Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

Project Update: North Nashville Duplex

Why Should the Fed Cut Rates at All?

The Setup for Spring Season

My Skeptical Take

The Weekly 3: News, Data and Education to Keep You Informed

Warnings flashing of ‘froth’ in crypto and stocks as S&P 500 valuation surpasses 2000 levels (BofA/Yahoo).

China is issuing record debt to stave off recession, while the US bull market continues (Wallerstein).

Texas vs California Home Construction. It’s not even close (FT).

Today’s Interest Rate: 6.93%

(👆.21, from this time last week, 30-yr mortgage)

Today we’re talking: housing market, interest rates, and a quick update on my latest rehab and rent project.

Let’s get into it.

We have a new Sponsor, Nike! No idea why they would slum it on this newsletter. But those new shoes look pretty damn nice. Support our pirate ship, please check out our sponsor! (or just click it and keep reading :)

Feel Your Best on the Field With Nike Kylian Mbappé Collection.

Discover the Nike Kylian Mbappé collection, crafted for players ready to take their skills to the next level. Featuring standout styles like the Vapor and Superfly, these boots combine cutting-edge technology with eye-catching designs inspired by the pros. Experience the game-changing Air Zoom unit for explosive acceleration and a responsive touch, whether you’re making that perfect through ball or striking from distance. Treat yourself to a fresh pair from the collection and dominate the pitch. You deserve to feel your best on the field.

Project Update: North Nashville Duplex

Construction has begun on a cozy duplex I picked up in North Nashville a couple months ago, a lovely little transitioning neighborhood just an 8-min Uber to downtown (yes “cozy” is real estate parlance for small, but it will be cozy!). You can see the development in the area is in full swing. The gray home to the left is on the market for $550k, to put things in perspective (it’s a 4 bed / 3 bath, 2000 sq/ft, with modest finishes).

This place was a little bit of a disaster zone, which is why I love it 🤠. A kitchen fire in the back unit got a little out of control and burned up to the roof. The previous owner started to repair it.

Looks a little rough, but we’ll get her all fixed up.

Exterior work just got going. Paint, trim, full perimeter fencing, 2 gates and landscaping are starting. There will also be a new front deck (and back deck eventually), and a small covered porch with a hipped roof.

In that burnt-out back unit, we have started the transformation! I designed a little U-shaped kitchen to fit right in the space. To maximize the sq/ft (and save cashola) and give it a more spacey feel, I’m doing open shelving instead of upper cabinets and the countertops will extend all the way to the near wall, fully covering the front load washer and dryer units, which also have their home in the kitchen. But when we are done it’s going to look sleek and intentional.

Painting has started on the interior (Benjamin Moore - Smoke Embers in case you were curious), as has flooring and lighting. The lighting is a little dark in the picture but this will be a lovely/bright kitchen and living room for our next resident.

The home is a duplex with 2 bed / 1 bath, on each side.

That light is going to go, don’t worry :)

The scope of work is pretty much everything: kitchens, bathrooms, flooring, gutters, deck, fencing etc…, except for most of the windows and walls/drywall, which I was able to save (except for the front unit, which had some rough popcorn ceiling).

The kitchen should look something like this render:

Kitchen Render

There wasn’t room for a dishwasher and what I felt was enough cabinet space so I’m going without for the first time in one of these smaller units. How do you feel about that? Heck, I hand wash my dishes mostly at home anyway.

I am targeting a February move-in. Rents should be a modest $1500 per side, depending on the time of year I’m able to get it on market. Spring is best obviously so we may be a little early, but that’s ok.

Any burning thoughts? Let me know in the comments!

Ok, that was fun. Now let’s get to the market update.

Market Update

For the second time in as many months, the Federal Reserve is on deck this Wednesday with a decision on whether to cut the Federal Funds Rate.

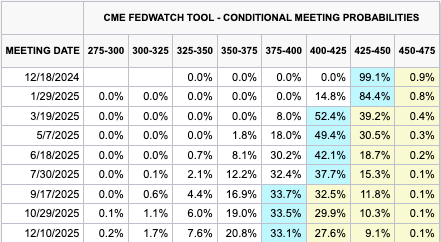

Over the last few weeks, Fed board members have been signaling that a cut is in the making. That would mark the third rate cut in a row, a full percentage point lower since they started cutting in September.

I have to admit, my prediction a month ago of a more restrictive Fed was wrong. I said they would pause and they went full steam ahead, albeit with a small .25% cut. I was early, but I do now think they will pause cuts starting with their next meeting on January 29th (just 9 days after the inauguration).

Folks in the press are already calling this month’s rate cut a “hawkish cut,” meaning that Fed Chair Jerome Powell will take time in his press conference tomorrow to downplay the speed at which the Fed will cut rates in 2025. The Bond market agrees with that assessment and is dubious there will be more than 2 total cuts in 2025.

Why Cut at All?

Some are saying, why is the Fed cutting at all? (myself included).

The stock market, gold, Bitcoin, and most real estate are all at all-time highs.

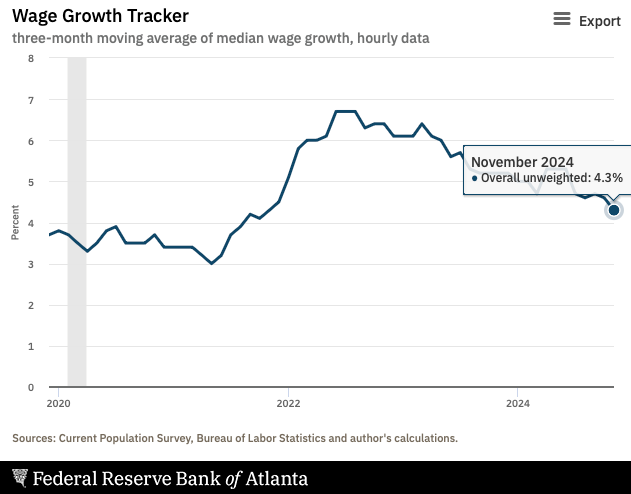

The economy is rocking, we have full employment (~4% unemployment) and wage growth is still at 4%.

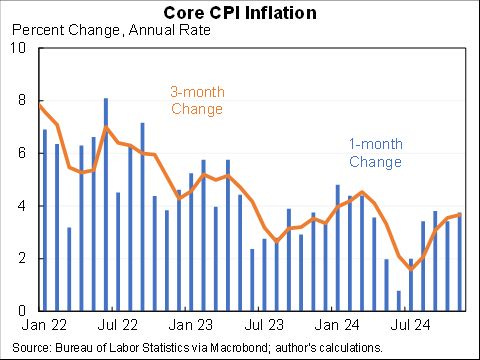

Case in point: Inflation is still sticky, like my sourdough bread leaven.

Core CPI levels came in this week a touch higher than expected: 1 month: 3.8%, 3 months: 3.7%, 6 months: 2.9%, and 12 months: 3.3%. The trend is down, but hovering just south of 4%.

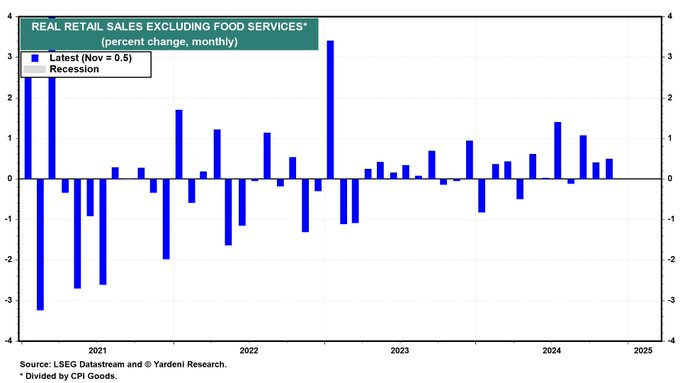

And the consumer is spending this holiday season. Retail sales so far are +.7% MoM and +3.8% YoY.

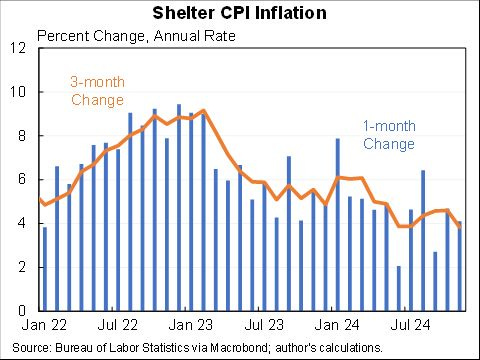

Some good disinflationary news: shelter growth is on the way down, which we do need frankly, and I say this as a landlord. Rents can’t realistically continue to appreciate at the rate they were if we are to maintain a healthy housing sector. Progress has been made since the 2022/23 highs but need to further come in. Shelter growth is still higher than overall inflation, at 4%.

So maybe, the Fed has interest rates around where they should be in the cycle?

One example of the hot U.S. economy: wages. Wage growth is still running at over 4%, above core inflation.

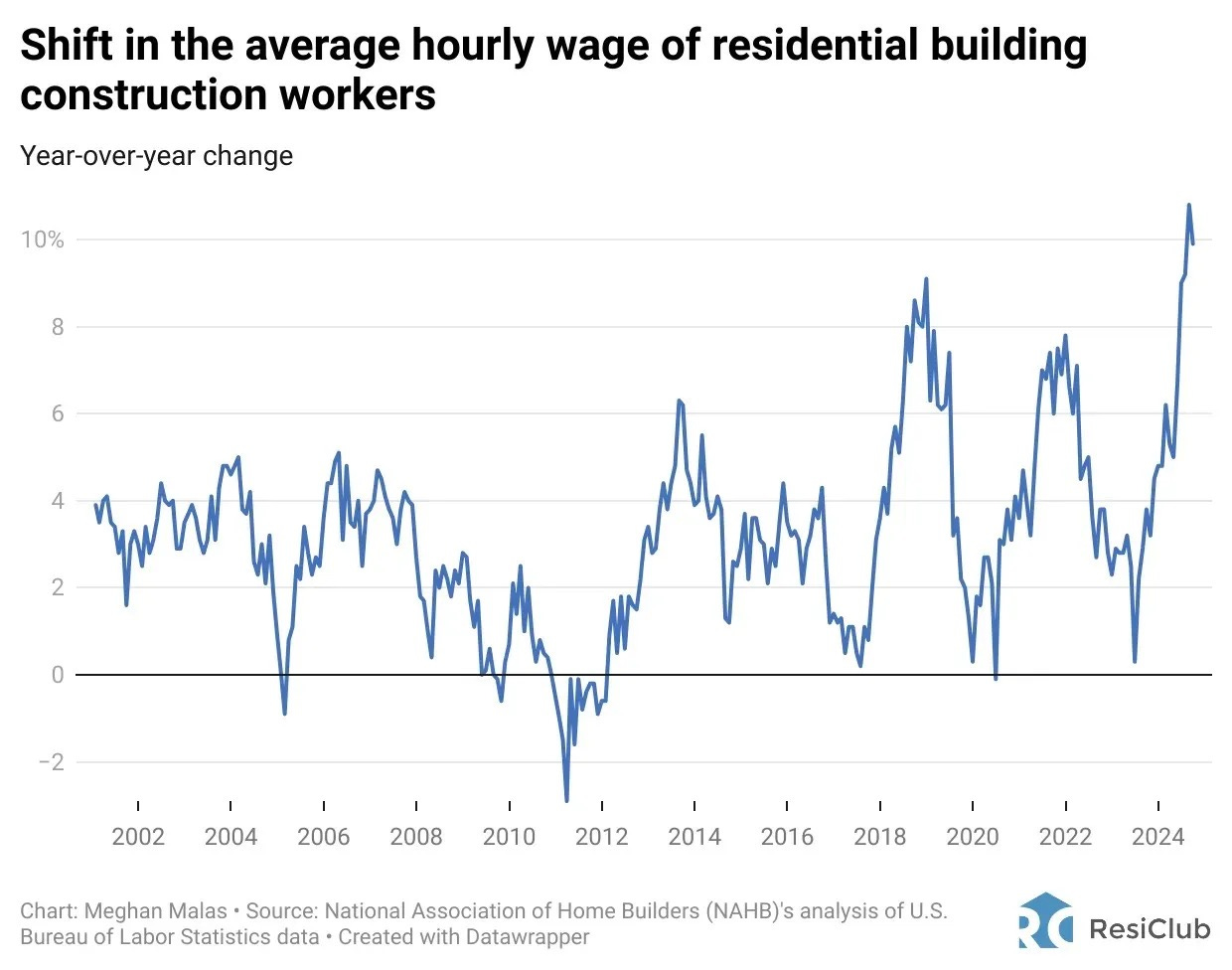

This permeates to all workers, including the construction trades, and thus, to the price/cost of homes. In fact, construction wages have far outperformed average wage growth in the last 2 years.

According to the National Association of Home Builders (NAHB), average hourly wages for residential construction workers rose 10.8% between August 2023 and August 2024, the largest YoY jump since the BLS started tracking the data.

This is no surprise. I’m seeing double this frankly in most trades.

Could wages be making a top?

Normally I would say absolutely, looking at the above chart. But the NAHB also reiterated evidence of an ongoing labor shortage, saying, “The ongoing skilled labor shortage in the construction labor market and lingering inflation impacts account for the recent acceleration in wage growth.”

For now, the hot market is still rolling. I personally know several blue-collar millionaires from HVAC techs to plumbers. If you sweat for a living, there is good money to be made.

We covered more on this potential risk in a previous article: Are we Close to a Minsky Moment?

My Skeptical Take:

I’ll do a 2025 prediction post in the coming weeks, but for now, I’ll just say that all signs are pointing in the ☝️ direction.

I’m bullish going into 2025.

But my skeptical spider senses are starting to flash.

In the next 100 days, I do think we take a little breather, or as the finance folks like to say, a correction. We have been on such a tear, that it is appropriate that we see a bit of a pullback, likely starting with the the stock market and filtering down into the real estate market. Folks feel less rich and pull back when stocks and their 401k’s are flashing a bit of red. For investors, this makes this winter a great time to acquire your next deal.

To be clear, any correction, in my opinion, will not be related to an economic slowdown, but rather the opposite. Because there have been such significant gains in the markets this year (unless you are a bond investor😬) fund/asset managers and stock traders will likely do some portfolio rebalancing in January, selling winners, and locking in tremendous 2024 gains. I bet they wait until January or February so they don’t have to pay the tax on those gains for another year (which is why we may be seeing less selling this month than in a normal cycle).

Counterpoint: On the other hand there is jubilation in the streets.

Well, street.

Wall Street, that is.

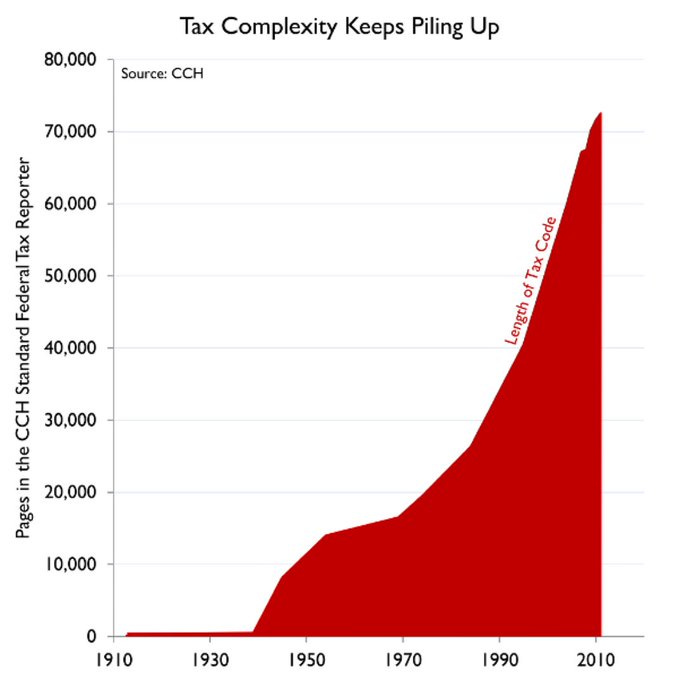

The fervor in the air is palpable. Business leaders can’t stop talking about this “pro-business administration” that is coming on January 20th. They see a renewal of the current business tax rates, regulation and permitting rules getting slashed, tax code being simplified, and federal deficits on a one-way ticket down the elevator (which are a longterm drag on economic productivity).

Just look at the growth in tax code complexity over the last 20 years. Holy hell.

This is totally regressive. For me, this is just a few extra bucks I have to pay to the CPA industrial complex. But if you can’t afford that you don’t get to take advantage of the tax code complexity.

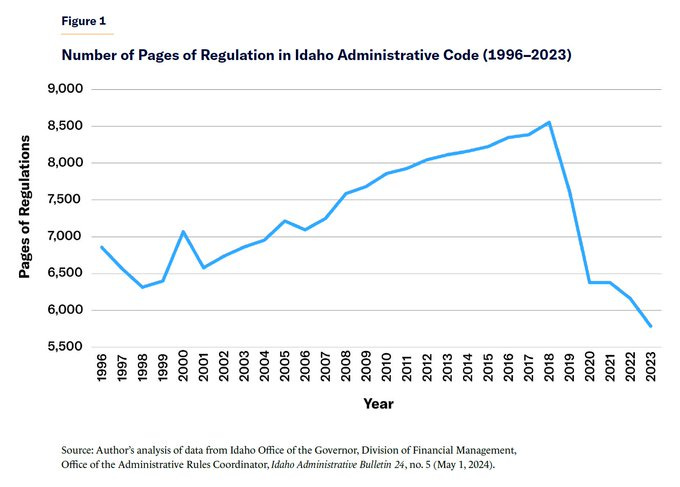

And for all the naysayers (myself sometimes included!) who say deregulation is possible.

Idaho says, “hold my beer.”

You go Idaho!

All this is to say, the US may have a very auspicious directive in the making.

Thoughts on two perceived tale risks: deportations and tariffs.

A quick non-political note on two topics I can’t seem to avoid: mass-deportation and tariffs.

I am not concerned about the saber-rattling from the TV talking heads about “mass deportation” and “tariffs.” I view these as fear-mongering, and it makes me bristle. Looking into my crystal ball - which I still keep in my closet from my previous life on Capitol Hill - neither of these risks have a realistic path to a meaningful economic effect. To be sure, both deportations and tariffs will likely be carried out, but they will most likely be minute in scale vs US GDP. These are political wins the administration wants from promises made on the campaign trail.

So beware of these (and other forthcoming) dog whistles, they will lead you astray, fighting imaginary ghosts.

But I digress…

I am feeling hopeful that government can get its butt in gear and make meaningful change, both in size and complexity, with help from both sides of the aisle. This doesn’t need to be all at once, and can be done one bite at a time. I bet we see a steady stream of government efficiency statements, cuts, proposals, updates etc… sprinkled out into the media every few weeks all next year. This will be bullish for markets.

As then Senator Everett Dirksen is quoted as saying:

“A billion here, a billion there, pretty soon, you're talking real money.”

-Everett Dirksen

For us real estate investors, I think the setup for the Spring will be there. Aptly-timed when another rate cut likely in the offing.

“But, what if inflation does rear its ugly head Andreas…?”

Good for real estate owners. Property values up.

“Ok, well, what if these economic signals are not a sign of a normalizing economy, but of one that may be approaching recession….?”

Good for real estate seekers. Interest rates will plummet and you can refinance that property, lock in 30 years of low interest rates, pull out equity, and buy another! (aka the BRRR method).

But, if you stay on the sidelines, acting fearful and not greedy, you will reap the benefits of neither.

Again I do think we see an early pullback in 2025, in the first 100 days.

But long term, I can’t hope to be a little giddy, always with a skeptical eye toward the horizon, of course.

Be cautious out there. Always protect your downside.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

*** What about you? Did this article motivate you to get started? Drop me a line and tell me. I always love hearing a new investor has decided to get started on the path to Fiscal Freedom! ***

We have passed 9000 subs! Let’s Go! Please help grow the community!

It takes hours to write this weekly article, and they will always remain free. All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you think I was going to send you a Starbucks gift card? 😅

Ready to Start Investing in Real Estate?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great deals, as well as manage their real estate portfolio, here in Nashville, TN. If you are looking for an investment property, give us a call today!

For all the information on who we are and what we offer, visit our real estate website www.NashvilleInvestorAgent.com or setup a call today!

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. 90+ people per day move here and last year 16.8 million folks visited our lively city. We have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, and no state income tax, to name a few amazing perks.

* I write this myself and get it out for you all on the same day. Apologize in advance for the likely errata. Don’t have a team of editors, yet.

** The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and do not constitute financial advice.