Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

The Weekly 3 in News:

Housing Will ‘Unfreeze’ in Weeks and 2% Inflation Will Return. "The housing market is stuck now, but I would expect that the housing market, sometime in the next few weeks, is going to unfreeze…it is Trump’s economy in 6-12 months -Treasury Secretary Scott Bessent (Bloomberg)."

Active housing inventory for sale is rising on a year-over-year basis in all 50 states. Time for investors to dive in. (Resiclub).

Housing Hotspots for 2025, according to the National Association of Realtors. Hint: they missed a few, but a good list (NAR).

Today’s Interest Rate: 6.74%

(👇.13% from this time last week, 30-yr mortgage)

Today, we’re talkin’ how to pick your market to invest in. Tampa or Seattle? Austin or Nashville? Charleston or Denver? Growth market vs cash flow? It’s all about the market metrics.

First a quick look at the rent growth vs supply scare.

Let’s get into it.

In General…Growth is Good

Choosing the right city is critical because it directly impacts the success and profitability of your investment. Cities vary widely in terms of economic growth, population trends, job markets, and housing demand—all of which influence property values and rental income potential. A well-chosen city to invest in can offer strong appreciation, consistent cash flow, and lower risk, while a poorly chosen one might leave you with stagnant properties or high vacancies.

Now many folks just think about cash flow and rent growth when selecting a market. This is no doubt important. But, it’s not everything and the data can be misleading.

* A quick break for a real estate request! *

Need a property manager? - Don’t let just anyone manage your property baby. Reach out to Nashville Investor Agent. Their experienced team knows how to handle all property management needs. How? Because they are investors too. No hidden fees, just simple flat-rate pricing. Get a free on-site quote today.

Ok, back to business.

Rent growth is a key metric BUT the data can be skewed

Before we get into our main topic: growth markets vs cash flow markets (its a fun one:) I want to address the current hullabaloo of rent growth/losses as it relates to supply, which has been much “doomered” in the news.

Folks I talk to often focus too much on rent growth as a key metric, but beware… it's nuanced.

Now don’t get me wrong. Renovating a slumlord’s scary 4-plex into something habitable ain’t cheap (I’ve done it many times). An investor needs to generate a return for spending the money and taking the risk to turn that place into a something a tenant would love to live in. So over time they need to be able to raise the rents to keep up with the market and cover their insurance, property tax, repair, maintenance, vacancy, landscaping etc…costs (all of which have been inflating markedly).

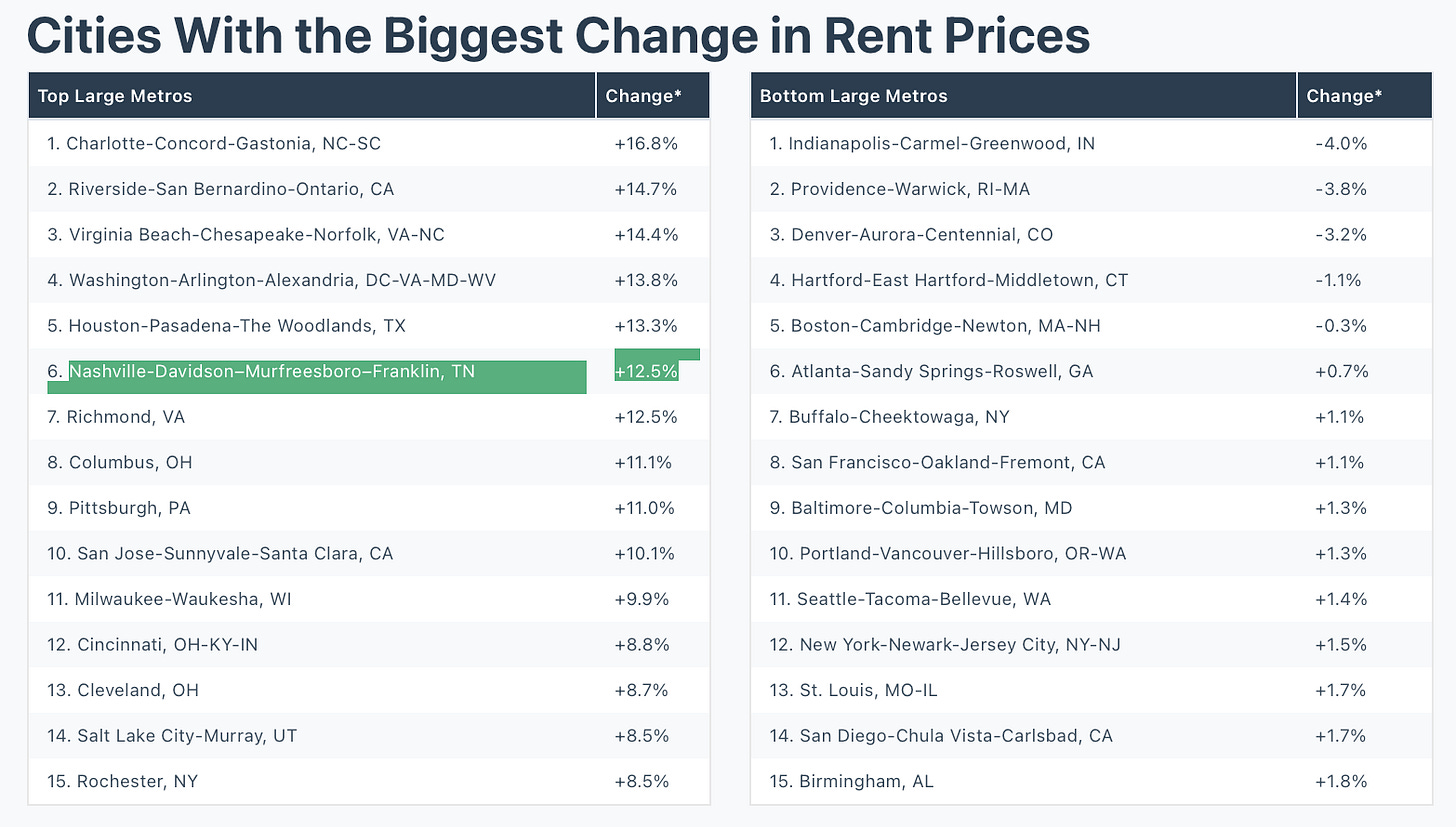

And yes, certain markets are growing rents faster than others, but watch out!

If you only look at rent growth and cash flow, you are likely missing the forrest for the trees.

Why?

Supply. If housing supply is growing in a city it will suppress (or even depress) rent growth. But housing supply growth is a good sign. It is a key signal of a city’s population and economic growth.

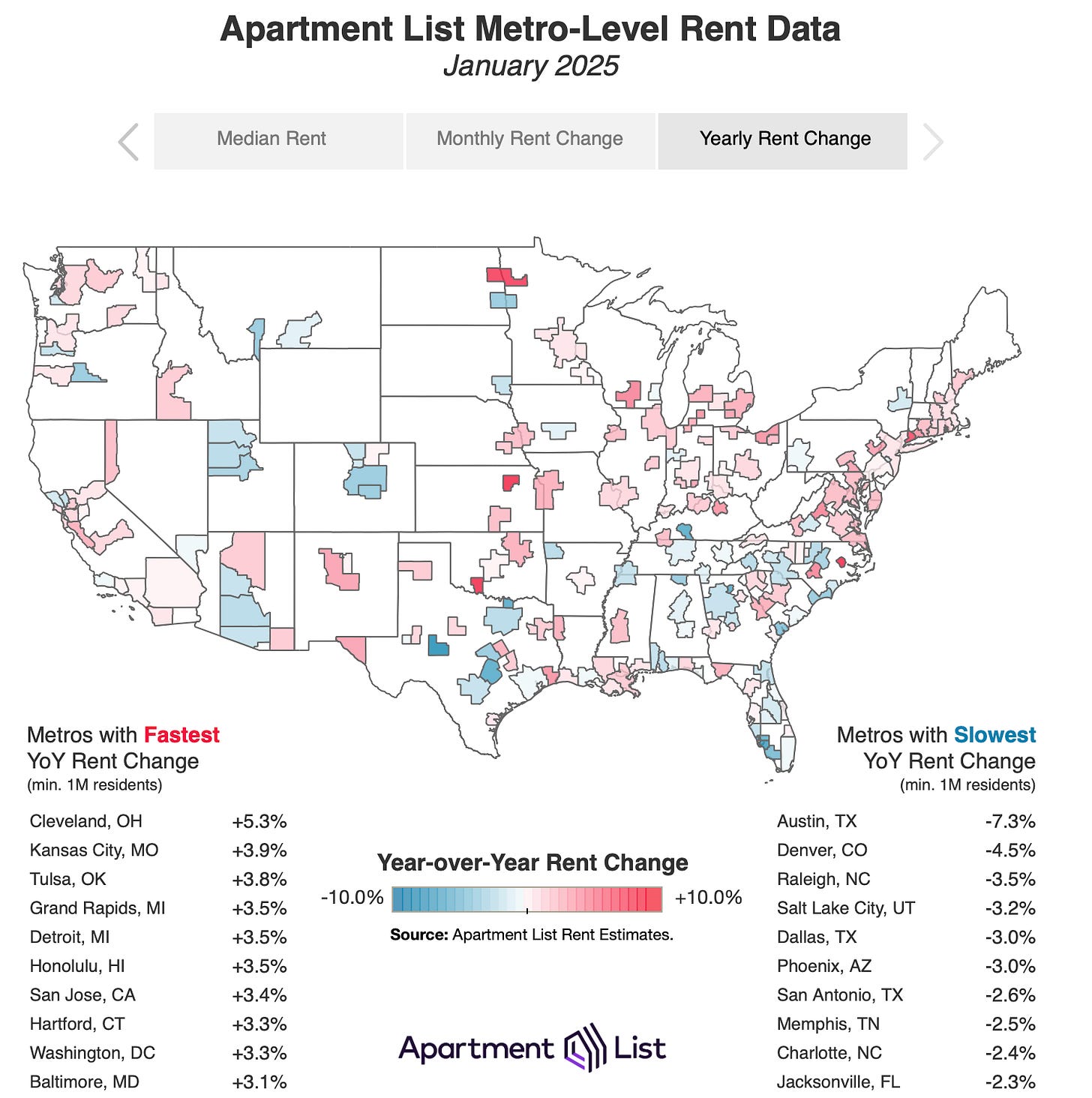

For example: Austin is a solid city to invest in. But recently it experienced significant housing supply surge, particularly apartment unit growth, causing rents to come back to earth. This is great for housing affordability, and a strong sign of a healthy market. We can’t have housing prices double and rents up in kind.

But if you looked only at the YoY rent metrics it would send you into a panic! Rents are down? AHHHHH.

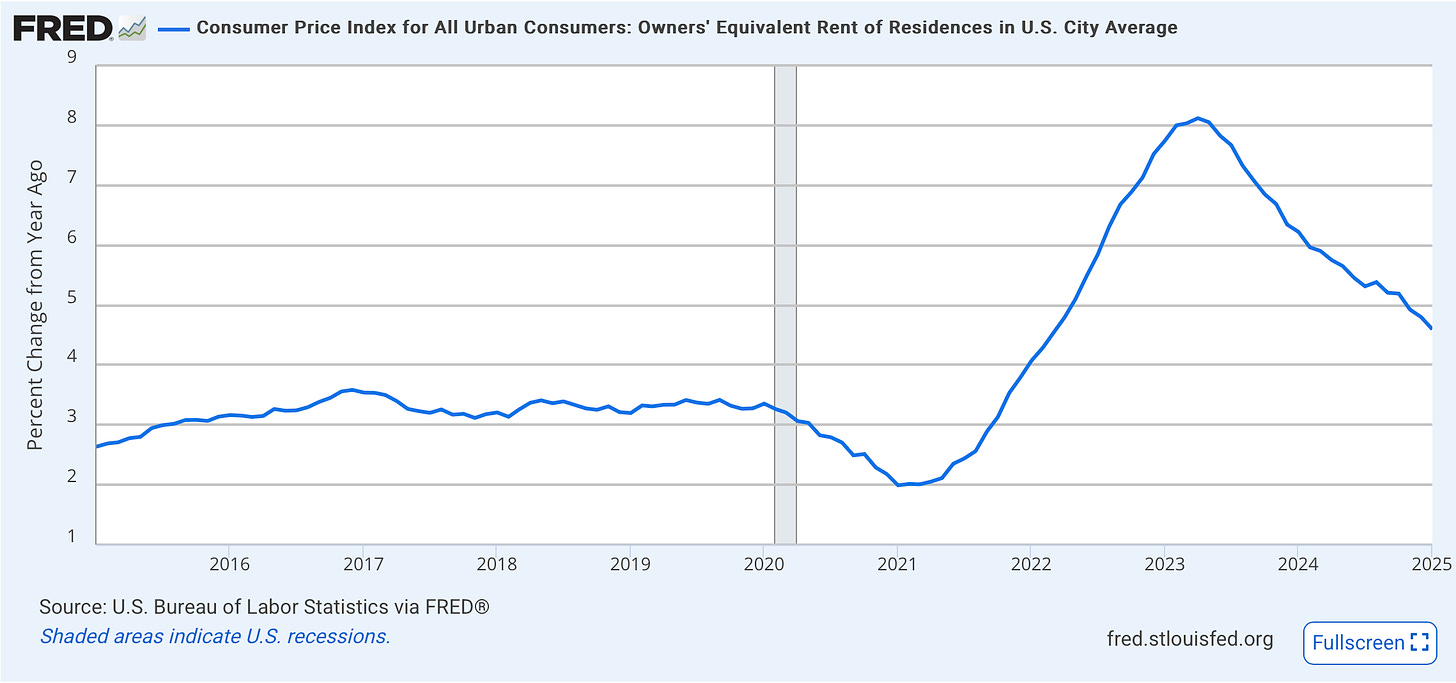

First off, in general, nationwide, rent growth hit 8% YoY 2 years ago. That was not sustainable and had to come down. Some markets built more than others so they went down faster (Austin).

And rent growth is still elevated at ~4%, 33% higher than the historical average (although wage growth is still higher than rent growth, barely).

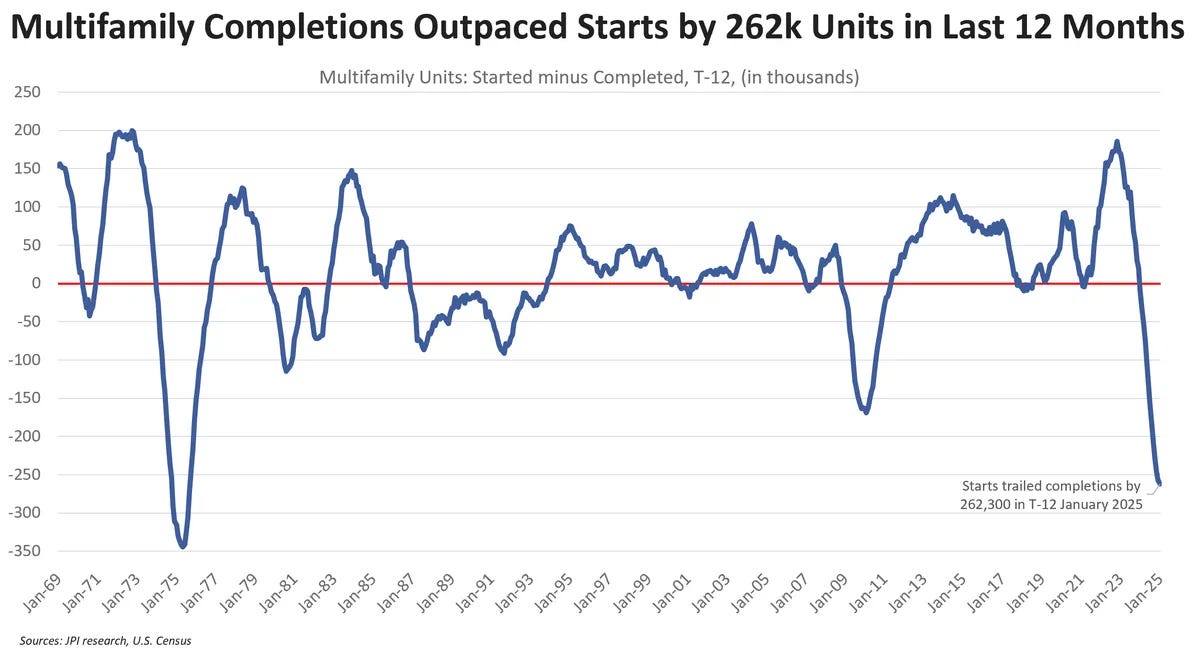

This is… dare I say…. transitory. And something very important is about to happen to housing supply.

The supply of available housing units will soon fall off a cliff.

Why?

Apartment completions are at a record high today, but apartment starts are at a record low.

Why?

4 years ago we had ~0% interest rates followed buy 2+ years of wildly high interest rates.

Here is a snapshot of apartment rent growth data nationwide.

And detailed chart for apartment rent growth:

And single family home rent growth.

(source: Madera residential research via housing economist Jay Parsons)

High rent growth also trends to the smaller markets. So don’t be too swayed by those shinny objects. Smaller markets normally increase rents faster than large markets. And while these ternary markets can be wonderful investments, they are also likely higher risk, with fewer employers or a small number of large anchor employers, which if they left/closed, would crash the market. *cough* Detroit *cough*

Fun fact, Detroit just grew its population for the first time since 1957…wow.

So let’s look at some key metrics for picking your target real estate market.

Cut Through Noise with The Flyover!

One Email with ALL the News

Ditch the Mainstream Bias

Quick, informative news that cuts through noise.

Housing Market Metrics

In general, and in this humble (not really) investor’s opinion, there are two general market types. Growth markets and cash flow markets.

Well actually three: Uninvestable markets. Yuck.

I do not focus on cash flow markets, which we normally find in the midwest (but not always, no offense Indiana!). What is a cash flow market? You guessed it, cash flow/cash on cash return is higher (at least at first) than you will find in a growth market, maybe even double, say 12% vs 6%. The problem with these markets is, by our definition, the natural appreciation of the property is slower and the forced equity appreciation when we renovate/develop property has lower margins/returns, on average.

But this depends on your strategy and life needs. For example: if someone is 65, it may make more sense to buy for immediate cash flow, or even sell/exchange their growth market properties and plow that capital into cash flow markets.

Disclaimer: We are talking about averages and likelihood here these are broad categories. Of course you can get a deal anywhere that has one or the other or both. Hell you can get a deal that is all three! ☝️growth, ☝️cash flow and yet completely uninvestable (aka super ☝️risk: disaster prone, crime, next to your ex-wife… you get it).

“We should always be deal dependent,” as I like to tell clients. But in general I focus on growth markets to maximize my return across the 5 ways investors make money in real estate: natural appreciation, forced appreciation, depreciation, principle pay down and cash flow. Most of the wealth your property generates over time will not be from cash flow, especially in the beginning. It will be from the appreciation categories. And it’s not even close, in my opinion. *(I wrote a whole article on the 5 ways, if you are interested in further reading).

The cash flow value trap.

Growth markets actually bring higher cash flow/CoC returns, it just takes time.

Wait what?

Cash flow (and principle pay down) becomes very interesting over time as the property rent appreciation compounds. Cash flow is like a house plant. It starts out small. You have to nurture it. But over time, it grows. You raise rents. Yet, your long-term debt stays fixed (thank you America). Yes, property taxes and insurance (especially in some parts of the country, watch out) will tick up, but rent increases will cover those costs. So by investing in a growth market you don’t miss out on cash flow, it just comes later. And because you are in a growth market, you will be able to raise rents faster. So over time, even cash flow will likely be higher in the end.

So how should we measure housing markets?

Ok, now all that mumbo jumbo is out of the way, let’s get into it!

Again, this will somewhat depend on your preferences, risk appetite, age, family status and investment goals…BUT, I would argue there are a several foundational items the savvy real estate investor looking in a growth market should always include:

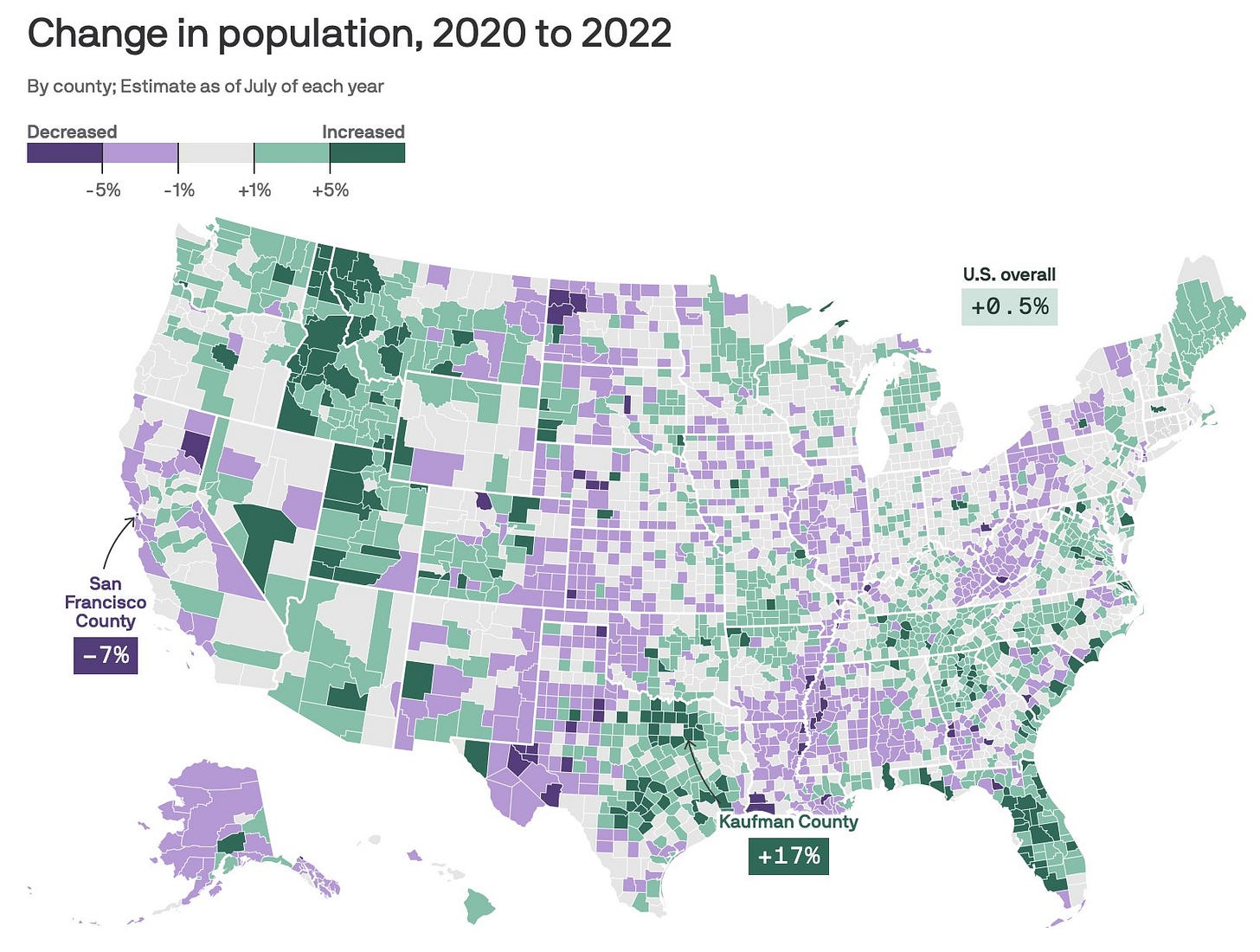

Population growth trending up. This, and the next metric, are the basic prerequisites for what makes a growth market and are what I focus on when I choose a market. Population growth directly impacts all the below metrics and is a primary signal for housing demand (see chart). At its center, that’s all real estate is. Buy in growth areas, were people not only want to live but are actively moving to. Investors should always track population trends and sell when you see this dip. Case in point: Two years ago I sold my last investment property in DC and redeployed to Nashville. I saw the downward trend happening. It ended up being one of the best financial moves I’ve made.

Buy Green

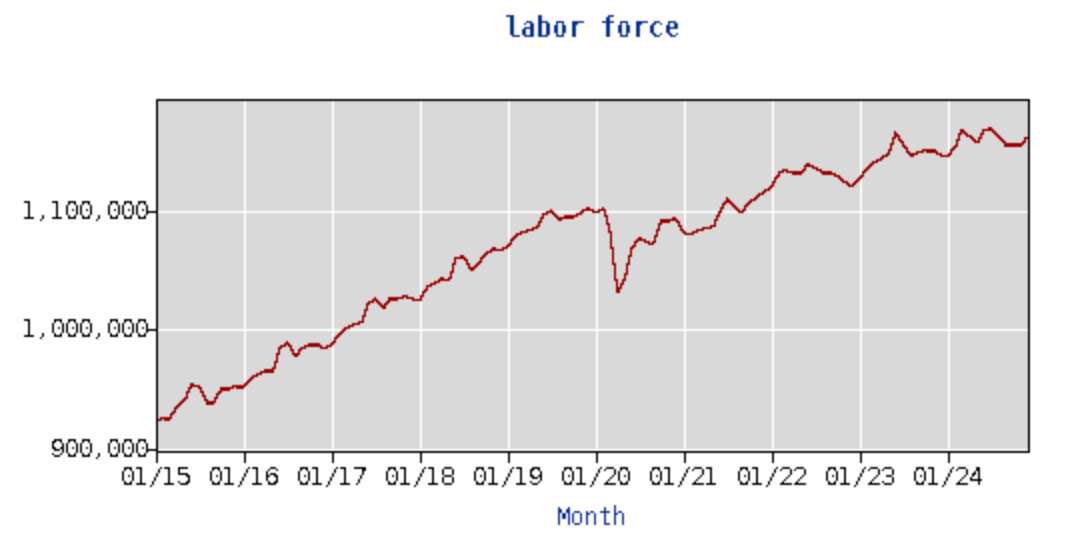

Civilian labor force. I want to see this trending up and to the right. A growing number of working folks in the arena is a key filter for me when selecting a metro. If this is decreasing (seasonally adjusted/non US recession), beware! (note: labor force is different than employment. Labor force = employed + unemployed but looking). Nashville chart below.

Nashville labor force 10-yr chart

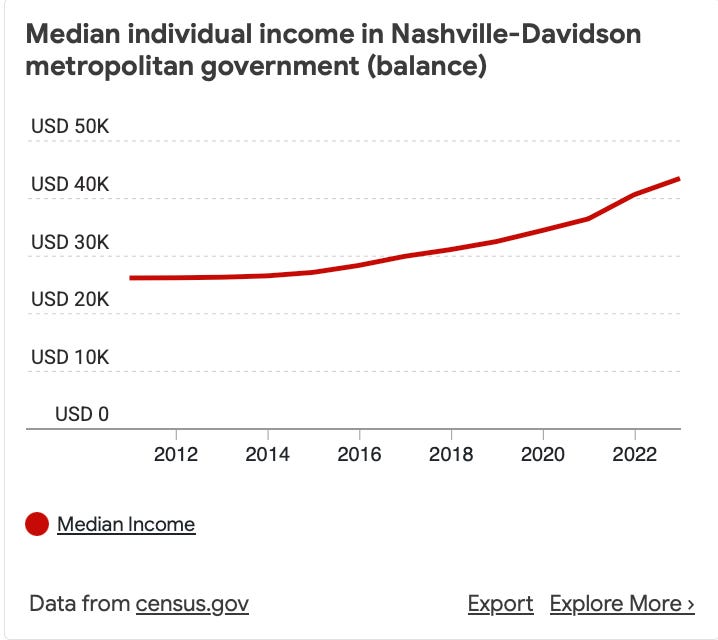

Individual income. A city with a growing individual income level is a big green flag for me. It signals a cycle that can supercharge investment returns.

Rising incomes = people have more purchasing power. That translates to higher demand for housing, whether it’s buying homes or renting apartments, which can drive up property values and rental rates. Growing income levels signal stability and opportunity. If folks are earning more, it’s likely tied to new businesses/industries moving in/expanding and is often correlated with infrastructure improvements, better schools, and overall quality-of-life upgrades—think parks, transit, and nightlife. These make the city a magnet for more residents, keeping your property in demand long-term. A stagnant or declining income level? That’s a black flag, and I’d steer clear. You want a market where the tide’s lifting all boats, not sinking the ship.

Nashville income growth

There are more I’m missing here. What else is important to you? Drop me a note.

Consider Becoming a Paid Subscriber!

Paid subscribers get the best stuff, including a one-on-one call with me personally. How much? Just $5 bucks/mo? LFG!

Economic Growth/Stability. This one is obvious and important. A city’s overall economic health ensures resilience during downturns, protecting your investment. A diverse economy and mix of businesses reduces reliance on a single industry or employer. Look for low unemployment, economic diversity, and a history of stability during recessions.

Home price and forced appreciation. In general, anything above 5% long-term is healthy growth, which is higher than the US Case-Shiller average. I look for this to be a long term trend of 10+ years. You can force this by renovating or developing your property. Renovated properties also naturally appreciate faster. And in growth markets you will get a higher return for adding value to the property. I like to set a baseline of a 50% return on my construction dollar when I renovate. For example: if I spend $50k on a renovation I need the property to appreciate at a minimum of $75k. I normally shoot for 100% return as my goal, or $100k appreciation, in this example. This is very hard to do at this level in a cash flow market. And I don’t know any other investment vehicle where you can get an almost guaranteed 50% return. How? Because you can calculate the return fairly accurately. You know the comparable property values to estimate your buy price, you have an estimate for construction and you know the comparable sold properties once removed in the area (After Repair Value, ARV). The difference is your forced equity appreciation (ARV- (purchase price+construction costs) = forced equity appreciation). *** Important note! Keeping construction costs down within your necessary scope of work is THE most important skill to hone as an investor/developer. This is where shit can go sideways fast.

Rental Yields. Again, rental yields are important. But not the most important. Cash flow is like a house plant. It starts out small. You have to nurture it. But over time, it grows. You raise rents. Yet, your long-term debt stays fixed (thank you 30-yr mortgage, only in America). I look for 3%+ as a baseline. But beware. Large supply influxes can skew the data (see above).

Insurance Problems? Is insurance expensive? Is actually obtaining insurance difficult? Are insurance agencies leaving the state? Insurance troubles can make a market uninvestable. Make sure you are baking your insurance costs in your analysis and weighing the risk of environmental catastrophe. This can affect everything from rentability to profitability to refinancing to long-term appreciation.

Infrastructure Development. Investments in transportation, schools, and public services enhance a city’s appeal, increasing property values and attracting residents. Look for planned / ongoing projects like new highways, transit systems, city development plans are a great resource.

Favorable regulatory environment. Is the state/city landlord friendly? This can make or break you as an investor-operator, and is another reason some markets are uninvestable. It’s like the city/state politicians think landlords are evil. I look for places that are firm but fair, like Tennessee. Additionally, favorable zoning laws and property taxes are of course important, particularly for developers, and can make larger projects much more attractive.

Quality of Life. Hell, dont forget this, do folks actually want to live there? Or are they there because they have to only to move to the burbs/another state in a few years *cough* Washington DC *cough*. Good schools, healthcare, low crime, recreational opportunities etc… attract residents, supporting property values.

My Skeptical Take:

As the great hip-hop group Wu-Tang once rapped about “Cash rules everything around me, CREAM get the money, dollar dollar bill y’all…”

True that.

But beware of the cash flow value trap.

Just like stock market investors buy blue chip and small-cap stocks, so do real estate investors, who buy in major metro markets and in smaller tertiary markets. In growth markets and in cash flow markets. On may be more volatile and one more stable. One focuses on long term growth and one on shorter term higher returns. The choice is yours really, and is based on your risk appetite and investment goals. IF you decide to go into something higher risk, perhaps consider diversifying so you don’t get caught naked when the tide goes out.

Monitor your investments everyone. Especially if you have a property manager telling you everything is roses. You may still be getting that same rental check but how is the asset doing? Are there any emerging local trends that may cause concern? How can you asset manage the property better? For example: It may make sense to build a deck or landscape the backyard to keep top-quality residents and / or increase rents. In a high mortgage interest rate environment reinvesting in your current properties may make more sense than buying another property. I’m doing this now for my portfolio and our property management clients.

Do you think there is a problem in a market you are already invested in? Is growth slowing or can you get a higher return on equity in another property? Should you redeploy?

Look at the metrics above. Run the numbers, double check that every dollar you have is still a little worker bee making you the highest return on equity, even when you’re sleeping. A great book on this is “Real Estate by the Numbers: A Complete Reference Guide to Deal Analysis,” by J Scott and Dave Meyer. Highly recommend.

But sometimes, success in real estate is not a hard science. It’s a soft skill, where how you behave is more important than what you know. If your numbers look good don’t panic unless there is reason to. In 2009 I had a few properties that I had to drop rents and a few I was just under construction on. But I didn’t flinch. I didn’t sell out at the bottom. I wasn’t over-leveraged. As I know from much experience, pretty much without exception, that you can always tell an ultimately good investor from a bad one by this simple test:

Equanimity. Or as the Finnish people say, sisu!

I love the Nashville market. Am I biased? Totally. But for good reason. It checks all the above boxes. And I’m putting my money where my mouth is.

Labor force growth? check. GDP growth? Housing price growth? Check. Check. Rent growth? Check. Tourist destination? 18 million visited last year. Check. Super fun? Check.

Do I like smaller/tertiary markets?

In general, I personally stick with the larger metros that are experiencing population, labor force and economic growth. My home market of Nashville is fantastic. It has the lowest unemployment of ANY of the top 25 major cities, strong employment growth, robust GDP, and decent rents.

However, there are some notable exceptions where I may take additional risk and I feel I have asymmetrical knowledge, like some tertiary markets around where I live and have personal experience with. But there, I go higher risk barbell approach. I look for really really small cities that are in some way easily connected or a result of the outgrowth to larger anchor metro areas. For instance, I love Madison and Ashland City, two tiny towns in the Nashville metro. Ashland City’s population is only 5500, and is 30 min from Nashville.

It’s all about aligning the city’s characteristics with your investment goals—whether you’re chasing cash flow, appreciation, or a flip. Research the above market metrics. Pick wrong, and you’re fighting an uphill battle; pick right, and the market does half the work for you.

Never lose money. That’s rule number 1.

Rule number 2?

See rule number 1.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. Want to protect yourself from inflation? Buy a rental property; buy real estate. Don’t know how to get in or where to start? Give us a call! We got you.

Subscribe Today! (and get some amazing perks)

Paid subscribers get the best stuff! Join the Skeptical Investor Community to access:

Premium content and NO paywall,

Every article we have published - a treasure trove of information and education,

Conversations with other investors in the Skeptical Investor community, and future meetups and special events,

Key insights and predictions on the latest financial news,

PLUS, subscriptions include an annual one-on-one call with me personally. So make sure to take advantage! Subscribe today.

Just $5 bucks a month.👇

We have passed 10,000 subs! Thank you for your support, next stop, 20,000!

Please help grow the community!

It takes me several hours to write this weekly article, and they will always remain free (but you get some pretty cool perks with premium, including a one-on-one with yours truly :). All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you think I was going to send you a Starbucks gift card? 😅

Ready to Start Investing in Real Estate?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great real estate deals, as well as manage their rental properties, here in Nashville, TN. We pride ourselves on being tough negotiators. We want our clients to get an amazing deal, we never let our clients pay retail.

If you are looking for an investment property, give us a call today!

You can also find out more about us and what we offer on our website: www.NashvilleInvestorAgent.com

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. We have the lowest unemployment rate of the top 25 major cities and folks are moving here to take those jobs. Nearly 90+ people per day move to Nashville. And tourism continues to hit record levels. This past year 16.8 million folks visited our lively city. Plus we have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, no state income tax… to name a few amazing advantages. Come check us out, the water is warm :).