Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

The Election Doesn’t Matter

Real Estate Fundamentals are Strong

Be in the Arena

My Skeptical Take

We have a new newsletter partner! Looking for unbiased news? Look no further.

Looking for unbiased, fact-based news? Join 1440 today.

Upgrade your news intake with 1440! Dive into a daily newsletter trusted by millions for its comprehensive, 5-minute snapshot of the world's happenings. We navigate through over 100 sources to bring you fact-based news on politics, business, and culture—minus the bias and absolutely free.

The Weekly 3: News, Data and Education to Keep You Informed

US GDP Continues to Outperform. A year ago Economic Forecasters expected real GDP growth to be 1.3% in 2024-Q3. Two months ago they expected it to be 1.9%. The numbers just came out, it was 2.8% (BLS).

We now have direct-to-cell satellite phone service, to your existing cell phone, connecting more than 27,000 phones located in hurricane-ravaged parts of the US (SpaceX).

Man Arrested and Charged with Attempting to Use an Explosive to Destroy an Electric Substation Facility in Nashville (DOJ).

Today’s Interest Rate: 7.05%

(☝️.02, from this time last week, 30-yr mortgage)

Today is Election Day, so I’m sending the newsletter out a day early.

Why? I’m having an election night party and no matter who wins…

…. I’ll definitely be hungover tomorrow.

I’ve always loved election nights, dating back to when I was a lowly 20-something-year-old staffer in Congress. The local bars on Capitol Hill were full of energy, excitement and… drinking games. You haven’t lived ‘till you get a DEM vs GOP flip cup game going in the basement of Pour House, just a few steps from the Capitol and Supreme Court. But that was back when we could seemingly have fun together, no matter your political persuasion. I hope we can get back to that. Make bi-partisan flip cup great again!

It was good times.

For us Skeptical Investors, the election is largely irrelevant. And unlike these elections, investing is not a coin toss. It’s not a hope or a dream. You don’t have to swing at every ball. You can wait for that fat pitch to come across the plate, load up, and clout that bad boy.

While it is true that perceived election uncertainty does exist and; thus, will likely cause some skittish folks to de-risk, this should mainly be constrained to the stock and bond markets. And I do expect some volatility in the next 7 days (especially if the election results take a day or so), which could affect mortgage rates in the very short term. But, in my opinion, this is a fleeting psychological phenomenon. It likely does not matter who’s in the White House when it comes to real estate, or the economy for that matter. Our economy is like the Titanic, and even a President has very little power to turn it meaningfully one way or the other. Sure there may be effects around the edges but those will be negligible, especially as it pertains to us long-term real estate investors.

Markets will do well.

Why?

Real Estate Fundamentals Are Solid.

There’s a lot to like. Let’s get into it.

The Fed Is Unwinding its Stranglehold

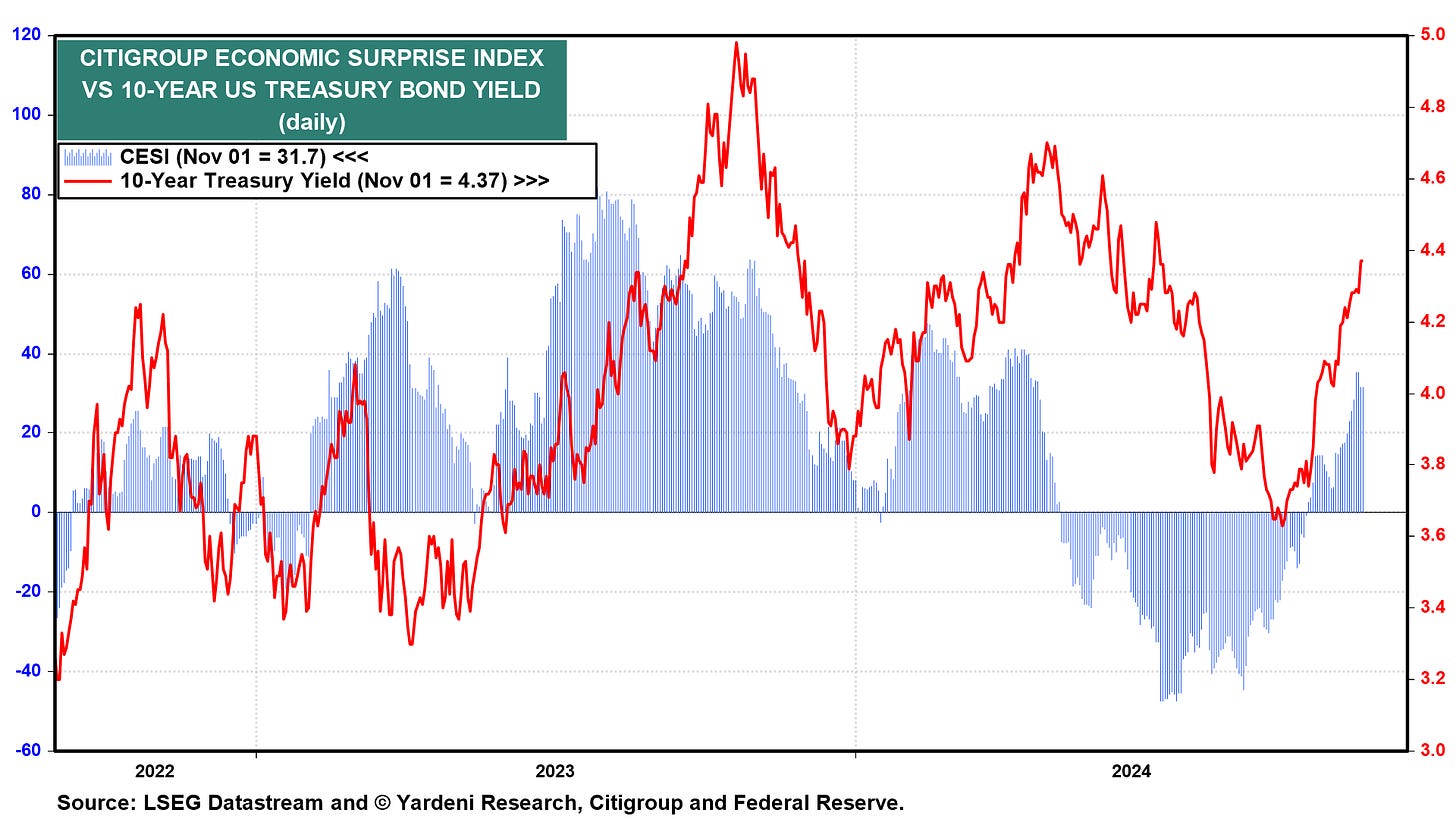

The Federal Reserve has begun a new cycle: loosening monetary policy, after 2 years of tightening. This just started in September. They cut once, by .50% and will decide again this Thursday whether to pause or cut .25% (the two likely scenarios). However, mortgage rates are actually up, but this is because of two very specific reasons 1) a perceived risk that inflation may return and 2) better-than-expected economic numbers, which have catalyzed the sale of Treasury bonds.

The good news: whichever way the economic winds blow, real estate investors win.

IF the .50% Fed cut in September was too much too soon - i.e. they stimulated an economy that didn't need stimulating - inflation may go up, but so will the value of assets in tandem. Including real estate. This good for property owners. IFthe economy does better than expected, yet doesn’t overheat, ostensibly that means that unemployment is low, business earnings are high, wages are robust and real estate activity increases. Also good. True, rates will take more time to come down in this scenario, so us Skeptical Investors should be ready for this. Assume higher mortgage rates when calculating returns. This may be the likely case since fiscal policy in a new Administration, no matter which political party is in power, will likely remain stimulative as well. Lastly, IF the bears on Wall Street are correct and the data is pointing to a recession and not a normalization / return to the mean for labor markets, good. The Fed will accelerate interest rate cuts, and bond / mortgage rates will drop, opening the buying window for real estate investors, particularly developers who utilize more expensive construction loans.

This is why I love real estate.

Homeowners’ Financials are Historically Robust

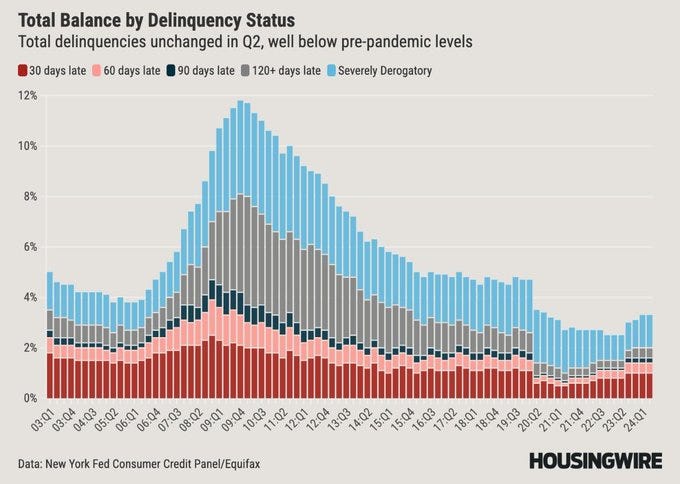

Mortgage delinquencies are low and holding steadfast, roughly flat since 2020 and far below both pre-COVID and pre-Great Financial Crisis.

Homeowners’ also own far more equity in their home. The loan-to-value of the typical homeowner is below 50%, vs 85% in 2008. Rising property values, combined with locked in low mortgage rates, mean we have the smallest percentage of homeowners underwater in history (Mohtashami). Good.

Labor Markets are Tightening but Still Strong

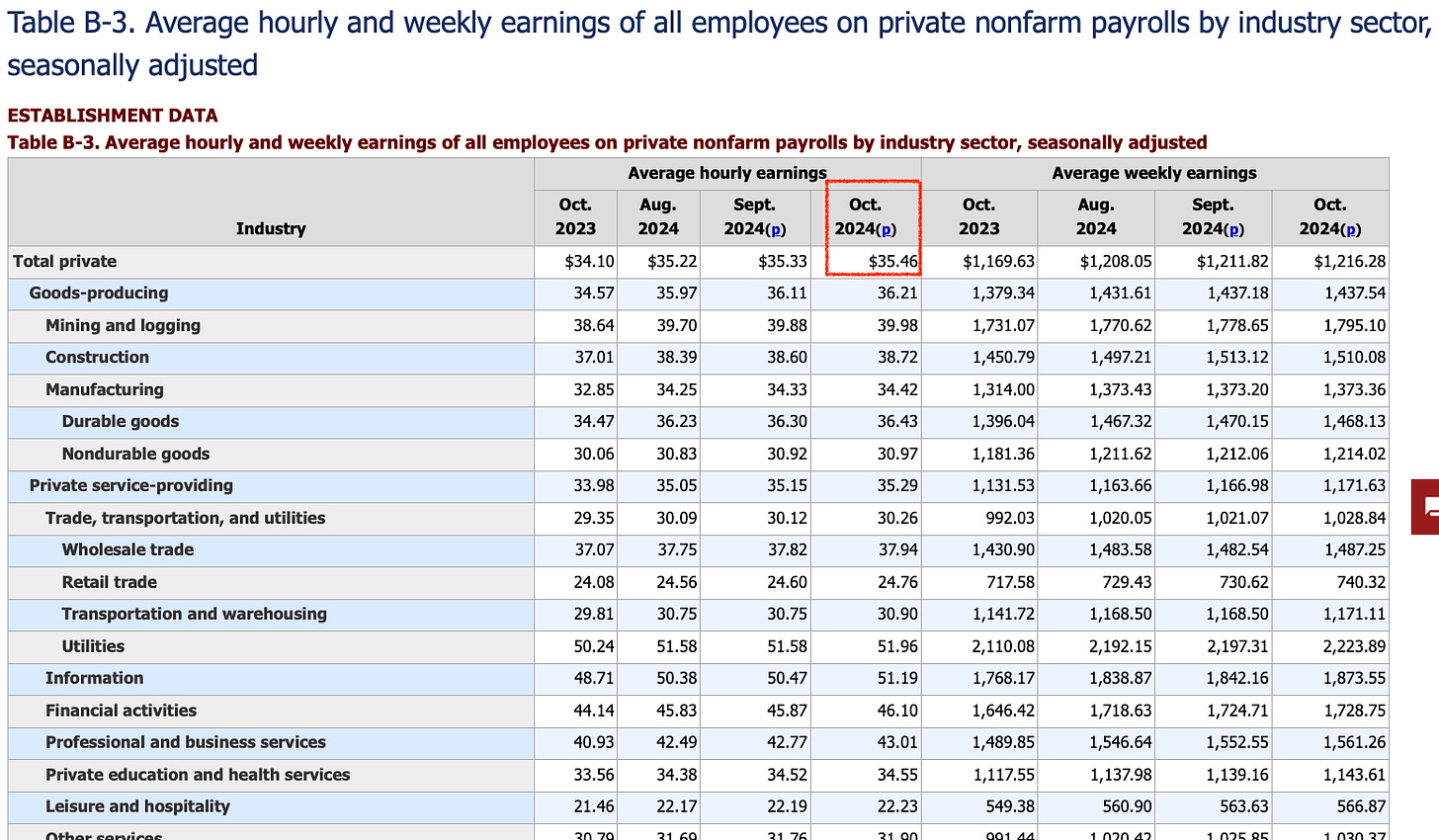

October employment numbers were just released and they remain positive. From the BLS:

Average hourly earnings growth remains high at $35.46, and was up 4% from last year, growing faster than current inflation. Good.

and,

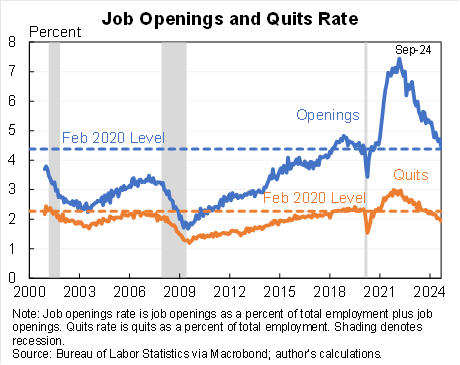

Job openings and quits rates (JOLTS) were both down slightly. Job openings is now back to pre-COVID levels and the quits is back to 2015. Remember, the quits rate serves as a measure of workers’ confidence and willingness / ability to leave their jobs. This loosening labor market is either: a sign of a labor market weakening undesirably, or one that is normalizing to more historic levels.

I am in the latter’s camp, for now. If so, Good.

and,

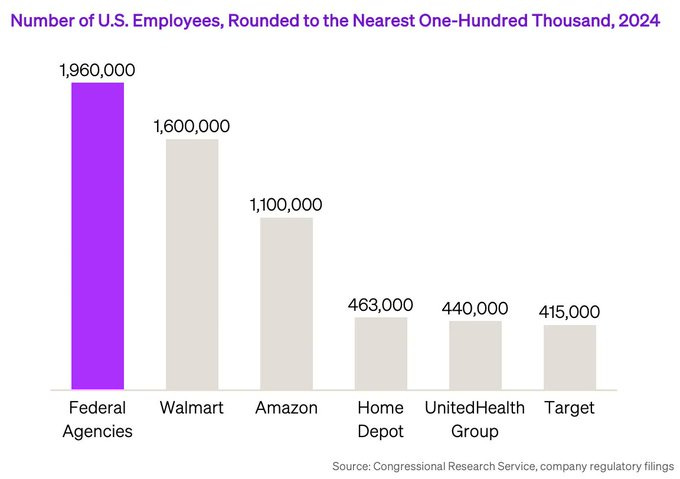

"Total nonfarm payroll employment was essentially unchanged in October (+12,000), and the unemployment rate was unchanged at 4.1 percent."Good. However, one large caveat with the numbers here: government employment continued to make up a large amount of overall employment growth. +40,000 (wow that’s a lot of bureaucrats). So if you back out government growth from the numbers, labor growth was negative in October. The Federal gov is the largest single employer, employing nearly the same number as Walmart and Amazon combined. Not Good. We need fewer gov workers/spending as a % of the economy. This is a drag on productivity and contributes to our enormous $35 Trillion debt.

Counterpoint, there were other negative factors contributing to the October numbers, like 1) Hurricane Helene and 2) multiple large labor strikes of more than 44,000 folks, including 33,000 Boeing machinists, who walked off the job on Sept. 13. They just returned to work today.

Additionally, the September employment number of 254k was revised down to 223k (-31k) and the August number of 159k was revised down to 78k (-81k). Trends of lower revisions MoM are eyebrow-raising.

Something to keep a Skeptical eye on. Not Good.

Fed Watch: Inflation Continues Lower

We also got Personal Consumption Expenditures for September last week, which fell YoY from 2.3% to 2.1% as expected. This is the Fed’s preferred measure of inflation as it captures a wide range of consumer expenses. This number highly influences future rate-cut decisions. *** Remember the Fed meets this Wednesday and Thursday to decide on a potential rate cut. Their next meeting is December 17-18.

I’d say it’s really 50/50 that the Fed pauses or slices .25%. It’s hard to handicap it.

Business / Economic Environment

Things are good! Corporate earnings are outperforming expectations, GDP growth is up and above expectations, the stock market is at all-time high…While I am always default Skeptical, so far so good for 2024.

As I said last week, I am now officially less bearish, but remaining vigilant, of course.

PUT AD HERE

Don’t forget to share, if you dare…

My Skeptical Take:

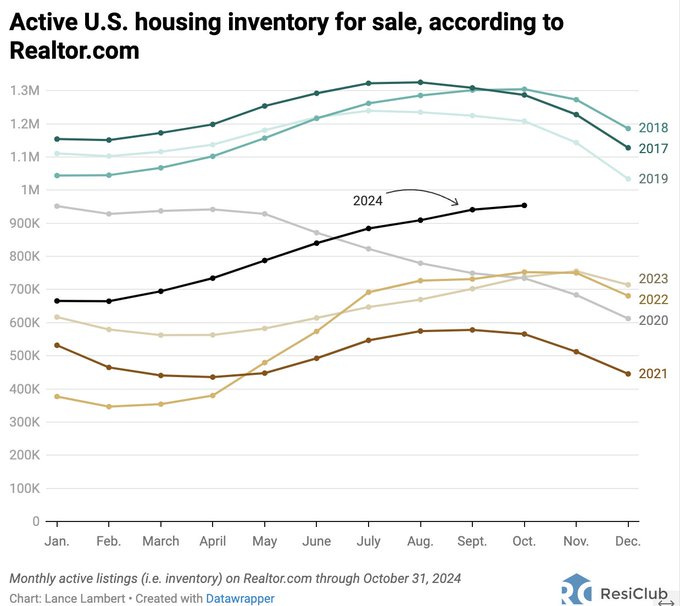

I’ll say it again, now is the time to pick up a deal investors! We are at a potential crossroads in markets. The good news is, either path has a pot of gold at the end. Plus, housing inventory is up, buyers have the power in negoitations and deals are to be had.

Anecdotally, I just had two savvy clients pickup a large duplex deal for $25k under market (ie $25k under median comparable sales), here in Nashville.

They are IN the Arena, so what action are you taking this Winter?

Folks who can’t afford the higher rate can’t afford to participate in this higher interest rate environment. They have to wait ‘till Spring (or maybe even longer).

So if you can, do.

“But, what if inflation does rear its ugly head…?”

Good. Property values up.

“Ok, well, what if these economic signals are not a sign of a normalizing economy, but fo one that may be approaching recession….?”

Good. Interest rates will plummet and you can refinance that property, lock in 30 years of low interest rates, pull out equity, and buy another! (aka the BRRR method).

But, if you stay on the sidelines, acting fearful and not greedy, you will reap the benefits of neither.

To succeed you have to be, as Theodore Roosevelt put it: “In the Arena.” His wise words are apropos of today’s market. And I will leave you with them as food for thought.

We all want to grow our wealth for our us and families. The only question is, what are you going to do about it?

“It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does actually strive to do the deeds; who knows the great enthusiasms, the great devotions; who spends himself in a worthy cause; who at the best knows in the end the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who neither know victory nor defeat. Shame on the man of cultivated taste who permits refinement to develop into fastidiousness that unfits him for doing the rough work of a workaday world. Among the free peoples who govern themselves there is but a small field of usefulness open for the men of cloistered life who shrink from contact with their fellows. Still less room is there for those who deride or slight what is done by those who actually bear the brunt of the day; nor yet for those others who always profess that they would like to take action, if only the conditions of life were not exactly what they actually are. The man who does nothing cuts the same sordid figure in the pages of history, whether he be cynic, or fop, or voluptuary. There is little use for the being whose tepid soul knows nothing of the great and generous emotion, of the high pride, the stern belief, the lofty enthusiasm, of the men who quell the storm and ride the thunder. Well for these men if they succeed; well also, though not so well, if they fail, given only that they have nobly ventured, and have put forth all their heart and strength. It is war-worn Hotspur, spent with hard fighting, he of the many errors and the valiant end, over whose memory we love to linger, not over the memory of the young lord who “but for the vile guns would have been a valiant soldier.”

- Theodore Roosevelt, speaking at the Sorbonne in Paris on April 23, 1910.

Until next time. Stay Curious. Stay Skeptical.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

It takes hours to write this weekly article, and they will always remain free. All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you think I was going to send you a Starbucks gift card? 😅

Ready to Start Investing in Real Estate?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great deals, as well as manage their real estate portfolio, here in Nashville, TN. If you are looking for an investment property, give us a call today!

For all the information on who we are and what we offer, visit our real estate website www.NashvilleInvestorAgent.com or setup a call today!

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. 90+ people per day move here and last year 16.8 million folks visited our lively city. We have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, and no state income tax, to name a few amazing perks.

* I write this myself and get it out for you all on the same day. Apologize in advance for the likely errata. Don’t have a team of editors, yet.

** The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and do not constitute financial advice.