Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.25%

(👇.2% from this time last week, 30-yr mortgage)

This week, we’re talkin’ are rents up or down? The data is mixed. + Interest rates (my favorite topic) and could the President declare a national housing emergency?

Let’s get into it.

The Weekly 3 in News:

Mortgage refinancing volume continues to reaccelerate. Refinancing share up to 45.9%, albeit from a low base last year (Sonders).

Women are expected to control the majority of personal wealth. The biggest disruptor to the financial planning services industry isn’t technology: It’s the great wealth transfer and the female investor (Nashville BizJournal).

Nashville News - This Nashville spot is listed among six U.S. fall destinations for a vibrant autumn stroll (Tennessean).

Housing Cost Inflation UP?

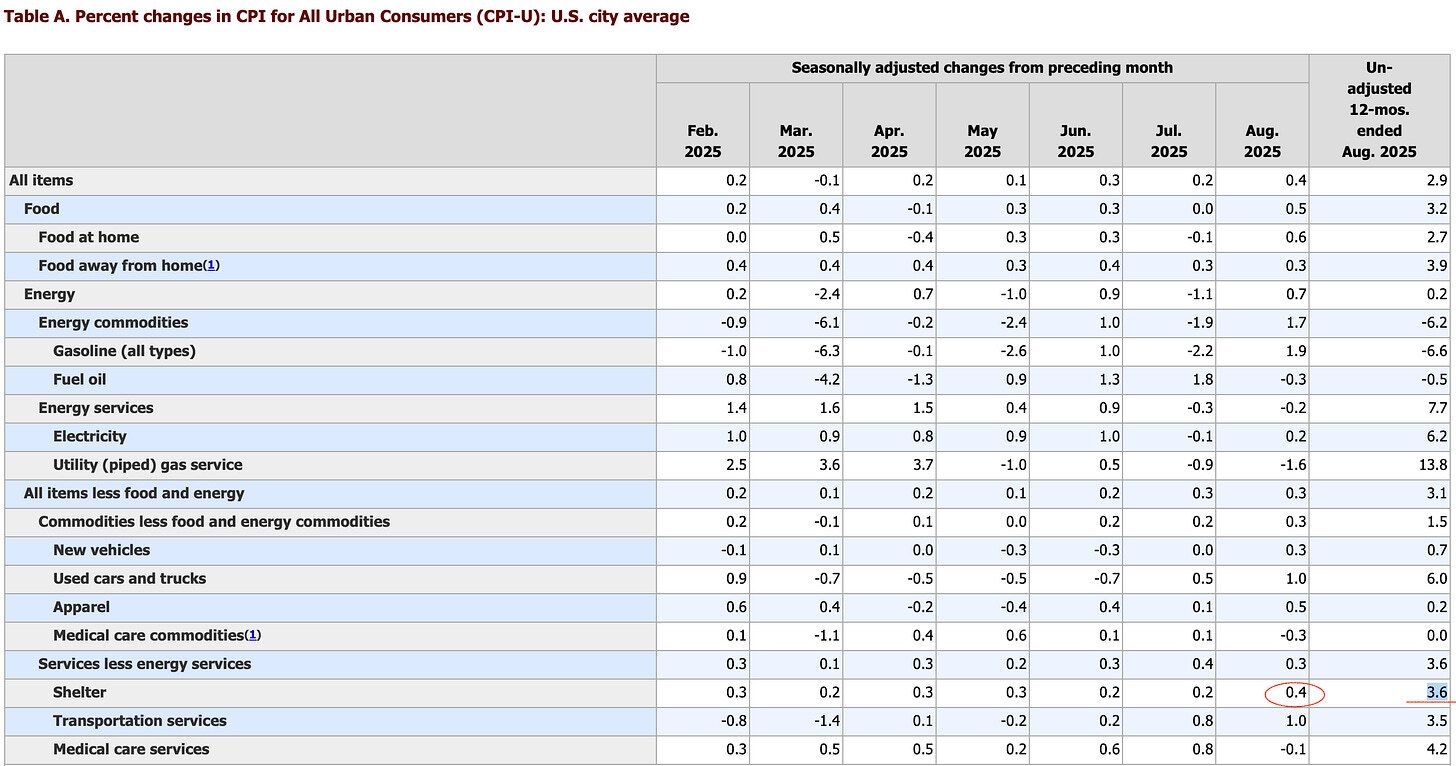

Last week, on the back of much lower PPI producer/wholesale inflation numbers, we got CPI consumer price report. And it was no bueno.

Up .04% on the month, putting the annual inflation rate at 2.9% and 3.8% core (excludes volatile food and energy prices), both hotter than expected. Importantly: many prices were actually in line with expectations. But housing was way off.

The index for shelter rose 0.4% in August and “was the largest factor in the all items monthly increase (BLS).”

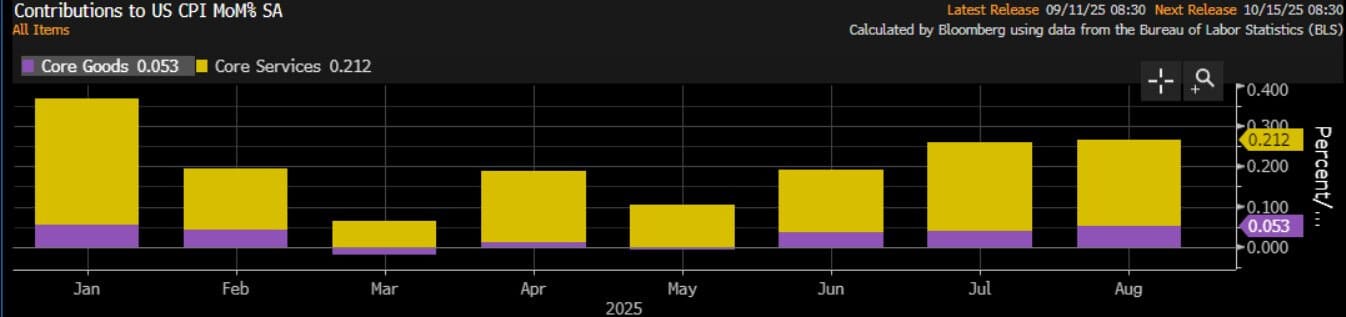

No Tariff Effect, Yet

And so far, there has been “no big alarming sign of tariff-induced inflation… in fact, goods prices increases are decelerating. core goods ex vehicles (which have been volatile) up 0.13% this month In Jun,e those goods prices were rising 0.55% (Eisen).”

It’s all service inflation, indicating a healthier-than-thought consumer.

Wells Fargo echoed this sentiment last week, saying, "In our own data, things are remarkably stable... Consumer credit is as good as it's been in the last six months. In fact, it's probably trending a touch better. Companies are in really great shape... Things actually feel VERY GOOD today (CNBC)."

Again, so far.

But, and I hate to have to say this, with all the problems over there at the Bureau of Labor Statistics, they have earned my Eye of Sauron-level skepticism. I just can’t trust the numbers they are spitting out, only to invert them opposite a few months later. Last week, they reported revised jobs numbers showing the U.S. economy added close to a million fewer jobs in 2024 and early 2025 than they previously reported.

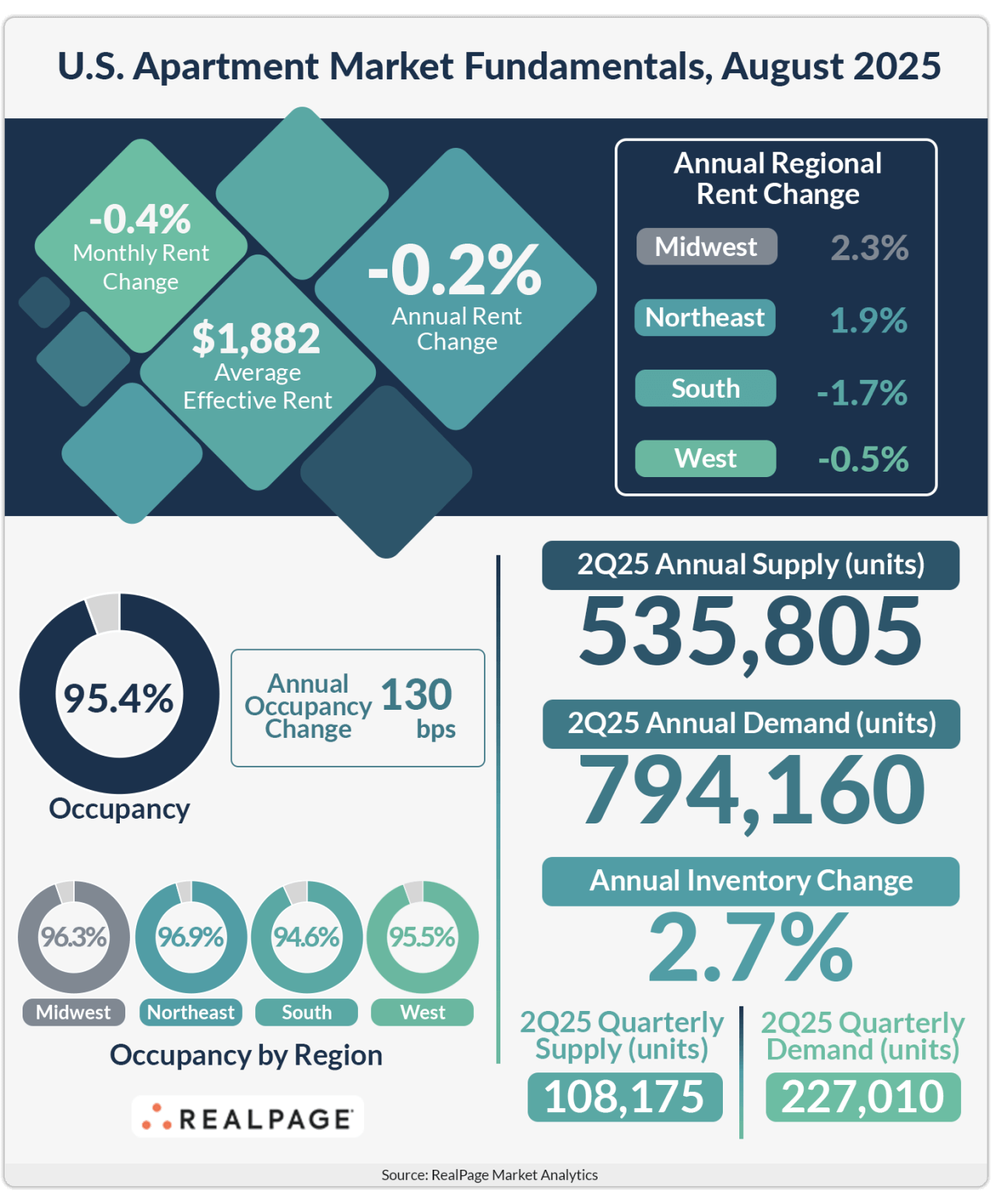

Differing Housing Numbers

Case in point: here are 4 headlines re: multifamily rent rates (Parsons).

From CoStar …

From Yardi:

And finally, from Real Page:

With this chart.

Now, the trend seems to refute the BLS numbers and shows rents down. But regardless, we need better housing data!

Earn Your Certificate in Real Estate Investing from Wharton Online

The Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate Program is an immersive 8-week experience that gives you the same training used inside the world’s leading real estate investment firms.

Analyze, underwrite, and evaluate real estate deals through real case studies

Learn directly from industry leaders at firms like Blackstone, KKR, Ares, and more

Earn a certificate from a top business school and join a 5,000+ graduate network

Use code SAVE300 at checkout to save $300 on tuition $200 with early enrollment by January 12.

Program starts February 9.

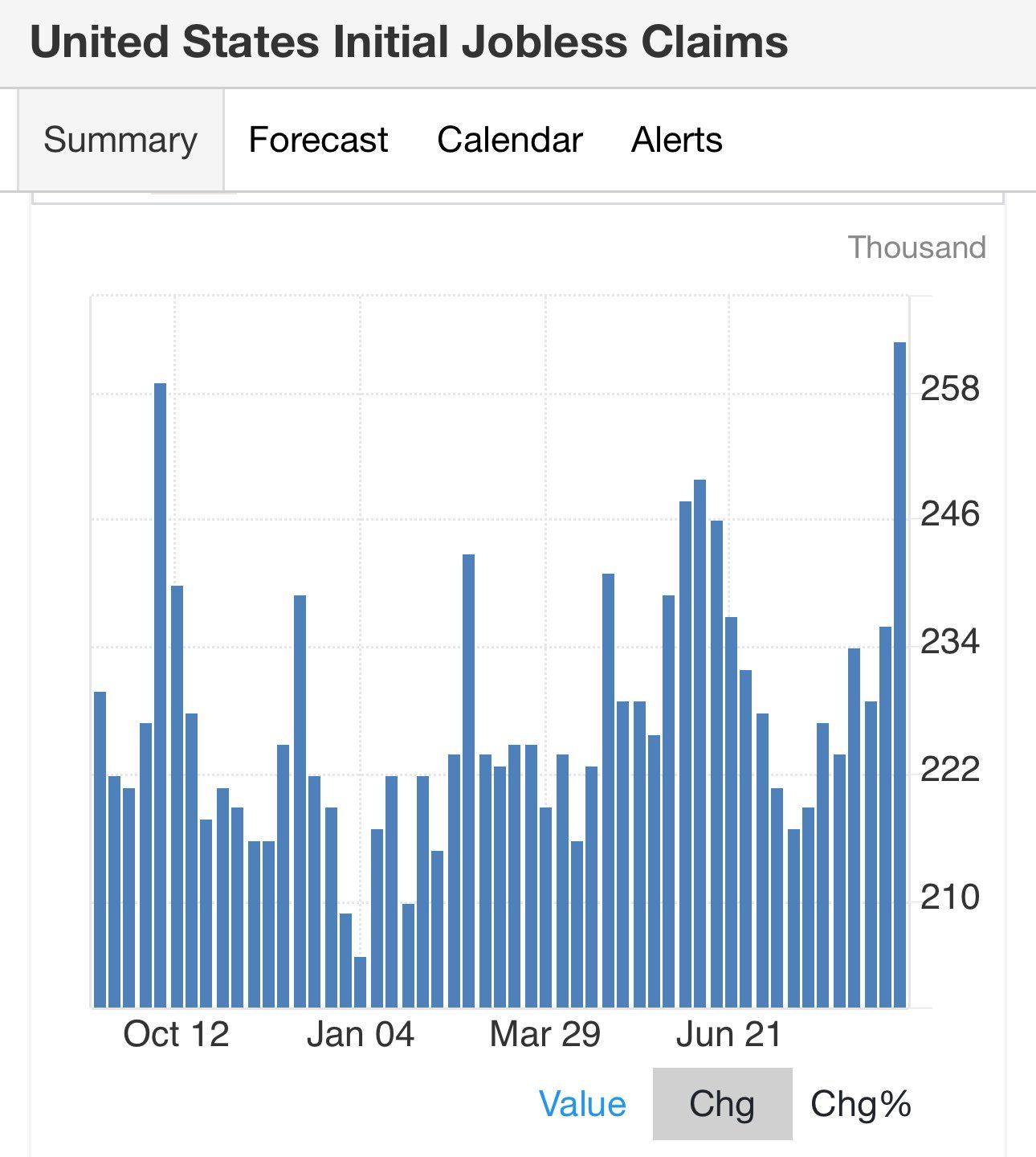

Unemployment is Flashing Red

This wasn’t as reported on for some reason, but the Labor Department also reported a surprise increase in weekly unemployment filings to a seasonally adjusted 263,000, the highest since October 2021.

*One weird note: there was a spike of 15,000 from Texas in unemployment. That is a prime candidate for correction/revision next month.

But the bond market took notice, and bonds got bought up at a rapid rate, dipping the 10-yr Treasury yield briefly below 4%. It’s lowest since a flash in the pan moment in April, and before that October 2024.

The 10-year Treasury is now sitting at 4.034%, as I write today.

Mortgae rates are at 6.25%, down .33% in just the last 30 days. The spread between the two continues its compression, without any Fed cuts. As I spoke about last week.

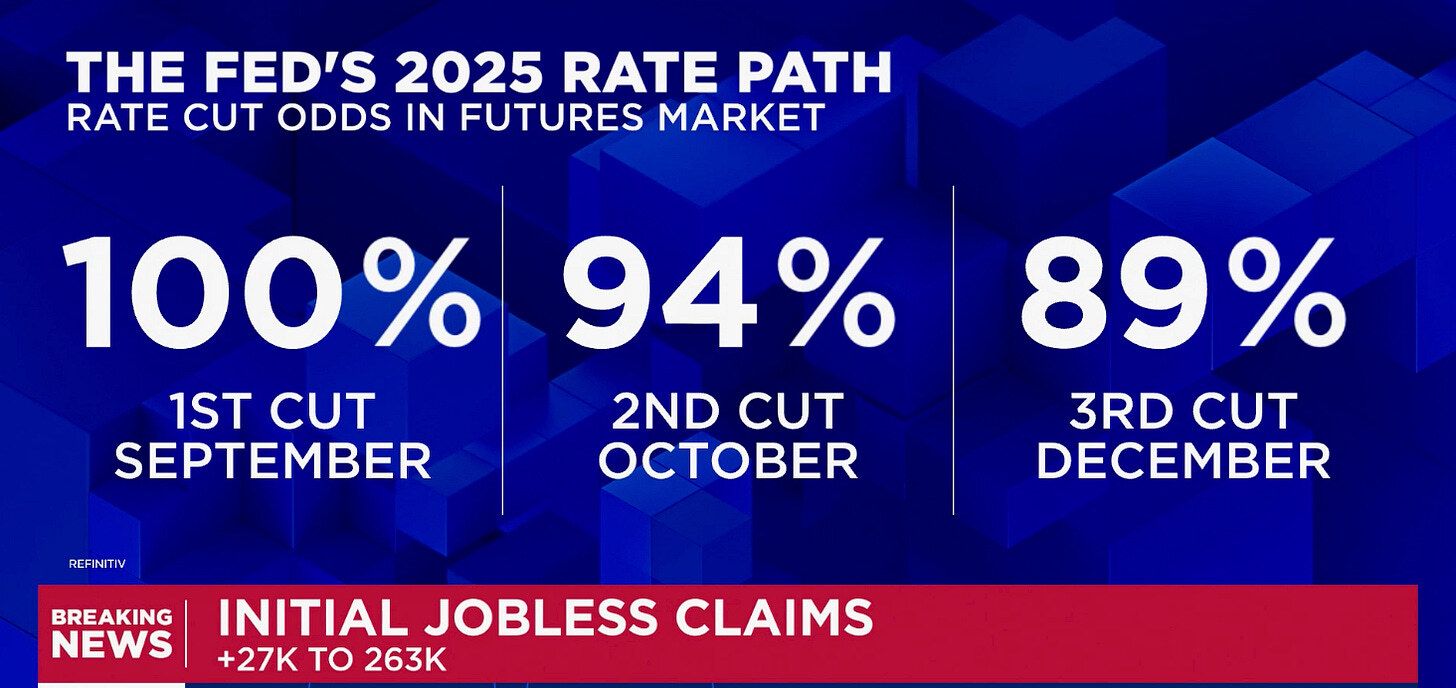

Fed Likely to Cut, but How Much?

So if the Fed is true to their word and “data dependent,” and the data is horrible, the Fed may even cut .5%, not just .25%. And the data would say they should have done it in June (remember, this decision is in 2 days)!

Here is what the bond market thinks:

Now, 3 cuts is a lot to ask for, but I now do think .5% lower rates this year is very possible.

A Quick Ad Break…

Ready to Start Your Next Construction Project?

May Construction is THE up-and-coming new construction builder making waves in the Nashville metro area.

Offering development and design/build consulting and focusing on residential new construction of all sizes and scales, May Construction is a strong contender for any investor looking for a sophisticated, repeatable builder relationship. Representative projects range from $135/SF 1600-2000 SF (approx cost) "nice builder grade" SF homes & townhomes to large-scale projects such as 14, 40, and beyond-unit townhome projects and large-format luxury specs in West Brentwood exceeding 8,000 SF.

Investor/client amenities of partnering with May include: industry-leading financial and project management & reporting tools, professional in-house interior design, unlimited residential/commercial licensure, & a proven, long-standing sub base.

May Construction clients praise their transparency, honest communication, and work ethic to perform at a high level on every project they take on.

A reliable contractor is worth its weight in gold. Call May Construction today

The US May Declare a Housing Emergency

Now, we don’t have many details, but during an interview the other week, Treasury Secretary Scott Bessant, off camera, after an interview with the Washington Examiner said that the US “may declare a housing emergency.”

Wait, what?!

Now, details are thin at this point, but so far we know that a primary focus of the Treasury this year has been to get those pesky interest rates down. (cite my newsletter)

Off camera, the reporter asked Bessent a question on the housing [affordability] crisis, “What else can the president really do here?”

And the reporter is right, the President is limited in their power to affect interest rates (and really the bond market). But that hasn’t stopped him from trying. The President has been really pulling out all the stops to, let’s say, “encourage” the Federal Reserve to cut interest rates since even before he took Office. And as I have written about before, he's taking extra extraordinary measures in an attempt to incentivize Jerome Powell to cut rates and potentially remove a Fed Governor for alleged (and seemingly likely) multiple counts of mortgae fraud.

But Bessent responded promptly, with a bomb shell:

Bessent: “We may declare a National housing emergency.”

Reporter: “Oh wow, is there a timeline for that?”

Bessent: “This Fall.”

Oh wow indeed!

Bessent went on, again off camera, to talk about their push to lower mortgage rates, the tremendous inequality in both" the rich benefiting from high interest rates (aka their stock/bond accounts), but the poor/middle class get crushed with higher housing costs and credit card costs when rates are high.

The problem emerged out of the 2008 Great Financial Crisis where developers and banks didn’t build and fund enough housing, leading a lost 2 decades of limited housing supply coming on market, then following that with too much governement stimulus, spiking inflation and permanently high prices mixed with accelerated demand from the Fed’s zero interest rate policy in reaction to the COVID pandemic scare. Median mortgage payments are up 59% 2020-2023.

So what may an emergency declaration on housing bring?

Options could include:

Forced zoning/density reforms.

Standardize building codes.

Provide loan guarantees and subsidies to builders.

Provide significant incentives for builders.

Ditto for landlords to renovate and add square footage to existing properties.

Reduce closing costs and offer homebuyer assistance.

Release Fannie and Freddie from government conservatorship.

Provide Federal land to developers for housing.

Suspend or waive environmental and permitting regulations.

Change tariffs for building materials

Continued influence of the Fed, and nominating more dovish Federal Reserve Governors.

I bet we can think of more, just give me another cup of coffee….

Drawing from my time in Congress, I bet there is a weekly standing meeting in the Treasury and amongst a group of lawmakers meeting right now (with unlimited coffee available). Their mission: figure out what we can do re: housing. Fueling this, Congress likely sees this as a winning political issue come 2026 and 2028.

Stay Tuned.

A Quick Ad Break…

Veterinarians nationwide reported that corporate managers pushed clinics to focus on profit, with vets often paid based on revenue. This encouraged them to see more pets, order more tests, and upsell services, creating a growing burden for uninsured pet owners. Pet insurance could help you offset some of these rising costs, with some providing up to 90% reimbursement. View Money’s top pet insurance picks to see plans starting at only $10/month.

Want to advertise to the more than 30,000+ weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

My Skeptical Take:

“Interest rates are to asset prices like gravity is to the apple" …"they power everything in the economic universe" - Warren Buffett

It’s true. Interest rates affect everything, from car loans to medical debt to credit cards...They influence the cost of borrowing and the potential returns on savings. Most people in America live on debt, and every single one of them has been paying more every month over the last three years because the Fed has kept rates high.

Moreover. This year, when almost every other country was cutting its rates, we weren’t.

Why?

We thought the job market was robust. And there were fears of inflation from tariffs.

So far, neither was true. And over the last several months, we now realize those job numbers were bullshit. Now we have a problem. We watched as inflation came down and cheered that. But did not think that could have been a signal of economic weakness, because we thought the job market was secure. That’s what the data told us.

Thus, the Fed has been behind. They spent the first half of the year telling everyone they couldn't cut rates, but now it is obvious they should have been cutting rates in June. So this potential rate cut in 2 days should be an easy one.

They should cut the damn rates.

And then do it again twice more this year, and then again at least twice more at the beginning of the year / Spring.

I hope that the government now sees that we need to change the way we collect important economic data. This is why the Bureau of Labor Statistics really matters, as I’ve been talking about the last few weeks, why the head of that deserved to get fired, and why we need to fix that damn agency. At the same time, my hope is that this does not get political. We really don’t need that infused into our data. Let’s get it fixed. Let’s bring us into the 21st century.

On the costs of housing and potential housing emergency declaration, we need something done here, too.

Now, the Administration doesn’t likly want to wade in too high up their gaters into the business of states, counties, and municipal governments re: building and zoning. BUT they may during an emergency. Hell, if it is truly an emergency, they may do pretty much anything, for a time. Hell again, if the National Guard could build homes, they’d have them do that too….

hmmmm…. well wait a minute there… (kidding!).

But I do think everything is on the table. Politically, it would make sense to do this now, starting in the Fall, and continuing up to the 2026 midterm congressional midterm elections.

I hope they take some sort of action to incentivize development, while leaving the Fed and bond market to do their thing.

Just don’t get crazy, ok guys?

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. Want to start investing in real estate but are you STUCK? If you need a little push, read my new book! It is a must read for all investors. The 5 Ways Real Estate Investors Make Money and Build Wealth: Anyone can create wealth through real estate. Including You! (yes yes it’s a shameless plug, but I get ~$1/book, FYI. This is about education!). So pick your copy up today and get in the arena.

Please Share this Article!

We have passed 30,000 subs! Thank you for your support, next stop, 40,000!

Please help grow the community!

It takes me several hours to write this weekly article, and they will always remain free (but you get some pretty cool perks with premium, including a one-on-one with yours truly :). All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you think I was going to send you a Starbucks gift card? 😅

Subscribe Today! (and get some amazing perks)

Paid subscribers get the best stuff! Join the Skeptical Investor Community to access:

Premium content and NO paywall,

Every article we have published - a treasure trove of information and education,

Conversations with other investors in the Skeptical Investor community, and future meetups and special events,

Key insights and predictions on the latest financial news,

PLUS, subscriptions include an annual one-on-one call with me personally. So make sure to take advantage! Subscribe today.

Just $5 bucks a month.👇

Ready to Start Investing in Real Estate? Know someone who does?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great real estate deals, as well as manage their rental properties, here in Nashville, TN. We pride ourselves on being tough negotiators. We want our clients to get an amazing deal, we never let our clients pay retail.

Enjoying this newsletter? Know somebody looking to buy real estate? Send them to the best in the business, THE Nashville Investor Agent! Referring real estate business helps us keep the lights on and me keep pushing out fresh real estate analysis each and every week. Help peep this newsletter going for all you awesome folks out there; refer someone to us when you may hear they are in need. We promise to take great care of them and make sure they get a fantastic deal. They will thank you for it.

If you or someone you know are looking for an investment property, give us a call today!

You can also find out more about us and what we offer on our website: www.NashvilleInvestorAgent.com

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. We have the lowest unemployment rate of the top 25 major cities and folks are moving here to take those jobs. Nearly 90+ people per day move to Nashville. And tourism continues to hit record levels. This past year 16.8 million folks visited our lively city. Plus we have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, no state income tax… to name a few amazing advantages. Come check us out, the water is warm :).