Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.90%

(☝️.08% from this time last week, 30-yr mortgage)

Today, we’re talkin’ the lazy bones existing home market, what is a shadow Fed President, and is the US economy actually shrinking???

Let’s get into it.

The Weekly 3 in News:

Has GDP Gone Negative? Maybe not.

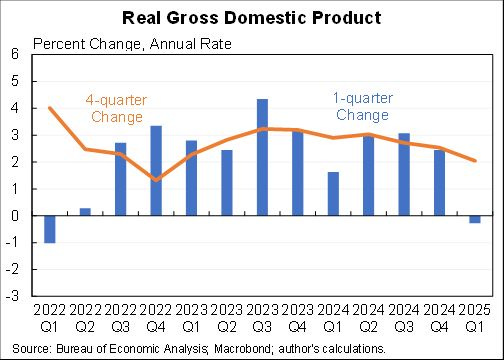

For a moment, pundits, media personalities, political folks, and most economists (good job to the few) went a bit off the rails last week when a negative GDP print hit the shelves, showing Real GDP down -.3% last quarter. Well, they are still

Ah recession! See, I told you! Doom! Ahhhhh! Yay I was right!

This got folks majorly tilted and elated. Depending on your politics, I must assume (remember, a recession is roughly defined as two consecutive quarters of negative GDP growth, ie an economy in contraction).

BUT….

The underlying GDP numbers were extreme, skewed by an enormous increase in imports and inventories. In general, GDP accounting technicals count imports negatively to GDP and exports as positive.

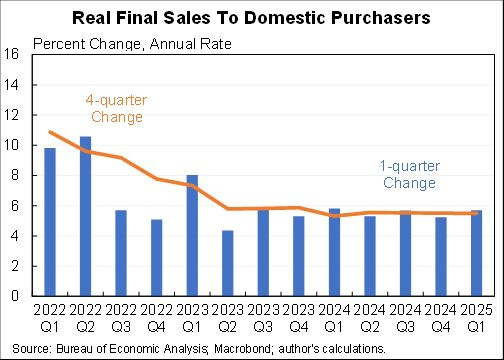

However, Core GDP, real final sales to private domestic purchasers (GDP less inventory change, net exports, and government spending), actually grew 3%.

Many analysts I like to track think this is a better measure of underlying domestic demand, when we have outlier data.

Obama’s former economic chair Jason Furman agreed, saying, “Final Sales to Private Domestic Purchasers is usually a better predictor of future GDP growth….My preferred measure of "core GDP" a better signal, up at a 3.0% annual rate.” He put up this BEA chart on X.

The only caveat is that equipment spending (driven by high-tech equipment) surged 22.5% in Q1, likely companies importing a tremendous amount to front-run potential tariffs, so even the 3% growth may be a bit overstated, as it pulled forward some future demand. In a few weeks, we will see a revised GDP number once more data comes in. Let’s see how the -.3% number holds up. Bookmark this.

I bet you a Chipotle burrito it’s revised positive. Seriously. The first 25 folks, you tell me if I’m wrong and I’ll UberEats you a burrito! (no guac tho, I’m still licking my wounds from my UFC bets this last week. What happened Bo Nickel?! You were my lock of the week!)

But, I digress…

Atlanta Fed is All Over the Place

The Atlanta Fed sees growth in Q2, estimating 2.4% GDP to to upside.

Wait! Sorry, my mistake. Their estimate was 2.4%, on April 30th…

…But a couple days later, they just revised their estimate to 1.1% for Q2.

This, after last quarter when they shocked the market and predicted Q1 GDP would be…checks notes…. -2.7%?!

What are they doing over there? What a shit show @AtlantaFed. Stop the politics, just give us the data.

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

Shadow Federal Reserve Chair Talk

Speaking of politics, without getting political here, the President has threatened plenty of times that he would fire or remove Jerome Powell as Chair of the Federal Reserve. But in the last few datys he has walked those comments back, saying he has no plans to do so (*cough*, thank you Treasury Secretary Scott Bessent for your sage advice).

But could the President influence or even control monetary policy, without replacing Powell?

Imagine the President, eager to replace Federal Reserve Chair Jerome Powell as his term nears its end, selects someone now, roughly a year ahead of Powell’s term ending. This person, with encouragement from the President, takes to the media with a clear and calculated message: cut the Fed funds rate and lower mortgage rates. Their consistent, forceful campaign signals a shift in monetary policy in just 12 months time, moving [bond] markets and in essence doing the Fed’s work for them. er,,,or for the President, depending on your perspective.

Who may he pick?

Become a Premium Subscriber

Become a paying subscriber to get access to the rest of this post and other awesome subscriber-only content, like a one-on-one with yours truly.

Upgrade for Just $5 Today!Subscription Benefits:

- Premium Content and NO Paywall

- Subscriber-only market insights

- Breaking News Analysis

- Every article we have published - a treasure trove of information and education

- Annual one-on-one coaching with me personally! ($1000 value!)