Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 7.02%

(☝️.10% from this time last week, 30-yr mortgage)

Today, we’re talkin’ market updates, housing affordability, and how anyone can get started owning real estate. Conservatively. No gurus, no gimmicks. Just tried and true real estate investor strategies.

It’s a longer article today. I thought I would give a few extra nuggets this Memorial Day week. You won’t want to miss the end, on my dad’s wild real estate ride. Trust me, it’s worth it. 😉

Let’s get into it.

The Weekly 3 in News:

Is it a bull market? ““All in all, I’ve remained bullish,” says economist Ed @yardeni, “I think it’s a bull market, and I think we’re heading higher over the rest of the decade.”

Emerging Trends in Real Estate: 2025 Top Markets lists the top 10 markets to watch. Dallas, Miami, Houston, Tampa and, of course, Nashville round out the top 5 (EmergingTrends).

Fun Random Fact: You prefer the smell of a potential romantic partner over another because it reflects their underlying immune system composition. In general, people select/prefer partners with immune systems more different than their own. Which makes perfect sense. Any offspring = hardier. Who knew? (Huberman).

News headlines will be aplenty this shortened Memorial holiday week. Data releases on Core PCE inflation, pending home sales, and Federal Reserve minutes will provide signals about interest rates, housing demand, and economic growth. We will also get a double dose of consumer sentiment numbers (both Conference Board and UMich), the revised GDP growth for Q1 2025, and jobless claims.

Let’s get ready for volitilityyyyyy!

The key to a $1.3T opportunity

A new trend in real estate is making the most expensive properties obtainable. It’s called co-ownership, and it’s revolutionizing the $1.3T vacation home market.

The company leading the trend? Pacaso. Created by the founder of Zillow, Pacaso turns underutilized luxury properties into fully-managed assets and makes them accessible to the broadest possible market.

The result? More than $1b in transactions, 2,000+ happy homeowners, and over $110m in gross profits for Pacaso.

With rapid international growth and 41% gross profit growth last year, Pacaso is ready for what’s next. They even recently reserved the Nasdaq ticker PCSO.

But the real opportunity is now, before public markets. Until 5/29, you can join leading investors like SoftBank and Maveron for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

Interest Rates Popping

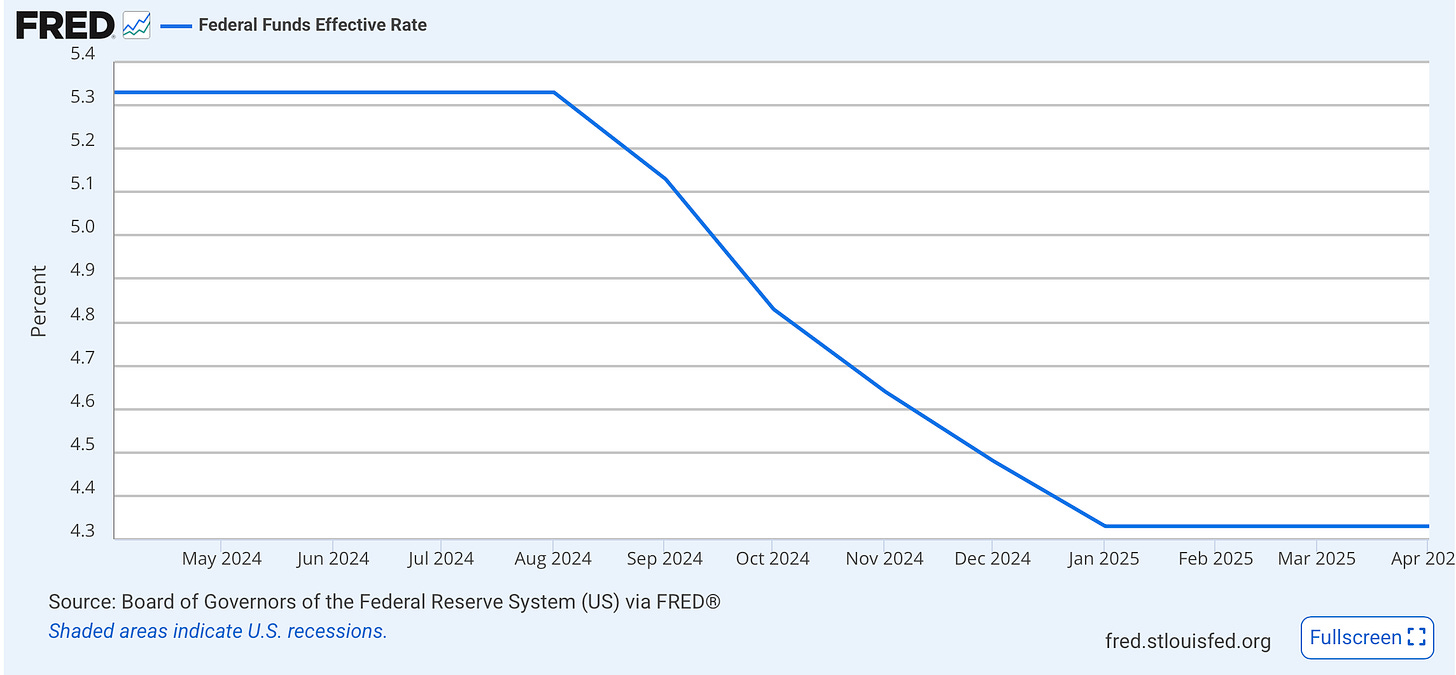

The Federal Reserve meets 8 times a year, the next is June 17-18. At each meeting, they make a binary decision: Cut interest rates or increase rates (yes, yes they can also just leave it alone too, smart ass :) ).

Should they cut? Inflation looks under control, and the bond market is throwing a tantrum about our escalating federal deficits, which are being exacerbated by high interest rates.

I think they should.

Will they? Here is Atlanta Fed President Austan Goolsbee on the upcoming decision,

“The bar for me is a little higher for action, in any direction, as we are waiting to get some clarity [on potential tariff effects].”

I think they won’t.

The problem. GDP data comes out after the quarter is over. And even then that number isn’t final, more lagging data needs to come in, and it is revised (like it will be this week). So Something might have already happened to slow (or grow) the economy. It’s like watching the game you recorded after the fact, and before you check you text messages.

Also, a side note: the Fed doesn’t trust the Administration. Right or wrong, they are concerned, bordering on fearful, that global trade policy is being rewritten at too rapid a pace and with too much uncertainty. However, that is precisely the intended strategy of this Administration, so the two may be at loggerheads for a while until the Fed gets comfortable with being uncomfortable. Or if the labor market breaks down.

I got distracted there…the Administration’s trade policy is not my point. It’s that the Fed has another armament in its arsenal, and it’s not being discussed much.

There is another way the Fed affects long-term interest rates: Quantitative Tightening/Easing. Aka printing money and buying bonds.

Interest Rate Pressure from the Fed

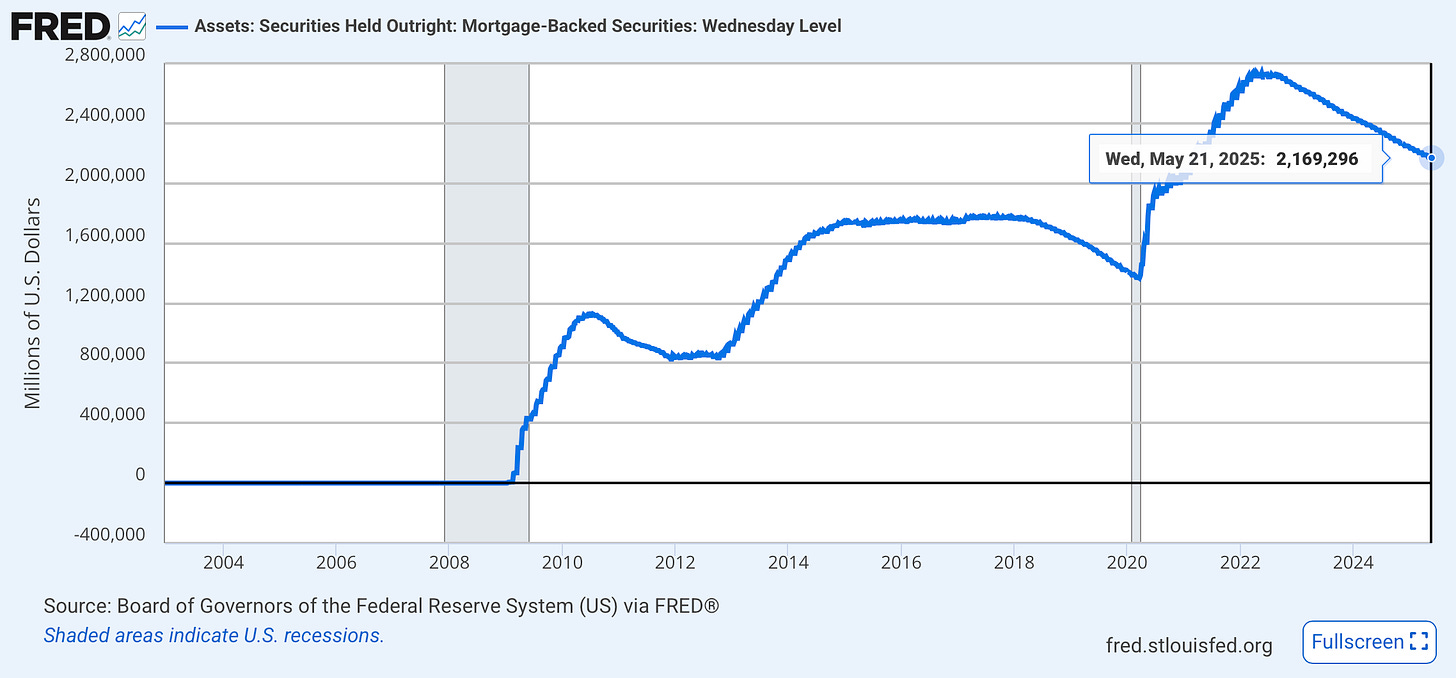

The Fed is slowly unwinding its ownership of mortgage-backed securities (MBS) off its balance sheet, which it bought heavily in 2020, and didn’t stop even in the red-hot 2021 real estate market. This kept interest rates unnecessarily / artificially low. Fun fact, the Fed never owned MBS prior to '09, then put trillions of these assets on its balance sheet. And reupped with another trillion during COVID. As of May 22nd, the Fed still owned almost $2.17 trillion of these assets.

This extreme buying of MBS artificially kept interest rates down both in the post Great Financial Crisis and COVID eras 2020-2022, distorting the housing market.

When times were really good, that was the time to take the foot off the gas pedal. Yet, the Fed kept buying MBS. The result: inflated home prices.

As they unravel their ownership (aka Quantitative Tightening) of these holdings , removing the liquidity they injected in the market, it will put upward pressure on 10-yr Treasury and mortgage rates. This is one reason why the Fed announced at their last few meetings that they would be slowing their rate of selling MBS off their books. This process of quietly slowing their Quantitative Tightening (QT) started in April.

This is another reason, in my humble opinion, the Fed should restart cutting interest rates. QT is what they should have done back in 2022, while raising rates.

The Fed should stop QT, and resume once rates are back down to normal (r*) levels.

Home Prices and Affordability

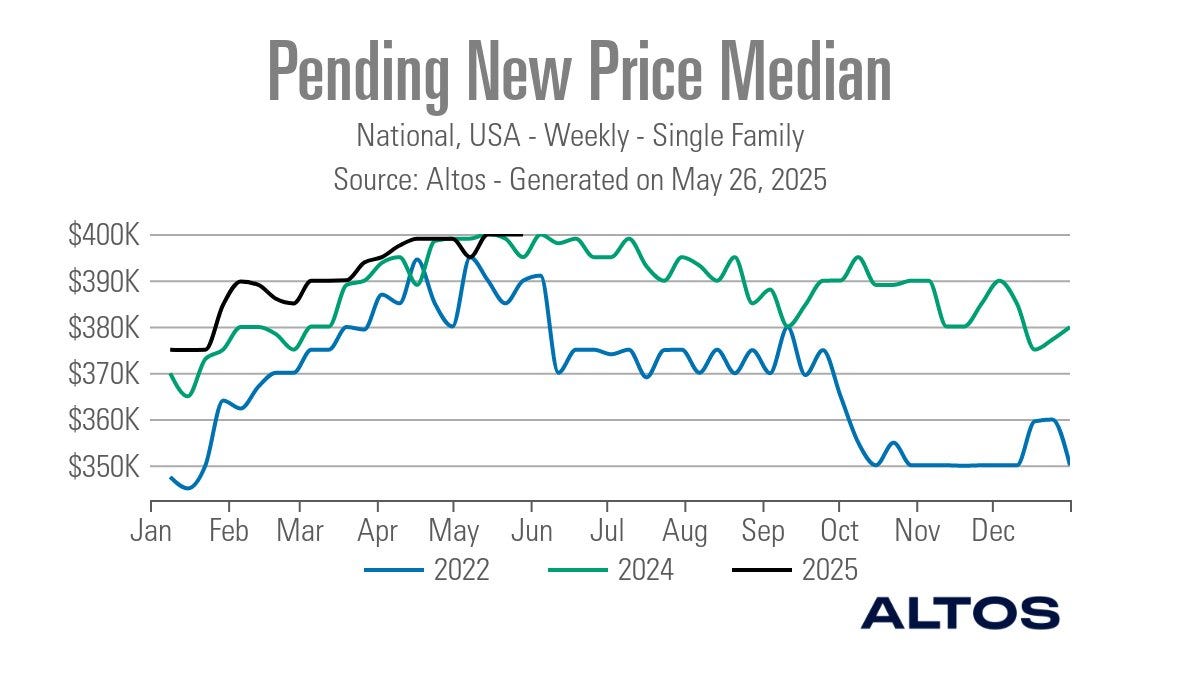

Keeping on this home price theme, we all know home prices are elevated, and will likely stay that way. Inventory is gradually improving but remains tight, with home prices expected to rise moderately in Q2, the strongest quarter of the year. Real estate is highly seasonal; homebuyers start buying in March and continue through mid-summer, driving seasonal price increases. And this year is looking no different (Altos).

Home Price Crash! ? No.

Home prices were up .8% Feb-March (latest data), up 3.4% YoY, and up 52.3% since March 2020 (ResiClub).

All the gurus out there are predicting a home price crash this year, like they do most years, but this is unlikely. Inflation may be variable, but prices are permanent. If you are waiting for prices to meaningfully decrease, it’s going to be a long wait.

But that is not to say affordability has been rectified, far from it. So, how is this affecting homebuyers?

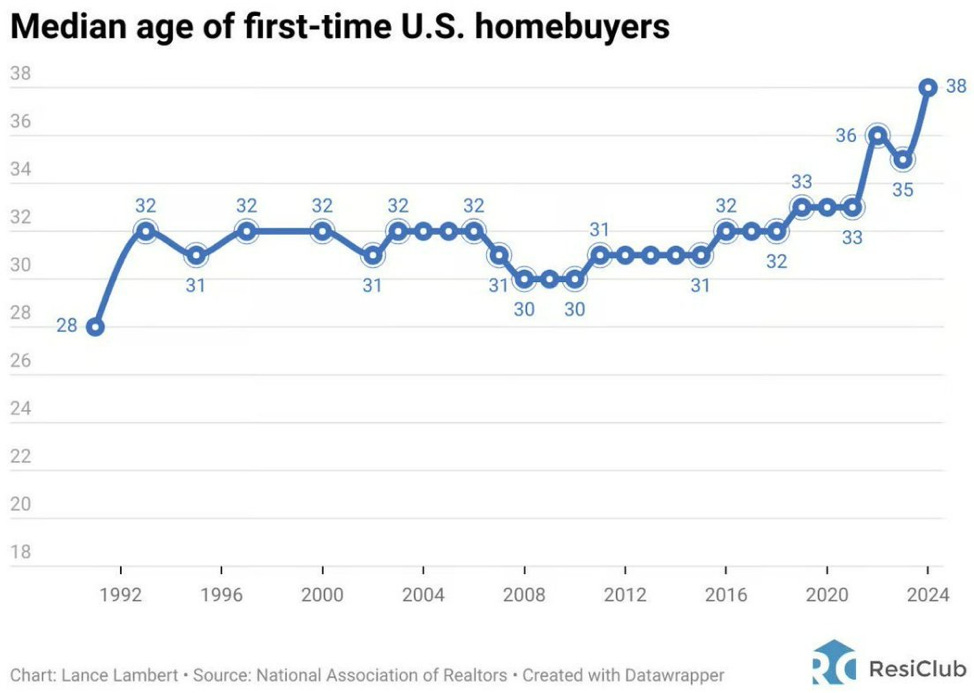

Median age of first-time homebuyer hits all-time high.

In 2005, the median U.S. homeowner lived in their home for 6.5 years. Today, that number is 11.8 years (RedFin). Why? Much of this is being driven by home price affordability for first-time homebuyers. The median age of first-time homebuyers is now 38, ten years older than it was in the 90s.

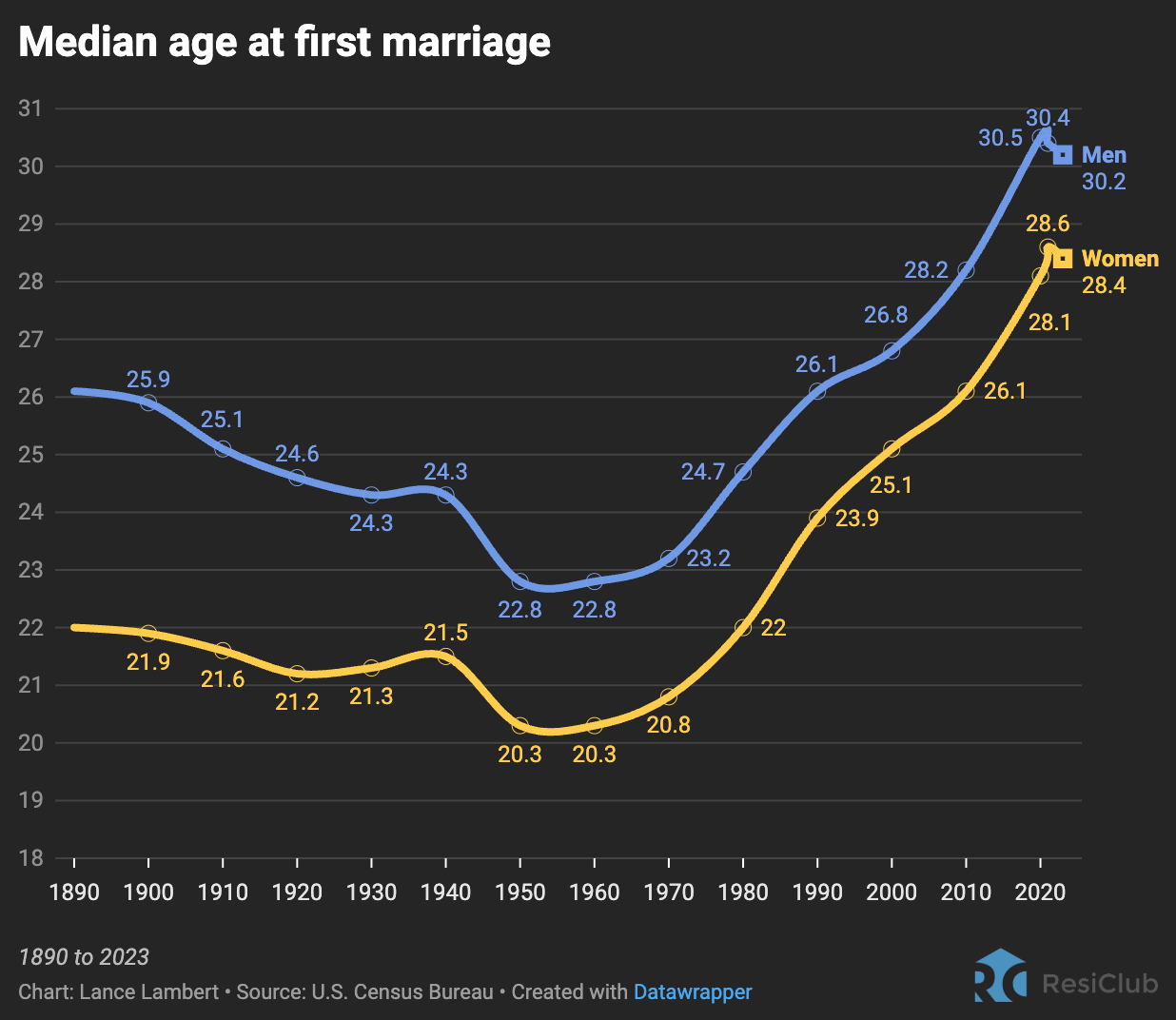

And, first-time homebuying is often part of another life event, marriage, which is also happening later in life (yours truly included, sadly ResiClub).

Why is this happening and what to do about it?

Mortgages are expensive. So for first timers, it’s likely interest rates, which have driven up that monthly payment, even more than the overall home price, which is driving unaffordability.

To get the housing market healthy again, we need two things to happen:

Lower interest rates. This will happen once the Fed cuts rates, and the federal government gets its fiscal house in order, driving Treasury bonds down, and thus mortgage rates.

More homes! But….new construction is still slow vis-a-vis demand.

Sadly, this is not to be.

Construction of Single-family homes is slowing

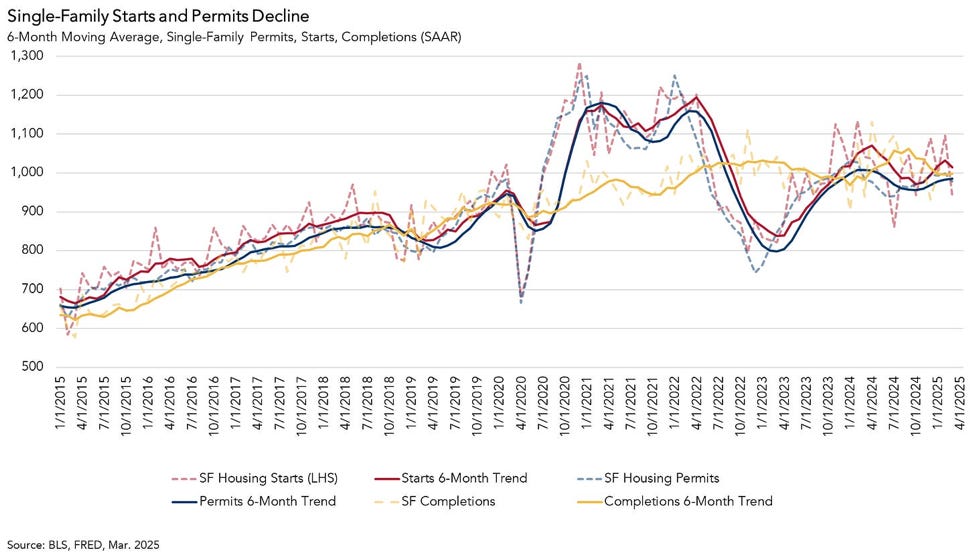

New building permits dipped 2% in March, after having stagnated for months. Completions are still heightened, meaning we will likely see lower new supply coming on market in the upcoming months. (Here is a fantastic set of charts from housing analyst Odeta Kushi).

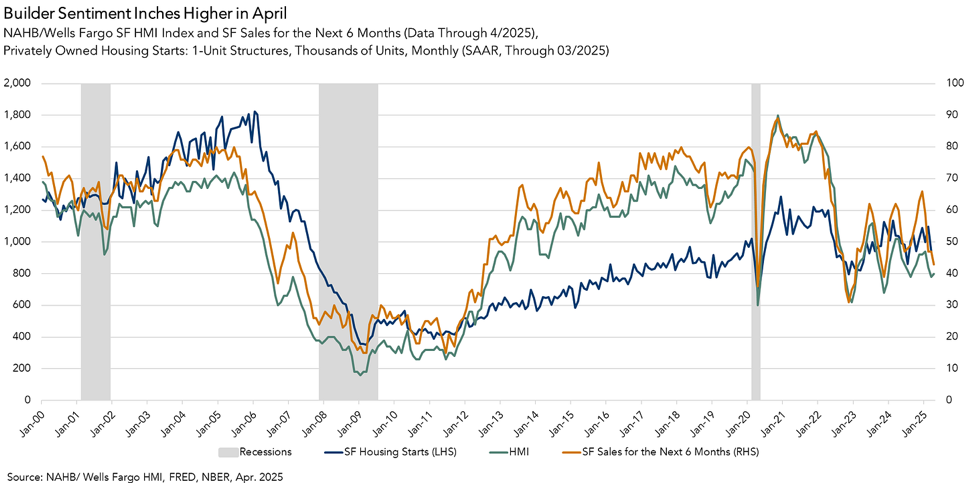

Case in point, home builder sentiment is in the pits. Well below 2019 levels.

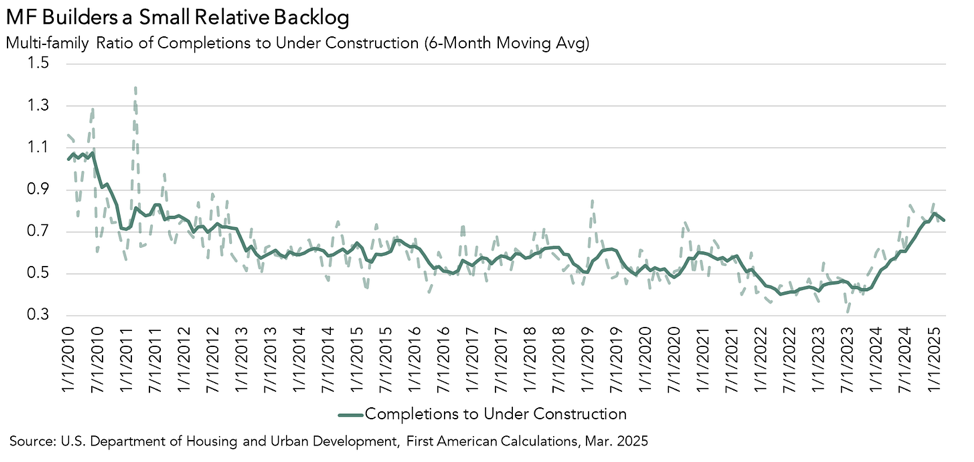

Multifamily builders now have the smallest backlog relative to completions since the tail-end of the Great Financial Crisis in 2011.

This imbalance will be the primary reason home prices, and to a larger extent rental rates, will resume their trek higher.

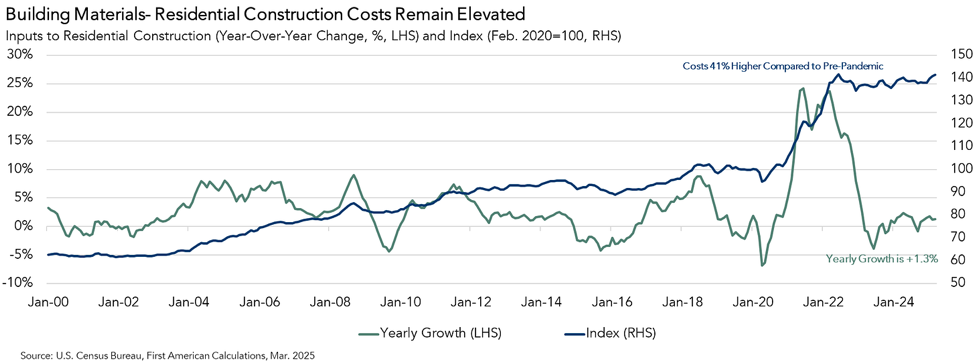

Yes home prices are ~40-50% higher than 2019 levels. But guess what led this increase? Inflation. Hell, building costs went up 40%!

This is why inflation sucks. And again, why Fed policy and government spending really matters for real estate.

So, don’t buy a house, right? I mean, it looks and feels like it’s a terrible time. I’ll just wait till interest rates come down and maybe prices will come down too? I hope.

I disagree. Hope is not a strategy.

Is it really not a good time to buy a house?

I would argue no, it’s a fantastic time to buy (but it’s a difficult time to sell one).

And further, I offer this...

Anyone can own real estate.

Anyone.

It just takes a little savvy and a bit of a typical lifestyle sacrifice.

Let me tell you how…(after the shameless plug below).

*** Want to own real estate, but don’t know where to start? ***

Start by getting some coaching and mentorship. Elevate your real estate knowledge. Gain expert advice from someone who actually owns real estate.

No "guru" trying to sell you an expensive course.

No BS, just frank, brutally honest advice.

Ask anything you've always wanted to but were afraid to ask.

Starting at just $100 smackeroos. It will be the best money you've ever spent, if you don’t think so, full refund. You can’t find that guarantee anywhere else in the industry.

Join the investor-class, become an owner.

Plus, act now and get 10% off!!! Use my special Skeptical Investor link 👉. Join the Investor-Class!

Want to advertise to the more than 20,000 weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

Owning Real Estate is within reach for Anyone.

Again, it is absolutely true that home affordability is still really really tough. 7% interest rates are pure yuck, especially when we were just teased with 3% rates and 80% of all mortgages today are below 5%.

A rate of 7% vs 3% can seem like a world apart. To put this in perspective, a $400,000 home with a 20% down payment would have a monthly payment today of ~$800 more than just a few years ago. Put another way, the same monthly payment then would buy you a $600k house, now you can only afford a $400k house.

Scheiße!

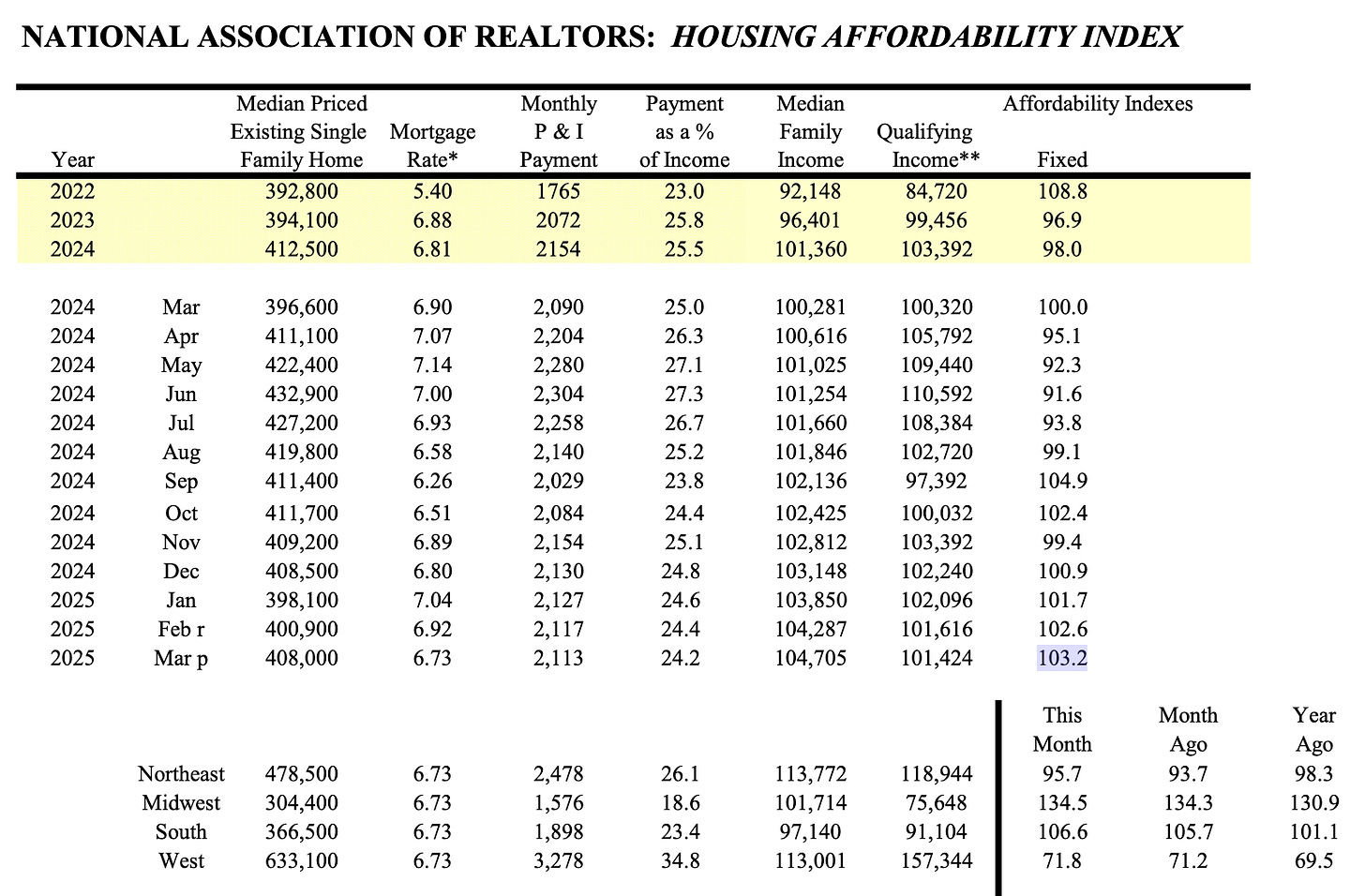

But the market is adjusting, although I would argue temporarily. In fact, according to the National Association of Realtors Housing Affordability Index has improved for 5 straight months, the highest reading since last September, back to 2022 levels.

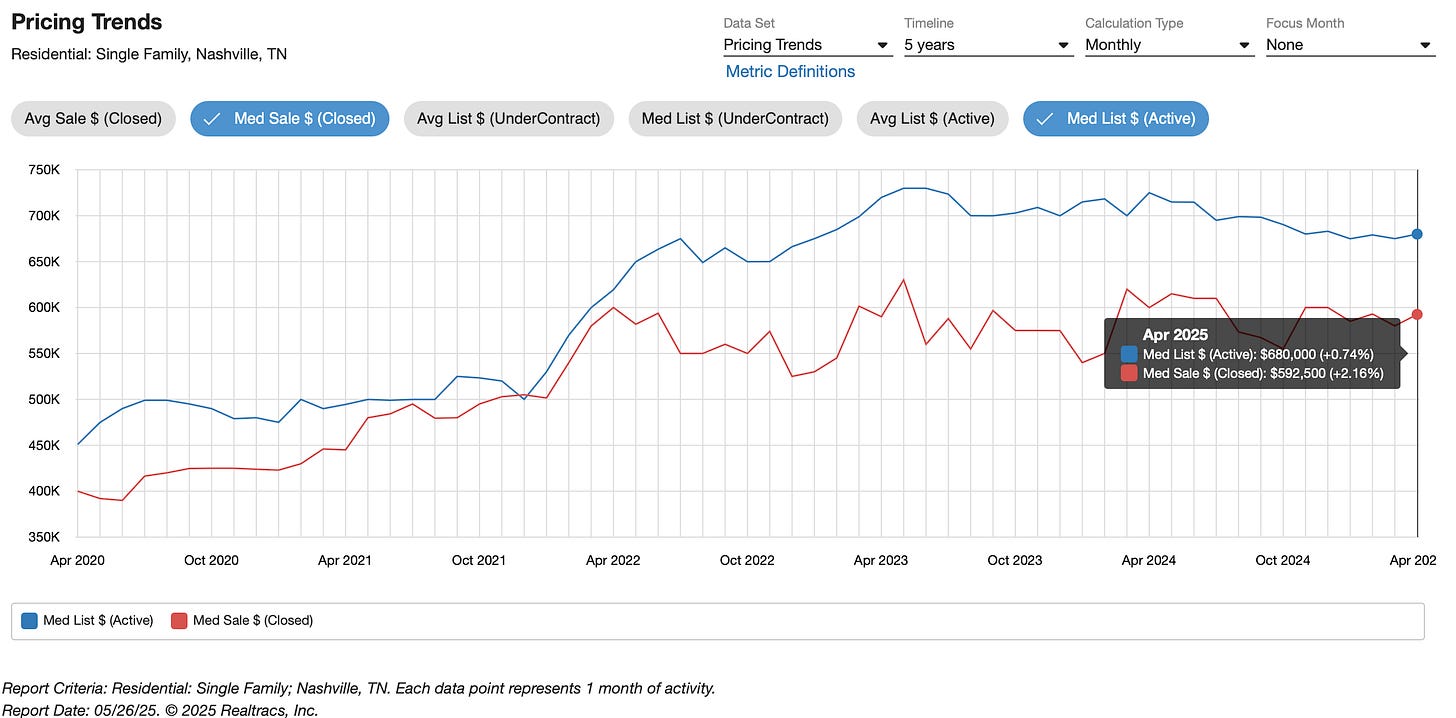

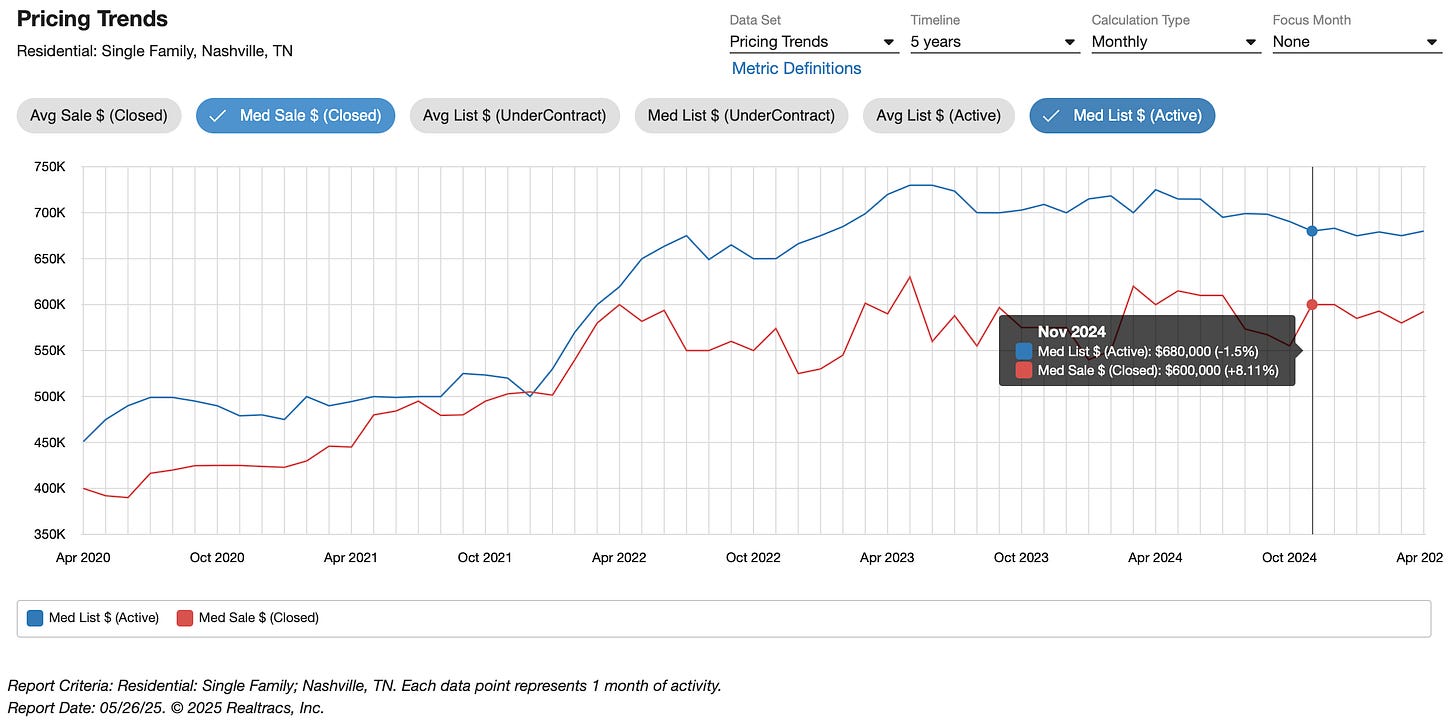

Home affordability is hurting buyers’ ability to buy, meaning those looking to sell are having a hard time finding buyers and are being forced to lower their asking price (again this does not mean overall prices are dropping. The asking price is lower). Savvy buyers, and us investors of course, who can afford the mortgage (or have cash) are finding themselves in the driver’s seat. The avg list-to-sale price gap is staying wider, albeit better than 2023 when interest rates hit 8%.

This is called a buyer’s market. And I love it.

And see that tick up in November data, tightening the ratio of list-to-sale price? Know why it tightened?

Remember what happened last September?

The Fed started cutting. And the home list-to-sale ratio tightened.

But then they stopped cutting in December. And since then, well, you guessed it, homebuying demand flatlined (driven by bond prices, which took mortgage rates back up to 7%).

So while it is true that home affordability is low, this is a direct result of higher interest rates, not a systemic financial or housing crisis, as there was during ‘08-09. The Federal Reserve is holding rates artificially high on purpose, in an effort to slow inflation.

This is why we will not see a meaningful decline in home prices, in my humble data-driven opinion.

Further, inflation is progressing down, and is now almost back to its 2% target, which we all see in the grocery store and gas station. Hell, egg prices have fallen back to reasonable levels, down ~50% since March.

What this means is - and it might be 10-18 months - but mortgage rates will fall. And once they do, home prices will spike higher than ever as literally millions of households get back into the market looking for a home. And then again, when rates hit 6% and then 5.5%, demand will hit rabid zombie levels. And rising demand will mean home prices 👆.

And you will have wanted to have purchased that property already.

So…Buy now, or Wait?

It’s the age-old (lazy) question: should you buy now or wait?

Let’s look at an example of a typical single-family home and see what the digits tell us.

Why Buying is better: Example Case

Let’s say you are purchasing a home for $400k in Nashville, TN, using my home market as an example.

At 7%, your mortgage is ~$2560.

Let’s assume it takes 12 months for rates to come down and the “normal” rate will be 5.5%. (The 3-4% COVID-era mortgages are likely never happening again, so let’s just forget about that pipedream).

Purchasing that home today will cost you 12 months of higher interest at 7% (vs 5.5%), or $6006 in additional interest costs.

So, if you purchase a home today you will want to make sure you get a deal, and pay $6006 less for the home than comparable homes.

Then, the plan would be that once rates come down, you refinance your current loan into that lower 5.5% (or lower) rate.

Importantly, make sure to select the right lender, ask your Realtor for their preferred lender list, which any self-respecting one should have in their hip pocket (you can DM me for mine).

And let’s not forget we are in a buyer’s market. Why stop at $6006 off the purchase price? We can be much more aggressive in our home purchase negotiations. Just last week, I got a client $45k off the purchase price, which is below market value, below the comparable median sales price. That’s saving 7.5x the extra costs of stomaching the 7% interest rate. Boom.

And, remember that home will appreciate 5% on average. (Much more if you do some improvements).

So, in those 12 months while you are waiting, that’s an additional $20,000 you are missing out on, or ~3x the amount you were trying to save in interest by being “patient and waiting.”

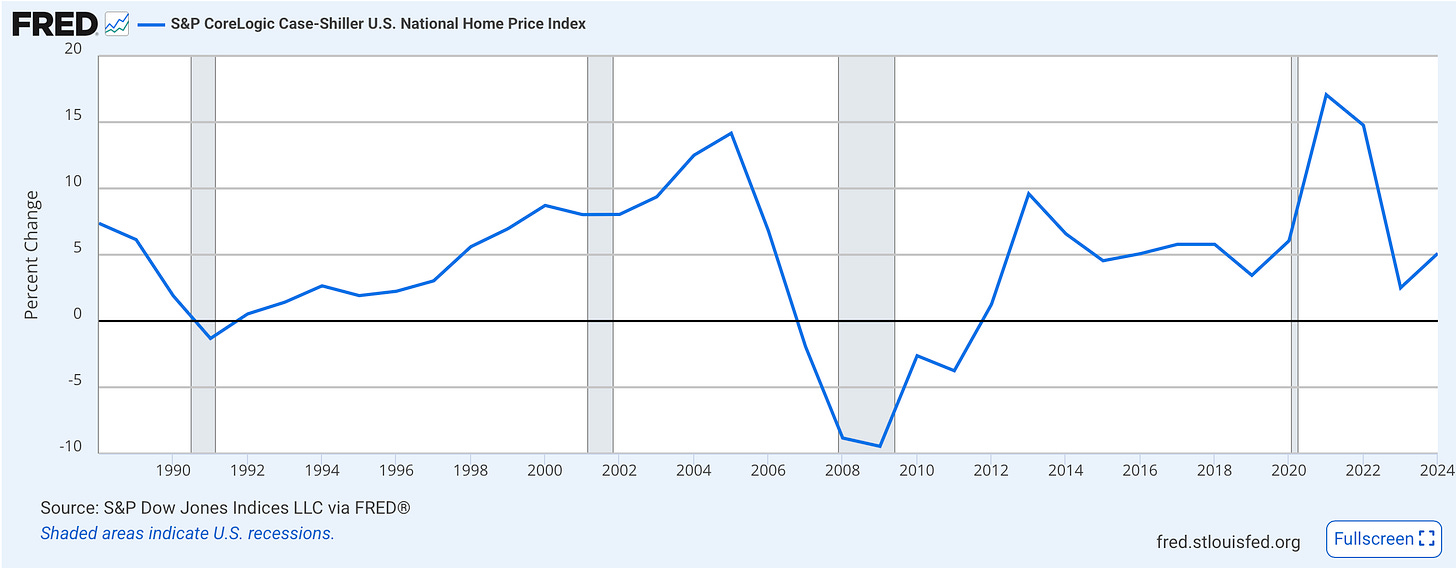

Home prices rarely go down. Since 1988, it’s really just happened once in a meaningful way, and that was the Great Financial Crisis, focusing on housing and bad financial practices.

So, what have we learned? As long as you can afford the higher mortgage, it likely makes far more financial sense to just eat that higher mortgage cost and refinance later into a more normal rate. Even if it takes twice as long for rates to come down the math still makes total sense. In fact, your real estate investment will likely make you several times your money back. And if you can improve the home through renovation, even if DIY / moderate, your wealth will grow even more.

But wait, there’s more.

When you own a home, vs rent, you can also:

deduct the interest you pay right off your taxes,

move out and rent it, and then depreciate the asset itself off your taxes

and if you sell it, you are exempt from paying $250k in taxes on the appreciation gains ($500k if you are married).

Now for the cresendo….

Do you think homeownership is unaffordable, out of reach, impossible, too expensive for you?

Hogwash!

You can “House Hack.”

What’s that? Well, kind sir / ma’am, get ready to have your mind blown.

Become a Premium Subscriber

Become a paying subscriber to get access to the rest of this post and other awesome subscriber-only content, like a one-on-one with yours truly.

Upgrade for Just $5 Today!Subscription Benefits:

- Premium Content and NO Paywall

- Subscriber-only market insights

- Breaking News Analysis

- Every article we have published - a treasure trove of information and education

- Annual one-on-one coaching with me personally! ($1000 value!)