Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.04%

(👇.11% from this time last week, 30-yr mortgage)

This week, we’re talkin’, all this AI is crazy! But are we in a bubble? And what even is a bubble exactly? What risks exist from potential financial contagion? And how could this affect the real estate market?

Let’s get into it.

The Weekly 3 in News:

Rents have bottomed, as housing supply pressures drop from record peaks to below-average. Here is the latest from large apartment operator Camden (Parsons).

Ready for Tax Season? Don’t miss this episode on ‘How to legally pay the least amount in taxes as a real estate investor (BP).’

Chinatown Development Coming to Nashville. Nashville's largest Asian supermarket opens as part of Chinatown development (Fox17).

The 2026 Economy is AI.

All these crazy apps, models, algorithms, bots, agents, etc., are quickly making their way into our daily lives, and are proliferating even faster in the corporate world.

I bet all of you have made some use of AI this week.

Perhaps something simple like asking ChatGPT to summarize a long news article or draft an email response to a client?

Or something slightly more in-depth, like analyzing the P&L and rent roll for potential financial red flags?

But what is really being built in the economy is not software.

It is not another app or SaaS company.

It’s real, physical infrastructure - split between advanced semiconductor fabs and chip manufacturing on one side, and old school electric generation on the other.

We need to generate A LOT more power to run all this stuff. And China, our near peer in AI, is now generating twice as much electricity as the US.

Companies and nation-states are warring for electrons.

We are in the midst of the Fifth Industrial Revolution!

Or are we?

This tech and power build-out is taking a LOT of money and resources to do.

So the worry is that all this may not really be needed, or not at this massive scale, which is why some are warning of a potential “AI bubble.”

So, are we?

((I promise I’ll bring it back to real estate, hang in there :) ))

The World Watt War.

The largest AI investors (Amazon, Google, XAI, Microsoft, Meta, Oracle etc…) are on track to spend a staggering $680+ billion on AI infrastructure this year. To put that in perspective, that is roughly 1.3% of the entire U.S. GDP funneling into physical assets: silicon, memory chips, power plants, land, specialized buildings...

This is significant. In a world where 2% growth is considered “healthy,” the AI boom is effectively the difference between a growing economy and a stagnant one.

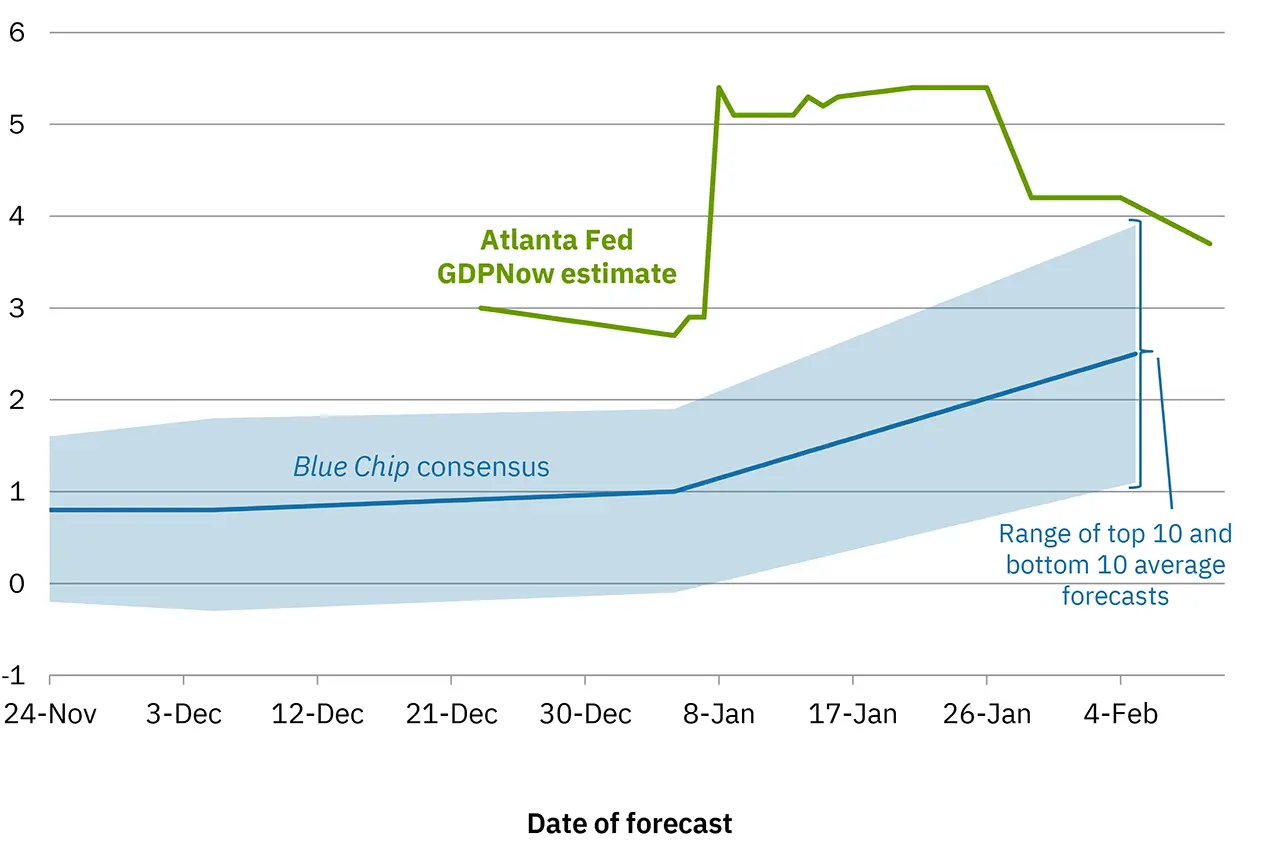

US GDP at the end of 2025 is expected to grow 3.5~5.4%, on the shoulders of the AI build out (AtlantaFed).

Enormous.

So, is this the next industrial revolution, or will our future be empty data centers in jobless suburbs, left as a relic of tech overenthusiasm?

So, What is a Bubble?

Let’s first define our terms.

What even is a bubble?

And by this, I mean not just a small economic recessionary hiccup that is over in 2 months. Specifically, something that would create a serious recession we all worry about, ala the Great Financial Crisis of 2009.

For this, I look to famed investor Steve Eisman, who was depicted by Steve Carell in the movie The Big Short, who defines the causes of a deep crisis resulting from a bubble as having four interlocking elements:

Excessive leverage/debt.

A massive asset class blow-up (subprime mortgages/housing/DotCom).

Heavy ownership of that asset by key institutions.

Derivatives creating contagion.

Importantly, Eisman emphasizes derivatives (particularly credit default swaps) as the unique accelerant of the GFC, which made it a global crisis, creating opaque interconnectedness across financial institutions that risked total systemic collapse.

What are derivatives? Essentially, they offer insurance against the risk of a bond issuer - such as a company that is borrowing to fund its AI buildout - not paying its creditors.

I’ll let Selena Gomez explain an example of derivatives to you, it to you in her fantastic scene in The Big Short.

This is when a bubble really gets bursty.

What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.

So, Do These Causal Bubble Items Exist Today?

Again, big leverage, a large asset class, heavy ownership by systemically important financial institutions, and derivatives tie the balance sheets of these large firms together in a complex, intricate web.

These are the hallmarks of a potential bubble popping and turning into a deep recession.

And, so far, no.

Whew! I’ll explain.

The Good News - Leverage is Minimal

The hyperscalers (Alphabet, Amazon, Meta, Microsoft, Oracle, Xai…) are spending at a historic pace, guiding roughly $650 billion in capital expenditures for 2026, a 60-70% increase from 2025. But today’s tech investment buildout, unlike the 2000 tech bubble, which was built on eyeballs and leverage (debt), is funded mostly by massive free cash flow. In other words, these companies aren’t borrowing to build; they are spending profits to ensure they aren’t left behind. Many of these companies would otherwise just buy back stock to boost their share price, so this could be money better spent.

Oracle and OpenAI do stand out as leveraging much more since they do not have the immense free cash flow the other hyperscalers do. But so far, those two have shown plans to fund the buildout (and OpenAI is backed by the hyperscalers anyway, much of it equity).

Oracle is the clear outlier, but not overleveraging as of yet. This month, the company announced plans to raise $45–50 billion through half equity, half bond issuance. This follows $18 billion in bonds issued in 2025. As a result, Oracle’s balance sheet is now meaningfully more levered than its hyperscaler peers. Total debt exceeds $130 billion. Rating agencies have explicitly flagged this as a concern, though Oracle’s bonds remain investment-grade, for now especially since they issued the equity raise.

In summary: This is elevated leverage, yes, but it is transparent, contract-backed, and deliberately balanced with equity.

OpenAI is funding its enormous compute build-out almost entirely through equity, not debt. It is currently raising a $100 billion funding round (following a $40 billion round in 2025). Investment company SoftBank (not a bank) has committed more than $30 billion and is in talks for another large slug; Microsoft, Amazon, Nvidia and others are also participating in the equity raise. OpenAI carries no large material debt on its balance sheet. Instead, it is burning cash at a projected $14–17 billion pace in 2026 while sitting on $1.4 trillion in long-term infrastructure commitments (including the $300 billion five-year deal with Oracle).

In summary: the financing risk here is not traditional leverage but continuous dependence on ever-larger equity infusions at ever-higher valuations and cash burn.

How does this compare to 2009?

None of this approaches the 30-34× leverage ratios or subprime-style debt loads of 2009 GFC. The system is not over-levered in a systemic sense. But Oracle’s pivot to debt and OpenAI’s reliance on perpetual equity raises are the first real signs that the AI build-out is beginning to strain available funding.

Do we have heavy ownership by key institutions?

Sorta.

The hyperscalers themselves are by definition heavy owners, but large financial institutions are not, nor are they interconnected via derivatives (keep reading). However, the “Magnificent Seven” hyperscalers now represent roughly 33% of the stock market, so if they go down, that could bring deep problems. Thus, we should get more skeptical IF they start leveraging up with debt issued by large financial institutions.

Sudden Stop Risk

Of note, investors betting/hedging against Oracle, again the company that has borrowed the most ($100+ billion) to fund its AI capex, are piling into credit default swaps, aka derivatives.

But, importantly, as of now, no interconnected web of these default swaps between systemically important financial institutions exists (#4 above).

Counterpoint: If I were a bear, I would point out that risk does exist IF this buildout were to “sudden stop.”#2 above. Billions are being spent, and the revenue generated from the buildout has been slow to mature. This is the “revenue gap” between what is being spent on infrastructure and what is being earned by the AI software using that hardware. Again, in 2026 total Capex is estimated to reach $650 billion. But direct AI software revenue is only expected to hit $45 billion.

The concern is that if software revenue doesn’t catch up by 2027, we may see a CapEx Cliff (aka a sudden stop), where companies halt their spend and a potential for overbuild overhang. The breakneck demand for new data center starts could stall, leaving investors holding expensive, power-hungry shells with no tenants.

Bubble burst.

But so far, the asset class—data centres, chips, and the power to run them—is undeniably massive and expanding, derivatives are not widely held among the big banks and the big AI hyperscalers are not leveraging up.

Good news all around.

So, why the heck is this important for us real estate investors?

I hope it’s fairly obvious at this point.

The AI infrastructure boom is the thing driving economic growth. And if it were to stop suddenly, it would take down the economy.

Definite recession. Job loss, all the bad stuff. Folks are under pressure to pay the rent.

BUT, the good news again is: worst case, we still don’t have the cocktail for an economic contagion ala the 2009 GFC,

We really only have 1 of the 4 potential causes for that: a potential massive asset class blow-up.

But a sudden stop of AI-related spending would be highly recessionary. And, thus, we will keep an extremely close, skeptical eye on this 5th “revolution.”

Too Big To Care? Putting the Real Estate into Perspective

Much of the wealth and investment - and thus risk - from the AI buildout are capatalized in the stock market (and a growing amount in the bond market).

But real estate is highly insulated from the boom and bust cycle of this market. Even with the mindboggling amounts being spent by these tech companies, real estate is in another league.

Real estate is big. Really big.

Moving this market is extreamly hard. If the stock market is the tip of the iceberg—the small, visible part above the water—then real estate is the behemoth lurking below the surface.

Real estate is the world’s largest asset class, dwarfing the combined value of global equities and debt, country balance sheets, making it the most significant store of wealth globally.

Global real estate is valued at ~$673 trillion, representing about 61.2% of the total $1.1 quadrillion in worldwide assets (AssetMarketCap).

Now that is scale.

(Yes yes, global real estate value estimates vary: Savills reports ~$393T (2025), while some projections like Statista reach $673T (2026). For total global assets, McKinsey’s global balance sheet shows $1.7Q (2024).) The important thing to know is it’s the largest, by far.

This is why, during most recessions, nothing happens to real estate.

Case in point:

Of the 13+ economic recessions since World War 2, only the 2009 Great Financial Crisis, which was housing-related, significantly affected the real estate market (Housing Wire).

It can take a punch. Just look at that!

Save this chart. This is perspective.

A Quick Ad Break….RentRedi

Ready to Take Your Property Management to the Next Level?

Enter RentRedi. Built by landlords, for landlords

Inspired by people like you, RentRedi makes managing properties smarter, simpler, and more human. Many members of our team also own and manage rental properties.

Plus, Skeptical Investor readers get $100 off. Click this referral link and test drive today!

Want to advertise to the more than 50,000+ weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

One last note: inventory was high back then in 2005-2006.

Really high. Not like today.

Furthermore, homeowners today are in the BEST financial shape of their lifetime.

Homeowners are in Fantastic Financial Shape

While credit card and car loan delinquency are on the rise, mortgage delinquency is not following this trend.

In fact, as of Q4-20205, it’s almost non-existent.

“It’s remarkable how few people are behind on their mortgage,” Compass Chief Economist, Mike Simonsen (great follow on X).

Low Leverage

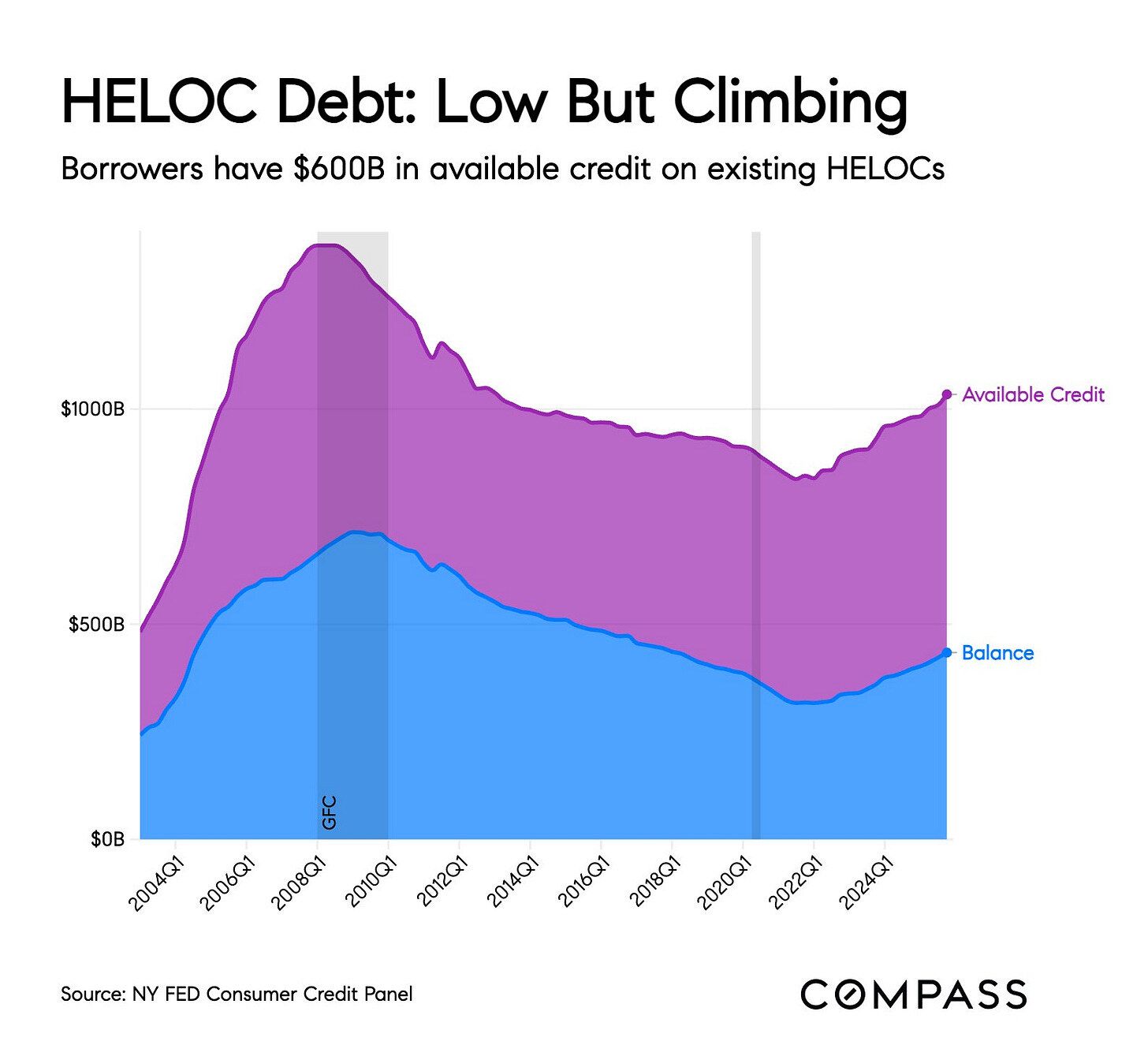

And even though the amount of equity in one’s home has climbed, folks still aren’t under financial pressure, where we would see them tap that and increase their leverage with a Home Equity Line of Credit (HELOC) (Compass).

Remember, one of our 4 elements of a bubble is high leverage, which doesn’t exist today.

My Skeptical Take:

We are living in an AI Capex economy.

Massive hyperscaling companies are building the factories before we even know if the products will sell. We all see the potential for AI, but we don’t know for sure.

There is a lot of money at risk. And these companeis are betting the farm.

But does there exist the threat of a bubble, and could it burst, spilling over into a global contagion that takes down the real estate market?

Likely not.

Again, we likely need the four interlocking root recessionary causes to be present...

Become a Premium Subscriber

Become a paying subscriber to get access to the rest of this post and other awesome subscriber-only content, like a one-on-one with yours truly.

Upgrade for Just $5 Today!Subscription Benefits:

- Premium Content and NO Paywall

- Subscriber-only market insights

- Breaking News Analysis

- Every article we have published - a treasure trove of information and education

- Annual one-on-one coaching with me personally! ($1000 value!)