Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

The Weekly 3 in News:

Redfin is laying off 450 employees from its rental division, this, after agreeing to a $100 million deal making Zillow the exclusive provider of multifamily rental listings on Redfin (NewsWire).

Women are buying more homes. In 1985, 75% of first-time buyers were married; that share is just 50% today. Single women first-time buyers grew from 11% in 1985 to 24% in 2024. In the most recent data, single men rose from 9% in 1985 to 11% in 2024 (NAR).

Nashville hotel industry is expanding rapidly, 2nd only to New York City in its growth. The Music City is set to add 2,849 hotel rooms (current total is 58,959), according todata. Over the last decade, Nashville has grown its hotel room supply by 52%, opening 20,000 rooms. Of the 2,849 rooms set to open this year, most fall in the upper-scale classes. Nashville has been growing luxury offerings with the openings of hotels like the Four Seasons Hotel Nashville, SoHo House Nashville and 1 Hotel Nashville and restaurants like Craig’s, Sushi Bar, Joe Muer Seafood, Harper’s and more (CoStar).

Today’s Interest Rate: 7.02%

(👇.03% from this time last week, 30-yr mortgage)

Today, we’re talkin’ Fannie Mae and Freddie Mac, the mortgage giants still under government conservatorship 17 years later. In the coming months, they may be released from their government overlords. There are a lot of thorny issues associated with this transition back to independence. We get into it all.

A quick programming note, weekly articles may be a titch shorter going forward (but not today :). Frankly, business is booming and it’s hard to keep up, which is a great problem to have of course. It takes many hours to research and write this piece each week, so I need to tighten up these pieces. I’ll be getting some help soon to expand content, and give more timely analysis, especially for you paid subs (nudge nudge :). So don’t fret, there will still be many rants, asides, and long-form pieces on emerging topics that really grind my gears.

Send us deals and get paid - If you have a multifamily property/deal of any size, we are buyers! And we always pay commission to anyone sending us deals. Shoot me a note or simply reply to this email if you have something and let’s talk turkey.

Follow me on the artist formally known as Twitter @andreasmueller, for daily market insights and whatever sage thoughts are darting around in my noggin. This is going to be the secondary content conduit. (* Sidebar, does everyone hate the word “content,” or just me? We aren’t opening a box from Amazon. I need a better/new word. Send me your ideas @andreasmueller. ** Sidebar for the sidebar: why the hell do we say price “point” so often in sales? It’s redundant. It’s just price. And if you want to infer an approximation, “price range” is a more flexible term.)

But I digress… (see, I’ve got ♾️ rants still in the jar ;)….

Let’s get into it.

Fannie and Freddie: What are they?

First, a super quick refresher.

Fannie Mae (the Federal National Mortgage Association) and Freddie Mac (the Federal Home Loan Mortgage Corporation) are two government-sponsored enterprises (GSEs), established in 1938 and 1970, respectively. GSEs are entities established but not operated or owned by the Federal government to (oftentimes) enhance credit availability, in sectors that have some sort of public good connection like agriculture or housing. GSEs, once established, operate as private corporations, with shareholders, and are sometimes even listed on stock exchanges. Fannie Mac is a publically traded company, ticker FNMA (more later).

These GSE’s were created to to promote homeownership by providing liquidity to the secondary mortgage market.

These are GIANT housing players, and this is hard to understate. For example: Fannie Mae backs 25% of all single-family mortgage loans, including 1.4 million in 2024 alone and 21% of outstanding multifamily apartment mortgage debt (Fannie).

What do Fannie and Freddie even do?

Mortgage rates tend to fall as the supply of funds in the mortgage market increases, making homeownership more affordable. So, put simply, Fannie and Freddie facilitate financing/liquidity to this market, focusing predominately on single-family mortgages and multifamily construction. For it’s part, Fannie Mae historically has focused more on purchasing mortgages from larger financial institutions, while Freddie Mac was originally designed to support smaller/regional/thrift institutions. However, this distinction has completely blurred over time. Even their mortgage products and target audiences have morphed to be both strategically and technically similar

Here you can compare Fannie and Freddie. But I’ll save you the click. If you drew a vendiagram, they would be largely overlapping.

What is Conservatorship?

In 2008, the Great Financial Crisis (GFC) smashed these two but good. And because they were so intertwined in our ecoomy, they needed a bailout. However, their failure was much their doing. They were totally overlevered, undercapatilaized, and were taking risks like a large hedge fund.

Taxpayers to the rescue.

So Congress passed, and President Bush signed (wow, kinda forgot about Bush until now), the Housing and Economic Recovery Act of 2008 (HERA), which established a new agency (we love creating new federal agencies in this country): the Federal Housing Finance Agency, giving it authority to place regulated entities into conservatorship or receivership. This is what they did with Fannie and Freddie.

Side Note: I was working as a staffer in Congress at the time, what a wild year. We thought the sky and the heavens were falling. Truth is we didn’t yet know how bad the crisis was and how finaical markets had been allowed to run amok. It was chaotic.

Conservatorship allowed these entities to conserve their assets in order to preserve their solvency and ultimately stabilize the housing finance market. FNMA took total control over these entities. As stated on their gov website: “FHFA is responsible for the overall management of Fannie Mae and Freddie Mac and has informed the Enterprises which decision-making functions should be performed by the Enterprises' boards of directors and/or management teams. The boards and management teams must consult with FHFA and obtain conservator approval as FHFA directs. Overall, the conservator has ultimate authority over all operations of the Enterprises.”

In exchange, the US Treasury injected up to $200 billion each in capital and owns stock (technically warrants and senior preferred) in FHFA, upwards of 80% of it. And, since 2012, after FHFA was back on its feet, the Treasury has been paid an ongoing dividend on the earnings of FHFA. ie the government / taxpayers are making money on Fannie and Freddie, for bailing them out (more on this later).

Afraid of secondary effects, both Fannie and Freddie remain in conservatorship today.

What specifically did they do wrong?

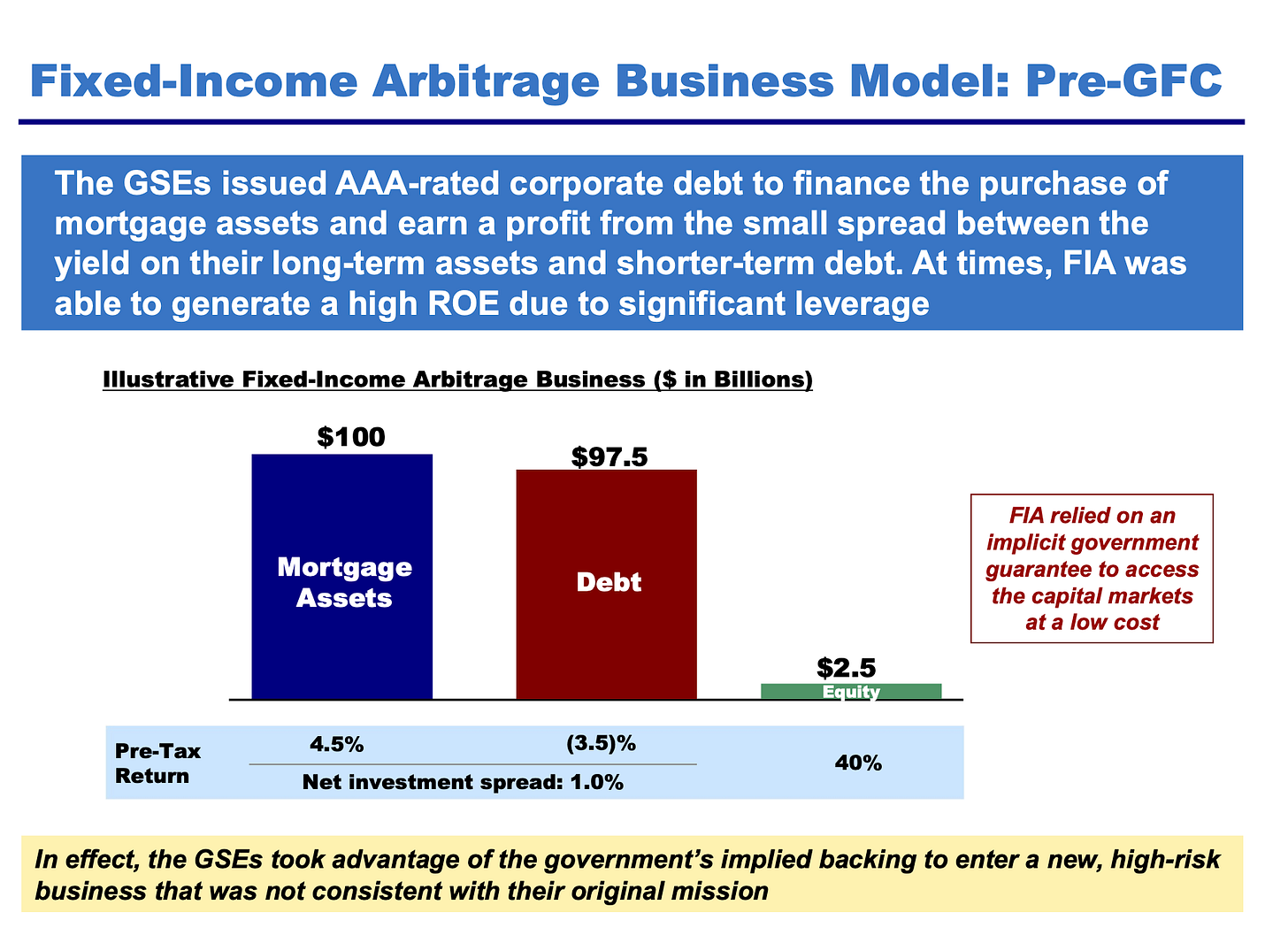

According to Warren Buffet, Fannie and Freddie really failed because of high-leverage risk-taking in the fixed income arbitrage space, saying:

“The portfolios are what really got them into the trouble…the managements of Freddie and Fannie tried to juice up the earnings, basically, because the insurance guaranteed that they were given that mortgage. I always thought that made a lot of sense. But the portfolio operations enabled both of those entities to use, in effect, government-related borrowing costs and sort of unlimited credit, to set up the biggest hedge fund in the world...So the portfolios are poison. They aren’t really needed to carry out the function of Freddie and Fannie.” - Warren Buffett, 9/8/2008

Fannie and Freddie no longer do fixed-income arbitrage, as it served no credible purpose for the mortgage market. IMO: It looks like regulators were asleep at the wheel here, just like they were concering the big banks and derivative providers like AIG.

Whew, ok background done…. (yes some of this is oversimplified, hold the comments keyboard warriors).

Is it time to end the government conservatorship?

Just the other day, incoming Treasury Secretary Scott Bessant was asked about ending conservatorship, saying “[concerning a Fannie and Freddie release,] …anything that is done around a safe and sound release is going to hinge on the effect of long-term mortgage rates.” In other words, the government is concerned about an immediate affect on mortgage rates, because rates are so high today, and will be cautious in their approach.

What could happen to financial markets?

So what’s the big deal? They have been operating effectively since ~2012, so why take the government's thumb off the scale?

Could a return to independence help lower mortgage rates, or have other positive effects?

Yes! There are some potential material benefits to GSE independence. But…

If you haven’t noticed, we have been in a bit of a precarious situation these last few years. Interest/mortgage rates are at historical highs, crashing new home construction and existing home sales to the lowest level in 30 years. And while the government wants to be rid of responsibility for Fannie and Freddie, they have to be careful. Ending conservatorship would have significant implications for the mortgage finance system, broader financial markets, and economy writ large.

I should have gotten into government mortgage buying….

But I digress….

The gold standard of business news

Morning Brew is transforming the way working professionals consume business news.

They skip the jargon and lengthy stories, and instead serve up the news impacting your life and career with a hint of wit and humor. This way, you’ll actually enjoy reading the news—and the information sticks.

Best part? Morning Brew’s newsletter is completely free. Sign up in just 10 seconds and if you realize that you prefer long, dense, and boring business news—you can always go back to it.

Key conservatorship issues to consider

Any plan to exit Fannie and Freddie’s conservatorship should promote market liquidity, and thus, access to mortgage credit. Treasury, HUD, and market participants/investors will have to carefully navigate many thorny issues, including:

Increased Market Competition: Fannie and Freddie will compete more aggressively for mortgage business, which will lead to innovation but also potentially higher risk-taking. Adequate capital requirements and clear guardrails should be implemented to mitigate risk. Much of this has already been done, as a result of Dodd-Frank and other landmark laws following the GFC.

Portfolio Caps: Fannie and Freddie’s tight lending portfolio caps will likely be removed. But, if overly onerous capital requirements and regulatory restrictions are put into place, this would likely limit efficiency gains from independence, which is the whole point. They should also be subject to federal stress testing.

Mortgage Rates and Government Support: If Fannie Mae and Freddie Mac were to operate without explicit government support, mortgage rates might increase due to higher perceived risk. Therefore, implicit government backing, as they did in 2008, may need to be part of their return to independence, albeit it with limitations to prevent moral hazard risk. We also should be prepared for temporary bond market volatility in the short term, as the GSEs reenter the market. This is natural. To minimize this government must be fully transparent, and not surprise the market.

Liquidity: These entities are a colossal source of liquidity for the mortgage market. Their exit from conservatorship must be clearly telegraphed to avoid liquidity issues. This is extremely important.

What’s the difference between me and you? Fannie and Freddie have molded themselves into a uni-blob. Returning to independence should reestablish differentiation and creativity between Fannie and Freddie. For example: Treasury may want to incentivize Freddie to refocus on regional, small lending products to reinvigorate smaller homebuilders/developers. New home and existing home renovation/construction in the pipeline has fallen off a cliff, especially in the current high interest environment. An independent Fannie and Freddie has the power to incentivize/create lending products necessary to boost the future housing stock.

Taxpayer benefit: Exiting conservatorship will be a significant revenue event for taxpayers, providing the US Treasury with more than $300 billion, for their ownership interest.

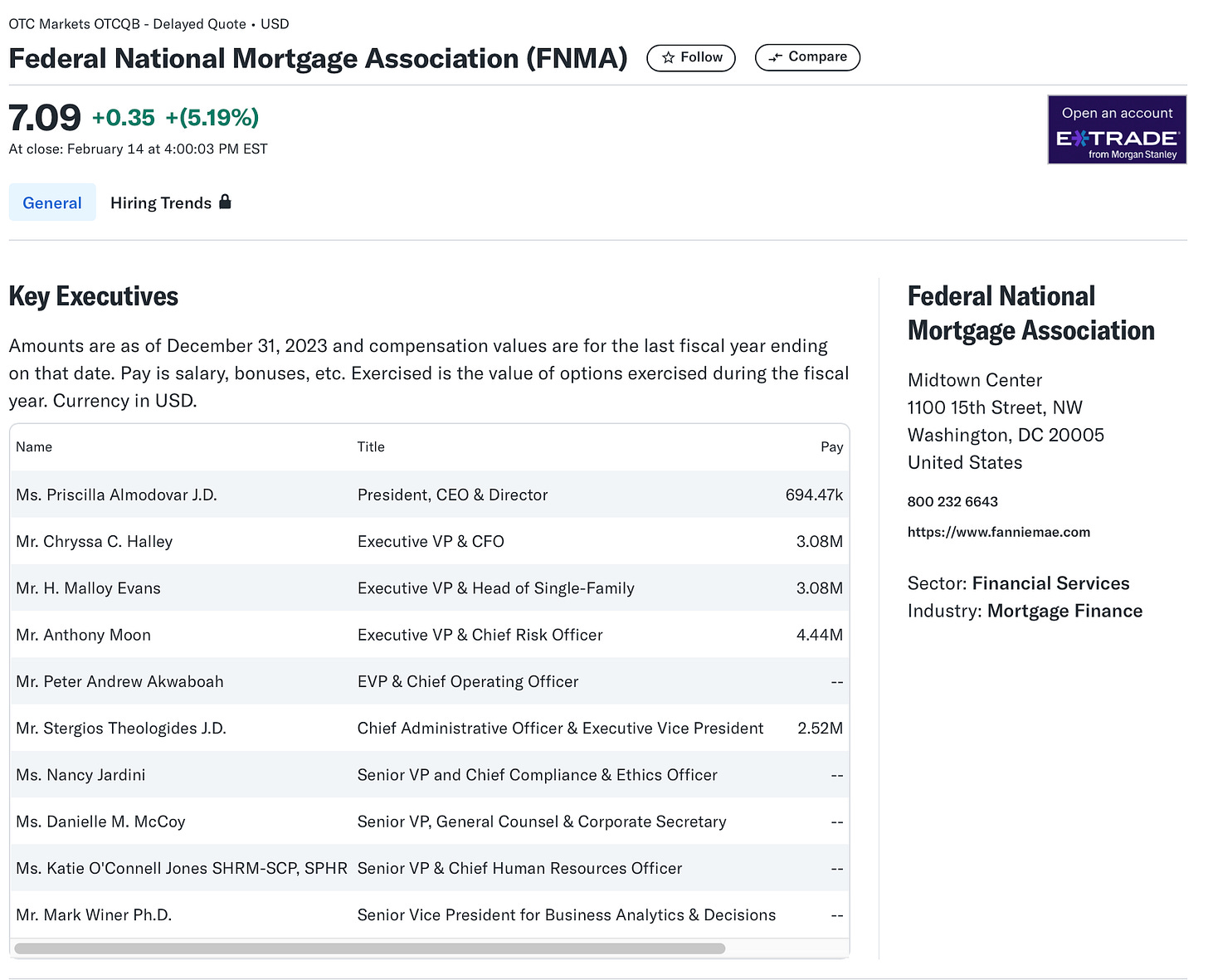

FNMA is still publicly-traded

Remember, the FNMA stock still trades today. And on the news of potentially ending conservatorship, it has gone gangbusters. Up 433% since the election. Chart on:

Think that’s a bid number? Well hold my beer.

What the hell is up with the salaries over there?! They are still in government conservatorship but folks are making wild money. For example:

Executive VP, Mr. Anthony Moon is making $4.4 million / year.

President, David Benson $4.5 million

Executive VP, Chryssa Halley, $3 million

My Skeptical Take:

The conservatorship of Fannie Mae and Freddie Mac represents a unique intervention. The federal government took control to prevent collapse, manage through crisis (and their mismanagement), and potentially reform these institutions for improved stability in the U.S. housing market.

Government “owned” Fannie and Freddie have successfully provided liquidity to the US mortgage and multifamily construction market for more than 15 years. So as we transition out of conservatorship we obviously need careful planning to mitigate disruptions.

That being said, we have to end it, private markets can do a better job. IMO. Ending conservatorship presents an opportunity to improve market liquidity, access to mortgage credit and, perhaps most importantly, boost home and apartment construction.

Investor Bill Ackman has a fantastic in-depth presentation on why we should end the conservatorship, which is a must-watch. But if you don’t have time, in summary, he argues that Fannie and Freddie took excessive risk to juice profits, which had nothing to do with supporting the mortgage market. This was the single reason for their failure and could have been prevented, even during the GFC. Unfortunately, many financial institution were doing the same, and regulators were asleep at the wheel.

Ackman’s key objectives for ending conservatorship are:

Maintain the availability / affordability of the 30-year, fixed-rate,

prepayable mortgage.

Protect taxpayers from bearing the cost of a housing downturn.

Minimize government involvement in the housing finance system.

Maximize probability of successful private capital raise.

Maximize taxpayers’ profits on Treasury’s investment in the GSEs.

Ackman’s key steps to ending conservatorship are:

Set appropriate capital requirements.

Limit government-granted benefits.

Develop market-based compensation and governance policies.

Clarify the nature of ongoing government backstop (implicit and/or explicit).

When could this happen?

We have time, likely 12-24 months, IMO. Ending conservatorship may be a lower priority endeavor for the Administration, but they want to do it. As I wrote about last week, lowering mortgage rates via the bond market are their priority. That and continuing the current tax cuts. I think they wait until rates are lower to end conservatorship so they aren’t potentially blamed just in case ending it has a temporary affect on long-term interest rates.

BUT, the time to START acting is likely now. Which may bring some market volatility, and us Skeptical Investors should be aware.

Why?

Unemployment remains near record lows.

GDP growth trending at approximately 3%.

National home prices have surpassed the 2006 peak.

Major stock market indices at or near all-time highs.

Housing construction, supply and existing home sales are all at recessionary levels.

In other words, things are good. The economy is functioning well. This is often the best time to take action.

HUD Secretary Scott Turner will function as the “quarterback” of this effort (apropos as he played in the NFL). He has said publicly that he plans to act. And it’s important to know that ending conservatorship was set to happen earlier, but was upended by COVID. On October 28, 2019, FHFA announced a strategic plan to prepare Fannie and Freddie for their eventual exit from conservatorship. And FHFA is currently drafting a recommended approach to the termination of the conservatorship, for Treasury review, which they began before this Administration took power.

A return to independence for Fannie and Freddie could promote a healthier mortgage market and lower costs for consumers.

Just be aware of the potential ramifications and market volatility.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. Want to protect yourself from inflation? Buy a rental property; buy real estate. Don’t know how to get in or where to start? Give us a call! We got you.

Subscribe Today! (and get some amazing perks)

Paid subscribers get the best stuff! Join the Skeptical Investor Community to access:

Premium content and NO paywall,

Every article we have published - a treasure trove of information and education,

Conversations with other investors in the Skeptical Investor community, and future meetups and special events,

Key insights and predictions on the latest financial news,

PLUS, subscriptions include an annual one-on-one call with me personally. So make sure to take advantage! Subscribe today.

Just $5 bucks a month.👇

We have passed 10,000 subs! Thank you for your support, next stop, 20,000!

Please help grow the community!

It takes me several hours to write this weekly article, and they will always remain free (but you get some pretty cool perks with premium, including a one-on-one with yours truly :). All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you think I was going to send you a Starbucks gift card? 😅

Ready to Start Investing in Real Estate?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great real estate deals, as well as manage their rental properties, here in Nashville, TN. We pride ourselves on being tough negotiators. We want our clients to get an amazing deal, we never let our clients pay retail.

If you are looking for an investment property, give us a call today!

You can also find out more about us and what we offer on our website: www.NashvilleInvestorAgent.com

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. We have the lowest unemployment rate of the top 25 major cities and folks are moving here to take those jobs. Nearly 90+ people per day move to Nashville. And tourism continues to hit record levels. This past year 16.8 million folks visited our lively city. Plus we have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, no state income tax… to name a few amazing advantages. Come check us out, the water is warm :).