Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Read Time: 15 minutes (worth it :).

Consider Becoming a Paid Subscriber!

Paid subscribers get the best stuff, including premium content and an annual one-on-one call with me personally. So make sure to take advantage!

We have a returning partner! The Daily Upside: concise business news in your inbox each day without the clutter. Support our pirate ship, each click promotes our newsletter! Click the link below 👇

What Top Execs Read Before the Market Opens

The Daily Upside was built by investment pros to give execs the intel they need—no fluff, just sharp insights on trends, deals, and strategy. Join 1M+ professionals and subscribe for free.

The Weekly 3 in News:

Today’s Interest Rate: 7.07%

(Unchanged from this time last week, 30-yr mortgage)

Today we’re talkin’ government, the Trump 2.0 Administration, and how their actions may affect interest rates (without getting political). This is a big f#ck!ng deal.

Let’s get into it.

Federal spending is why inflation and high rates

Government spending is absolutely out of control.

But this is not just another platitude from yesteryear; the situation is not sustainable. We need to course correct this right now.

I’ll tell you why.

Uber-brief history

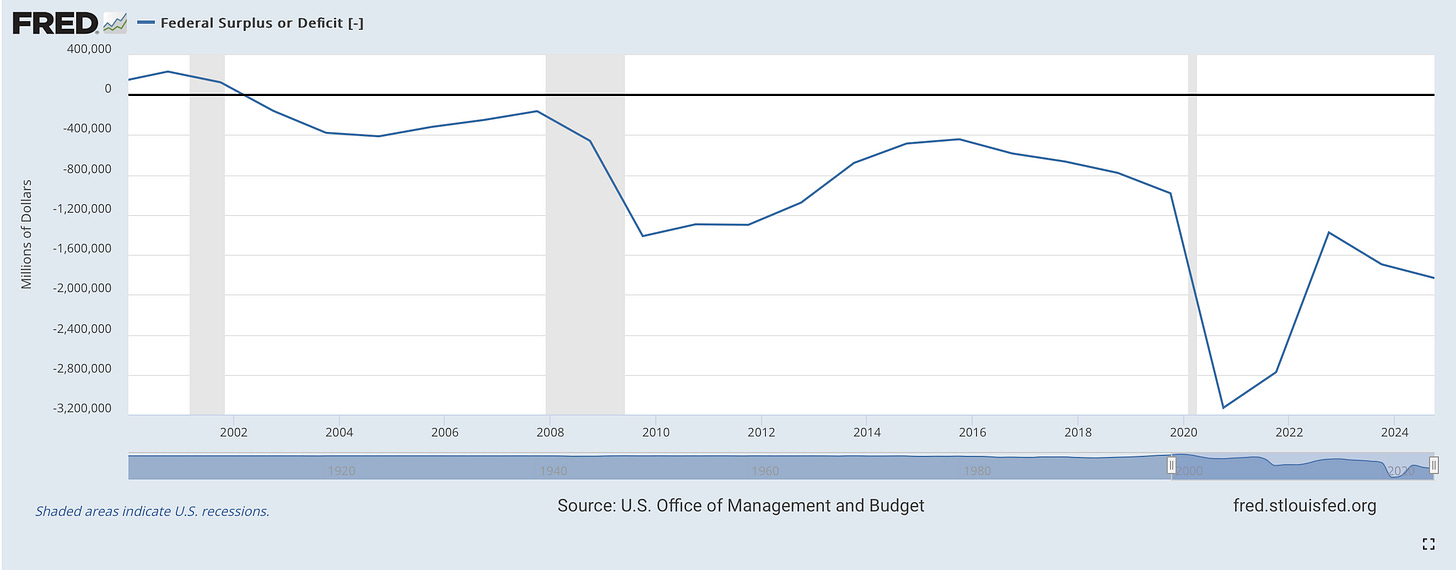

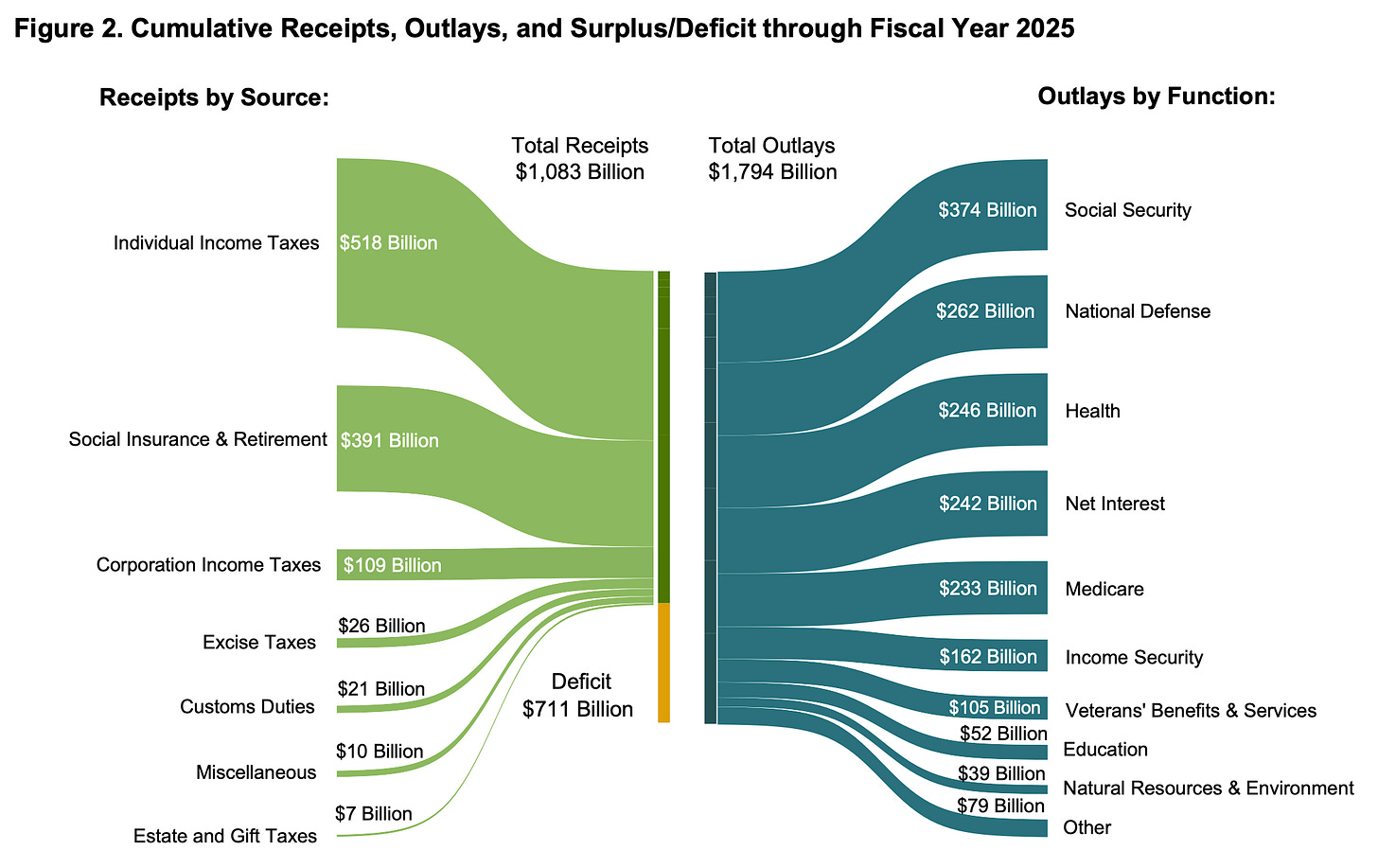

In the last 25 years, we went from a surplus to a deep deep deficit. The current annual federal deficit is more than $2+ trillion (ie how much the federal government is borrowing to spend). That is DOUBLE the military’s entire budget. And half of that deficit is just to pay the interest on our debt.

We need to stop this.

If we don’t, nothing we are talking about in finance, real estate or investing matters.

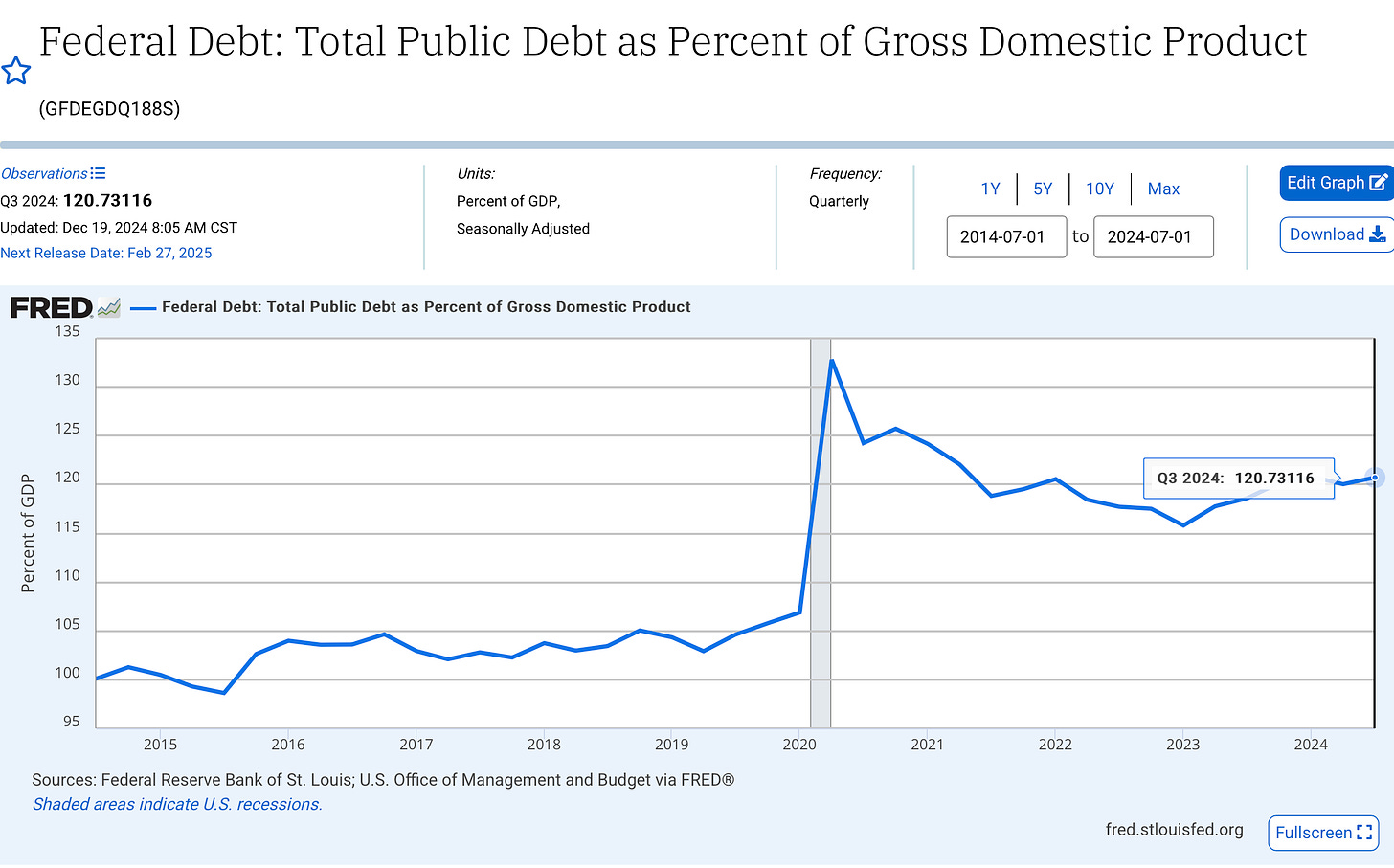

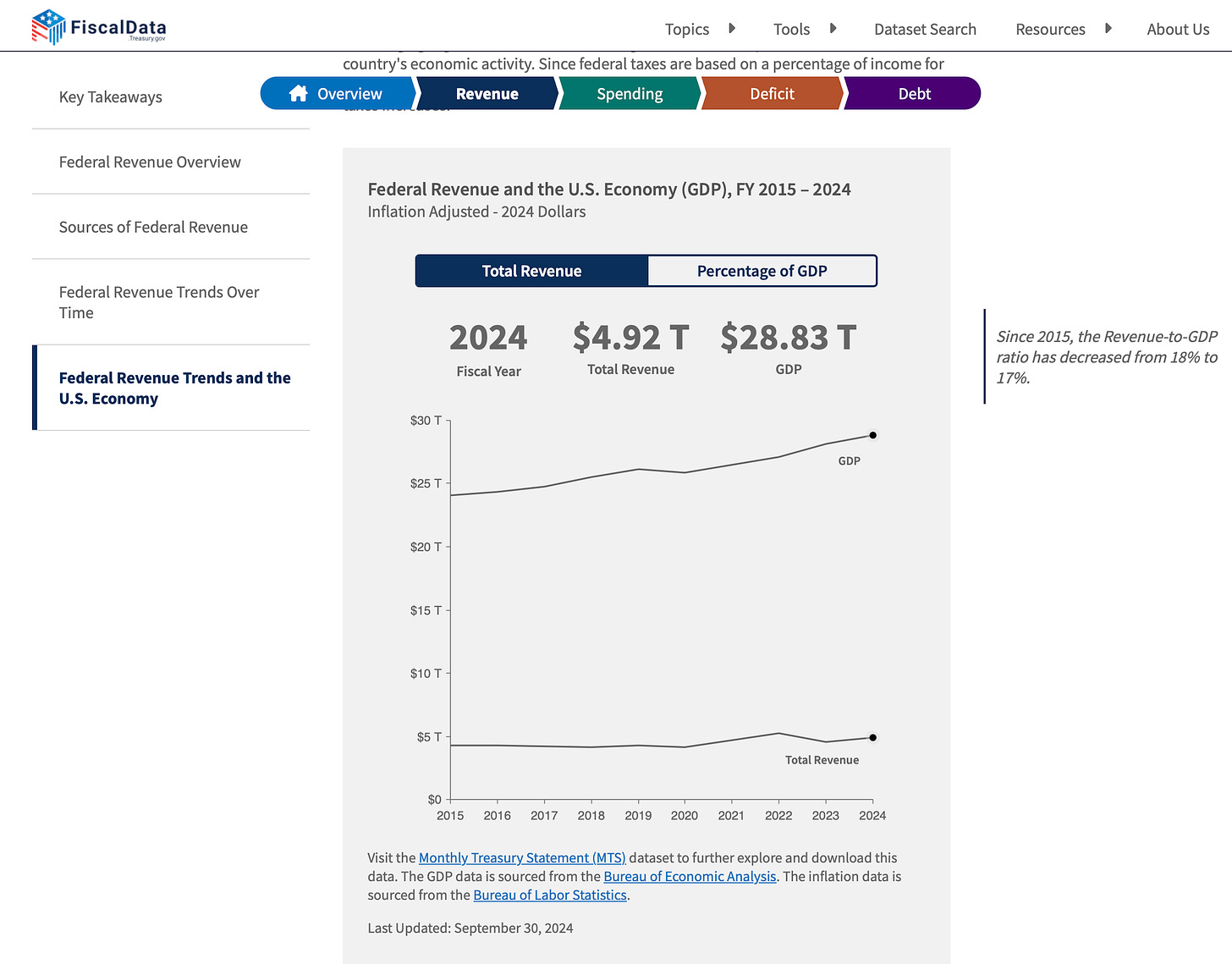

Our total debt is now $36.5 trillion. Our GDP is $29.7 trillion. This means our debt is 120% of our total gross domestic product.

Yes, US debt is 20% larger than our entire economy.

And much of this came as a result of a COVID overspending and stimulus response.

This is why we have inflation and high interest rates today.

I’m not going to re-hash that all here, because I already have. So if you want an in-depth analysis of how we got here:

I’ve written a detailed article on that here, if you are a glutton for punishment.

This discussion on the federal debt crisis with Ray Dalio is a fantastic listen,

As is this MIT study showing that federal spending causes inflation.

Ok, back to business…

Why is deficit spending so impactful now?

Federal spending is highly inflationary. Rebember, it is Government that creates inflation through spending. Not the market. Not the grocery store. There is no free money from the government printing press. In a way, government deficit spending is a tax on all, delivered via inflation.

The more than $10 trillion we spent as a reaction to COVID is why the last 2+ years have been particularly inflationary, and why the Fed had to raise interest rates to combat it.

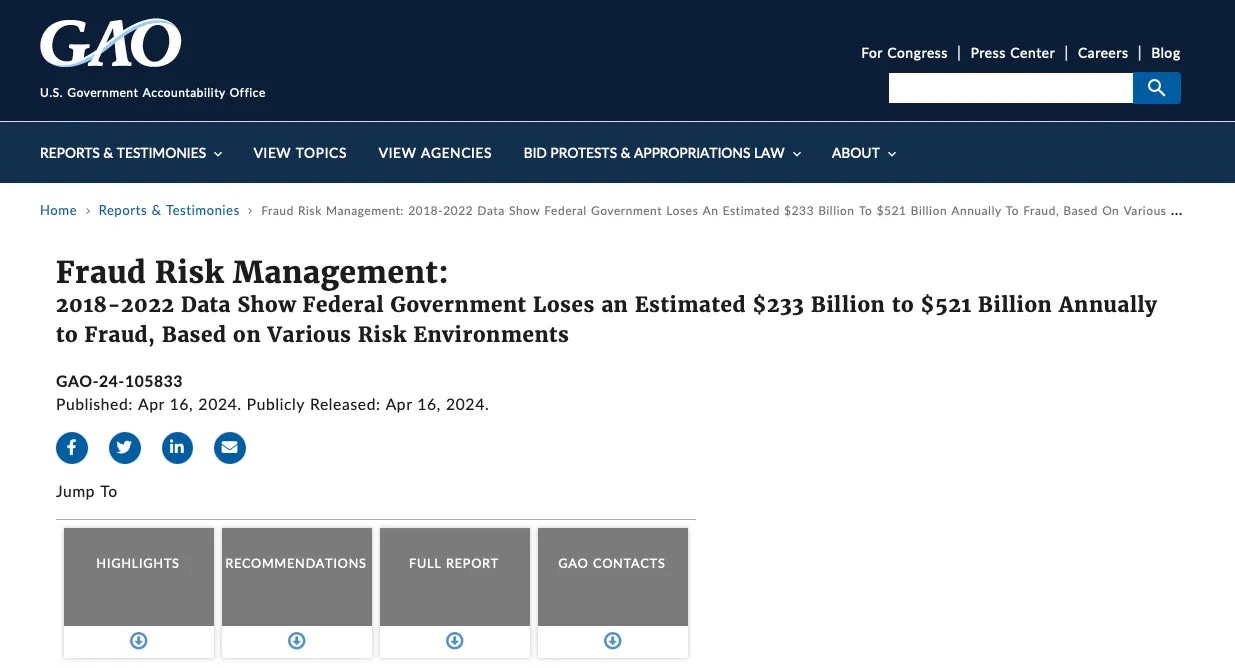

Anger alert! This is not to mention the enormous waste and fraud rampant in the unaudited federal spending process. Just last year, Government Accountability Office, estimated that the Federal Government Lost somewhere between $233 Billion to $521 Billion.

This is annually. As in every year.

Ahhhhhhhhhhhhh.

So here we are. Folks are upset at the price of everything. Homes, cars, eggs, insurance etc…

And then we had an election, and the American people made a change.

This is where I want to focus your attention today.

This is not political.

First and foremost, both parties this far have contributed equally to this predicament.

Both of them did this.

But there appears to be a new sheriff in town, who has brought a few hyper-motivated deputies that are taking action (again this article’s perspective is from an investor standpoint. I am not judging these decisions, only that they are happening and I will provide my analysis on what the effects will be, for you! The Skeptical Investor Community).

What is DOGE?

The Department of Government Efficiency (DOGE), was announced in late 2024 and was formally established by executive order on January 20. Its aim is to: “[cut spending, reduce regulation, restructure federal agencies and enhance government efficiency.]” The initiative works through the Office of Management and Budget, the budgetary arm of the White House. It is headed by Elon Musk, who is now an advisor to the President.

And they are moving fast.

DOGE’s initial goal is to cut/stop $2 trillion in federal spending, starting with a reduction in the “federal deficit from $2T to $1T in FY2026.” Or expressed another way, $ 4 billion / day in spending cuts.

On Jan 28th DOGE released an update asserting they had already canceled spending programs totaling $1 billion / day.

On Friday Musk said he was “cautiously optimistic that we will reach the $4B/day FY2026 reduction this weekend.”

Today is Tuesday, February 4th, and DOGE announced it is folding in USAID into the State Department and the US Dept. of Education will be scrutinized next.

They are moving fast on purpose.

Cutting spending fast means we don’t have to cut as much in total, because every dollar in deficit spending cut means we don’t have to pay future interest on that borrowed dollar. The rapid escalation in federal deficits is being catalyzed by high interest rates, which is a theme of this article if you haven’t picked that up already.

Because of the President’s broad foreign powers, it appears US funds spent abroad are the first on the DOGE chopping block, starting with USAID. Next is likely spending sent to Ukraine, IMO, and then domestic spending like the Dept. of Education. These departments don’t do much themselves, they function through grants and payments to non-government entities. As a result, it is easier to stop spending at these agencies. Until Congress can act on a larger Budget Reconciliation package, this will be the strategy.

It should be noted that the US does not need to get to a truly balanced budget (although that would be lovely) in order to get to fiscal sustainability. But spending does need to drop to 3% or less of our total GDP. That way, the deficit is not outgrowing the economy.

A Surplus is actually not (too) difficult

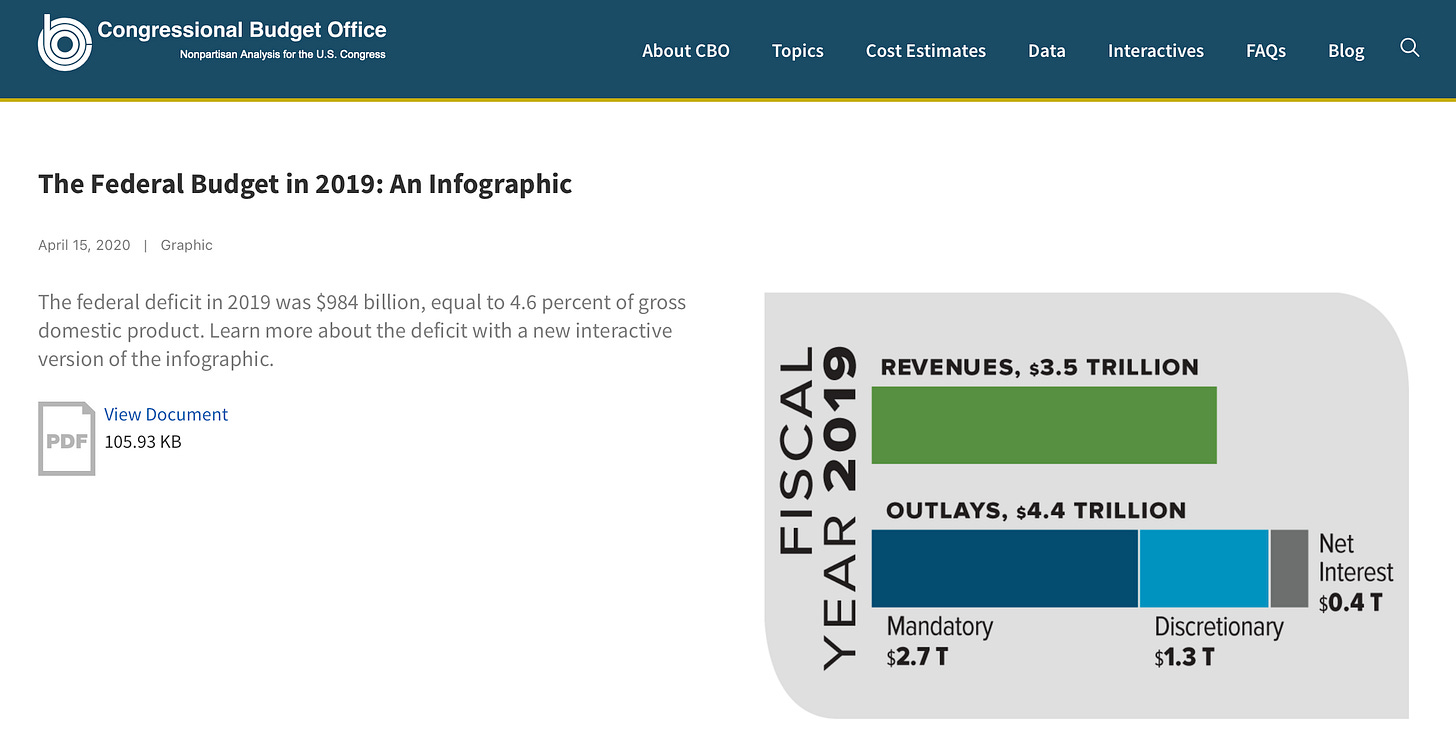

Here is something that I think you will find shocking: If we simply were to return to 2019 spending levels, and maintain the current 2024 tax revenue levels, we would have a balanced budget. This is how much extra spending we have done since 2019.

Here are the receipts:

2019 Spending: 4.4 trillion (CBO).

2024 Revenue: $4.9 trillion (US Treasury).

That’s it. That’s basically all we need to do. We just need to get back to normalcy.

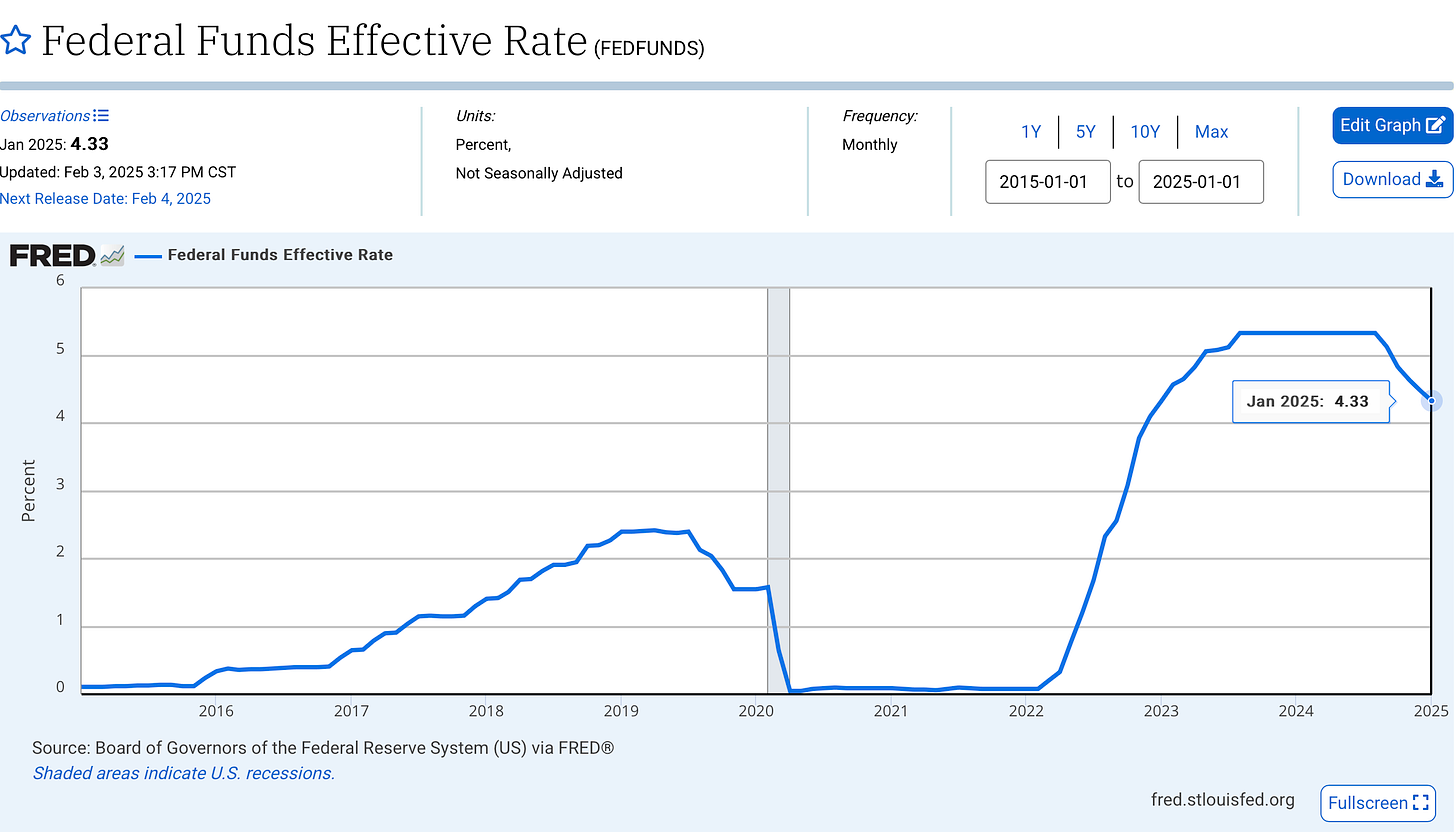

But it has to happen like yesterday. The problem is continuing to kick the can, which allows the interest expense to snowball, and is further catalyzed by today’s high rates. Interest rates today are now double that of 2019, because of overspending.👇

This makes government borrowing (aka deficits) very very expensive. And it is about to get worse. A major wrench in the spending spokes is the wave of impending Treasury bill debt issuance that is coming due this year, which will need to be reissued at today’s higher rates. Roughly $3 trillion in additional Treasury debt will reach maturity in 2025.

This is why it’s so important to get rates down ASAP. The primary way to do that is to rapidly cut spending.

Again, this is why DOGE has been directed to move so fast.

The upside is….

Significant spending cuts could mean 5% interest rates in 2025

(Ok it took me till here to get back to real estate and investing but trust me it’s worth the wait).

Yes, 5.xx% mortgage rates in 2025 are possible.

I’ll explain.

As I write, DOGE has allegedly stopped $56 billion in Federal spending going out the door, so far. (Federal spending and DOGE cut totals are being tracked here and the DOGE committee members are holding weekly live-streaming updates).

If true, this is remarkable. This puts it on a path to cut $1 trillion in the fiscal year. Again, DOGE calculates that they need to cut/block $4 billion per day from current spending to achieve this.

And if that happens:

DOGE won’t just be about spending cuts or federal deficits. Stopping $1 trillion of spending in the pipeline would slow inflation.

And if inflation slows (or rather when the bond market has confidence that inflation will slow in the next 6-12 months) interest rates will plummet.

Why?

The Fed can cut rates all they want, but they do not control the long end of the bond market (ie the 10+ yr Treasury, which mortgage rates track). The bond market is in control there, and bond market vigilantes are fighting the Fed. This is why interest rates are up more than 1% even though the Fed has cut rates 1% since September. The bond market believes the Fed is easing monetary policy in an economy that doesn’t need easing. They are worried about renewed inflation.

So if you are keeping track. Egregious Gov spending = higher interest rates.

And thus, significant and rapid spending cuts/stops by DOGE have the potential to bring interest rates down rapidly, back to the 5.xx% range this year.

Don’t believe me? Musk confirmed Monday that this is their intention.

** Note that Mr. Gerstner (a prominent venture capitalist and investor) echoes my point today on the bond market. Once bond market vigilantes believe that federal spending cuts will actually happen, interest rates - and thus mortgage rates - will drop like a rock. (The bonds will be more valuable with inflation under control and investors will buy them).

Want to know what those gov folks spend our money on? Here is a breakdown.👇

My Skeptical Take:

We have to STOP deficit spending at the current rate. The young generations are shouldering this cost and it’s not sustainable. I for one believe that the Congress and Administration can come together to get our fiscal house in order.

It’s been too long since ideological opposites Bill Clinton and Newt Gingrich were able to strike a balanced budget deal. So, even though the characters of this new Administration may be polarizing, why can’t we get together to do that again?

Both political parties completely abandoned fiscal restraint. “…the trend since the pandemic has been profligate fiscal policy,” as JP Morgan has put it. This was snot necessarily nefarious. It was a cocktail of good intentions (do as much as I can for the people), mixed with a little bit of self-preservation (get reelected) that our leaders are drunk on.

Setting aside the detailed choices of what to cut and what to fund, and remaining A-political, I am hopeful the new Department of Government Efficiency can do something about our perilous spending habit.

So no more blame games guys, just get together and fix it!

So what about real estate and investing in this tumultuous time?

I love it.

Yes, prices are permanent, and the effects of inflation are here to stay. But inflation has been on the steady decline for more than a year, and large spending cuts, even though the odds are admittedly low, could result in much lower interest rates in just the next 6-12 months.

So I’m revising my recent 2025 Bold Prediction.

I believe mortgage rates will get back to a 5-handle in 2025.

And because I’m a betting man, let’s handicap it at 70%.

Boom!

And as we tick down to 6.5%, and then to 6%, and then to 5.xx% we should see large spikes in real estate activity.

The risk is to the upside, I’m bullish.

Then again, it’s only been 15 days since the start of Trump 2.0.

Buckle up. Buy assets.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

Subscribe Today! (and get some amazing perks)

Paid subscribers get the best stuff! Join the Skeptical Investor Community to access:

Premium content and removal of newsletter paywall,

Every article we have published - a treasure trove of information and education,

Conversations with other investors in the Skeptical Investor community,

Key insights and predictions re: the latest financial news,

PLUS, subscriptions include an annual one-on-one call with me personally. So make sure to take advantage! Subscribe today.

Just $5 bucks a month.👇

We have passed 10,000 subs! Thank you for your support, next stop, 20,000!

Please help grow the community!

It takes me several hours to write this weekly article, and they will always remain free (but you get some pretty cool perks with premium, including a one-on-one with me:). All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you think I was going to send you a Starbucks gift card? 😅

Ready to Start Investing in Real Estate?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great deals, as well as manage their real estate portfolio, here in Nashville, TN. If you are looking for an investment property, give us a call today!

For all the information on who we are and what we offer, visit our real estate website www.NashvilleInvestorAgent.com or setup a call today!

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. We have the lowest unemployment rate of the top 25 major cities and folks are moving here to take those jobs. Nearly 90+ people per day move to Nashville. And tourism continues to hit record levels. This past year 16.8 million folks visited our lively city. Plus we have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, no state income tax… to name a few amazing advantages. Come check us out, the water is warm :).