Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.96%

(👇.01% from this time last week, 30-yr mortgage)

Today, we’re talkin’ fresh economic data points (what are they signaling?), the economic soft data (aka the vibes), GDP is about to explode, and I do a dive into the real estate provisions in the current “Big Beautiful” budget bill being debated in Congress. It’s a big June party.

Let’s get into it.

The Weekly 3 in News:

It’s rooftop pool season! But where to go? An insider’s guide to the best rooftop pools in Nashville (SB).

Nashville’s country music festival is here, with dozens of simultaneous concerts and events. Don’t miss out (CMA).

In a world of trade uncertainty, Nashville has a rock-solid real estate advantage: it’s got loads of concrete. The volatility of the price of steel has made concrete much more competitive. And with recent advances in formwork systems, a concrete structure can be built just as fast — or faster (NBJ).

Economic Data Signaling (Mostly) Bullish

Last week, we had a deluge of important economic news/data, most all of which was positive. I wonder why it wasn’t reported much?… Probably a distraction from the endless political doom loop on the tele.

Let’s take a look, I promise it’s worth your time.

You’ve never experienced business news like this.

Morning Brew delivers business news the way busy professionals want it — quick, clear, and written like a human.

No jargon. No endless paragraphs. Just the day’s most important stories, with a dash of personality that makes them surprisingly fun to read.

No matter your industry, Morning Brew’s daily email keeps you up to speed on the news shaping your career and life—in a way you’ll actually enjoy.

Best part? It’s 100% free. Sign up in 15 seconds, and if you end up missing the long, drawn-out articles of traditional business media, you can always go back.

PCE Inflation - The personal consumption expenditures price index, the Federal Reserve’s key inflation measure, increased just 0.1% for the month, putting the annual inflation rate at 2.1% (bea). Lowest in 4 years. This was huge, we are now almost at the Fed’s 2% inflation target. I’m not going full George W. Bush Mission Accomplished, but it sure feels like it. Very encouraging. The only hanging chad is trade/tariff policy. And so far, it is not coming through in the data. If we didn’t have it I would be satisfied that inflation is crushed. Stay tuned.

Pending home sales - Still suppressed, down 6.8% MoM. In April, all four U.S. regions had fewer transactions than in March. Homeowners don’t want to leave that 3% mortgage and sell only to buy again at 7%.

Federal Reserve meeting minutes - This I found interesting. Federal Reserve staff are increasingly more pessimistic than other market participants. As others, like JP Morgan, are backing off recession calls, the Fed folks now view a recession as “almost as likely” as their baseline forecast, according to minutes from the Fed’s May meeting (Barrons). To me, the minutes showed a clear concern internally over trade policy, including risks of inflation, weakening labor market, and slowing economic growth. So far, I’m skeptical of the inflation call, I don’t see it in the data. This smells to me more like politics and vibes/feelings, not rigor.

Consumer sentiment - Speaking of the zeitgeist (literally spirit/ghost of the time in German), and you all know I am not a fan of sentiment surveys one bit, both Conference Board and UMich consumer sentiment data were released for the month, and guess what? They reversed their 5-month negative march downward. All readings were much higher and better than expected. Count me surprised. If you ask me, my vibe on the vibes is that this is likely what we get when the economy is good, but uncertainty (trade) and politics (divisive headlines) create social consternation.

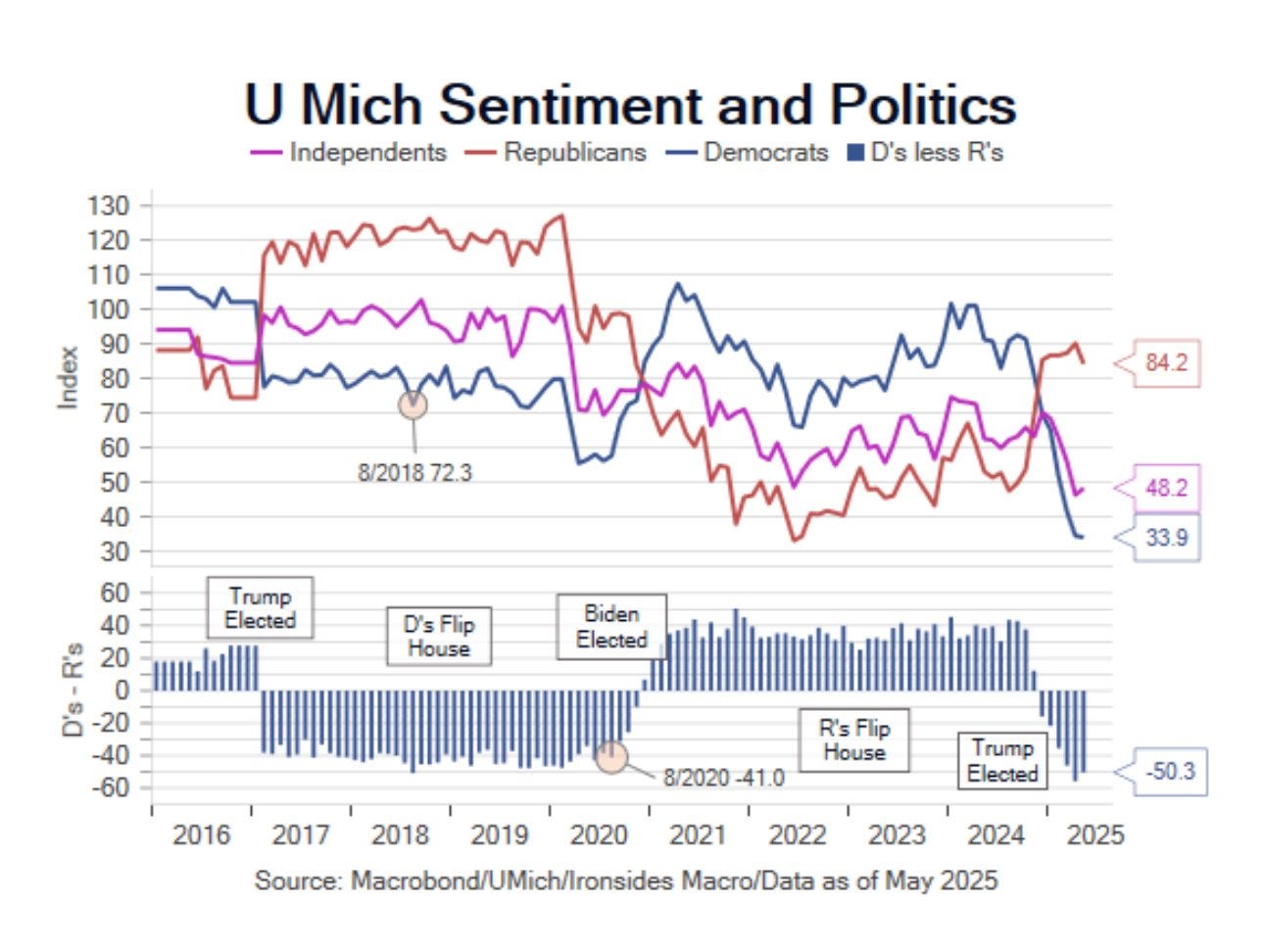

Politics in the Sentiment Figures - Case in point, while consumer confidence is still at one of the lowest levels in 3 years….It’s mostly Democrats. There is a 50-point gap in the confidence level between Democrats and Republicans. Further, the sentiment breakdown for inflation expectations is wild. Dems are predicting 7% inflation (which is insane), GOP folks think it will be -1% or deflation (equally insane). It’s a tale of two cities: GOP is elated, Dems are upset. Another reason why sentiment may be a useless economic indicator. Too political.

Last Sentiment Anecdote: True, sentiment is still low, but so far it’s not coming through in the data. Here is an example: American Express CEO, Stephen Squeri, said at a conference that "consumer sentiment is in the toilet, but yet they're just complaining as they go spend."

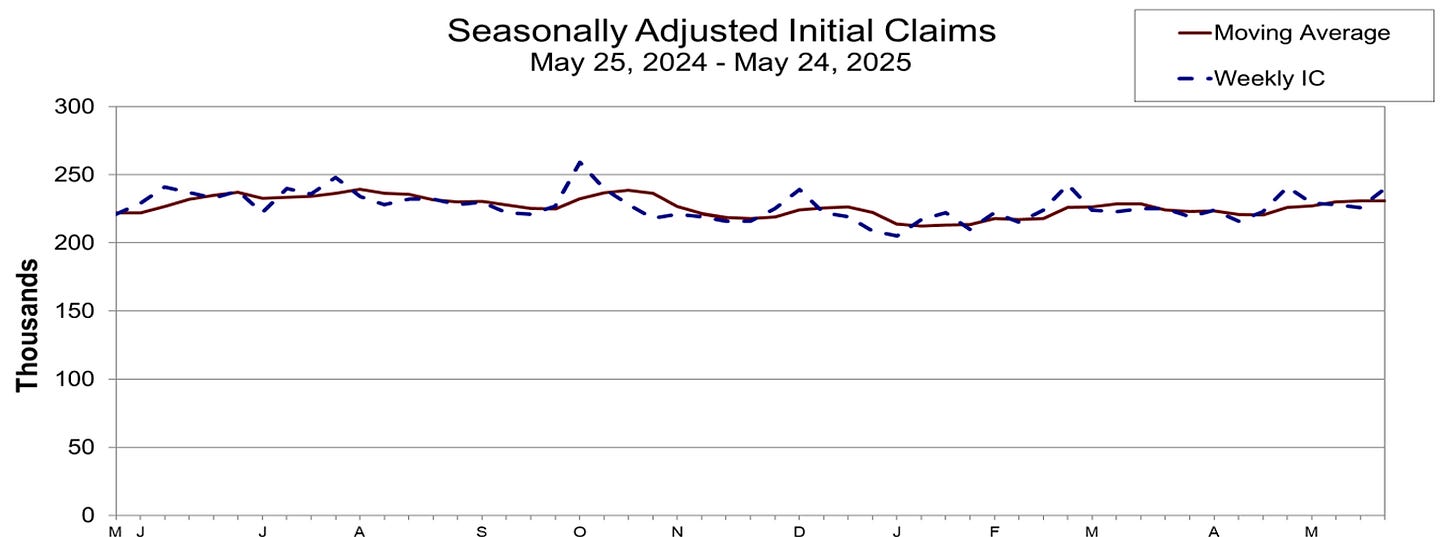

Jobless claims - Up slightly in May, rising by 14,000 to 240,000 for the week ending May 24. While this number is also slightly up YoY, this is still low. Count me on level 1 (low) alert. However, we should always have this as a perennial data point to watch. The labor market looks healthy. So far.

One last data point for you before we get into our Big Beautiful main story.

And it certainly is a big one.

GDP to Grow at 4.6%

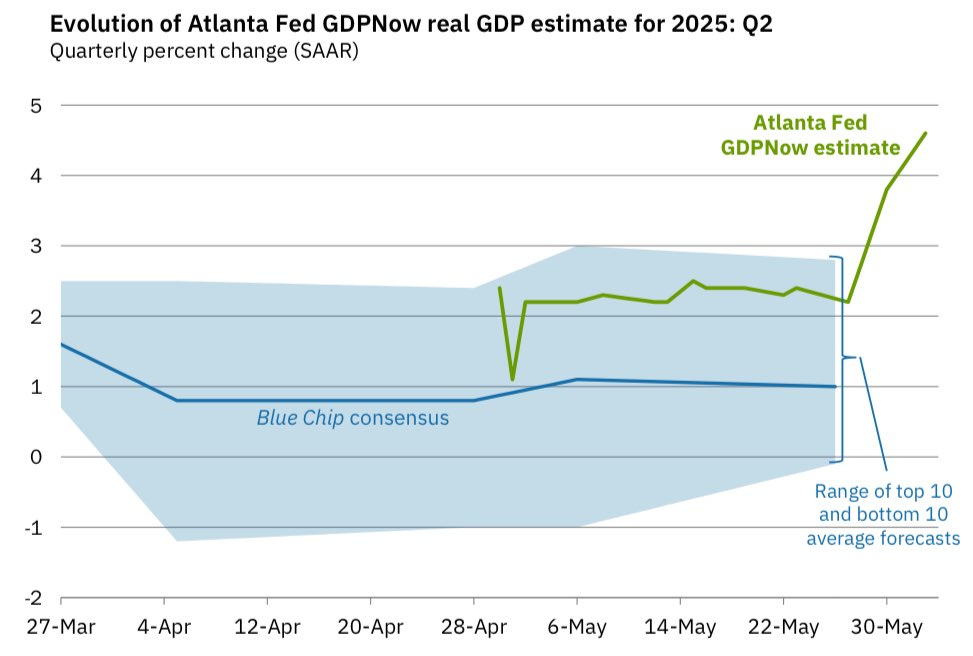

The Atlanta Fed released its economic model predictions yesterday, and guess what, it goes from Q1 -.2% to next quarter…+4.6%!

WOW! I don’t know how much more bilish one can get.

GDP above 4% has me loading the cannons with gunpowder. Pessimistic sentiment in an otherwise healthy economy with uncertainty in trade that doesn’t affect my core real estate investing thesis at all is exactly the setup I want to see to start deploying capital.

And guess what, there are some other reasons for optimism.

Some more big reasons…

*** Want to own real estate, but don’t know where to start? ***

Start by getting some coaching and mentorship. Elevate your real estate knowledge. Gain expert advice from someone who actually owns real estate.

No "guru" trying to sell you an expensive course.

No BS, just frank, brutally honest advice.

Ask anything you've always wanted to but were afraid to ask.

Starting at just $100 smackeroos. It will be the best money you've ever spent, if you don’t think so, full refund. You can’t find that guarantee anywhere else in the industry.

Join the investor-class, become an owner.

Plus, act now and get 10% off!!! Use my special Skeptical Investor link 👉. Join the Investor-Class!

Want to advertise to the more than 20,000 weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

The Big Beautiful Budget Debate (just the Real Estate part)

If you haven’t heard, Congress is working on a budget and spending package for next year, and it’s big. The official name of the bill, and this is true, is called “One Big Beautiful Bill Act.”

Reality is far more fun than fiction.

There is so much in it, Congress can’t pass it through the regular process (although in reality, the “regular order” process never happens, really since the 90s. Definitely not when I was working in Congress 15 years ago). They will use a parliamentary (aka the rules of Congress) rule known as budget reconciliation, allowing the bill to pass based on a simple majority vote and not the 60 votes normally needed in the Senate, when the minority party opposes it. This is used when trying to reduce the deficit. But using the reconciliation process is far less often used, for certain. Since its first use in 1980, reconciliation has been used to enact 23 budget and tax bills (This is the same process used to pass “Obamacare” back in 2010).

Now, I am not a fan of the overall legislation, as I have written about recently. Why? It continues borrowing to spend more and more money we just don’t have, instead of getting us back to normal, just back to 2019 spending levels. Higher deficits and debt = higher mortgage rates. IMO, if you are a real estate investor, you should be in favor of getting the federal budget under control.

The Bill Can’t be Both Big and Beautiful….

Become a Premium Subscriber

Become a paying subscriber to get access to the rest of this post and other awesome subscriber-only content, like a one-on-one with yours truly.

Upgrade for Just $5 Today!Subscription Benefits:

- Premium Content and NO Paywall

- Subscriber-only market insights

- Breaking News Analysis

- Every article we have published - a treasure trove of information and education

- Annual one-on-one coaching with me personally! ($1000 value!)