Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.88%

(👇.05% from this time last week, 30-yr mortgage)

Today, we’re talkin’ all the wacky market activity, I update my interest rate prediction, the President kicks off a Shadow Fed Chair Campaign to Cut interest rates, and I reveal the two exclusive risks to the economy.

Ok, there are three. Do you know what they are?

Let’s get into it.

The Weekly 3 in News:

Unemployment of those with a 2-year associate degree is FAR lower than those with 4-year college degrees. Unemployment 20-29 (4 year college grad): 15.3%. Unemployment 20-29 (2-year associate degree), just 2.1%. Learning a trade is powerful, especially in the era of AI (BLS).

Homeowner tenure has doubled. In 2005, the median U.S. homeowner lived in their home for 6.5 years In 2024, it’s 11.8 years (ResiClub).

AI is scaling faster than the Internet. A lot faster. It took OpenAI 8 fewer years to hit 400 billion searches than Google (Altimeter).

Inflation Down Again, Despite Tariffs.

So, are interest rates set to drop?

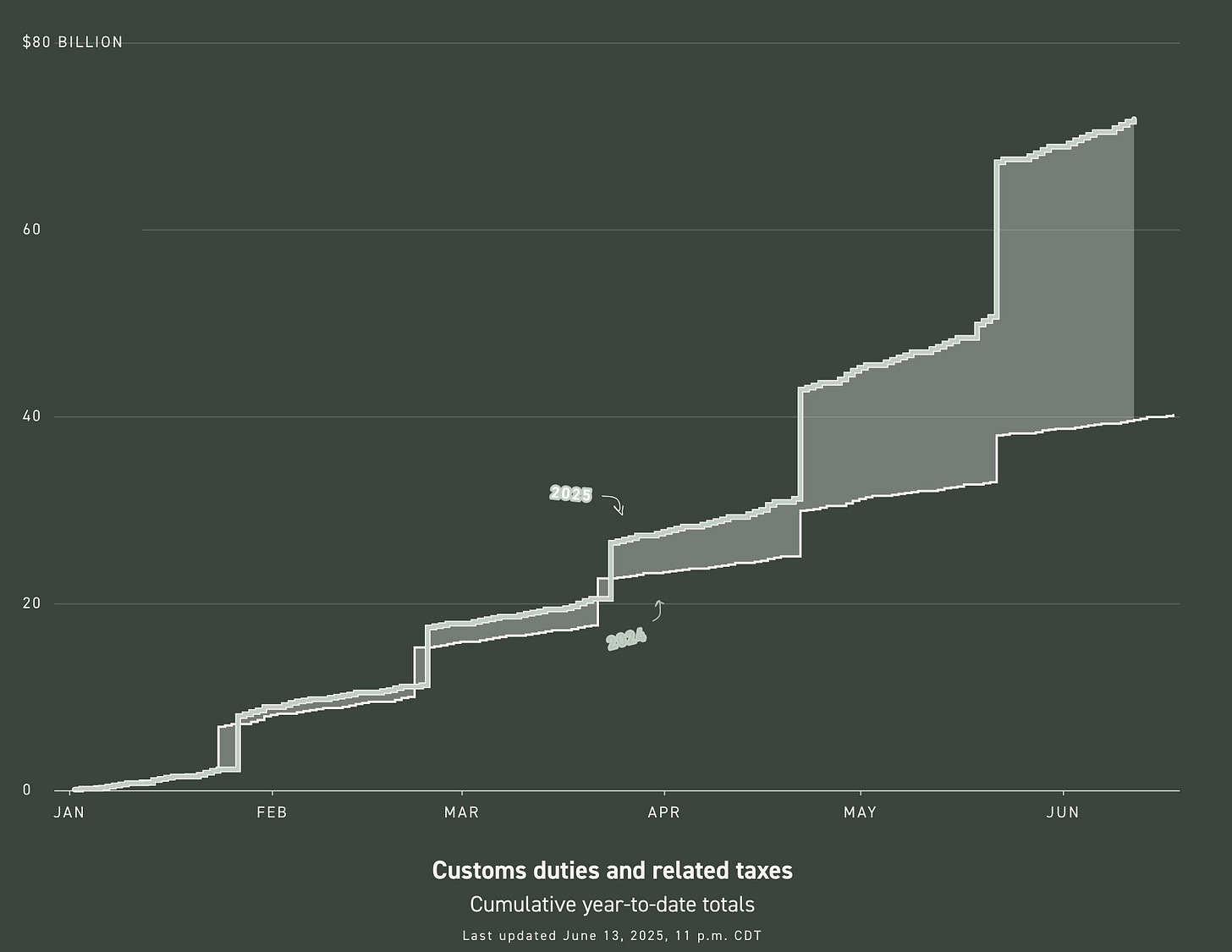

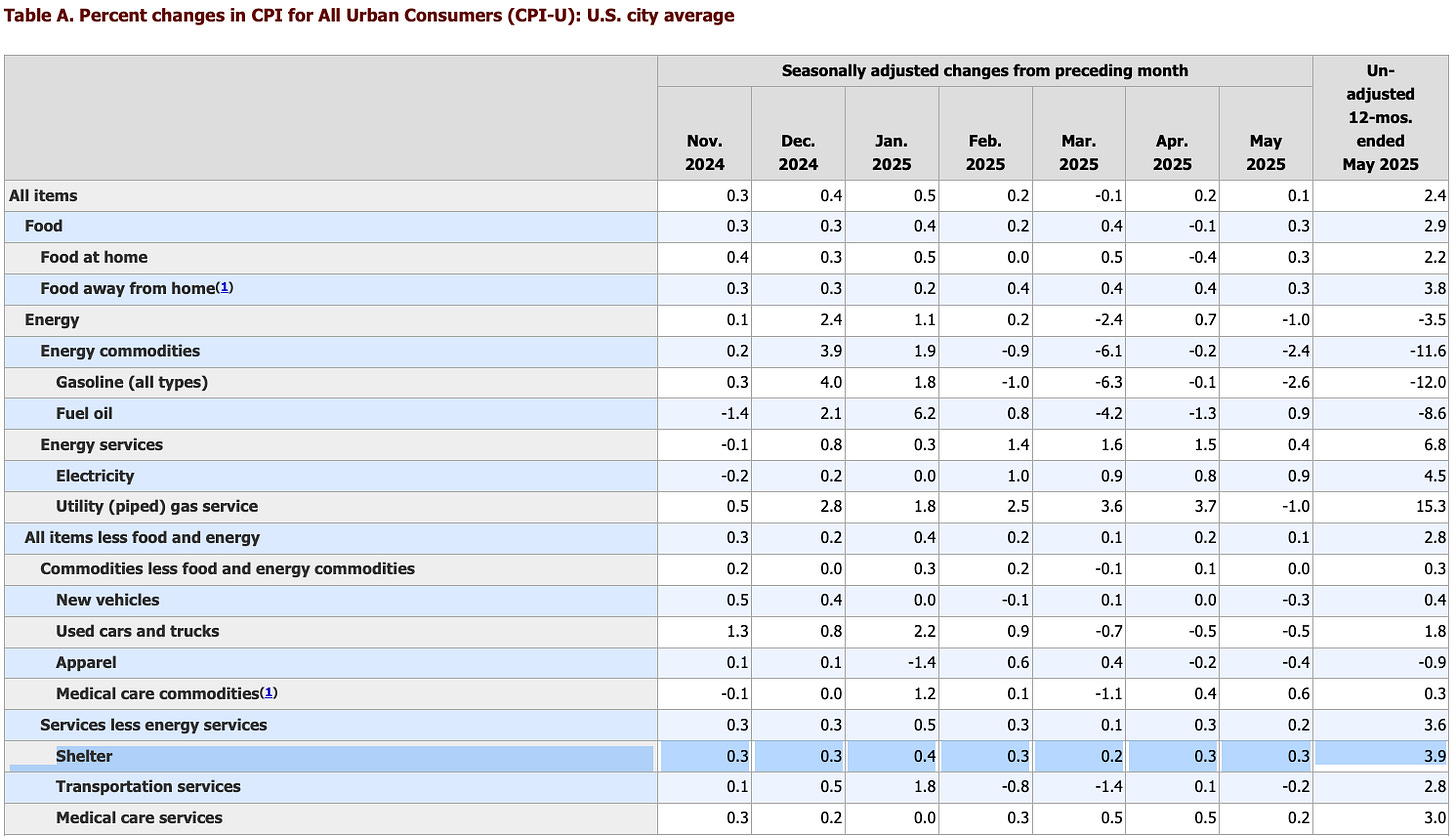

Another week and another positive inflation print. Consumer prices rose less than expected, CPI increased .1% for the month, putting the annual inflation rate at 2.4%. And vehicle and apparel prices, which had been expected to show tariff-related increases, actually posted declines. This year, tariffs have brought in close to $80 billion, with little inflation effect.

So far.

The shelter / rent inflation rate has started to flatten out, now hovering around 3.9% annual growth. Shelter inflation “was [still] the primary factor in the all items monthly [inflation] increase (BLS).” Shelter costs are still growing faster than overall inflation, but again, moderating.

Healthy.

So with CPI (2.4%) and PCE (2.1%) inflation now nearing the Fed’s 2% inflation target, is it finally time to resume interest rate cuts? Why have we paused rate cuts since last Fall, when inflation was much higher?

Heck, how the hell did all this happen anyway?

Interest Rates: How got here.

Between 2022 and 2023 the Federal Reserve, in reaction to being late on the subject, finally unleashed the hounds on inflation, spiking interest rates (Federal Funds Rate) from 0.25% up to 5.5%, in a historic tightening cycle. It wasn’t until Fall 2024, amidst a tricky economic landscape of stubborn inflation and the threat of a potentially weakening economy, did the Fed shift gears. Starting in September, it cut rates three times: a .50% reduction to 4.75%-5.00%, followed by two 25-basis-point cuts in November and December, landing at 4.25%-4.50% by year-end. These moves aimed to boost growth as inflation eased and the labor market softened. But since then, crickets.

Surprisingly, long-term Treasury bond yields didn’t drop concurrently, as expected. They stayed high and then climbed after the rate cuts began. Again, we real estate investors care deeply about the bond market, as mortgage rates closely track the 10-year treasury bond.

So What Happened to Bond Rates?

Normally, Fed rate cuts signal to markets looser monetary policy, stronger growth, and tame inflation, pushing long-term yields down alongside short-term rates. This lockstep movement has long been a pillar of monetary policy, allowing central banks to help guide the economy. But in 2024, starting in September, short- and long-term rates parted ways.

Several structural shifts drove this split. A flood of Treasury bond issuance sparked investor worries about U.S. fiscal health, with big deficits persisting despite full employment. Meanwhile, demand for U.S. debt shrank as the Fed trimmed its balance sheet via quantitative tightening, and major buyers like China and Japan pulled back. More bonds, fewer takers—interest rates rose.

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

How it’s Going.

Roughly 17 years ago, the Federal Reserve became an active participant like never before in shaping the US economy. Born in the shadow of the Great Financial Crisis, the Fed’s near-zero % interest rates and massive quantitative easingpolicies flooded markets with cash, propping up asset prices, curbing borrowing costs, and giving itself extraordinary influence over economic conditions. Holding vast amounts of U.S. Treasury debt, the Fed could jolt bond, mortgage rates, and stocks markets with a single move. The more liquidity it injected into the system, aka printing money, the more leverage it had.

The Fed’s balance sheet is still six+ times what it was pre-2008. But, that clout has faded slightly, as the Fed slowly unwinds its holdings. Although, not it’s not moving too fast; in fact, this year it eased the pace at which it performs quantitative tightening, cutting Treasury runoff significantly from $25 billion to $5 billion monthly. But the does Fed plan on ridding its balance sheet of the extra Treasury notes and mortgage-backed securities it acquired during the COVID era. Once they are finished, that shift will finally, hopefully close a chapter that began in 2008 with bold expansion, followed by a sharp retreat, leaving the Fed less dominant in today’s markets. Of course, they can (and likely will) always return should the economy need another hit of the good stuff.

The bond market is about to kick off this shift.

The Campaign to Cut Begins

The President and most lawmakers on Capitol Hill in both parties want the Fed to cut rates. For his part, the President has threatened a number of times to fire or remove Jerome Powell as Chair of the Federal Reserve. But he has since walked those comments back, saying he has no plans to do so (*cough*, thank you Treasury Secretary Scott Bessent for your sage advice).

But could the President influence or even control monetary policy, without replacing Powell?

Oh yes, and that time is now.

Sponsored

PowerPair

Join thousands of busy parents improving their family life 5% each week through simple systems & scripts focused on marriage, parenting, and mental health. Free, 5-min read every Thursday.

Imagine the President, eager to get interest rates down and replace Federal Reserve Chair Jerome Powell as his term nears its end next May, selects someone now, a year before Chair Powell’s term ends. This person, with encouragement from Administration officials, takes to the media with a clear and calculated message: on day 1, they intend to cut the Fed funds rate and lower mortgage rates. A forceful campaign would signal that a shift in monetary policy will take place in just 10.5 months time, moving bond markets, without the need for the Fed to act.

And the President just overtly telegraphed his intent to do this.

Speaking at the White House last week - Thursday June 12th - the President said, “He [Powerll] was in my office a couple of days ago, and I said, ‘If you think there's inflation, let's find out because I think we're going to keep it down.’”

He continued…

“We'd like to get this guy to lower interest rates…but let's say there was inflation in a year from now, raise your rates. I don't mind… I'm all for it … you don't have to keep them up [there] if [inflation goes] up, I'm okay with you raising [again if needed]…In a year we will guy get out of office, and somebody will come in and cut it a couple of points,and we'll save ourselves seven, eight, maybe even $900 billion dollars a year [if we cut rates].” “What is he doing? Why doesn't he lower these rates?”

The President outright says he will soon be out, he will install “someone” who will cut rates “a couple of points,” and knowing this, the Treasury is going to issue short-term paper today, and then in 1 year when the new Fed Chair cuts rates, Treasury will pivot to longer-term Treasuries.

In other words, it is SO ON. The Campaign to Cut has begun.

Become a Premium Subscriber

Become a paying subscriber to get access to the rest of this post and other awesome subscriber-only content, like a one-on-one with yours truly.

Upgrade for Just $5 Today!Subscription Benefits:

- Premium Content and NO Paywall

- Subscriber-only market insights

- Breaking News Analysis

- Every article we have published - a treasure trove of information and education

- Annual one-on-one coaching with me personally! ($1000 value!)