Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

Let Me Tell You A Story.

The Herd.

My Skeptical Take.

We have a new newsletter partner! The Rundown AI. Feel like you are falling behind on what’s happening in AI? Never fear, the Rundown AI is here 🙂

Stay up-to-date with AI

The Rundown is the most trusted AI newsletter in the world, with 1,000,000+ readers and exclusive interviews with AI leaders like Mark Zuckerberg, Demis Hassibis, Mustafa Suleyman, and more.

Their expert research team spends all day learning what’s new in AI and talking with industry experts, then distills the most important developments into one free email every morning.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

The Weekly 3: News, Data and Education to Keep You Informed

Denver Legalizes ADUs citywide. How many will choose to build: student homes, multigenerational, income producing rental, AirBNB… (Denverite)?

Barbara Corcoran: “Home prices will SOAR when Mortgage Rates DROP (Corcoran).”

Having a hard time making your numbers work for that investment property? How come you see investors online having no problem buying investments that cash flow and appreciate? Well, you may be missing something in your analysis! Running your numbers is a skill, and takes practice. I highly recommend Real Estate by the Numbers. It’s very readable and a fantastic guide (Scott/Meyer).

Today’s Interest Rate: 6.93%

(👇.15, from this time last week, 30-yr mortgage)

Let me tell you a story…

No not that kind of story! (sadly)

A spooky story… about markets and housing.

That’s more like it :)

It seems like everyone is making money in the markets. And when I say everyone, I mean everyone.

This weekend I was in an Uber, heading downtown to one of my favorite hole-in-the-wall spots to grab some Pho here in Nashville. I love me some good Pho, especially on a cold, drizzly, wintery evening (+ the restaurant’s extra extra hot pepper mix, the kind you need to ask them to get “from the back” and assure them that you really do want it Asian hot). MMM. And you have to find yourself a great place that comes correct with a brawny beef bone broth that ain’t watered down and goes light on the mirin. Some chefs add so much damn sweet mirin/sugar to their soup, trying to hide their weak broth that lacks depth, I suspect. If your local spot doesn’t braise their own bone broth, run! That’s not Pho.

Ok ok…back to the story.

In the Uber, the driver and I got to talking, as I like to do. I enjoy polling Uber drivers, waiters, receptionists…anyone roughly in the service industry about what they are seeing and experiencing, to try to get a helpful anecdote. I especially like querying them about what area of town they live, why, and for how long. Bonus points if you can get them to tell you their rent/home price.

What can I say, I can’t not talk about real estate, it’s a problem. I know.

The driver, Gary I think was his name, was up for a chat, to say the least. We chatted about all the above and the: up and coming neighborhoods, what developments he’s heard about, where tourists are going, who is coming to town for concerts etc… He prefers the East Nashville neck of the woods, which has a hipster/cool coffee shop/speakeasy kind of vibe here in the city. He’s a dad of 3, and does Uber on the side for extra cash.

After some chit chat, we had a few moments of silence. Classic country playing on the radio in the background. Some George Strait, if I remember correctly.

And then; It happened.

He asked me about Bitcoin.

To be fair, he was also interested in my thoughts on the stock market’s post-election run, and why real estate rates were still so high despite the Fed starting to cut their Fed Funds rate (for which I told him to subscribe to this newsletter :).

Now this, was an older fella. Not some young buck on the vanguard of new technology. He was looking to jump in on the seemingly easy returns. And I came to find out that he was contemplating selling almost all of his more conservative bond portfolio! And who could blame him for being nervous? Bonds have been like tap water lately: no fun, no taste, straight store-bought broth folks.

What I told him on crypto was this… I don’t give financial advice.

But I did leave him with this message: be careful and don’t reach. Ask yourself, what’s the worst that could happen? Do you have a plan when you feel the heat around the corner?

De Nero and Pacino in Heat

Now, to be upfront, I do personally own Bitcoin. It’s a decent, yet not significant, portion of my overall portfolio. It’s speculation, and I’m always speculating on something.

But Gary was not going to be speculating, he wanted to gamble. With a sizable chunk of change. He knew nothing about crypto technology, or financial markets, for that matter. But he didnt see it as gambling. He was excited, elated really, and thought crypto was something he had discovered. He wanted to tell me about it, he was trying to be helpful and give me what he perceived as the inside scoop. Perhaps, he thought he has some kind of edge because he overheard a few conversations about it in his car and didn’t realize he was blind to the potential irrational exuberance in today’s market. And he wanted to place a bet with a very significant % of his savings. He had FOMO.

This is not to say he could be right, even if accidentally. I myself am bullish on Bitcoin over the long term, so I want to be participating. And I’m not going to go into why or that I know better than Gary, or that I have more experience, education, horse sense etc…. because this is at its core open speculation. Further, nobody can time a market and if they tell you otherwise they are lying. So being right and being early can sometimes be the same thing, especially if you can’t wait it out.

My main point is this. In today’s market….

When you have Uber drivers asking your opinion on stocks and crypto, and is contemplating taking meaningful action…. it’s time to take notice. Be skeptical.

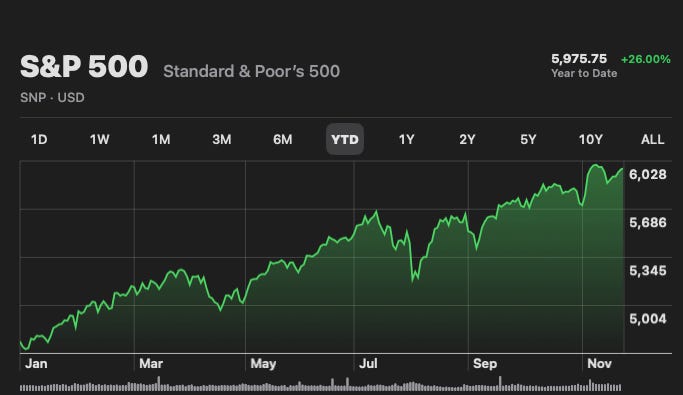

Today, markets are working, really working. The S&P 500 is up 5% this month alone, and 26% on the year. Many tech stocks are up double that. At the same time, the bond market is flashing red, the high-yield corporate bond yield spread is wider than the fixed rate mortgage spread, meaning investors see risk in businesses issuing the bonds and/or re-inflation eroding future returns. There is also talk that the incoming Administration will try to privative Fannie Mae and Freddie Mac, exposing investors to credit risk, which they don’t face now with the GSEs in government conservatorship (not that this is a bad thing/needs to happen eventually).

These concerns may contain mortgage rates in the dreaded “higher for longer” threshold. And it is conceivable that rates could go up from here.

My Skeptical Take:

But it’s hard, hard, hard to not just throw caution to the wind and YOLO. You could lever up on out of the money call options and potentially change your life.

Or you could go to zero.

Is a market correction in the making? I don’t know; and full disclosure I’m still fully invested in this equity bull market (with hedges).

The problem is, nobody knows when the music will stop. Could be months could be another 2 years. Calculated depressions do not happen. Nor do foretold booms. In 2023 most everyone on Wall Street was certain a recession was forthcoming. What happened? We had a record year.

Today, my skeptical ears are more perked than they have been.

And, a note. Being skeptical is more valuable in avoiding errors, than in definitive forecasting. When times are good ask yourself what could go really wrong? And when times are bad ask yourself, what could go really well? Watch out for herd mentality. The “crowd” is influenced by the heart, not by the mind.

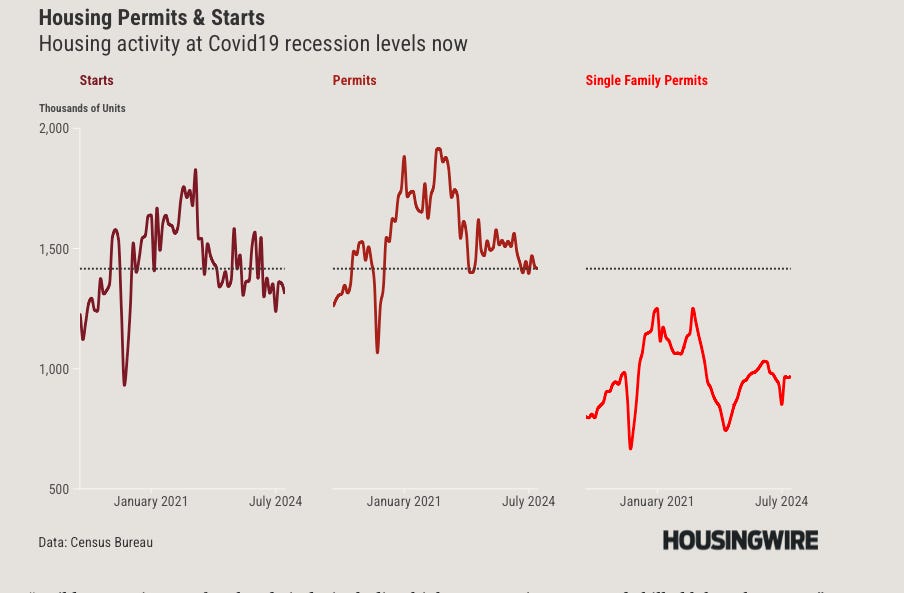

Real estate markets are being left somewhat ignored, driven by continued high interest rates, steadily higher prices and the slower winter season. Home sales are in year 3 of record low transaction numbers, yet new housing starts and permits are at recessionary levels. We don’t have enough housing in the pipeline to supply future demand. I see rent inflation in our future.

So, today, the heard is running together and all is jubilant. It seems equity investors bought the election.

Will they sell the inauguration?

I’m not going to tell you what to do. Be cautious out there. Protect your downside.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

We have passed 10,000 subs! Please help grow the community!

It takes hours to write this weekly article, and they will always remain free. All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you think I was going to send you a Starbucks gift card? 😅

Ready to Start Investing in Real Estate?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great deals, as well as manage their real estate portfolio, here in Nashville, TN. If you are looking for an investment property, give us a call today!

For all the information on who we are and what we offer, visit our real estate website www.NashvilleInvestorAgent.com or setup a call today!

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. 90+ people per day move here and last year 16.8 million folks visited our lively city. We have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, and no state income tax, to name a few amazing perks.

* I’m just a guy. I write this myself. Apologize in advance for the likely errata.

** The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and do not constitute financial advice.