Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Read Time: 15 minutes (worth it :).

Consider Becoming a Paid Subscriber!

Paid subscribers get the best stuff, including premium content and an annual one-on-one call with me personally. So make sure to take advantage!

We have a returning partner! The Daily Upside: concise business news in your inbox each day without the clutter. Support our pirate ship, each click promotes our newsletter! Click the link below 👇

What Top Execs Read Before the Market Opens

The Daily Upside was built by investment pros to give execs the intel they need—no fluff, just sharp insights on trends, deals, and strategy. Join 1M+ professionals and subscribe for free.

The Weekly 3 in News:

Budget deficit rose in December and is now 40% higher than it was a year ago. This why inflation (CNBC).

Comedian Nate Bargatze plans to resurrect Opryland Theme Park in Nashville (Yahoo).

5 things to know when buying a duplex, triplex or quadplex (BP Spotify Podcast).

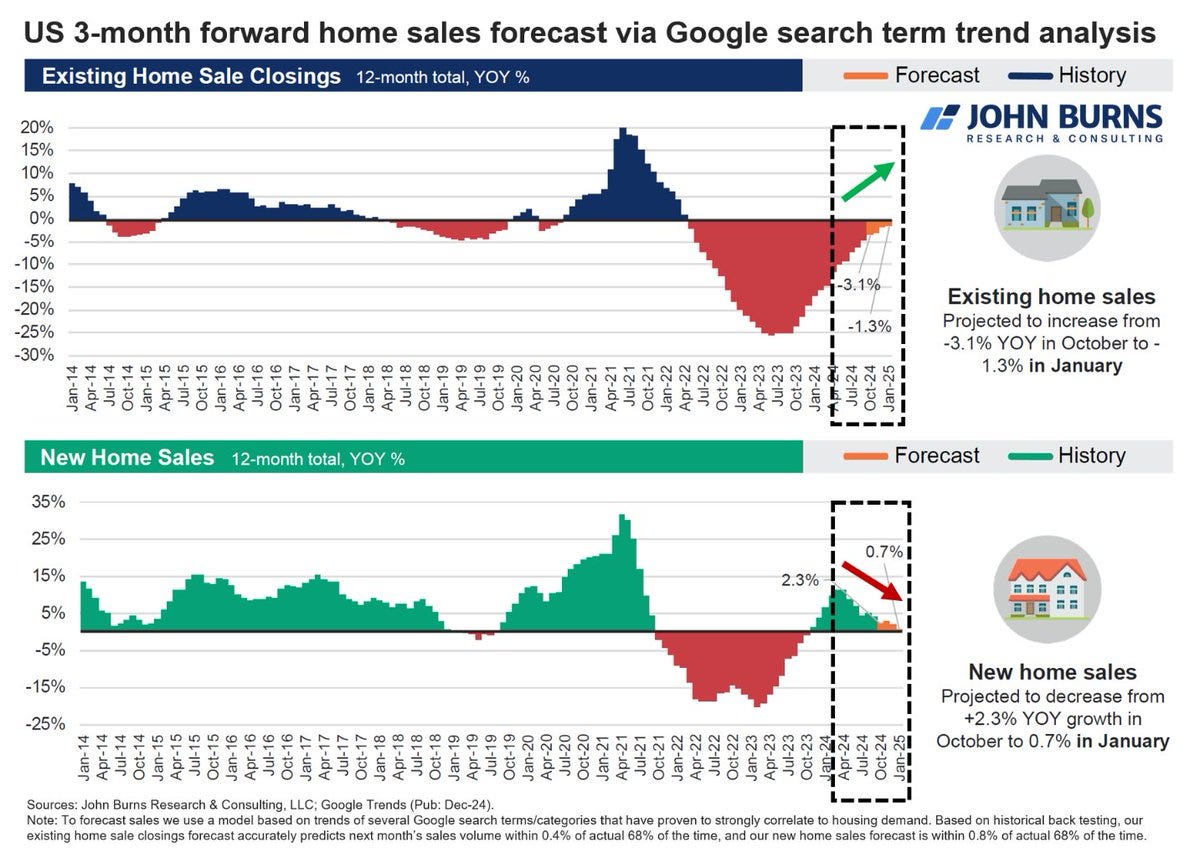

* Bonus - Existing home sales potetially recovering in 2025. A 3-month forward-looking model based on unique Google search terms (JBRE)

Today’s Interest Rate: 7.07%

(👇.01%, from this time last week, 30-yr mortgage)

Today we’re talkin’ prices, inflation and the impending seismic shift 👇 in housing units in 2025. Housing supply is about to fall off a cliff.

Let’s get into it.

Prices☝️: the chicken or the egg… or the house

Eggs have been in the news lately, with scary grocery store Instagram posts and salacious headlines. Eggs for $11? No bueno. Much of this spike is due to bird flu outbreaks and massive chicken culling, not inflation, as many are exclaiming. Shortage in eggs = price go up.

As my dad used to say, this too shall pass.

But prices for everything are still increasing. What gives?

Tangent: have you ever cooked a cloud egg? It is THE best way to fry an egg (well, tied with butter poached). Cook one this weekend to break-the-fast. Amazing.

Ok back to business…

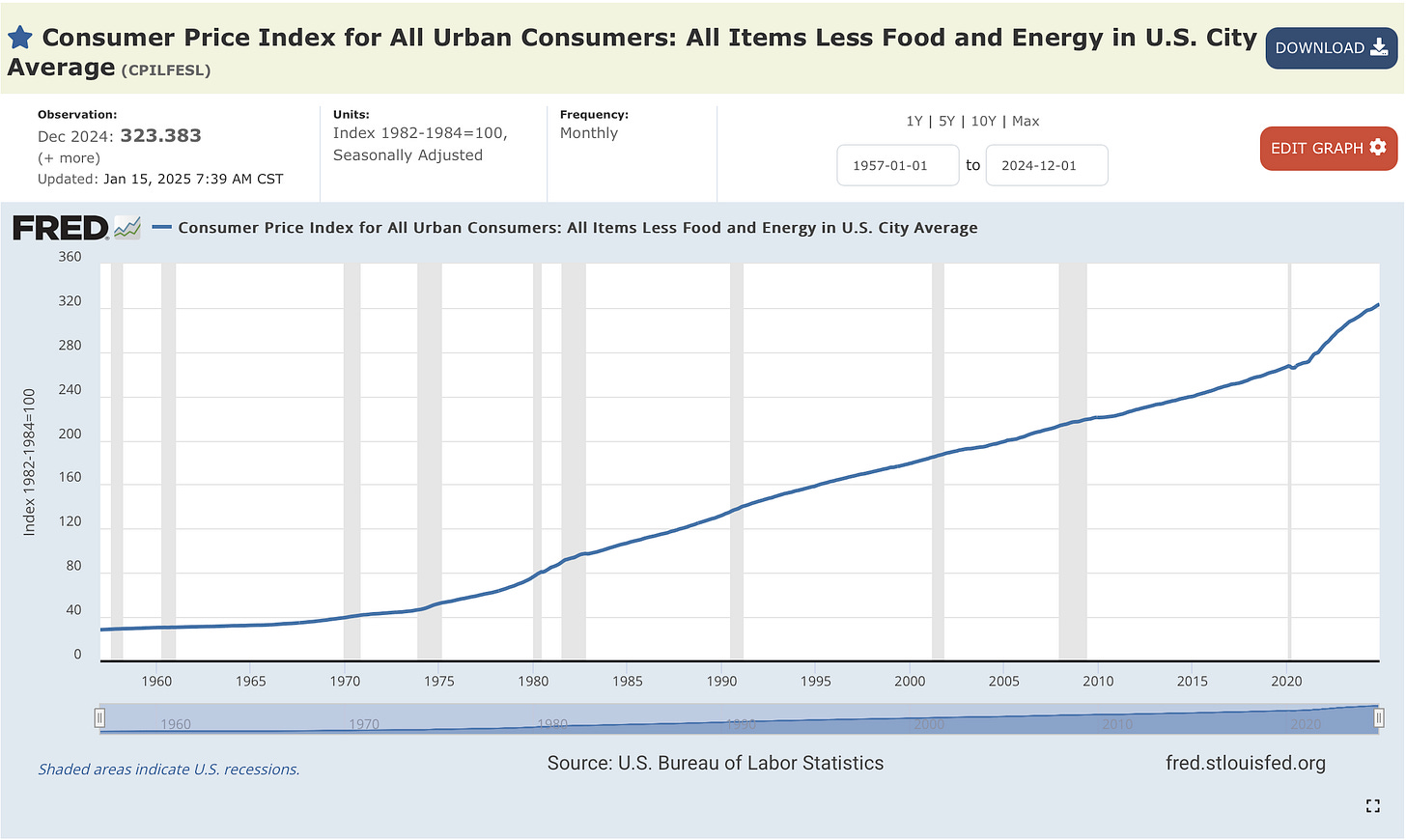

A few hard truths on inflation: Prices will not decrease (aka deflation), aside from temporary spikes up and down. This is why grandpa’s bubble gum is no longer 5 cents (did you know it costs the US Mint more than 3 cents to mint every 1 cent penny? Probably time to stop making so many of those). Here is a chart.

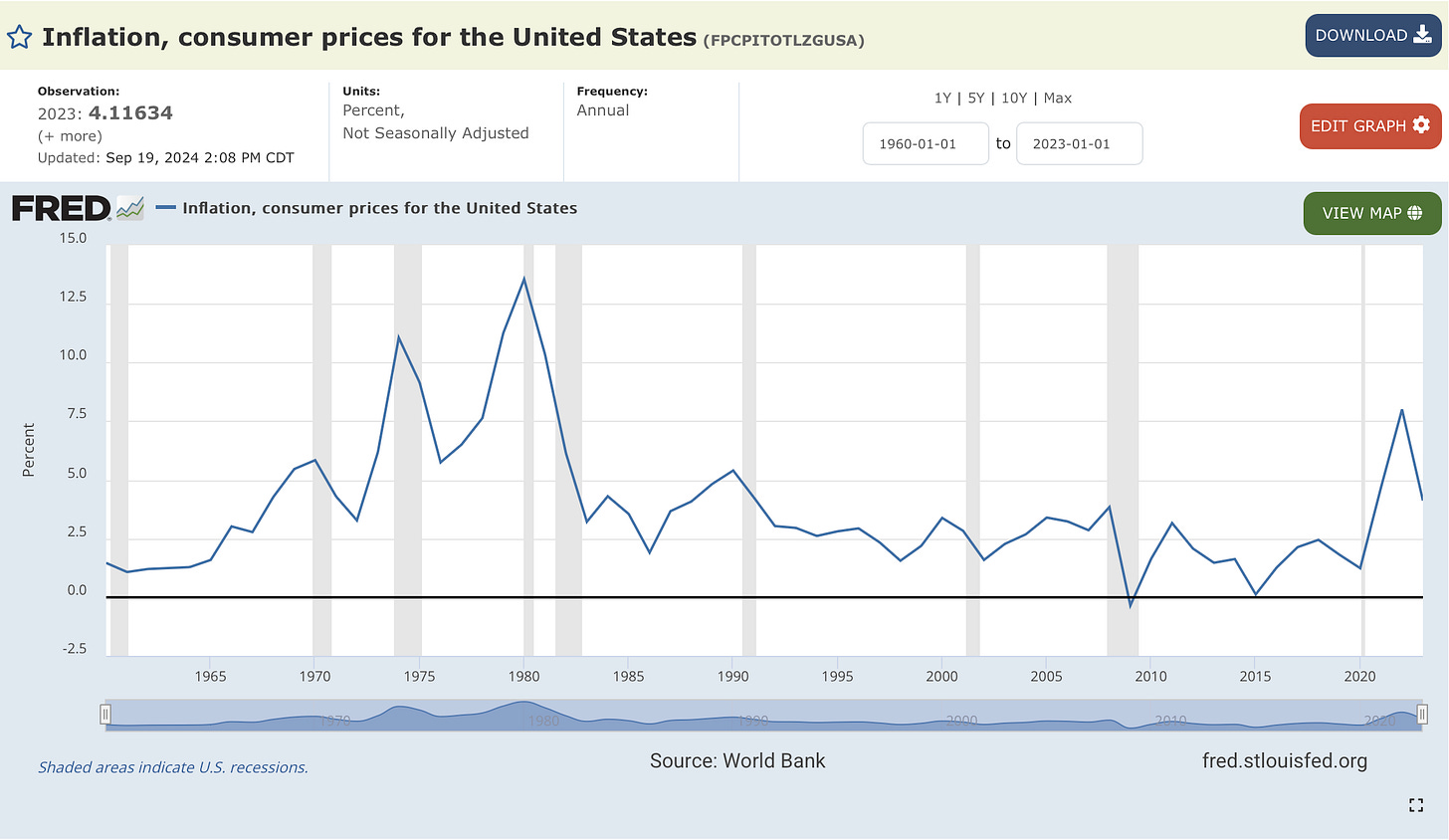

The impact of inflation is permanent. What matters is inflation’s rate. When that gets above the 3, 4, 5%+ range, things get a little frisky in the economy. So what we want is disinflation (aka slower inflation). Here is a 50 year chart.

Burn this into your hippocampus:

It’s HARD to get disinflation without government spending decreasing, especially as a percentage of GDP.

And this last fiscal quarter quite the opposite happened.

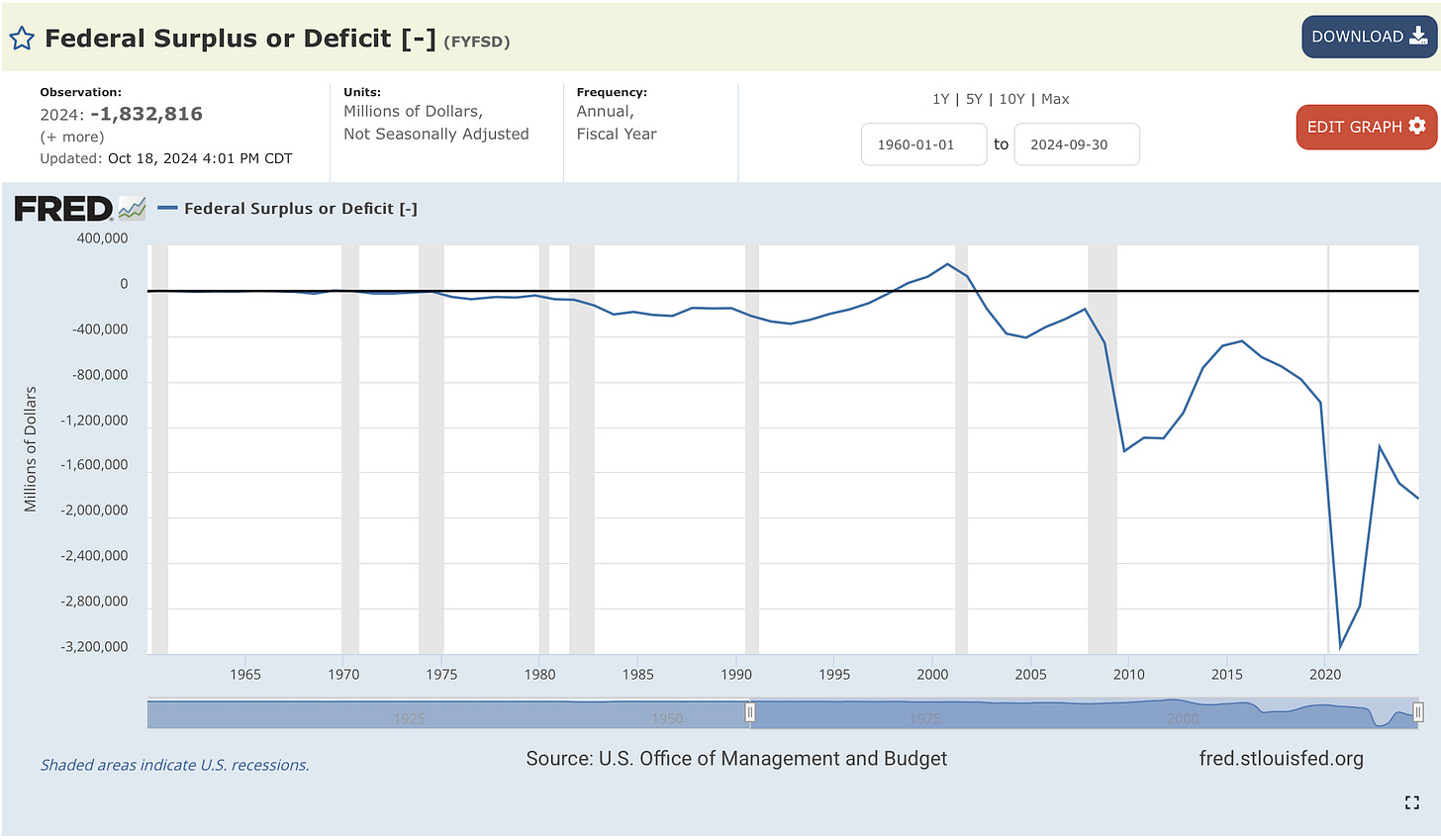

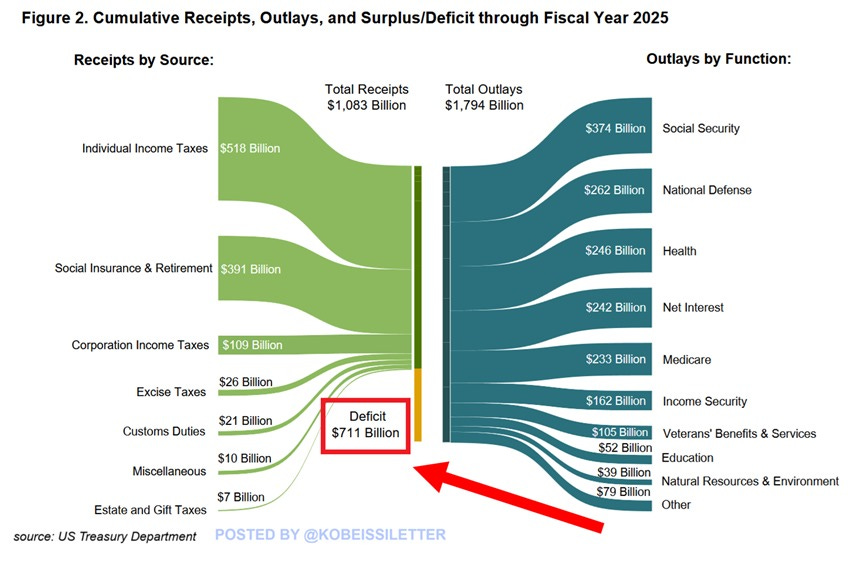

In the first 3 months of Fiscal Year 2025, the US budget deficit was $711 billion (10/24 - 12/24). This is roughly ~$200 billion, or 40%, higher YoY. Moreover, the annual deficit last year was a historic $2 trillion and deficit spending (aka the Federal Government borrowing) rose from 6.4% to 6.9% of GDP. We are on pace to beat that record.

This is wartime-level spending. Just look at the chart since 1960. Oh and that giant spending spike downward 2020-2022? The gov injected $10 trillion into the economy. All that is still sloshing around. (If you want further reading, here is an MIT study on federal spending causing inflation).

This is inflation.

Does this translate to housing?

Hell yes.

There will be no such thing as a low price Starter Home if we continue down the path of inflation caused by out-of-control government spending.

What about mortgage interest rates?

Yep, that too.

Interest rates are up more than 1% since the Fed cut rates 1%. Why? The Fed can cut rates all they want, but they do not control the long end of the bond market (10+ yr debt). The bond market is in control there, and bond market vigilantes are fighting the Fed. They believe the Fed is easing monetary policy in an economy that doesn’t need easing. They are worried about renewed inflation.

So if you are keeping track. Egregious Gov spending = higher home prices & interest rates.

Ah the humanity!

Want to know what those gov folks spend our money on? Here is a breakdown of just the last 3 months.

I am hopeful the new Department of Government Efficiency can do something about this. You can track DOGE and the Federal Debt for yourself, here and here.

Rents are poised to increase, because of apartments

Think rents are high now? Just wait till 2026.

Why?

Housing supply is about to fall off a cliff, due in large part to apartment building starts. This is going to rock the rental market, absent new supply.

I’ll explain.

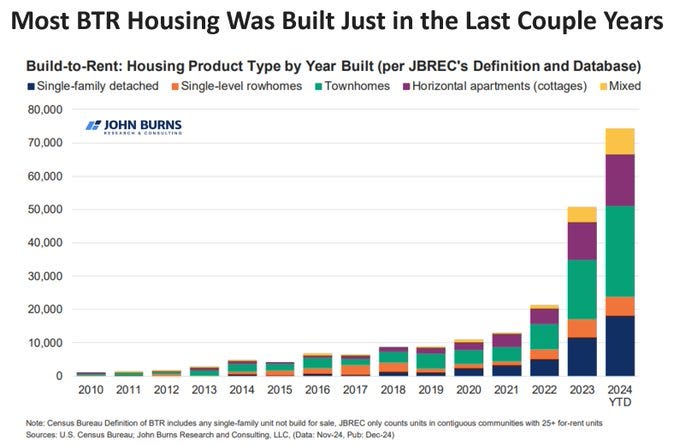

Last year, and continuing into 2025, a record number of apartment units have come on the market.

Here is a nice chart from @JBREC showing that more than 50% of apartments (build to rent) came on the market in just the last two years.

But, after 2025, we have a major problem.

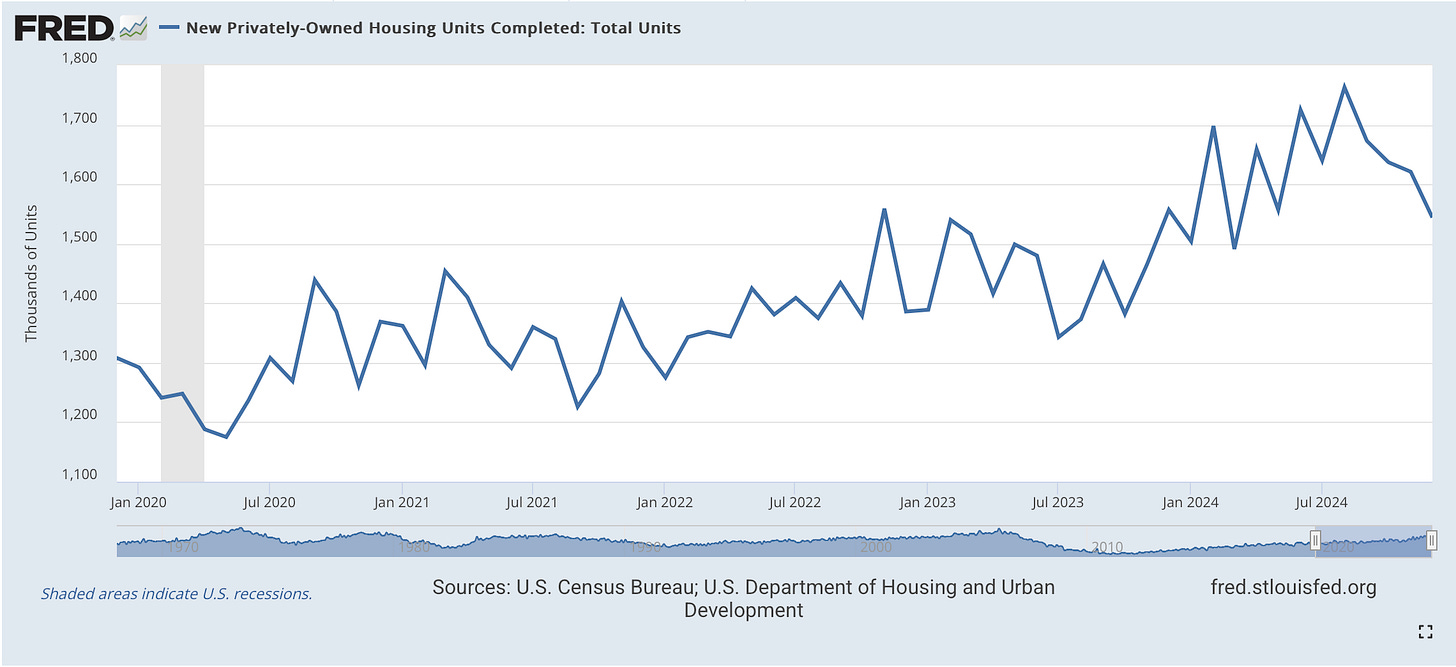

Completion of housing units in the US will soon start a sharp march downward.

This is just beginning.

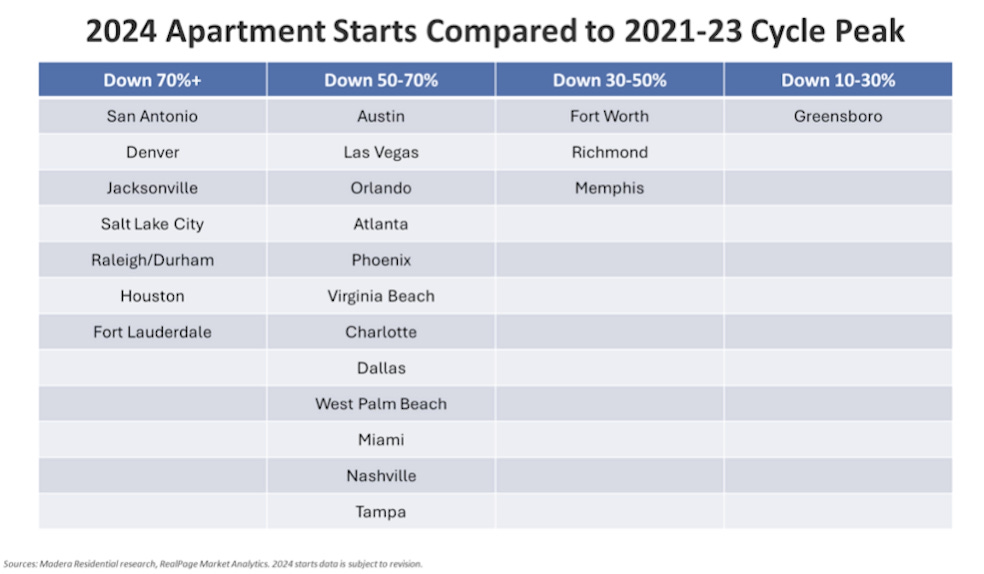

And at the same time, new project starts have plummeted. Many large metros down 70%+.

We are not starting enough new housing projects to maintain the housing stock we have, undersupplied as it may be, let alone grow supply. In places like San Antonio, Orlando and Nashville, apartment starts are down 50%-70%+.

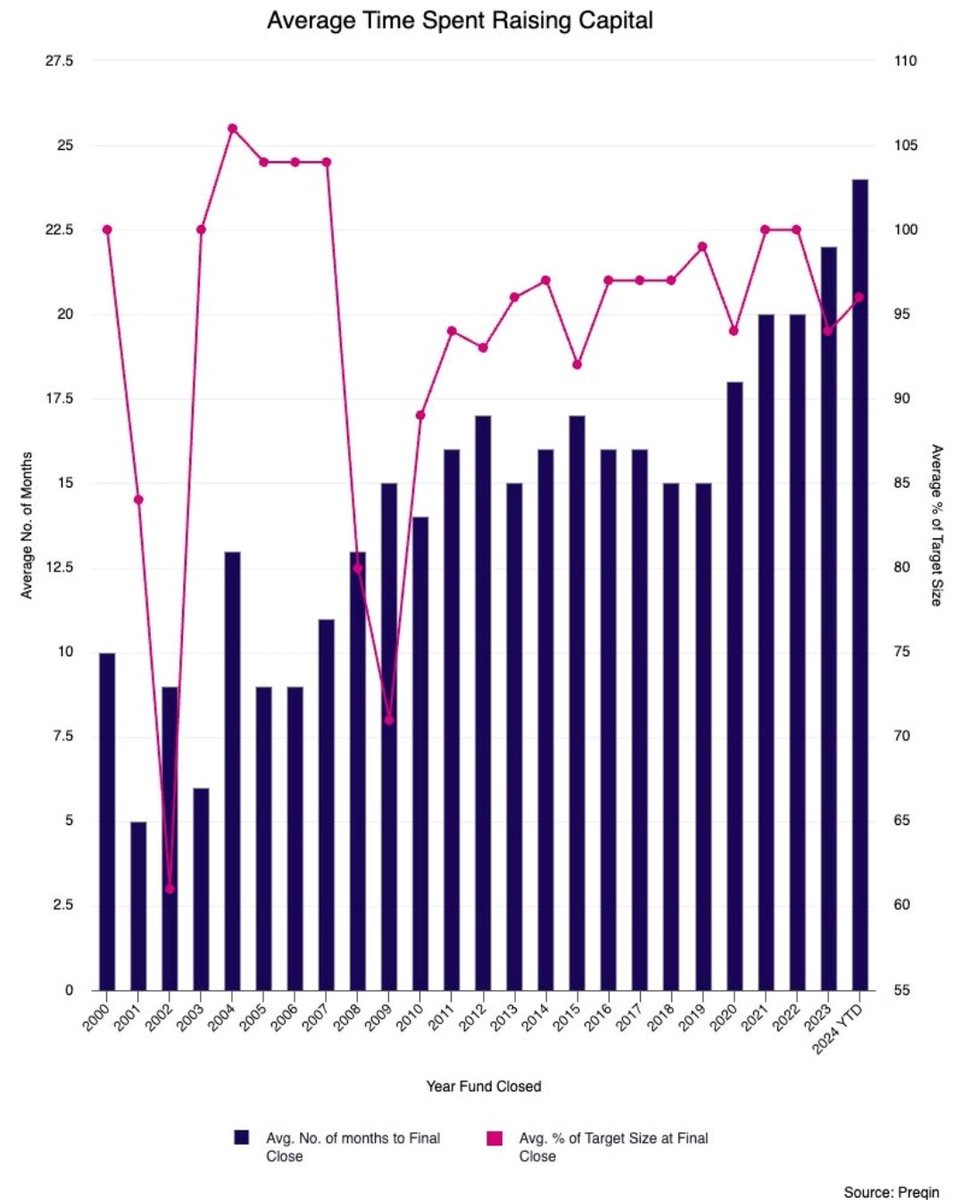

Why is this happening? Well, it takes around 4 years to build an apartment building (including all the regulatory fun), and 4 years ago we had near zero % interest rates. That was a catalyst for developers to raise cheap money and build!

This is also why funding / raising capital is taking much longer today.

Credit to @jayparsons

Housing shortage will get tight in certain markets

We are currently short 4.5 million homes than we need in the US. This is not insignificant.

Undersupply is major problem for folks looking to start a household, especially for existing homes where folks are golden handcuffed to their 3% mortgage rate.

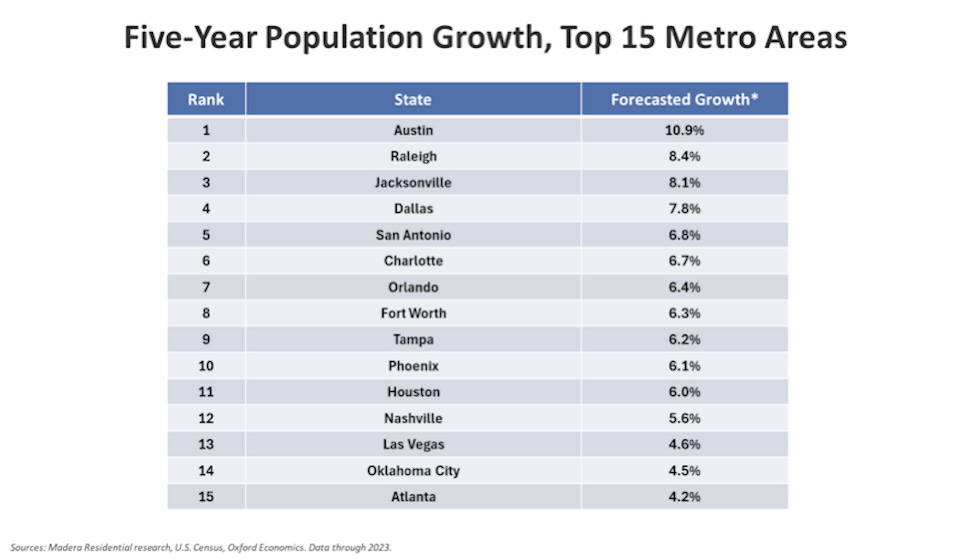

But in these 15 markets, where populations are growing fastest, it’s about to get even tighter.

What does this mean? Simple, absent more supply (which takes years to come online) home prices ☝️ and rents ☝️.

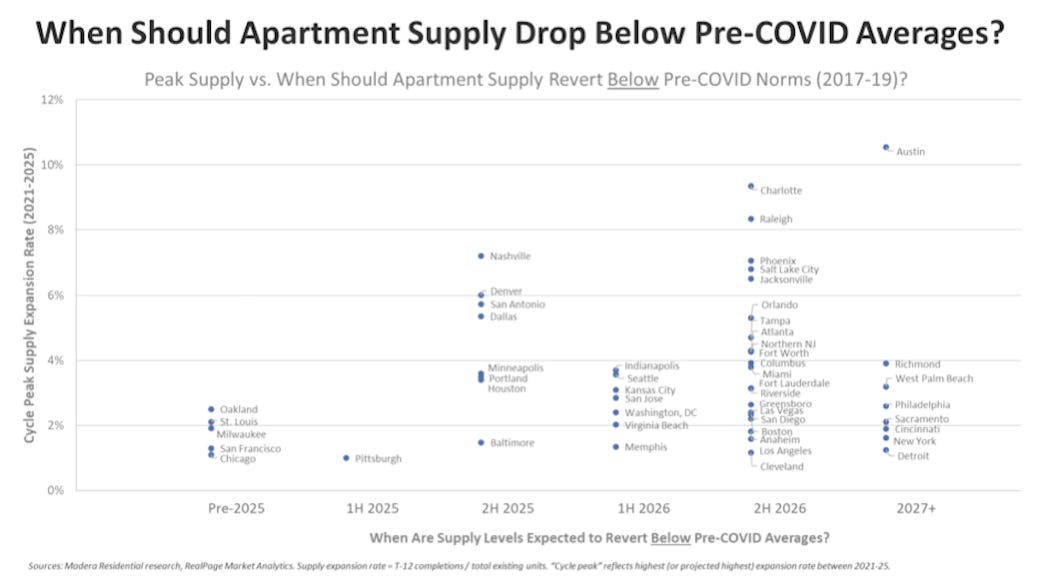

When exactly will apartment supplies drop below Pre-COVID levels?

Depends on the city. (chart)

In my home market of Nashville, for example, in the second half of 2025 apartment supply will be back down below 2019 levels, and falling from there. If you are in a growth market like us where population growth is on fire, I bet your city is on the chart above (and perhaps the rental chart below too).

How has this affected rent prices?

Chart 👇

Construction Coverage

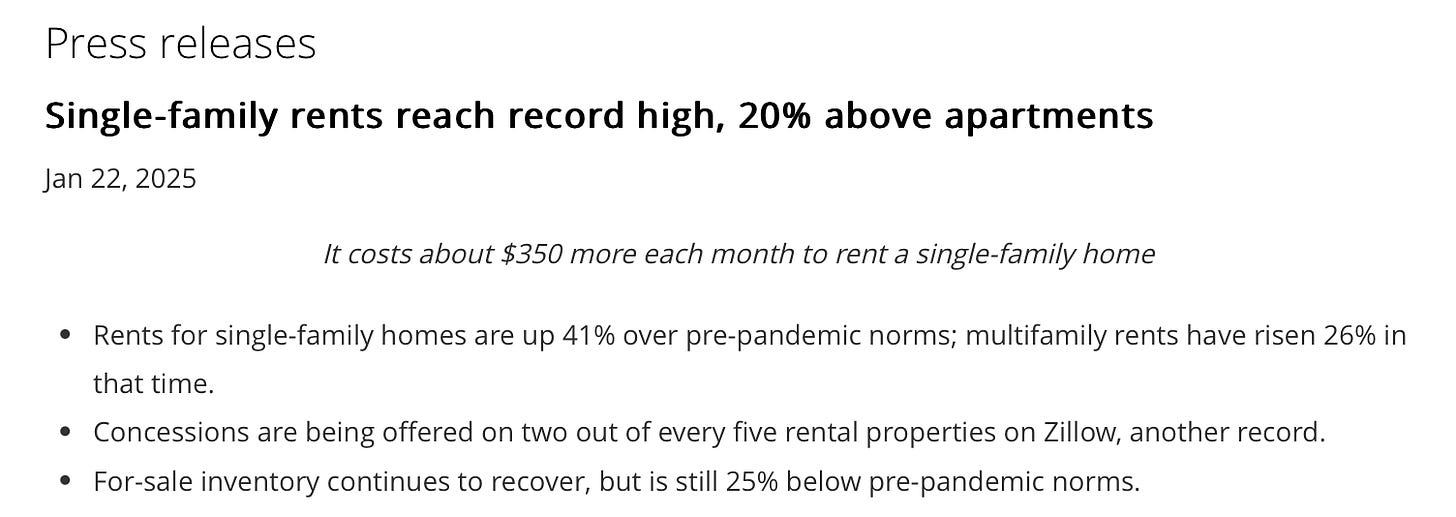

Single family home rents outpace apartments

Single family homes have reacted even more to the supply shortage, particularly since 2019. And while the two asset classes do compete, they are not the same. Single family home rents have outperformed 20% since 2019.

Zillow

All Housing Matters: the economics of luxury and affordability.

We need all types of housing, and building middle class and high-end luxury housing, which developers can construct profitably in this high interest rate environment, is beneficial for every level of income earner.

Why?

Higher-end housing plays a significant role in the broader housing ecosystem. While it might not directly address the needs of those seeking affordable homes, its supply does. The high cost of construction (30% of which is from regulatory policies, yuck) has long meant that affordable housing projects often require tax credits or other government subsidies to be viable. Without these financial lifelines, affordable housing just wouldn’t be built, it doesn’t pencil out for developers. Luxury housing does, so this is why you see more of it being built.

But the narrative surrounding luxury versus affordable housing often misses a crucial economic point: When you build new luxury apartments in big numbers, the influx of supply puts downward pressure on rents at all price points -- even in the lowest-priced Class C rentals. Each marginally higher income household vacates their previous, more moderately priced apartment to move into these new units. This movement opens up a cascade of housing options down the cost curve, freeing up units at the lower end of the spectrum.

According to housing analyst @JayParsons, “There are 21 U.S. markets where Class C rents are falling at least 4% YoY. What is the common denominator? You guessed it: Supply. Of those, all but one have supply expansion rates ABOVE the U.S. average.”

Here is an example: in November, zero (yes, zero) housing units were built in San Francisco, CA. Meanwhile, 738 were built in Austin, TX.

Where did Class C apartment rents fall? Austin.

Parsons also has a great chart on this (and he is a great follow on Twitter).

A warning on post disaster low income housing requirements

In the aftermath of the terrible LA wildfire disaster, a note:

More supply of housing, regardless of level, will free up affordable housing units.

New requirements for constructing affordable housing will delay reconstruction and hurt families at all income levels. The construction math is impossible, absent significant government subsidies, which even if provided, are highly encumbering/delaying.

Of course we all want housing to be affordable for folks, which I would loosely define as costing 1/3 or less of a one’s income.

What we cannot afford is to delay housing recovery and reconstruction, especially on the basis that “replacement apartment housing must be affordable housing,” which has been reported.

According to CoStar, 9500 housing units burned to the ground, almost overnight.

If government requires affordable housing apartments in the place of previous housing apartments my worry is 1) it will take much longer to replace, and 2) we will not take this opportunity to build more/larger housing units.

Again we need more housing. More More More. Any housing helps, especially if we can get it built fast to provide relief to the marketplace. Families need these homes.

Please engrain this in your medulla oblongata when you feel the urge to discuss the lack of affordable housing. Any housing being built is still good news for everyone.

Think rents are too high? Supply is the only cure.

So my hope is that the above evidence points clearly to this point as fact.

My Skeptical Take:

Again.

The effects of inflation are permanent. What matters is the inflation %, especially relative to wages and investments you have made in real assets.

Like real estate.

In fact, inflation has been a large part of why real estate has been such a powerful wealth creator, when allowed to compound over time.

Inflation erodes the value of our dollars, as the money supply increases with government deficit spending( remember our 5 cent bubblegum example?).

This phenomenon, often overlooked, is something we've all experienced. But while this might seem like a trivial observation, it's actually a potent wealth-building mechanism when leveraged correctly.

For owners of real estate, inflation is a feature, not a bug.

The secret to success in real estate is often figuring what areas, cities, asset types etc… will inflate more than others, while keeping your debt % fixed. You may know this by a different name: appreciation.

FYI, the 30 yr fixed mortgage is a uniquely American debt tool, other countries don’t have it. Thank you USA!

So if broader economic inflation is a concern, assets like real estate are a great way to not only hedge against its effects, but also outperform other investment vehicles.

I hope the data above now makes more sense.

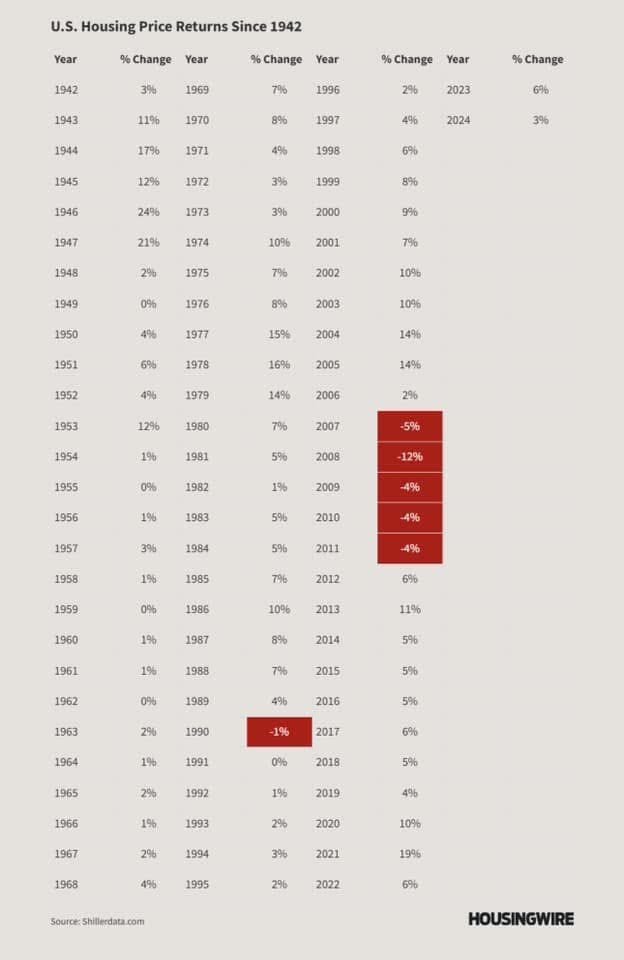

There are numerous strategies for building wealth, but real estate might just be the most consistent among them. Here is chart. Since 1942, home prices have declined just 6 times, mainly during the aptly named 2008 housing crisis.

And don’t, forget, there are 5 ways real estate investors make money. Appreciation is just 1 of them.

Real estate is a fantastic financial tool.

Take advantage.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

Subscribe Today! (and get some amazing perks)

Paid subscribers get the best stuff! Join the Skeptical Investor Community to access:

Premium content and removal of newsletter paywall,

Every article we have published - a treasure trove of information and education,

Conversations with other investors in the Skeptical Investor community,

Key insights and predictions re: the latest financial news,

PLUS, subscriptions include an annual one-on-one call with me personally. So make sure to take advantage! Subscribe today.

Just $5 bucks a month.👇

We have passed 10,000 subs! Thank you for your support, next stop, 20,000!

Please help grow the community!

It takes me several hours to write this weekly article, and they will always remain free (but you get some pretty cool perks with premium, including a one-on-one with me:). All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you think I was going to send you a Starbucks gift card? 😅

Ready to Start Investing in Real Estate?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great deals, as well as manage their real estate portfolio, here in Nashville, TN. If you are looking for an investment property, give us a call today!

For all the information on who we are and what we offer, visit our real estate website www.NashvilleInvestorAgent.com or setup a call today!

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. We have the lowest unemployment rate of the top 25 major cities and folks are moving here to take those jobs. Nearly 90+ people per day move to Nashville. And tourism continues to hit record levels. This past year 16.8 million folks visited our lively city. Plus we have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, no state income tax… to name a few amazing advantages. Come check us out, the water is warm :).