical Investor community, and future meetups and special events,

Key insights and predictions on the latest financial news,

PLUS, subscriptions include an annual one-on-one call with me personally. So make sure to take advantage! Subscribe today.

Just $5 bucks a month.👇

Ready to Start Investing in Real Estate? Know someone who does?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great real estate deals, as well as manage their rental properties, here in Nashville, TN. We pride ourselves on being tough negotiators. We want our clients to get an amazing deal, we never let our clients pay retail.

Enjoying this newsletter? Know somebody looking to buy real estate? Send them to the best in the business, THE Nashville Investor Agent! Referring real estate business helps us keep the lights on and me keep pushing out fresh real estate analysis each and every week. Help peep this newsletter going for all you awesome folks out there; refer someone to us when you may hear they are in need. We promise to take great care of them and make sure they get a fantastic deal. They will thank you for it.

If you or someone you know are looking for an investment property, give us a call today!

You can also find out more about us and what we offer on our website: www.NashvilleInvestorAgent.com

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. We have the lowest unemployment rate of the top 25 major cities and folks are moving here to take those jobs. Nearly 90+ people per day move to Nashville. And tourism continues to hit record levels. This past year 16.8 million folks visited our lively city. Plus we have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, no state income tax… to name a few amazing advantages. Come check us out, the water is warm :).