Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

The Weekly 3 in News:

Nashville News - $200 million price tag set for massive riverfront property “The Riverside” in Nashville, TN. And infamous investor Carl Ichan is the seller, who may be taking a discount for his property (BizJournal).

Is the Golden Handcuff loosening? There are more new property listings in 2025 than we saw in 2023 and 2024 (Lambert).

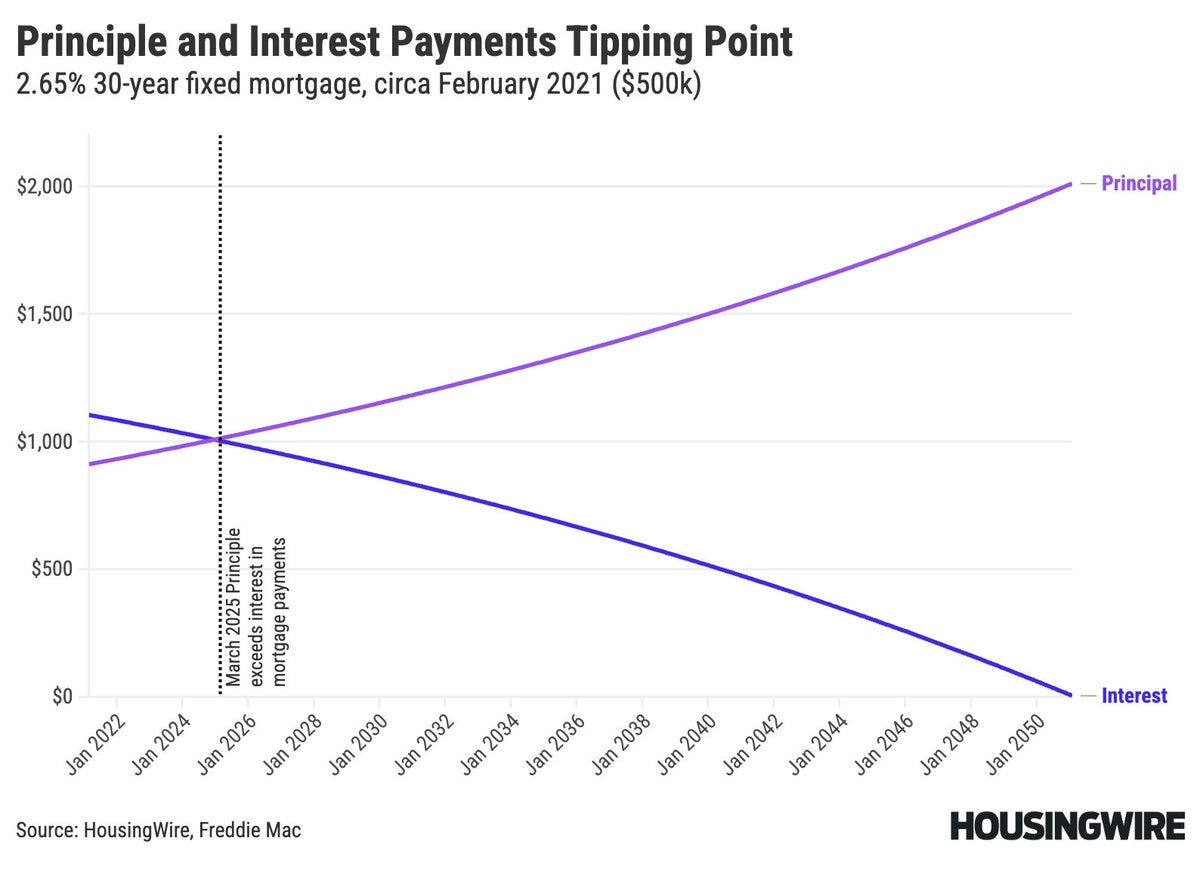

“If you were lucky enough to refi your mortgage at the absolute low in Q1 2021, the tipping point where your payments go more to principal than to interest is RIGHT NOW (Simonsen).”

Today’s Interest Rate: 6.80%

(☝️.08% from this time last week, 30-yr mortgage)

Today, we’re talkin’ about why folks are getting so pessimistic about the economy.

My unsolicited advice: ignore the noise.

The doomer news media is hammering us with apocalyptic reporting and punditry constantly. I for one am not feeling those negative vibes, especially in the real estate investment space. BUt, that being said, there are some significant issues to talk about. The get government spending, inflation and interest rates under control.

This is really important.

Let’s get into it.

Market turmoil

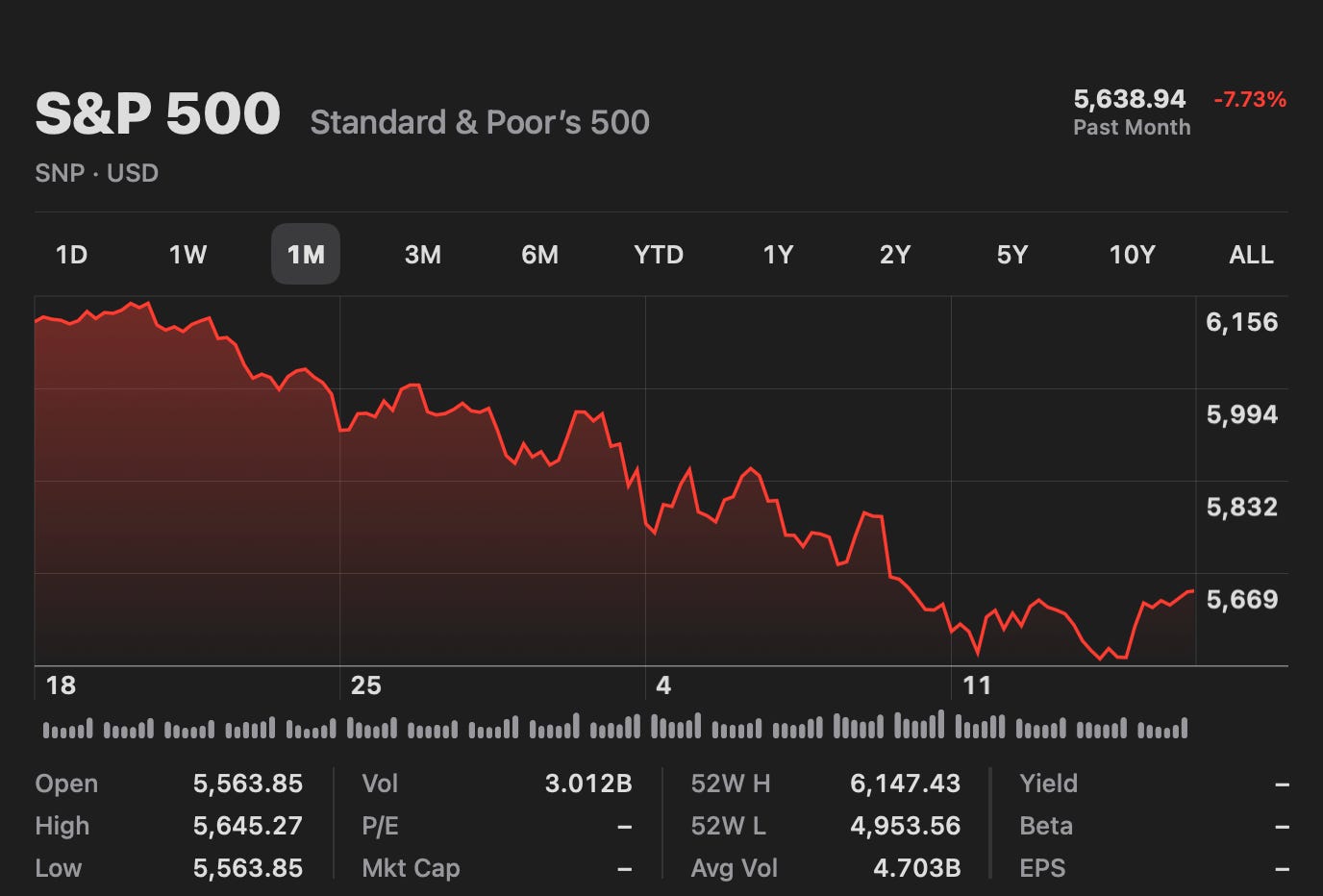

The stock market is experiencing some wild pessimism, down ~8% in 30 days.

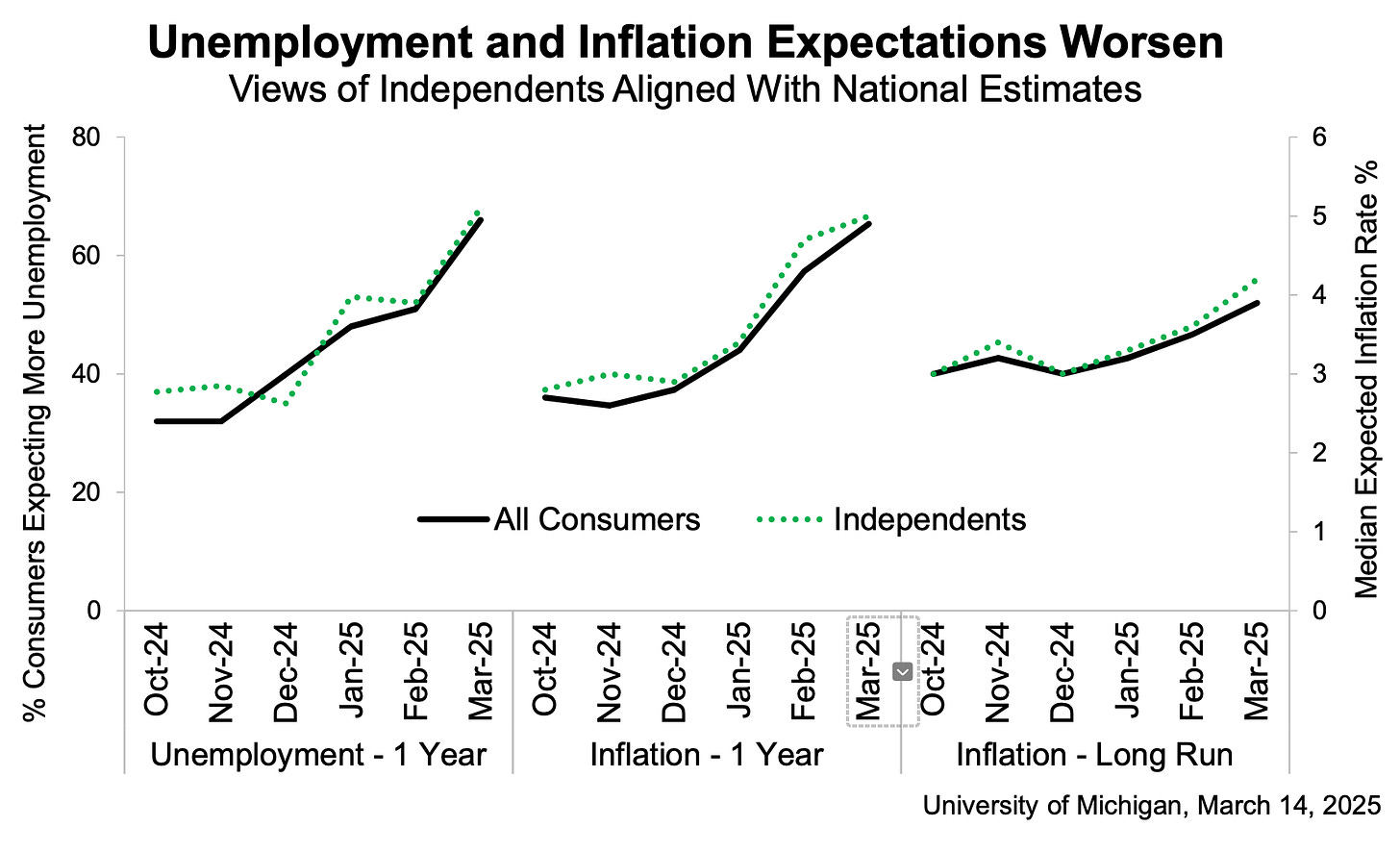

Consumer sentiment is sharply negative.

BUT, the Economic Data?

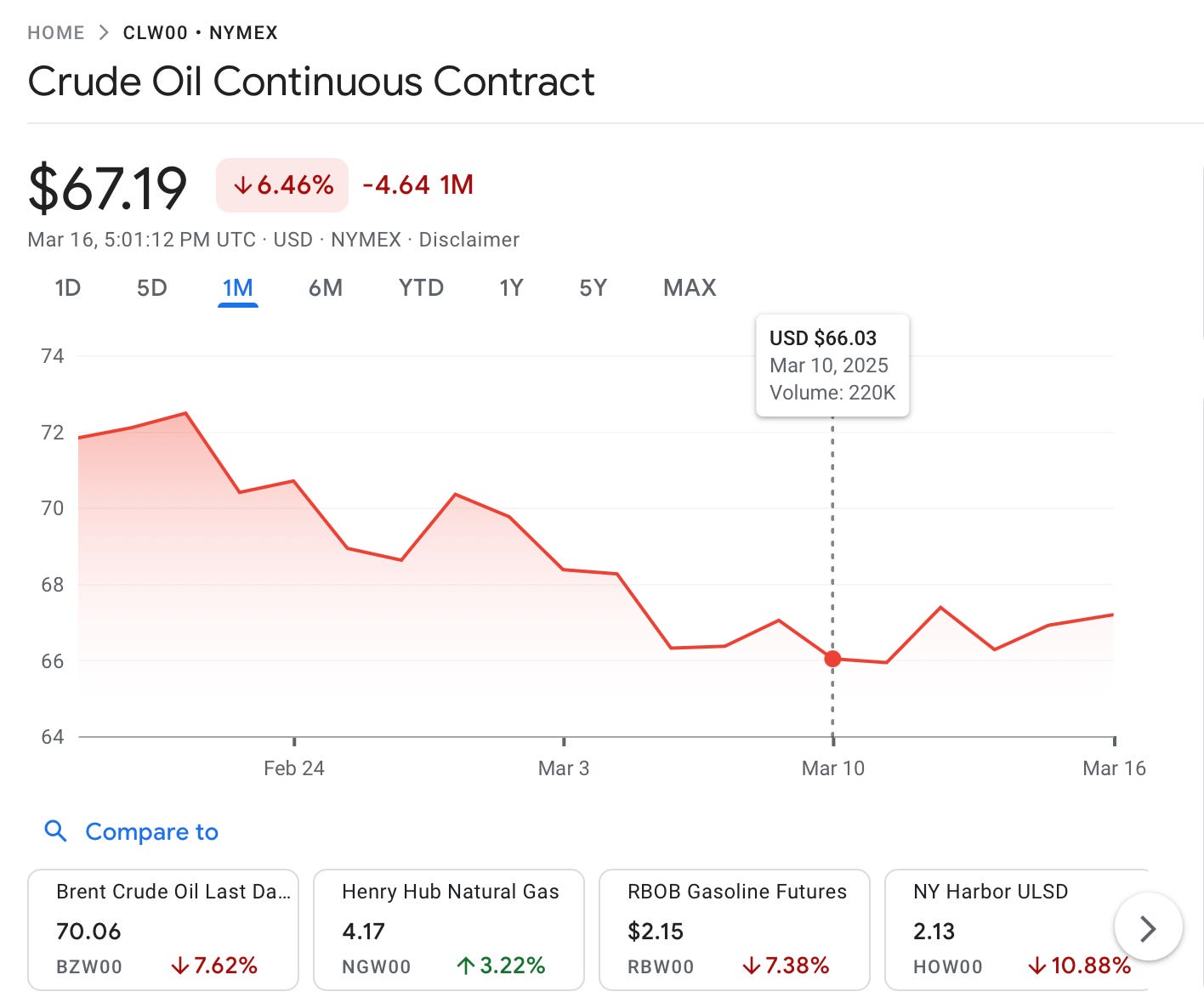

Oil prices are down.

Egg prices are rapidly coming down (still recovering from supply shortages).

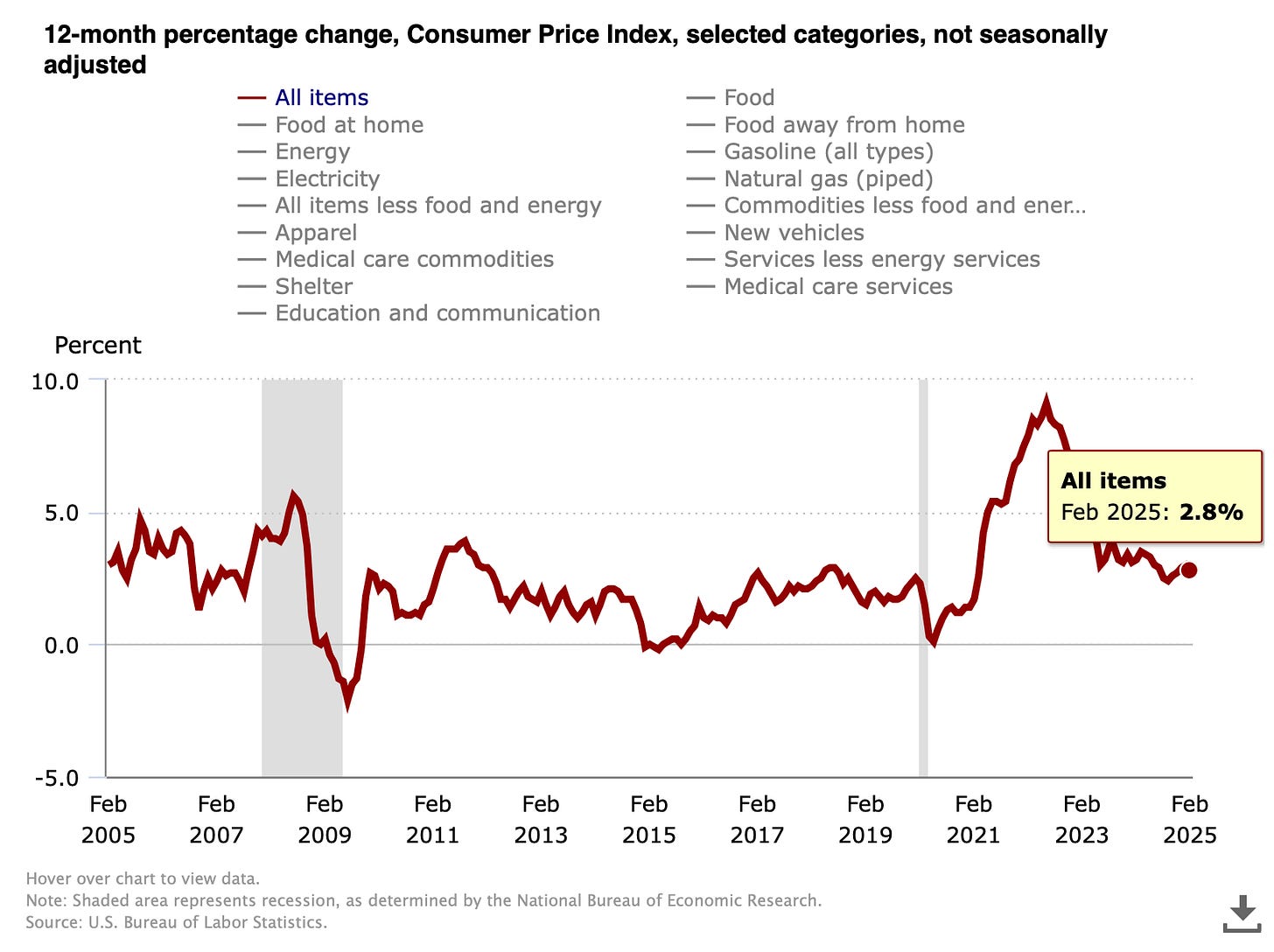

Consumer price inflation is again trending down, after 4 months of increases. (We will see if that was merely seasonal after we get a few more inflation reports).

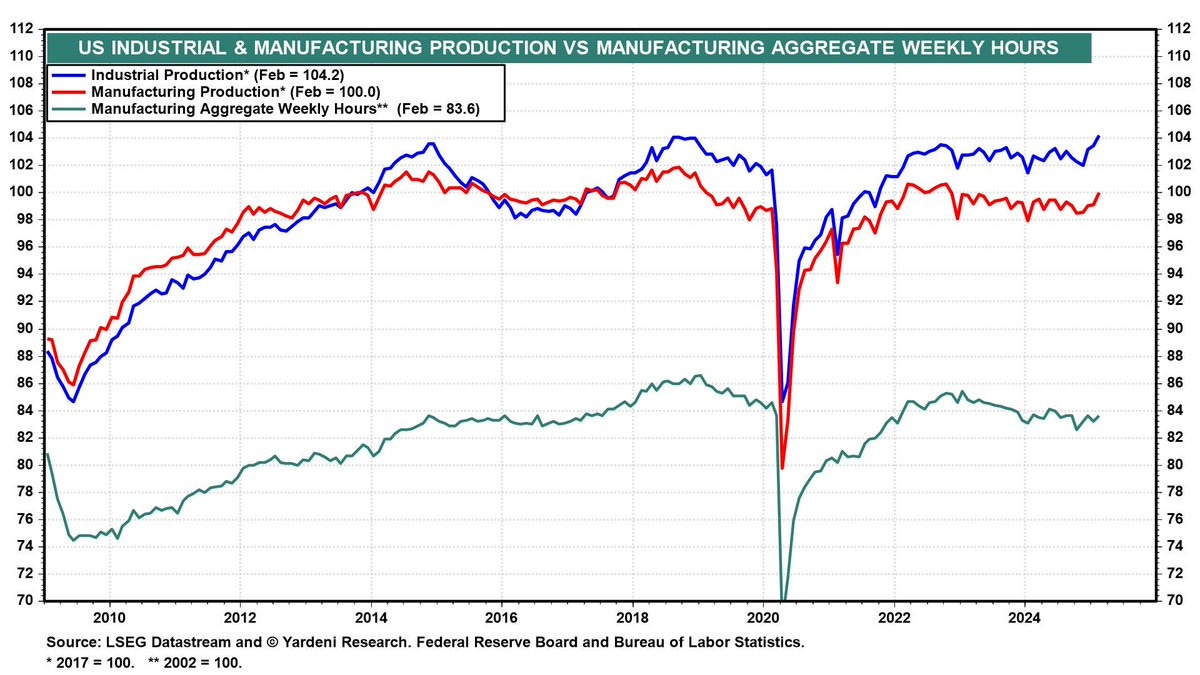

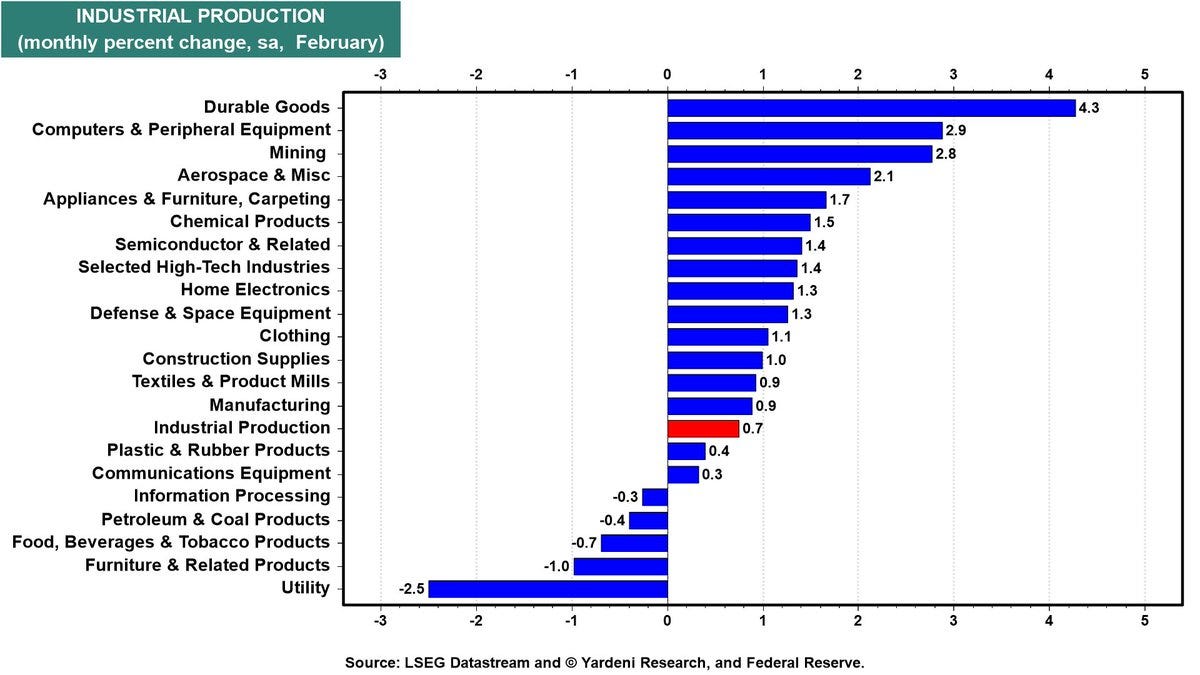

Industrial manufacturing? Strong. New numbers out today would be a new record high since 2010.

Particularly in tech, durable goods, aerospace, mining, defense….Utilities, food, oil declined (kinda good 😬).

This is all very positive.

Nervous Zeitgeist vibes, what gives?

Well……In my opinion, it’s a few things all at once…

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

First, something in economics that is hard for folks to comprehend: inflation may be down, but prices are permanent.

And high prices compared to just ~2 years ago - mixed with the perception of a chaotic government strategy - have ignited a fire in the news media, which has, in turn, spooked the consumer. All this while the fundamental risk to the economy lurks under the surface: out of control federal debt and high interest rates.

In my opinion. And despite their presumed good intentions, this Administration is doing a very poor job of messaging their strategy to remove those two underlying risks.

Don’t get me wrong, as I have written about before, I am a heeeuge proponent of the DOGE spending reduction effort, and even limited tariffs as a negotiation tool (not to be used long term, I am a free trade kinda guy). But the marketing/messaging has been erratic and not helpful. Unless that is their intent to further negotiations? Could be. Not what I would do but a plausible strategy.

This man recommends a refocus on risk, and IMO that is federal deficits/debt and interest rates (keep reading). The Administration should also address the American people directly and clearly so we get what the hell we are trying to do here. What’s the end state? You don’t need to give away your tactics, just tell us where you are taking us on this bumpy bus ride. We’ll go along if we understand. Otherwise, we will see much market volatility and perhaps an inadvertent recession, evoked by consumer pessimism.

Negative sentiment can become a self-fulling prophecy, especially when the news media and doomers on Twitter, Facebook, TikTok…. are using their mini-phones to influence perceptions.

Volatility is an expression of uncertainty about the future.

The market is definitely feeling uncertain.

The real issue: our spending and inflation debacle

How did we get here? It's a long story, and fortunately, I’ve already written it :). You can read all about it for background here: previous article. But, if you are not that patient (I don’t blame you); in short, the government likes to spend its way out of recessions instead of taking its medicine, setting us up for future, deeper recessions and inflation. It’s a toxic cycle.

This Administration, to their credit and despite my past criticism, is trying to get US deficits under control. And that, combined with an aggressive posture in foreign policy and trade, has spooked markets / investors / media talking heads / small businesses / my mom …. It can all be a bit overwhelming, admittedly.

And again, their communication sucks more than a couple on the edge of divorce.

Sentiment and the wealth effect matter to markets (as I wrote about last week). We need to get out of this pessimistic economic sentiment funk.

Why getting spending under control is so important

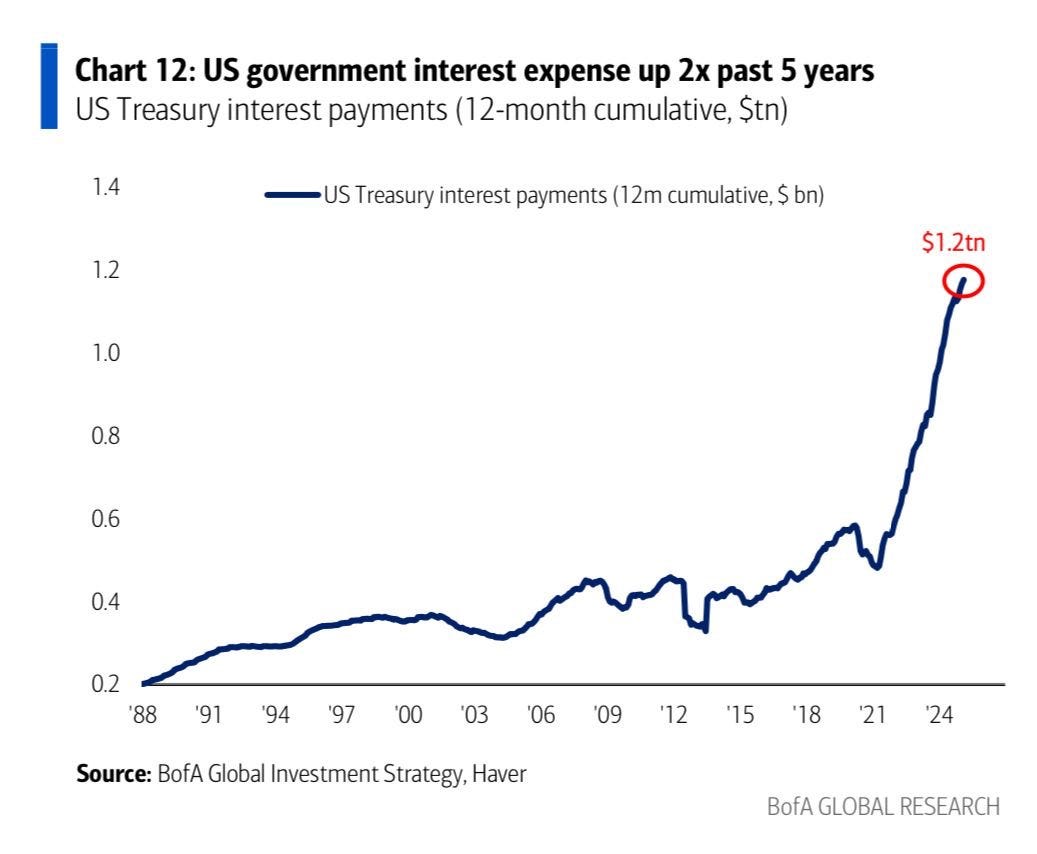

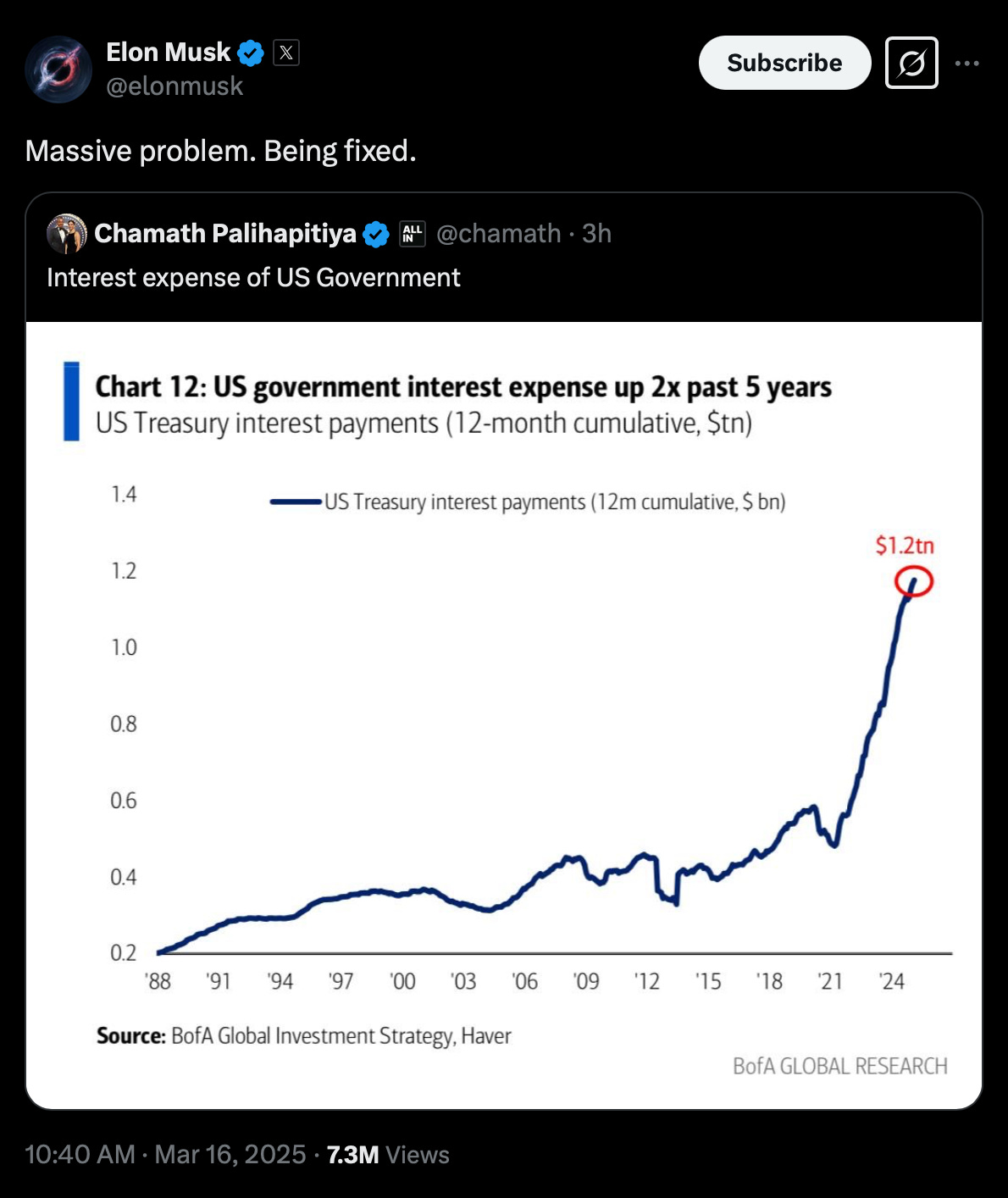

Did you know?… Just the interest on our $36 trillion debt is now costing $1.2 trillion PER YEAR?

AH!

This makes the interest on the debt the 3rd largest federal spending item, behind just Social Security and Medicare, recently eclipsing defense and health care spending, and is taking the inside corner on a path to race past Medicare.

AH AH!

And look who just noticed this, literally as I was looking it up and pasting this chart in my newsletter (wild coincidence!).

Mr DOGE himself.

The debt is growing / accelerating. Why?

When I say “out of control” I mean it.

Become a Premium Subscriber to read the rest.

Become a paying subscriber to get access to this post and other subscriber-only content, like one-on-one calls with yours truly.

Upgrade for Just $5 Today!Subscription Benefits:

- Premium Content

- Market Insights

- One-on-One Call with me!