Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.81%

(👇.17% from this time last week, 30-yr mortgage)

Today, we’re talkin’ confusion in the market, a little trade war fun (I couldn’t resist), and how the real estate market is enduring the tumult…and, if you don’t give up after that, I do a little Tennessee corner. Some great local data for you local folks and investors interested in Nashville, TN.

Let’s get into it.

The Weekly 3 in News:

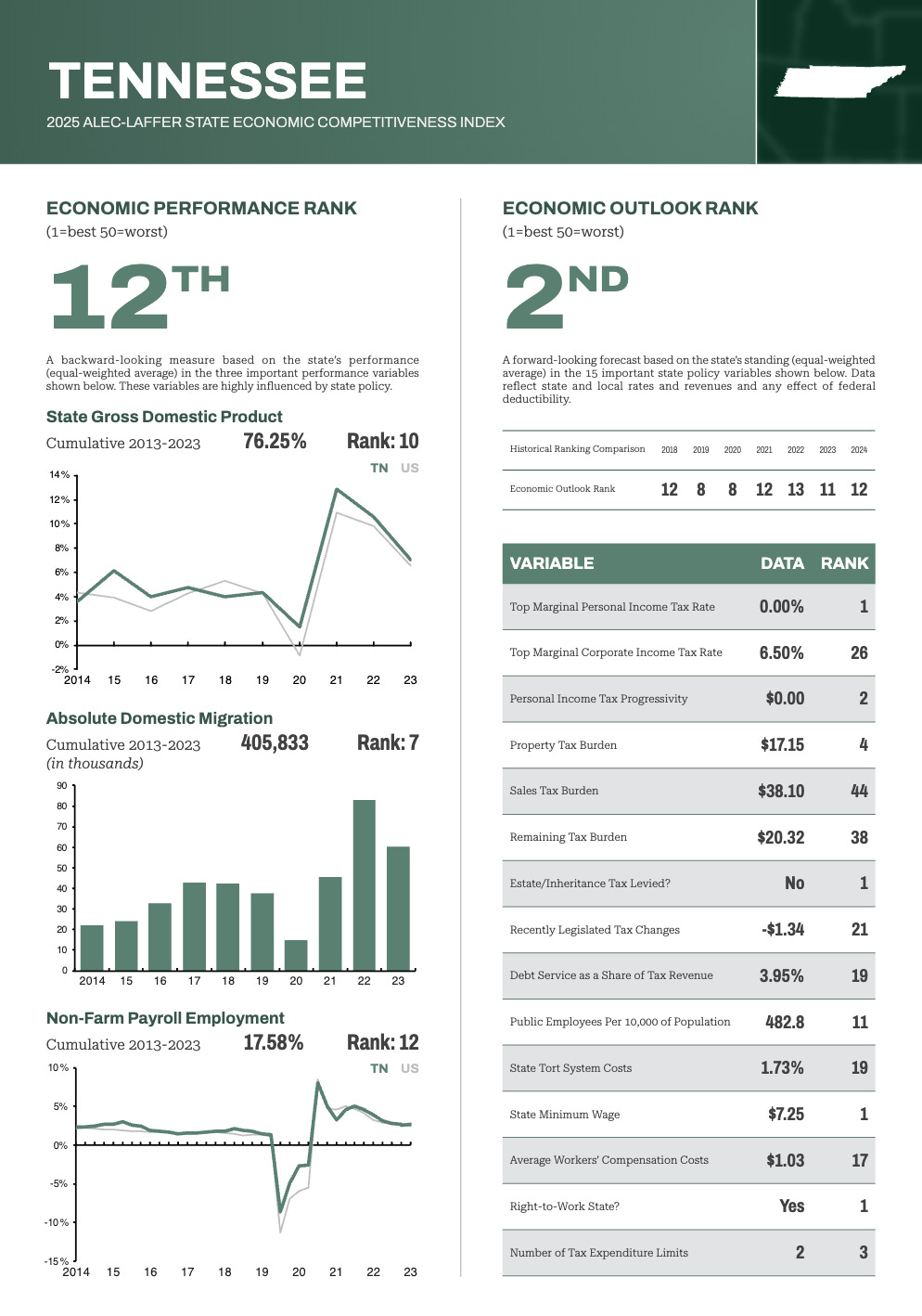

Tennessee ranks 2nd in future economic outlook and competitiveness, driven by low/pro-business policies (ALEC).

New Titans stadium is on track for 2027 in Nashville, bringing not only a first class NFL experience but also a one of the country’s largest and newest advanced event spaces (Gov Lee).

Looking to save some cashola? Tennessee is #1 in ease of saving money: low tax burden, relatively affordable living costs, and robust employment growth. With high interest rates and uncertainty, it may be time to take advantage of staying in cash and earn 4% (Bankrate).

First, Keep Perspective

Before I get started on a bit of a rant here, I want to be crystal: I am an optimistic and bullish investor in 2025, as I sit here at my desk in my office, sipping a coffee, looking out the window at my dog eat grass like a little cow in the backyard. Well, he’s really a land manatee but tomato, tomaato.

Not just a little bullish, big time bullish. Sentiment is down, yet the fundamentals of the economy are strong. Housing inventory has risen but housing supply just started falling off a cliff (keep reading). There is panic in the streets, but politics and emotions are driving it. Inflation is trending down. We are at full employment.

And even if we do have a dreaded “R-word…” oh hell, I’ll say it, Recession! That is just an opportunity to take advantage of undoubtedly low interest rates and even more fear in the streets. Also, recessions are normal, don’t freak out. If you can’t stomach the heat and volatility in the economy/market, get out of the kitchen.

Here is famed investor Peter Lynch explaining this point: 👇

Here is famed investor Peter Lynch explaining this point: 👇

“What you learn from history is the market goes down…and it goes down a lot…”

If everything was coming up roses, my skeptical spider sense would be on full blast nuclear attack red alert.

The fact is, I love this pessimistic setup for deploying some of my hard-earned capital.

Ok, and now….on a more tactical level…it’s rant time.

Dazed and Confused!?

I see more confusion in all markets today than since the last economic calamity: the 2008 Great Financial Crisis.

Granted, the rough economic barometer - the stock market - has recovered ~11% from the early April lows, sure. But today is Tuesday at 10 am. How about tomorrow? Later today? Hell, 20 minutes from now? Who knows. Why?

A very confusing federal policy message from up top:

“Fire Jerome Powell!”…“No, we aren’t even considering that.”

“We are close to a trade deal with China!” China: “We aren’t talking to the US.”

Saturday: “We are exempting auto manufacturers from tariffs!”…“Sunday: ‘No we’re not.”

‘Tariffs are about trade fairness for US business…” “No, they are revenue raising, you won’t have to pay any more income taxes!”

One can see how this may be a little, well, strenuous…

Tariff Party Fouls with Forever Earthlings

These are economic party fouls concerning policy process and execution, which make the market environment, in which we as investors operate, clear as mud. The overt “strategy” from the Administration is controversy, elevates message and importance, but is that an appropriate tack in global trade where we have to work with these folks forever. That is a long time. I don’t think we are getting to Mars anytime soon (but I am so down to go!).

IMO, there will likely be unintended consequences and third-order effects.

Note: Again, I am not passing judgment on tariffs as a negotiation tool (it could be a very effective policy tact). I’m criticizing the process here, which is leading to unnecessary confusion. This could have been done better. It’s an economic party foul.

Hell, one probably shouldn’t impose a one-size-fits-all tariff policy AND do it on every country simultaneously AND talk shit AND…. well that’s enough for now. You need to assess the volume and types of imports and exports, identify key products, determine what changes are feasible, and, importantly, what are the national security concerns. That demands individual conversations, not a blanket approach.

Realistically, can you negotiate with 100 countries at once? No. The ongoing tariff debates, coupled with exemptions like those for chips, autos, rare earths are spurring widespread unpredictability. This unease is impacting not just the US but global markets as well. Even the Federal Reserve is affected, with Fed Chair Jerome Powell navigating a challenging landscape. Imagine Powell's perspective: dealing with a an Administration oscillating between praising and threatening to fire him. This push-pull only deepens the uncertainty. It is unnecessary.

Counterpoint: But it could work… Only time will tell…

We don’t know, and we can’t affect policy (even if I were back in Congress). So we need to take action to operate in this environment for us and ours. That’s investing, remaining patient, navigating uncertainty and being ready to strike when we see opportunity. That’s it. And that is why we generate alpha, if we are any good at it.

Ok, phew, rant done. That was cathartic. Thanks for listening.

Now let’s talk about the economy and then real estate.

Economic Backdrop

Remember, these process offenses are against a backdrop of existing macroeconomic concerns:

Inflation: Currently at 2.5% (PCE), trending down but still above the target. Will tariffs reverse this trend?

Growth and Employment: Risks of slower growth and a weakening labor market. Are businesses pulling back hiring and/or starting to lay workers off?

Large public companies are pulling their earnings guidance for the year, uncertain about the year’s outlook.

Credit risk: stock market unrealized losses will mean wealthy individuals feel less wealthy and have less borrowing power to invest in their own real estate projects (they get favorable loans against their stock market portfolio), and they are less likely to deploy capital, which is a primary source of funds for new large housing projects. This could have downstream effects on the construction labor force and construction material supply chain, which is also roiling from trade policy uncertainty.

Hot Take - The Fed should be cutting rates now. But they don't want to be political. Which is ironically political.

Real Estate Anecdote: Materials not largely affected

Fortunately, most builders are not seeing large price increases in building supplies (NAHB). And they won’t. Remember ~93% of building supplies are produced domestically, and for non-residential construction (ie concrete) that number is close to ~97%. For example: large apartment developers expect tariffs to increase prices just 1%-3% (Parsons).

Further Reading: Full Picture on Tariffs

For a more complete picture tariffs, and the uncertainty they are spewing into the economic ether, I recommend the latest episode of BG2Pod with two great investors Brad Gerstner and Bill Gurley. Can’t recommend it highly enough for your next car ride/hike/dog park bench sitting pretending not to look at the pretty girl to your left.

A major source of acute economic uncertainty is in the real estate market, and it is not getting a lot of play in the press…

Housing Units Are About to Fall Off a Cliff

It’s housing construction/new starts/new units coming on market, which, after being at historically high levels, just peaked. The cliff edge is here.

And economic uncertainty will amplify the effect by slowing deal flow and access to capital. Further slowing new construction and new available housing units.

This is a BIG deal for anyone who owns residential/multifamily real estate.

I’ll explain.

Construction 👇= Prices ☝️

Think rents are high now? Just wait till 2026.

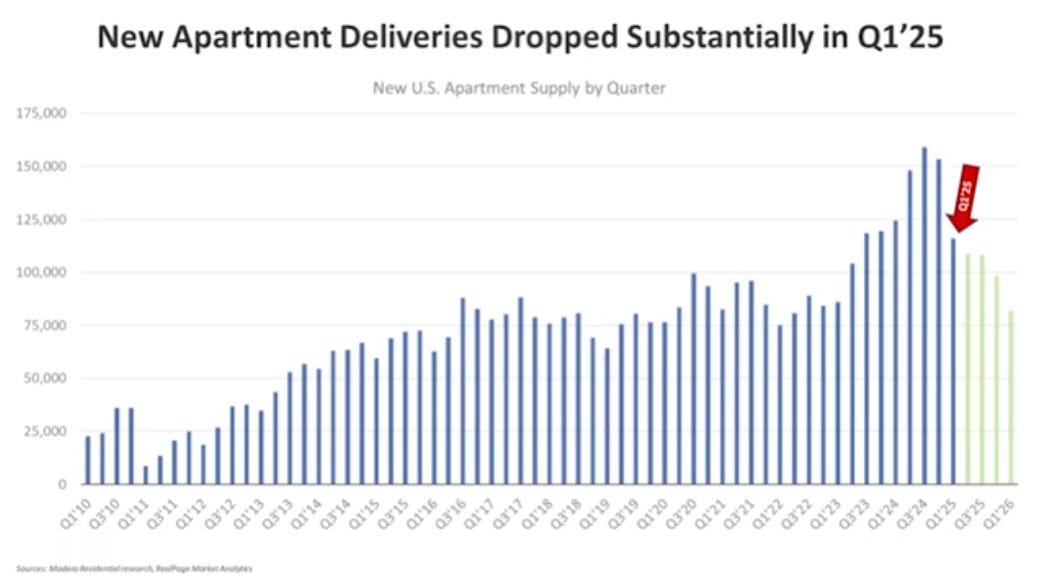

Last year, and continuing into 2025, a record number of apartment units came on the market.

This is still suppressing rent growth (I know it doesn’t feel like that renters but it has been true for the last 6+ months, rent growth is way down. I recommend you lock in a 24 month lease today if your landlord will do it (we do 🙂 ).

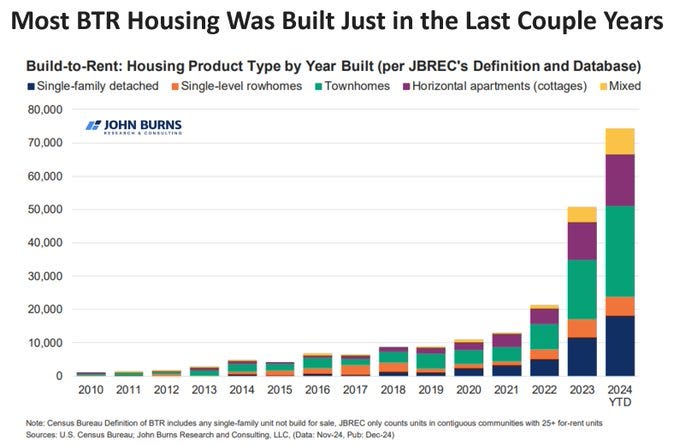

Here is a nice chart from @JBREC showing that more than 50% of apartments (built to rent) came on the market in just the last two years.

But, after 2025, we have a major problem.

After several years of astonishingly high supply coming on market, new apartment unit deliveries have now officially peaked (Parsons).

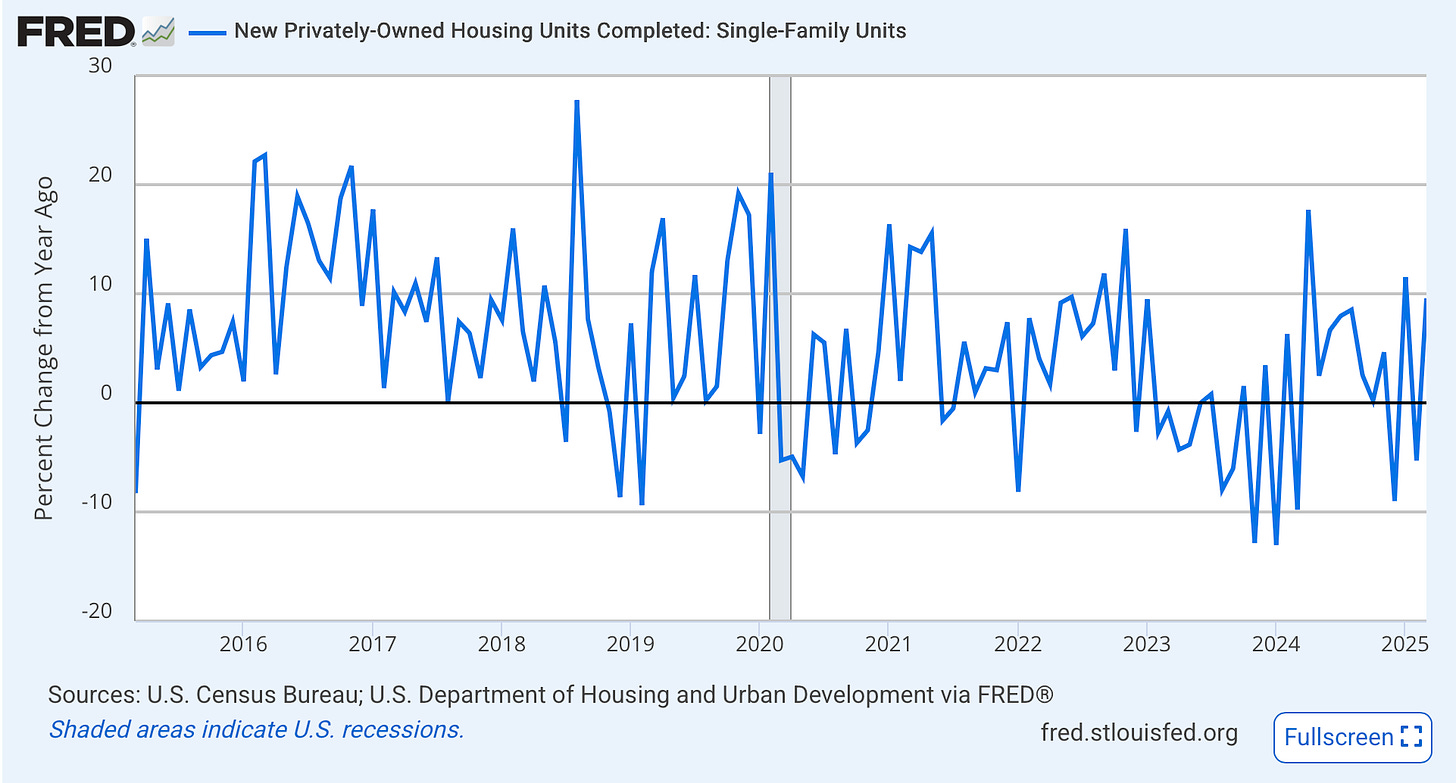

Completions are also slowly trending down for new residential/single family homes as well, albeit not nearly as sharply. Although this trend is much more pronounced in real life, adjusting for population growth and household formation.

And this is just the beginning, new housing units are about to take the elevator down faster than a Die Hard movie.

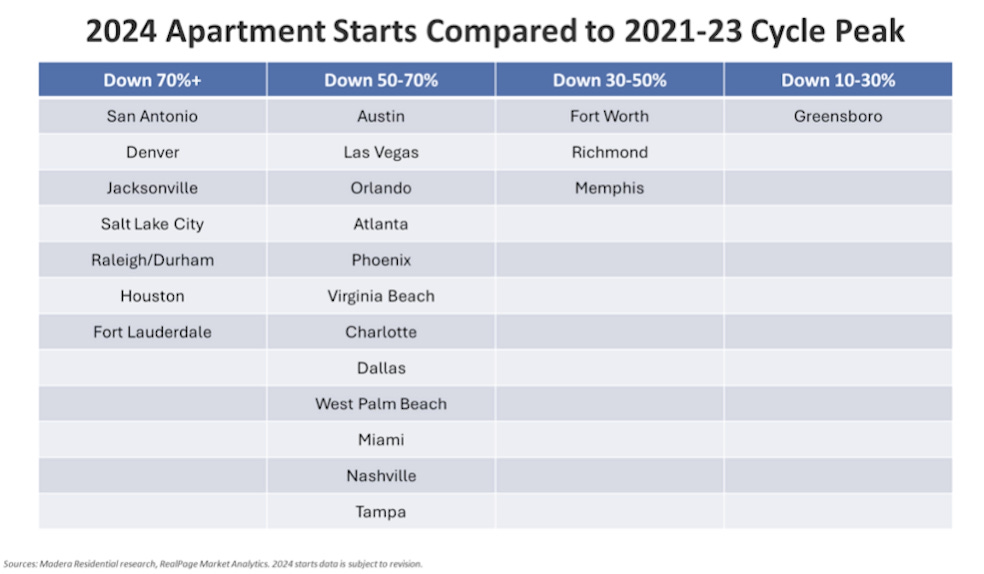

Future apartment unit growth in major cities is already way way down. In places like San Antonio, Orlando and my hometown of Nashville, apartment starts are down 50%-70%+.

Why is this happening? Well, it takes around 4 years to build an apartment building (including all the regulatory fun), and 4 years ago we had near zero % interest rates. That was a catalyst for developers to raise cheap money and build!

No longer, with rates today these projects just don’t pencil.

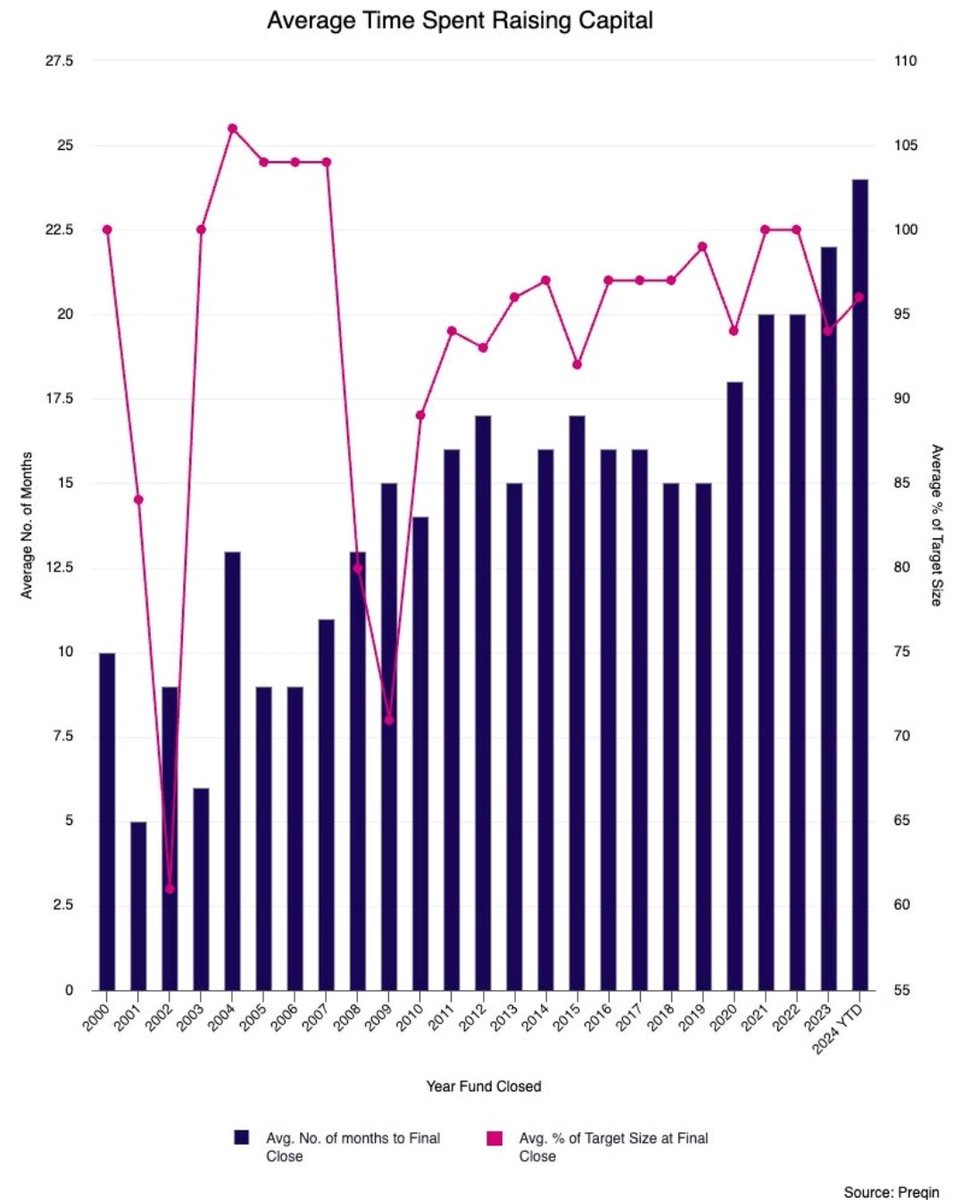

Moreover - again I need to make the point - market uncertainty will make raising money far more difficult. It’s hard to raise a ton of money to build a building, let alone while we have high interest rates and a dubious economic outlook.

Credit to @jayparsons

Housing Shortage Widens

Why is all this supply talk such a big deal? We have a significant housing shortage in America. How many housing units are we short in the US?

We are currently short 4.5 million homes than we need in the US. This is crisis-level stuff. And why young folks are so frustrated with home affordably.

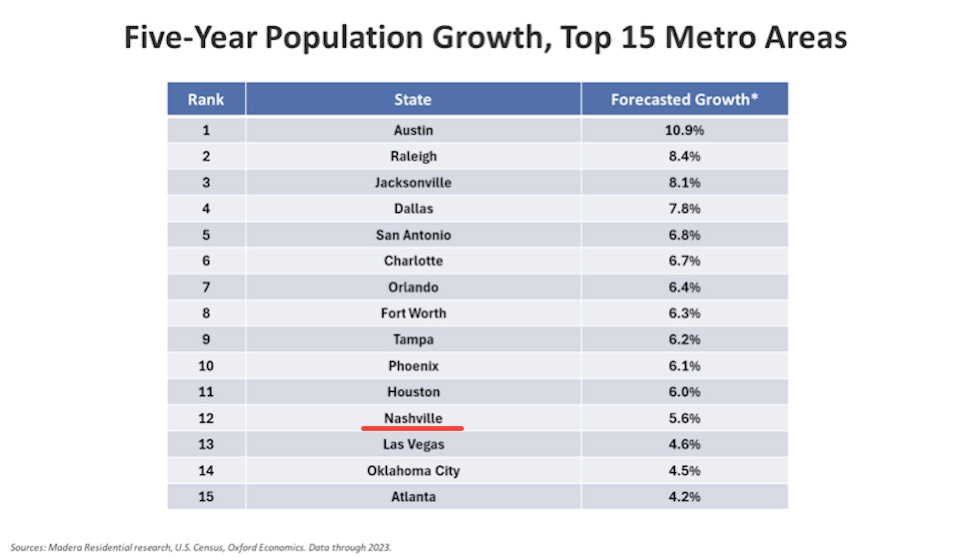

But in these 15 markets, where populations are growing fastest, it’s about to get even tighter.

What does this mean? Simple, absent more supply (which takes years to come online), home prices ☝️ and rents ☝️.

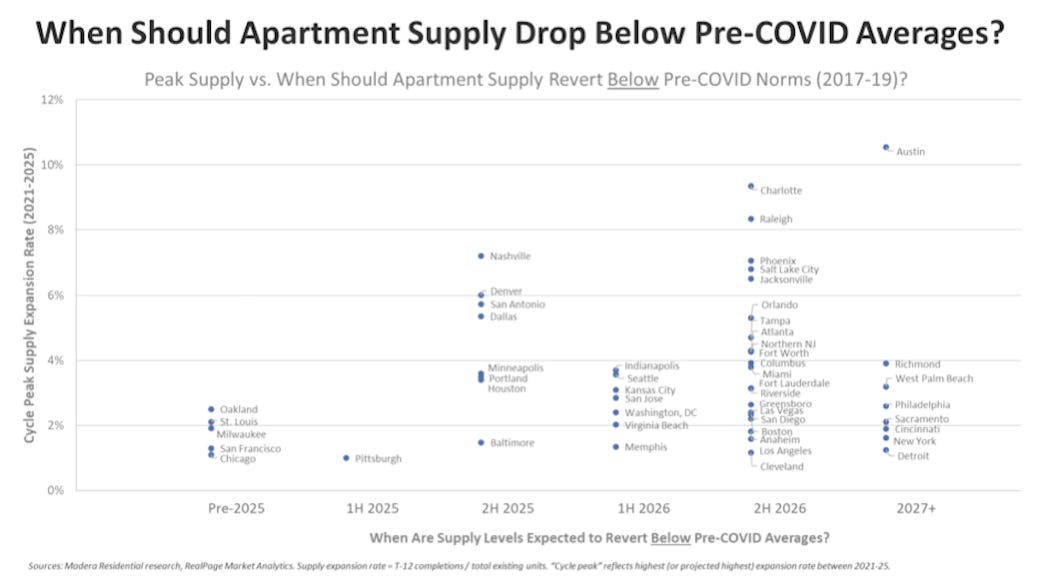

When exactly will apartment supplies drop below Pre-COVID levels?

Depends on the city. (chart)

In my home market of Nashville, for example, in the second half of 2025 apartment supply will be back down below 2019 levels, and falling from there. If you are in a growth market like us where newly hired labor is hot, I bet your city is on the chart above (and perhaps the rental chart below too).

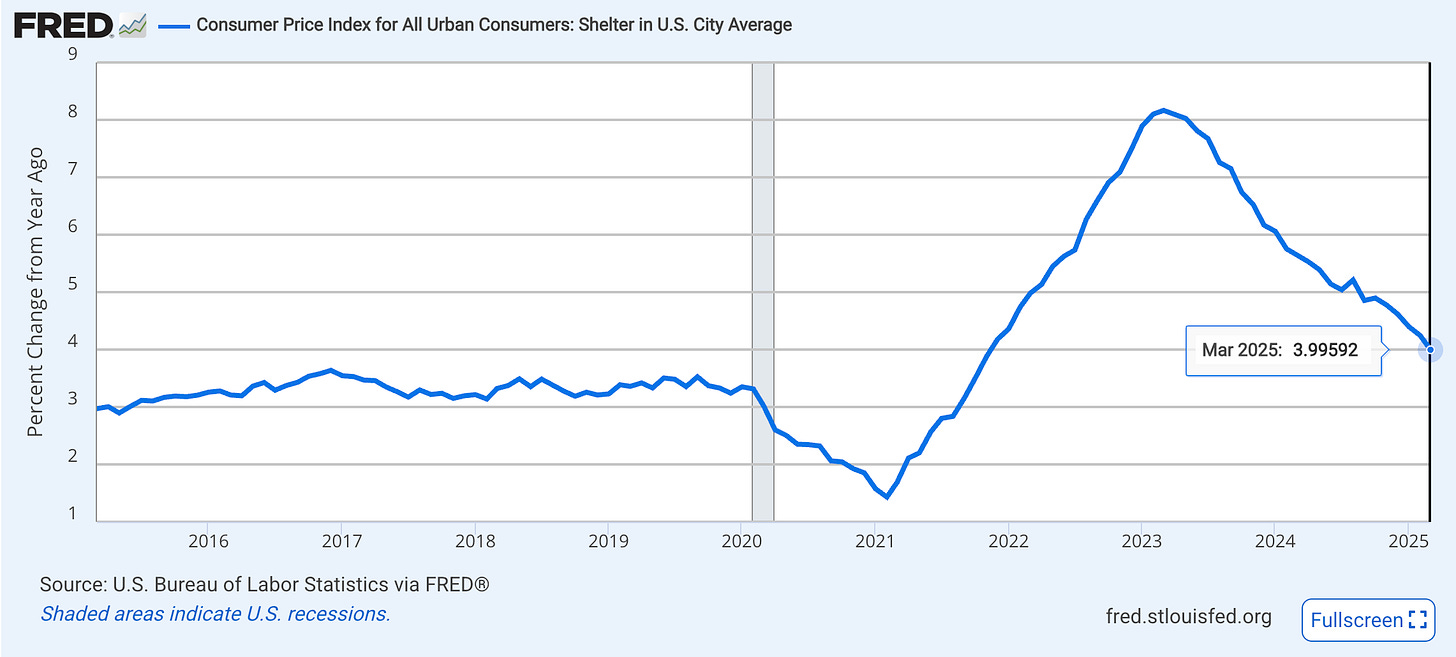

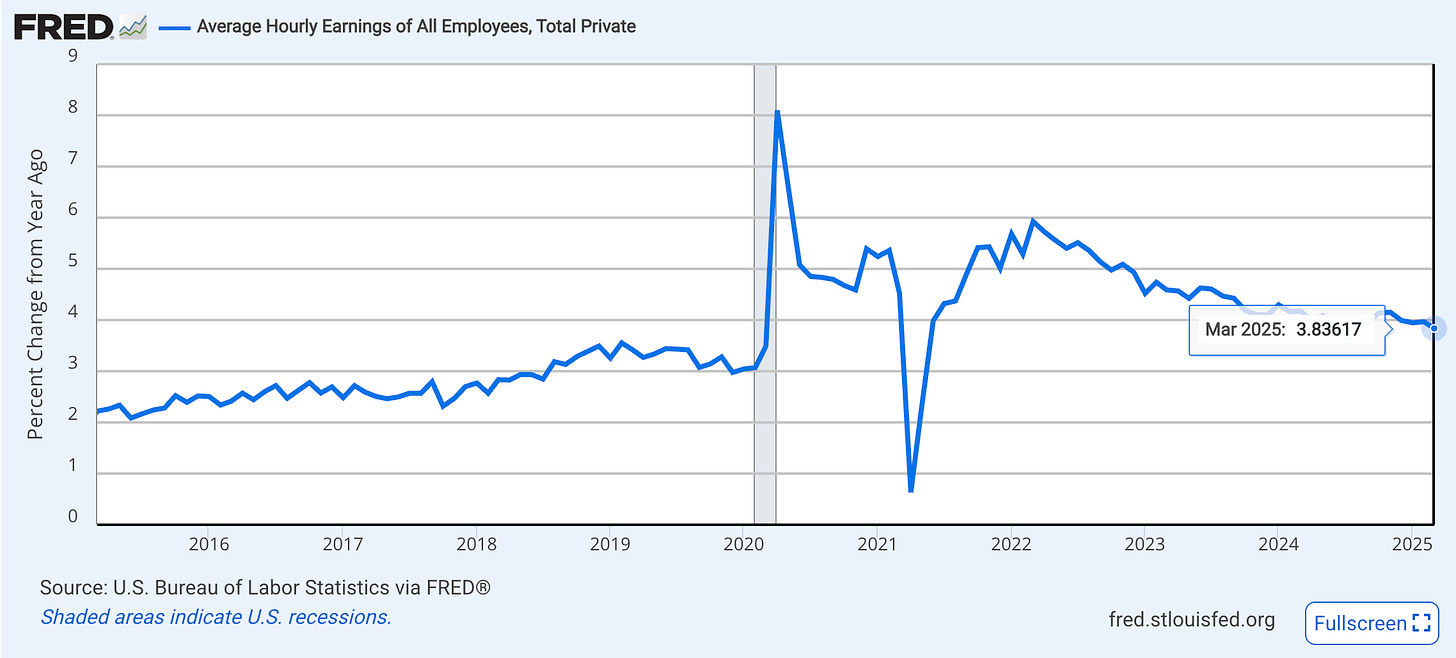

Wage growth no longer outpacing shelter growth

Until now, the story has been..”well at least wage growth is outpacing shelter costs…”

No longer.

Shelter inflation is finally below 4%, to 3.99%. Good!! This means we are normalizing. We are getting closer to pre-pandemic rent inflation numbers. (But not if we don’t build more housing units, see above).

But now wage growth has dropped below that, 3.83% Ahrgg!!

**And before you email me, yes, I know there is lots of data out there that differs. I’m using all BLS gov data. (CPI shelter in urban cities and average private sector hourly earnings for my calculations).

Rental property investors should take note.

*** Interested in real estate but don’t know where to start? ***

Start by getting some coaching and mentorship. Elevate your real estate knowledge. Gain expert advice from someone who actually owns mucho real estate.

No "guru" trying to sell you an expensive course.

No BS, just frank, brutally honest advice.

Ask anything you've always wanted to but were afraid to ask.

It will be the best money you've ever spent, or your money will be fully refunded. You can’t find that guarantee anywhere else in the industry.

Join the investor-class, become an owner.

Plus, act now and get 10% off!!! Use my special Skeptical Investor link 👉. Join the Investor-Class!

Want to advertise to the more than 20,000 weekly readers of The Skeptical Investor? Advertise with us; we can help you grow your business. Email me directly.

Ok, back to business.

Ok, phew, that was a lot. Now I’m changing gears for a quick local update.

Stay with me, if you are interested in Nashville, it’s worth it!

Tennessee Corner

Let’s talk about my home market of Nashville. The city is extremely young and underdeveloped, except for a few large institutional apartment towers. No river development, very few green spaces or city walks. Yes a few parks, but we can do better. And smaller developers/investors (like me) are just getting started, plenty of neighborhoods with cool/unique vibes that are up and coming. Plus, the city government is also just getting started designing/planning for the future and taking action on those plans.

Nashville is really starting to punch above its weight, and has yet to fill-out its lanky body. Case in point, in 2024 alone, 16.8 million visitors came to Nashville. That’s on a population of 700k.

It's morning in Nashville.

What to know what else? It’s great for business here too.

Tennessee now ranks 2nd in future economic outlook, moving up from 6th place, in a recent ALEC report. (Fun fact, TN is now the 15th most populous state (7.2 million), just in front of Massachusetts (7.1M) and behind Arizona (7.5M)).

Nashville is one city where we are going to need a LOT more homes/housing units. Doing some quick math, Nashville is home to a wild number of young people: 40.4% of the city is under 30 years of age, the prime age of household formation.

So come to Nashville, and drop me a line when you do!

My Skeptical Take:…

Become a Premium Subscriber

Become a paying subscriber to get access to the rest of this post and other awesome subscriber-only content, like a one-on-one with yours truly.

Upgrade for Just $5 Today!Subscription Benefits:

- Premium Content and NO Paywall

- Subscriber-only market insights

- Breaking News Analysis

- Every article we have published - a treasure trove of information and education

- Annual one-on-one coaching with me personally! ($1000 value!)