Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.83%

(☝️.02% from this time last week, 30-yr mortgage)

Today, we’re talkin’ random market thoughts. I got a few things knockin’ around the ol’ noggin. Today’s issue will be a little shorter than normal. PLUS….

A big announcement and gift! You’ll have to read to find out.

Let’s get into it.

The Weekly 3 in News:

Amazon CEO: No inflation so far: “We have so far not seen prices appreciably go up (CNBC).”

Wages for hourly workers are up 2% in 2025. One key reason, perhaps, why the consumer is holding up so well despite the confidence ups and downs (Treasury).

Weekly Trade Watch:

Forthcoming trade deals with Indonesia and Vietnam were just announced. U.S. exports to Indonesia would face no tariffs, while Indonesian goods would be charged a tariff of 19% in the United States. On the Vietnam front, the agreement is expected to include a 20% tariff on their goods with no such tax on US exports. Mexican President Claudia Sheinbaum is discussing trade collaboration with Canadian Prime Minister Mark Carney, focusing on countering U.S. tariffs set for August 1. South Korea also signaled progress toward a possible U.S. trade deal by August.

The Economy: State of Play and This Week’s Numbers

Both Consumer and Producer (wholesale) inflation numbers came in slightly higher and below expectations, respectively.

This week’s Consumer Price Index (CPI) showed inflation at 2.7% YoY, slightly above the expected 2.6%. Producer Price Index (PPI) came in at 2.3%, below the expected 2.5%, YoY. MoM was flat, also below the expected .2% increase. Core PPI (excluding volatile food and energy) was flat MoM and 2.6% YoY, both also lower than expected.

Fun fact, PPI came in lower than all 50 economists in Bloomberg’s survey predicted.

What’s the difference in CPI and PPI? PPI measures the average change in prices received by domestic producers for their goods and services over time. It’s focused on the wholesale level, aka raw materials, intermediate goods, and products before they hit retail. CPI tracks the average price changes for a basket of goods and services bought by consumers, like groceries, rent, or gas, retail goods... So, PPI looks at prices from the producer’s side, early in the supply chain, while CPI reflects what consumers actually pay at the retail level. PPI can signal future consumer price shifts since producer costs often trickle down, but it’s slightly narrower, missing things like housing/shelter, which CPI covers. This is important to know because shelter cost was the primary factor for the monthly increase in CPI. Up 3.8% YoY.

Importantly, shelter costs have a massively outsized weighting, making up ~40%+ of CPI. This hefty weighting means shelter has quite an influence on inflation numbers. Moreover, it may sometimes overstate inflation numbers due to lags in how rent data is collected (leases are typically 12 months), which can trail real-time market trends by many months. Of note, shelter costs are likely not affected by trade/tariff policy.

Other notable sector increases over the last year include medical care (+2.8%), motor vehicle insurance (+6.1%), household furnishings and operations (+3.3%), and recreation (+2.1%).

So, what do these numbers mean to us?

Inflation is still not showing signs of reigniting, signaling a higher likelihood of lower interest rates in the near future. What’s the chance the Fed lowers rates in September? 40%.

Just kidding, nobody knows.

Side Note: Whenever I see a TV/Newsletter/Podcast pundit making a bold prediction by assessing the odds at 40% - I always think of this Wall Street Journal 2018 piece.

40% is 100% correct, all the time.

Tariffs Aren’t Derailing the Party Train

So far, while tariffs are important to the President’s agenda, they may not necessarily derail the economy. We have not seen a meaningful increase in prices, consumer confidence or job numbers.

Let’s remember that the economy has remained strong despite all the craziness in the world. Hell, the stock market had a waterfall decline in April because of the tariff announcement, and everyone thought the market wouldn't recover because the Fed wasn't going to unleash liquidity, but it was a V-shaped rebound. Once investors recovered from the shock of a worldwide reorganization of tariff/trade policy, things started to make sense.

Fun fact, today stocks are actually cheaper than they were on the eve of COVID in 2020, by 1.5x. And we have had six Black Swans in that time!:

We had COVID.

We had the supply chain shock.

We had the inflation shock.

The Fed's fastest hikes in history.

We had tariff armageddon.

And then we had the US bombing Iran nuclear facility.

US companies produced earnings growth the entire time. The economy is looking, dare I say, indestructible (Tom Lee).

So, the good economic times are still a movin’. I know it may not feel that way to everyone. There is plenty of political angst, uncertainty, frustration, and even fear in the air. And we real estate folks are agonizing over interest rates (me included!). But our little ol’ economy is chuggin along. Thomas the Tank Engine would be impressed. (Tangent: Did you know that show lasted until 2021? 1984-2021! Holy hell, what a run y’all).

Do you really need a “mentor'“ when it comes to real estate investing?

Probably not.

The single most important part of real estate is finding a deal. You gotta find a deal. I can’t find you a deal. I can guide you on how to approach it, but ultimately, you have to do it yourself. Your mentor / coach / guru can’t do it for you.

BUT if you think you must. You can Consult with Me.

Don’t buy an expensive course, “coach,” or “mentor.”

Get professional advice from someone who actually owns, manages, and brokers real estate. Get clarity on how to grow your business. Let’s run the numbers together and chart your strategy of success.

No BS. No fluff. No Gurus. Only results.

Just $250 bucks. No lame subscriptions. (The swift kick in the pants is free 😂).

I guarantee you will be satisfied, or your money back.

Remember: I’m not your guru, I’m your guardian. I’ll keep you out of trouble and fill your jet with fuel so you can take off on your own.

Want to advertise to the more than 20,000 weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

The Campaign to Cut Continues

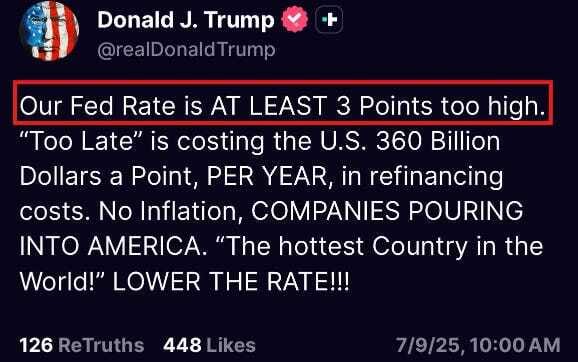

The President is getting ever more frustrated that the Fed has not cut interest rates. A reminder, the Fed cut rates last on December 18th, 2024, and has paused since.

The pressure on Powell to cut rates continues to escalate:

Powell’s stubborn stance on rates is starting to upset other Fed board members, with some now publicly saying they would support a rate cut.

The President wants the next Fed Chair to “be someone who will cut rates” and is expected to name Powell’s successor before the Fall, according to Treasury Secretary Bessent.

And, the President is now calling for the first 3% interest rate cut in US history.

Who will be the next Fed Chair?

Former Fed Governor Kevin Warsh is considered a top contender. He has

But then yesterday, when asked if the next Fed chair is going to be independent, Warsh said, "In a word, yes. I’ve strongly believed for 20 years, and history tells us, that the independent operations in the conduct of monetary policy is essential."

Guess he’s off the short list now. :)

Although he then backed off those comments, saying, “We need regime change in the conduct of policy,” and the Fed should have “[a policy alliance with the Treasury Department].” He also called their models outdated and a relic of the past.

I must admit I agree on the latter.

Ok, he’s back on the list.

My Skeptical Take:

The signal of a change in the Fed Chair is a form of forward guidance for markets. How far out will they look for guidance? When will Powell be considered a “Lame Duck?”

Prediction: The moment the President names a new Fed Chair, there will be a few days of volatility, and then rates will continue their stair-step downward. I do think we get a small .25% rate cut in September, but Powell seems increasingly stubborn, as he attempts to avoid looking political (to his credit this is a difficult position). Again, Powell’s effort to remain apolitical is beginning to appear political, as I have written about previously.

But time will tell. I’m gathering capital, selling some stocks and getting ready to fund my next real estate deal. Property prices are softening, and its starting to look like a damn great time to pick up a deal.

It’s a concise guide for aspiring and seasoned real estate investors. In it, I will walk you through the five primary strategies investors generate wealth through real estate. My book also introduces a few other lesser-known real estate strategies for beginners and includes practical insights, personal anecdotes, and, of course, a skeptical perspective on common real estate myths.

And you can get it now, it’s live now on Amazon and at a limited price (so share with your friends).

But wait, there’s more.

As a subscriber to the Skeptical Investor, I’m giving you the book for free! (although it’s just $5 bucks, less than my latte at this coffee shop I’m typing furiously at so I can meet my contractor on time for once).

I do ask one thing in return: leave me a review on Amazon. It helps the algorithm do its thing. Once you do, email me and I will immediately send you a refund. (To leave a review, you have to buy the book first on Amazon).

Thank you. Thank you. Thank you…all you awesome Skeptical Investor readers out there.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. Want to protect yourself from stock market volatility and inflation? Own assets, buy real estate. Don’t know where to start or know a friend looking for a home? Give us a call! We got you.

Ready to Start Investing in Real Estate? Know someone who does?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great real estate deals, as well as manage their rental properties, here in Nashville, TN. We pride ourselves on being tough negotiators. We want our clients to get an amazing deal, we never let our clients pay retail.

Enjoying this newsletter? Know somebody looking to buy real estate? Send them to the best in the business, THE Nashville Investor Agent! Referring real estate business helps us keep the lights on and me keep pushing out fresh real estate analysis each and every week. Help peep this newsletter going for all you awesome folks out there; refer someone to us when you may hear they are in need. We promise to take great care of them and make sure they get a fantastic deal. They will thank you for it.

If you or someone you know are looking for an investment property, give us a call today!

You can also find out more about us and what we offer on our website: www.NashvilleInvestorAgent.com

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. We have the lowest unemployment rate of the top 25 major cities and folks are moving here to take those jobs. Nearly 90+ people per day move to Nashville. And tourism continues to hit record levels. This past year 16.8 million folks visited our lively city. Plus we have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, no state income tax… to name a few amazing advantages. Come check us out, the water is warm :).

Please Share this Article!

We have passed 10,000 subs! Thank you for your support, next stop, 20,000!

Please help grow the community!

It takes me several hours to write this weekly article, and they will always remain free (but you get some pretty cool perks with premium, including a one-on-one with yours truly :). All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you think I was going to send you a Starbucks gift card? 😅

Subscribe Today! (and get some amazing perks)

Paid subscribers get the best stuff! Join the Skeptical Investor Community to access:

Premium content and NO paywall,

Every article we have published - a treasure trove of information and education,

Conversations with other investors in the Skeptical Investor community, and future meetups and special events,

Key insights and predictions on the latest financial news,

PLUS, subscriptions include an annual one-on-one call with me personally. So make sure to take advantage! Subscribe today.

Just $5 bucks a month.👇