Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

This week, we’re talkin’ the news de jour, I analyze the potential for a 50-year home mortgage. The good, the bad, and the ugly.

Let’s get into it.

Today’s Interest Rate: 6.34%

(Flat from this time last week, 30-yr mortgage)

The Weekly 3 in News:

Housing company Roam partners with OpenDoor to facilitate assumable mortgages, allowing you to assume the (lower) mortgage rate of the current homeowner (Roam).

First-Time Home Buyer Share Falls to Historic Low of 21%, Median Age Rises to 40 (NAR).

Nashville News - Ray Nashville tower development in downtown Nashville is starting to take shape. Construction crews have made it past the first half of Ray Nashville, a distinctive 32-story residential tower. (CityNowNext).

A 50-year Mortgage?

I woke up to the same headline everywhere:

“President proposes 50-yr Mortgage!” (or some subset of that line).

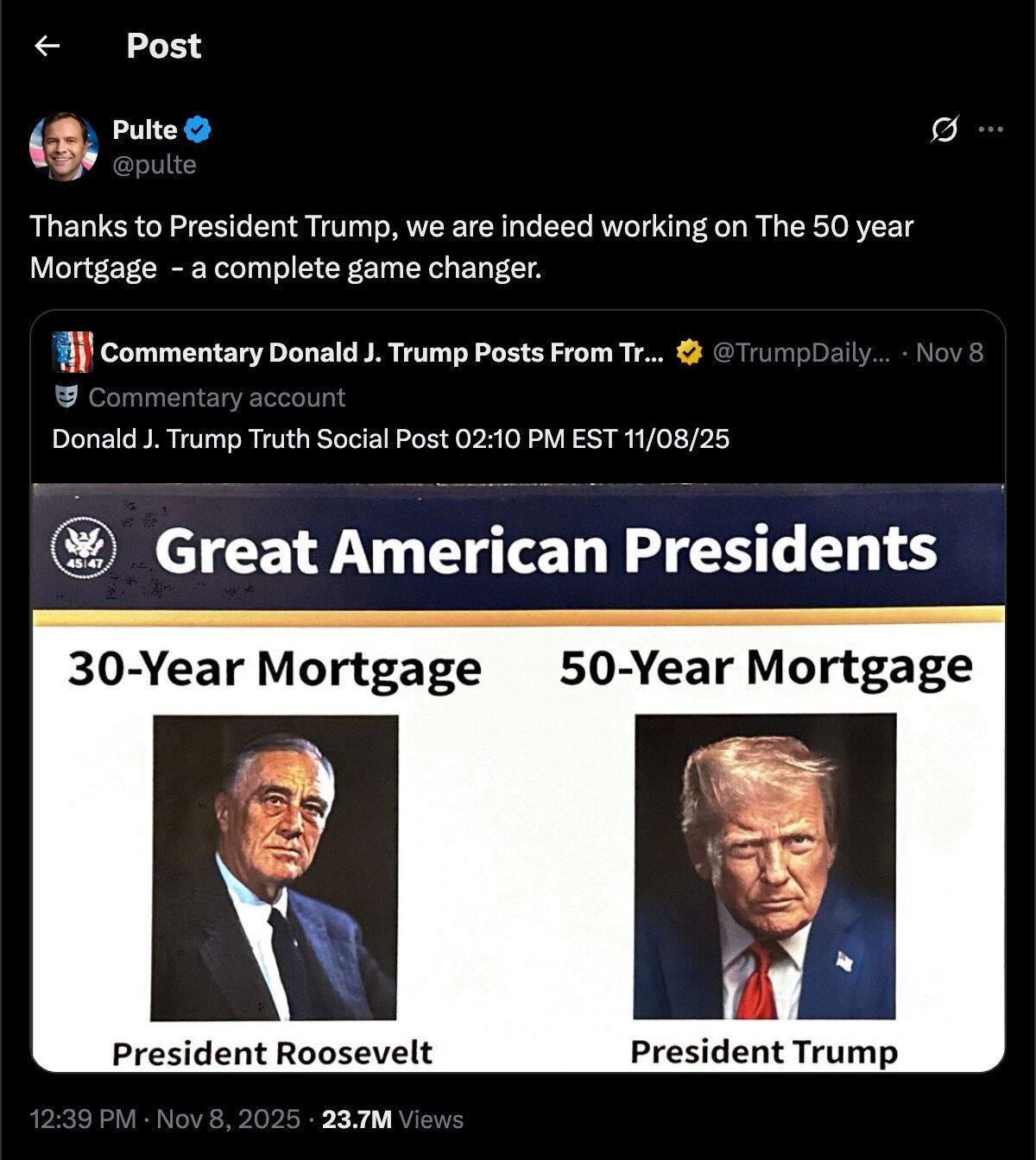

This, after the President posted this online:

And FHFA director Pulte followed suit:

In response, Fortune, Wall Street Journal, etc., basically wrote the same article.

And analysts, pundits, people online all collectively lost their minds in outrage…

Here is my favorite:

“Disgusting!!!!”

Wow, R-E-L-A-X bro.

Crash Expert: “This Looks Like 1929” → 70,000 Hedging Here

Mark Spitznagel, who made $1B in a single day during the 2015 flash crash, warns markets are mimicking 1929. Yeah, just another oracle spouting gloom and doom, right?

Vanguard and Goldman Sachs forecast just 5% and 3% annual S&P returns respectively for the next decade (2024-2034).

Bonds? Not much better.

Enough warning signals—what’s something investors can actually do to diversify this week?

Almost no one knows this, but postwar and contemporary art appreciated 11.2% annually with near-zero correlation to equities from 1995–2024, according to Masterworks Data.

And sure… billionaires like Bezos and Gates can make headlines at auction, but what about the rest of us?

Masterworks makes it possible to invest in legendary artworks by Banksy, Basquiat, Picasso, and more – without spending millions.

23 exits. Net annualized returns like 17.6%, 17.8%, and 21.5%. $1.2 billion invested.

Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

So, Why 30 years?

Why is this the standard and not 35, or 47, or 75, or hell,,, let’s just do 100?

It reminds me of that Something About Mary scene:

“Think about it, you walk into the video store, you see eight-minute abs sitting there, there's seven-minute abs right beside it, which one you gonna pick, man?!”

“Unless someone comes up with 6 minutes abs, then you’re in trouble, eh?”

“No, it’s 6, not 7!”

Well, like the movie, there really isn’t a totally right answer.

It was a way to increase homeownership through demand post World War II (remember this for later). And we kept it.

Now, the 30-year mortgage has become tradition in America.

And we like it.

And, while it may be what most households choose, it is still an option. There are plenty of other mortgages one can choose, from adjustable-rate mortgages (yes, they still very much exist) to a fixed 15-year mortgage. Also popular.

Remember, we're unique in having a 30-year mortgage that is fixed. And frankly, we are fairly lucky to have it, as I have written about before.

Most countries do not have a fixed long-term mortgage product option to purchase a home. This forces them to often put more money down to hedge against a correction in their financial markets, spiking interest rates because, again, their rates are normally not fixed, especially not for 30 years.

Not Japan, not Canada, Not the UK…

And the reason we have this standard 30-year product is that the Federal Government subsidizes it, mainly by having Fannie Mae and Freddie Mac purchase these loans from the originating banks, which they then hold to term, so the banks can then make more loans, and again sell them back to Fannie and Freddie. This also makes these loans popular on the secondary market to investors via mortgage-backed securities.

This is the system we have and it works pretty well, especially since 2008-2010, when we implemented stringent mortgage laws, most notably, the qualified mortgage law of 2010, which essentially says you have to afford the mortgage to get it (for some crazy reason this was not required before then and is one of the reasons why a housing bubble became a worldwide financial crisis).

So what do I think?

I think…We did it!

We finally found something on which everyone can agree. Vehemently agree.

It appears that everyone hates this.

Too funny…

And why did this even come up?

We all know the answer: Affordability.

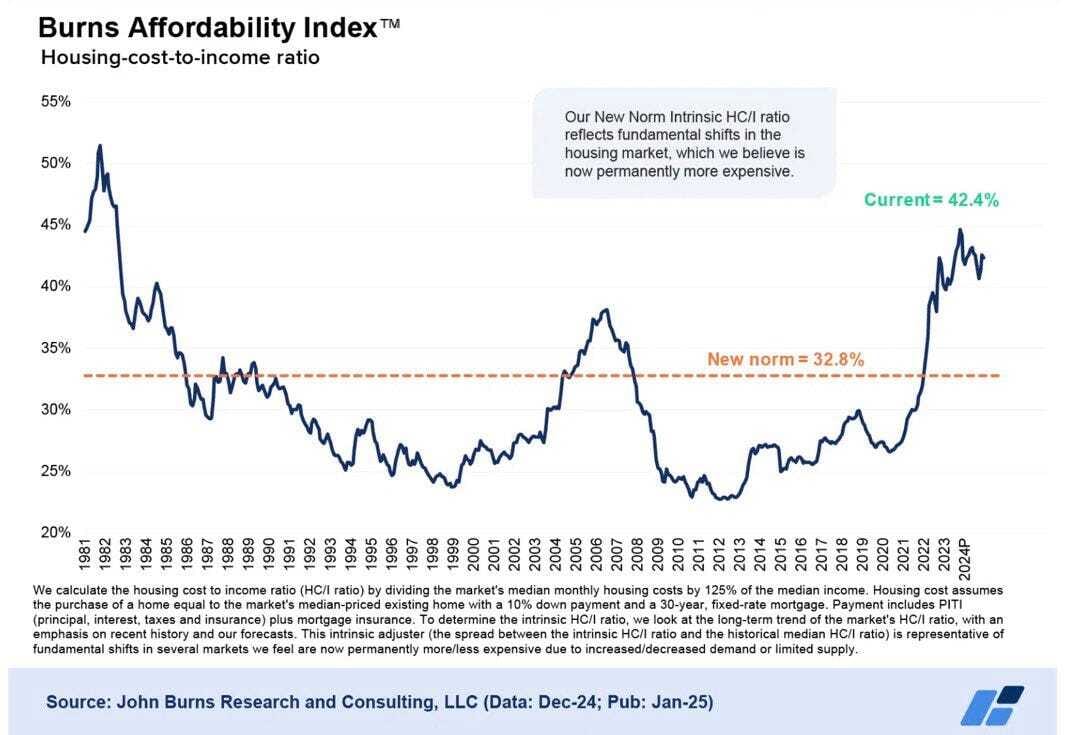

Homes (and many other everyday items too) are very unaffordable these days, historically unaffordable, in fact.

Why?

As I have written about many times before, the federal government printed $13 trillion in response to COVID.

Insane. Hope they never do that again.

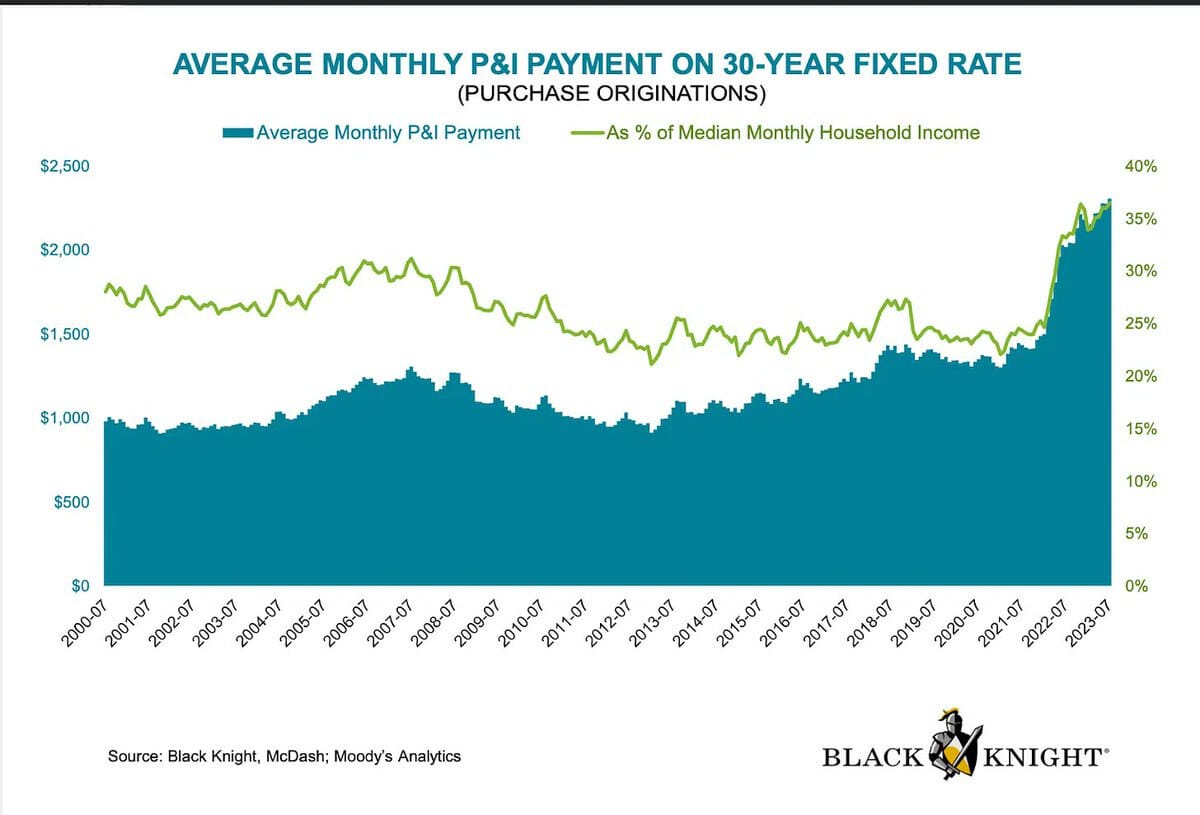

As a result, prices spiked. The average age of first-time homeownership is now 40 years old, and home prices spiked 40%+ since 2020, so quickly that we are back above 2006 affordability levels (see below).

But this is NOT 2006, I’m not drawing that comparison at all.

I am, however, comparing it to the late 70s/early 80s.

In fact, home price affordability was lower then, than what we are seeing today.

A lot higher.

Again, it’s all about affordability. What’s that monthly payment?

Affordability is likely the reason voters decided to elect the incoming mayor in New York this week.

It’s a big deal and the primary cost in one’s life.

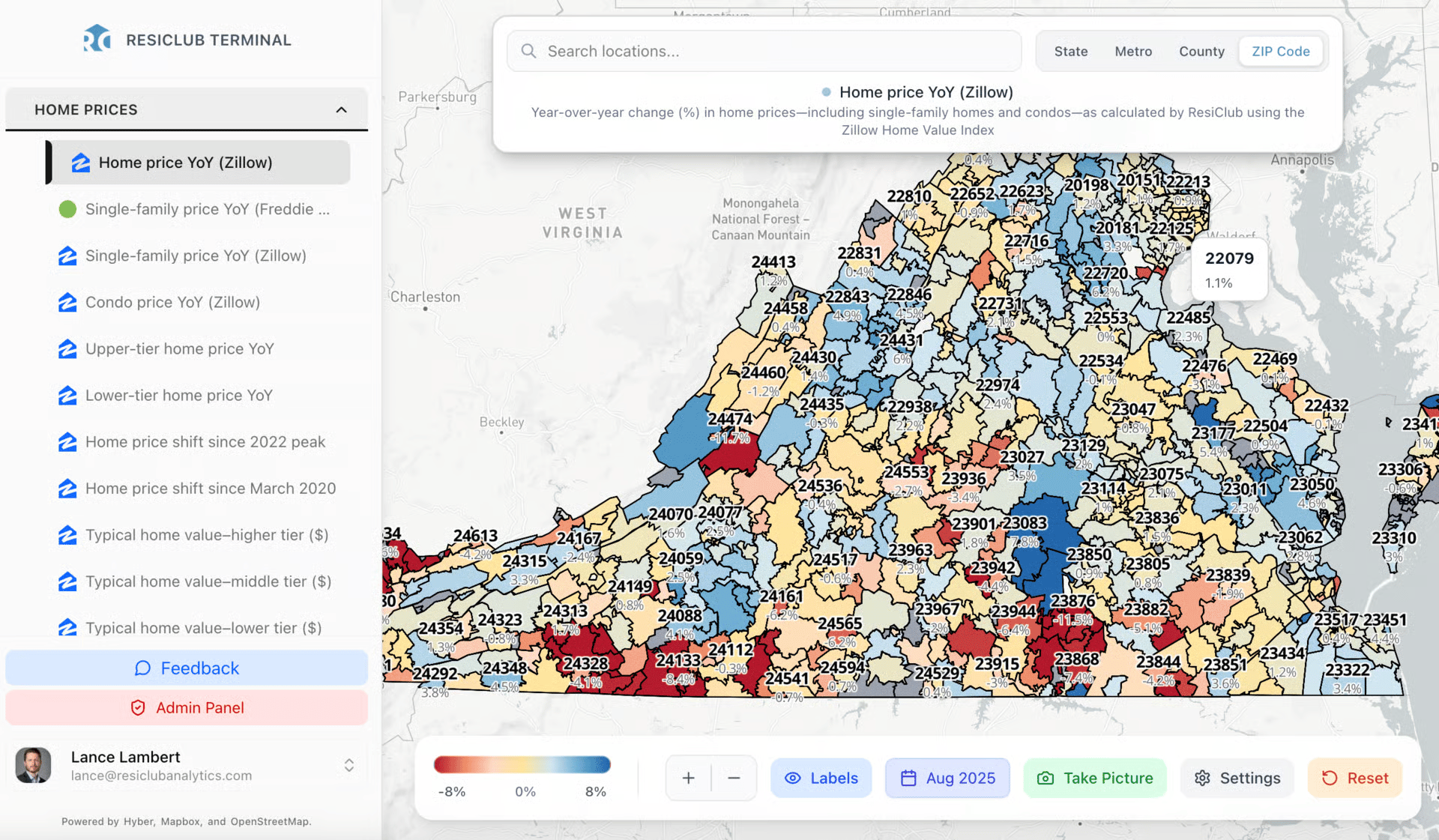

A Quick Ad Break….ResiClub Housing Analytics

Want the best housing data? Look no further than the new ResiClub Terminal. It’s the Bloomberg Terminal, for real estate professionals.

ResiClub is proud to introduce the ResiClub Terminal—a powerful new platform that brings together housing market data, analytics, and insights at the metro, county, and ZIP Code level—alongside our housing reporting and research.

Whether you’re evaluating a new land deal, modeling housing demand, tracking investor activity, or advising clients, the ResiClub Terminal helps you make better, faster, and more informed decisions.

And this is just the start—we’ll add much more analysis, data, and tools over time.

The ResiClub Terminal isn’t just a data platform—it’s the foundation for everything we’re building next. Future tools designed for this audience—like local market scorecards, forecasting dashboards, and interactive reports—will all live within the ResiClub Terminal environment.

Our goal is simple: to give housing investors, professionals, and executives the data and clarity they need to prepare for 2026, 2027, and beyond.

You can check out the ResiClub Terminal here!

Want to advertise to the more than 30,000+ weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

But seriously, my thoughts?…

So should we essentially boost government subsidies for home ownership?

My Skeptical Take:

Well, the housing market is already highly subsidized with the 30-yr loan program via Fannie and Freddie, as well as in the tax code. You get a ton of tax benefits when you own a home, and even more when you are a landlord providing homes to others.

This is why real estate is a fantastic investment vehicle, and why I even write this damn newsletter.

But I digress…

In my opinion, this is likely not a great idea for most people; it can add a little more risk to the equation.

Why?…

Well, a longer mortgage duration does not really make housing affordable.

And it may also:

Feed price appreciation/inflation further through expanded demand, which woudl just exacerbate the current problem,

Slow home equity (wealth) accumulation, which is how many households generate wealth, kind of on accident just by holding their home which acts as a forced savings vehicle,

Leaves households more exposed if prices fall significantly.

Of note, this is a BIG “if.” Home prices have only crashed once in our lifetimes, and that was the Great Financial Crisis, which was based on a variety of problems and regulatory issues. I was there in Congress at the time, helping to author those laws. But again, you never know. The crash was deeper and the recovery was longer because everyone had borrowed too much, and this would grow the amount of leverage/debt for households.

We don’t need it, the risks are only to the upside.

Instead, Federal Government, please get interest rates down, remove regulatory burden and incentivize business to grow the economy so income outpaces prices over the long term.

This is the (only) way to get to affordability.

The Cause for Concern is Only if Systemic

So I worry that if many many many people use this product and we do have a housing crisis again, it could spread into a systemic issue. Whereas if this is really a more boutique product for very few people to afford a home, I would not have that concern, so it could be a potential option for folks.

And nobody is forcing you to do it; the proposal is an option.

And guess what, back in 2005, California tried this!

And, shocker, it didn’t work.

Lenders in California, with government encouragement, offered 40 and 50-year loan programs to help with the wild unaffordability of homes.

And the message and reasoning back then was eerily the same as today.

Affordability.

But it didn’t help.

The product was not widely adopted by lenders, mostly because 1) the folks that would want them already couldn't afford a 30-year mortgage, and 2) because lenders couldn't turn around and sell them to Fannie and Freddie (more on that below), so they could issue more loans. They would be saddled with this 50-year product, making them far less money than if they could continue to pump out new loans at market rate and collect fees.

But they were offered, more frequently as a last resort, through loan modification programs to help distressed homeowners avoid foreclosure during the crisis.

One legal issue with a proposed nationwide 50-year mortgage.

Mortgages with terms longer than 30 years generally do not meet the guidelines for “qualified mortgages”. This means they cannot be sold to government-sponsored enterprises like Fannie Mae and Freddie Mac, making them riskier and less attractive for most lenders, since they cannot turn around and sell them off their books so they can make new loans (which is how banks make money).

Thus, this new 50-year loan would technically be illegal for Fannie and Freddie to subsidize under the 2010 qualified mortgage law.

That’s why FHFA Director Pulte chimed in on social media, supporting the President’s proposal. FHFA is the regulator for Fannie and Freddie. They would have to change the rules, likely with Congress’ help (although that last requirement is unclear).

But, is there a time when a 50-year mortgage may be a good idea?

Yes.

Hell, if rates are back below 5% in the future, and there isn’t a long period of prepayment penalty assessed. I would absolutely dive headfirst to catch a 50 year mortgage, especially on an investment property.

Yes, please.

But is there a good reason to have this subsidized product offered and widely available?

No.

More debt for those who can’t afford it is not the answer. 50 years is a long time to work to pay off that home.

So in other words, 7-minute abs is good enough.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. If you need a little push, here is my new book! It is a MUST for all real estate investors. The 5 Ways Real Estate Investors Make Money and Build Wealth: Anyone can create wealth through real estate. Including You! (yes yes, it’s a shameless plug, but we authors make ~$1/book, FYI. This is about education!). So pick your copy up today!

Please Share this Article!

We have passed 30,000 subs! Thank you for your support, next stop, 40,000!

Please help grow the community!

It takes me several hours to write this weekly article, and they will always remain free (but you get some pretty cool perks with premium, including a one-on-one with yours truly :). All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you think I was going to send you a Starbucks gift card? 😅

Subscribe Today! (and get some amazing perks)

Paid subscribers get the best stuff! Join the Skeptical Investor Community to access:

Premium content and NO paywall,

Every article we have published - a treasure trove of information and education,

Conversations with other investors in the Skeptical Investor community, and future meetups and special events,

Key insights and predictions on the latest financial news,

PLUS, subscriptions include an annual one-on-one call with me personally. So make sure to take advantage! Subscribe today.

Just $5 bucks a month.👇

Ready to Start Investing in Real Estate? Know someone who does?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great real estate deals, as well as manage their rental properties, here in Nashville, TN. We pride ourselves on being tough negotiators. We want our clients to get an amazing deal, we never let our clients pay retail.

Enjoying this newsletter? Know somebody looking to buy real estate? Send them to the best in the business, THE Nashville Investor Agent! Referring real estate business helps us keep the lights on and me keep pushing out fresh real estate analysis each and every week. Help peep this newsletter going for all you awesome folks out there; refer someone to us when you may hear they are in need. We promise to take great care of them and make sure they get a fantastic deal. They will thank you for it.

If you or someone you know are looking for an investment property, give us a call today!

You can also find out more about us and what we offer on our website: www.NashvilleInvestorAgent.com

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. We have the lowest unemployment rate of the top 25 major cities and folks are moving here to take those jobs. Nearly 90+ people per day move to Nashville. And tourism continues to hit record levels. This past year 16.8 million folks visited our lively city. Plus we have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, no state income tax… to name a few amazing advantages. Come check us out, the water is warm :).