Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

Fresh Real Estate and Economic Data

Apartment Construction Starting a Multi-Year Decline

Home Handcuffs

☝️Supply = 👇Rents

My Skeptical Take

We have a new newsletter partner! The Rundown AI. Feel like you are falling behind on what’s happening in AI? Never fear, the Rundown AI is here 🙂

Stay up-to-date with AI

The Rundown is the most trusted AI newsletter in the world, with 1,000,000+ readers and exclusive interviews with AI leaders like Mark Zuckerberg, Demis Hassibis, Mustafa Suleyman, and more.

Their expert research team spends all day learning what’s new in AI and talking with industry experts, then distills the most important developments into one free email every morning.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

The Weekly 3: News, Data and Education to Keep You Informed

Roughly 75% of U.S. residents who earn less than $50,000 struggle to afford their mortgage or rent. Both rental and home-sale costs have skyrocketed over the last five years (RedFin).

Americans are spending big on cars and gadgets, and going into debt to do it (Fortune).

Too Much Wine? A global decline in wine consumption is creating problems for vineyards: there are too many grapes, and there’s too much wine. This includes young Americans, who are not boozing like we used to. Grapes are entering over-supply (Axios).

Today’s Interest Rate: 7.08%

(👆.16, from this time last week, 30-yr mortgage)

Housing Handcuffs

Ok, today I’m breaking records!….I mean we’re record breaking…No that’s not it... Oh, I got it, I’m a broken record!

** How do all of these mean different things? Idiom-laden English is wild.

But I digress…

The theme today is we need more more more housing, at the risk of being a broken record (nailed it 😁). We need more units: more single family, apartments, in-law suites, duplexes, beach bungalows, luxury condos, backyard lean-to’s, tipis, ….. bring it all.

Housing supply will soon experience a historically sheer drop; project completions are peaking at the same time new apartment permits are starting a multi-year decline. This is a major problem for housing supply, affordability and prices over the next 3+ years. We examine this issue below.

Plus, there is lots of new data to unpack from just the last few days. We look at inflation, crypto, stock market, consumer spending, energy and several other data points that influence the real estate market. And, we have a few post-election anecdotes on the consumer and wild hot sentiment for markets. Are we overheating? Is the economy doing well? How’s consumer confidence?

Let’s get into it.

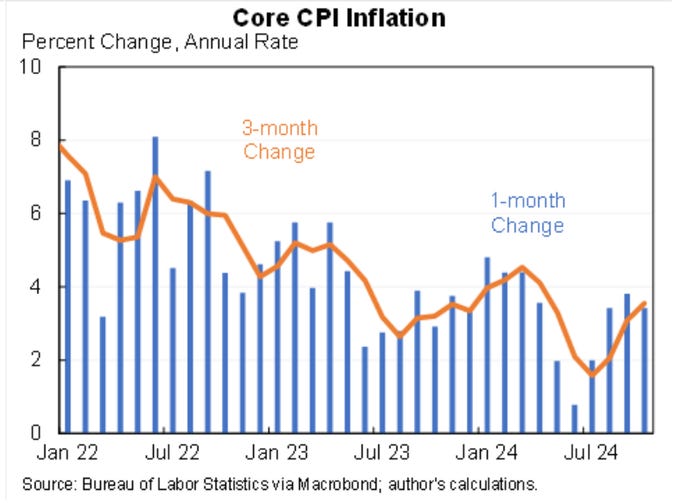

Inflation Up, But Was As Expected

New core consumer prices (CPI) are out, and they came in higher, as expected. Why? Well, we may be seeing the start of re-inflation (as we warned last week). Heck, inflation probably never really went away, it’s just been slowing slowly for 2 years. In all, Core CPI YoY was up 3.3%. Expected, but still not postitive.

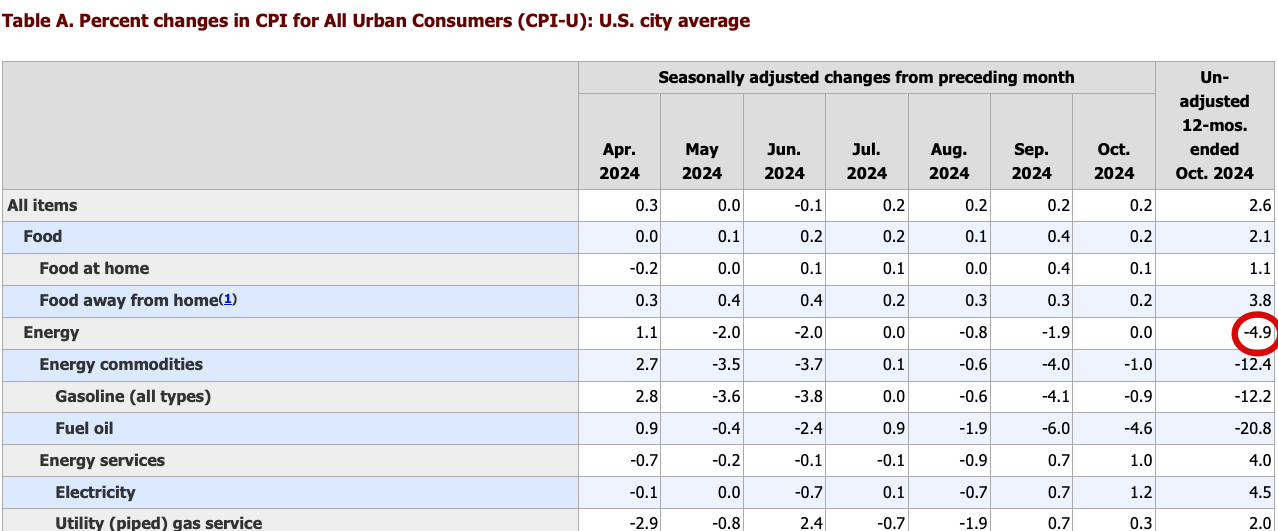

Energy is the Bright Spot

Energy costs were down 4.9% YoY, which y’all may be seeing at the pump these days. I know I am, just filled up for $2.61 here in Nashville.

One reason is oil production. The US is pumping significantly more oil than even Saudi Arabia. 50% more actually!

Fun fact, who is our largest oil buyer? The Netherlands!...followed by South Korea, then China, Canada and the UK.

Who knew?

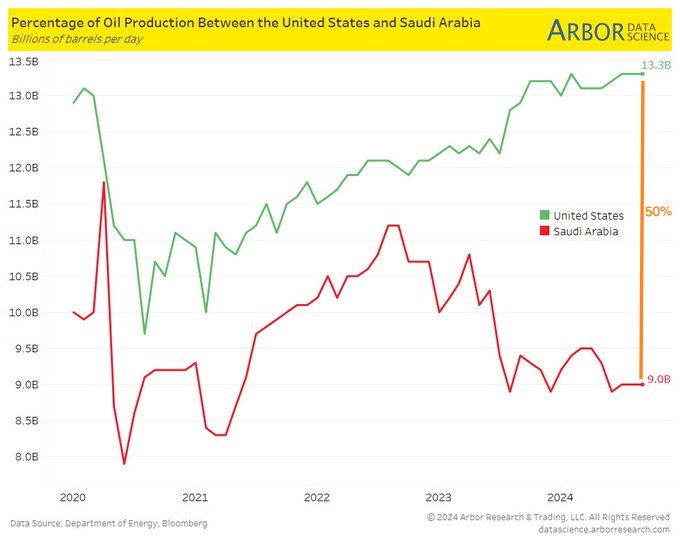

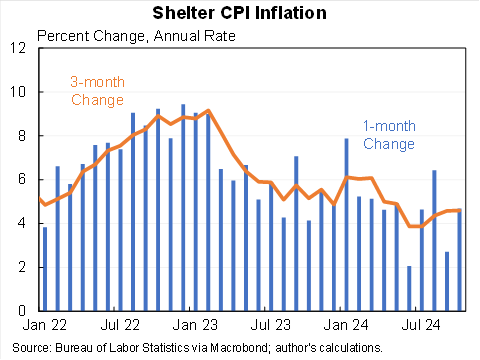

Housing Inflation is Still the Problem

However, as has been the case, there is one primary problem child. And that remains housing, up .4%. In fact. housing accounted for 50%+ of the monthly total inflation increase. If I were a betting man, which I am, I would posit that new rents have been up and are now starting to really hit BLS’ overall/lagging rent data. Michael Oliver would be proud (bonus points if you get that 90’s reference. Hint: 👹😂).

But .4% shelter inflation is not the real bad news…

Housing Starts Fall off a Cliff in 2026 = Inflation Spike

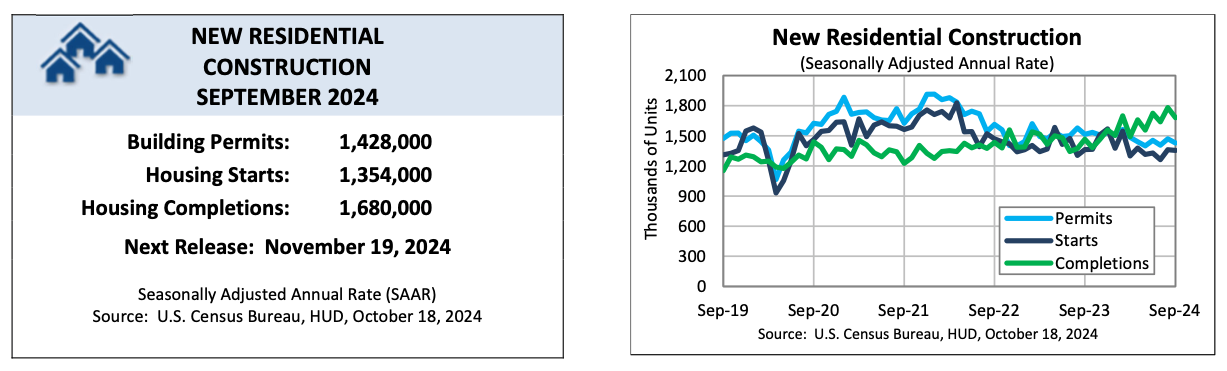

To review, today we have shelter inflation, which remains stubborn despite a record number of units that have come on the market in the last couple years, and on into next year.

But, after 2025, we have a major problem.

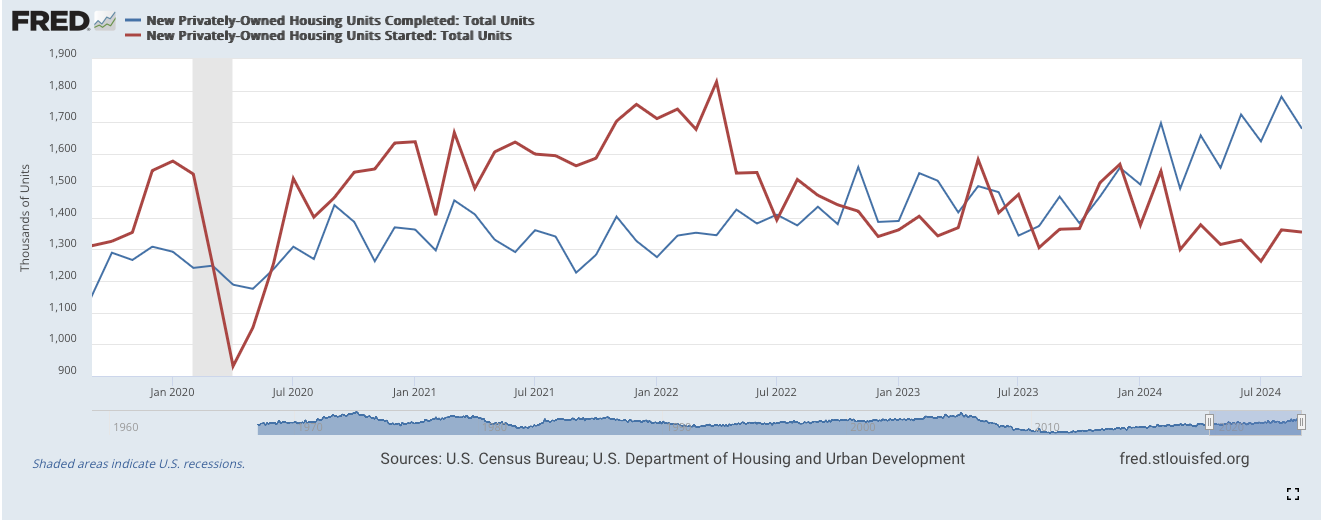

Residential construction is lagging completions, and this divergence is/has accelerated.

We are not starting enough new housing projects (no not those kinds of projects) to maintain the housing stock we have, undersupplied as it may be, let alone grow supply.

This separation between starts and completions is obvious in hindsight. Two+ years of higher costs, as well as regulation complexity, are disincentives to building. The relatively healthy number of housing completions today was the result of 0% ZERP interest rates in 2020-21.

That hasn’t been the case for the last 2+ years, and like an expecting mom in month 6, it’s showing.

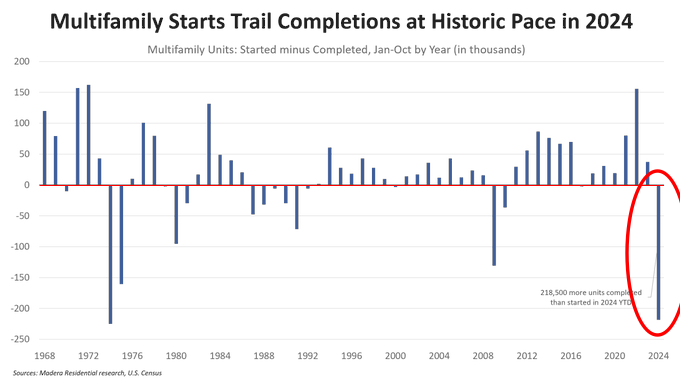

Multifamily completions are getting crushed. Construction starts are the lowest in 12 years. So far in 2024, completions are outpacing starts by 218,500, a historically large deficit.

Think that’s bad? Without a replenishment in starts, 2026 will be a disaster. We will have a significantly reduced housing unit stock.

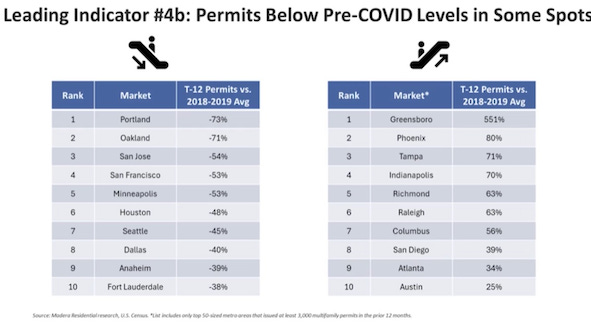

What Cities Should be Most Concerned?

The timing for this forthcoming dearth of supply is nuanced. New apartment building permits are down in most places, but some cities are experiencing this now, and some are still in their higher supply phase. It may be 6-12 months until their supply falls off a cliff. On the left is the former and on the right, the latter.

Multifamily Developer Sentiment is back to 2023 Lows

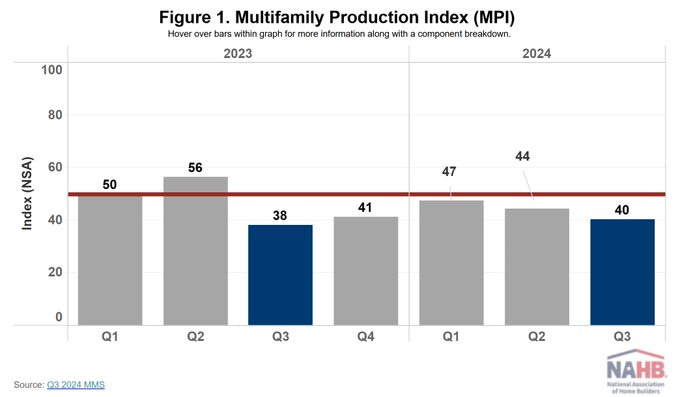

Apartment developers still see the environment for new development as risky. The NAHB Multifamily Production Index came in negative again this month, back to the sentiment lows of a year ago. In a statement, the NAHB said, "While demand for rental apartments remains strong enough to support relatively high occupancy rates in existing projects, multifamily builders and developers continue to face many significant obstacles on new projects such as higher construction costs, the cost and access to financing, and the availability of land and regulations."

According to a large apartment builder: "Regulatory pressures are driving up costs more than any other factor" in construction. He cites: energy codes, architectural features, mixed-use requirements, disagreements b/w city planners & inspectors etc…(Parsons).

No Bueno.

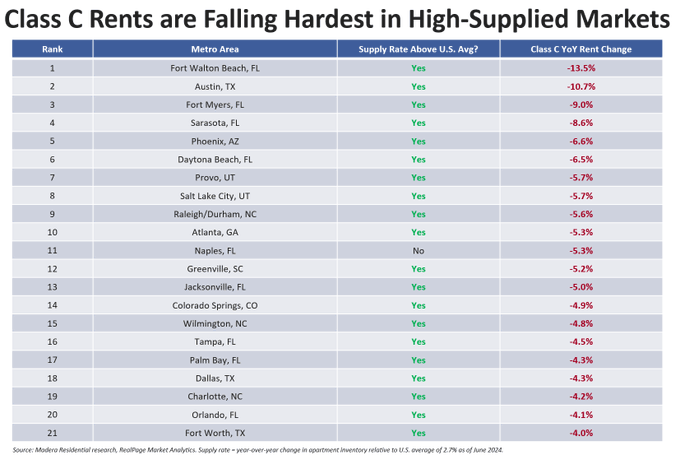

☝️Supply = 👇Rents

Let’s Remember when you build a lot of apartments, market-rate rents fall. This is true even when you construct luxury apartments. In fact, the most affordable apartments’ (Class C) prices plummet even when you build more expensive units. In 29 metros across the US, 26 saw Class C rents fall > 3.5% when new apartment supply exceeded the U.S. average (Parsons).

So when critics say: "We don't need more luxury apartments!"

“Yes, you do. Because when you build "luxury" apartments at scale, you put downward pressure on rents at all price points.” Apartment starts are trailing completions at a historic rate, dating back to 1968 (Parsons).

I couldn’t agree more.

I predict that rents in Q2 2025 will begin a robust 3+ year price escalation far above average, absent major housing supply increases and a material increase in new construction permits.

Strap in.

My Skeptical Take:

The 2 main things I’ve learned about markets in my investing career are: market effects are highly sensitive to changes in the perception of where economic growth and interest rates are headed.

Right now, the perseption in both is exuberant, approaching the jubilation of 2021.

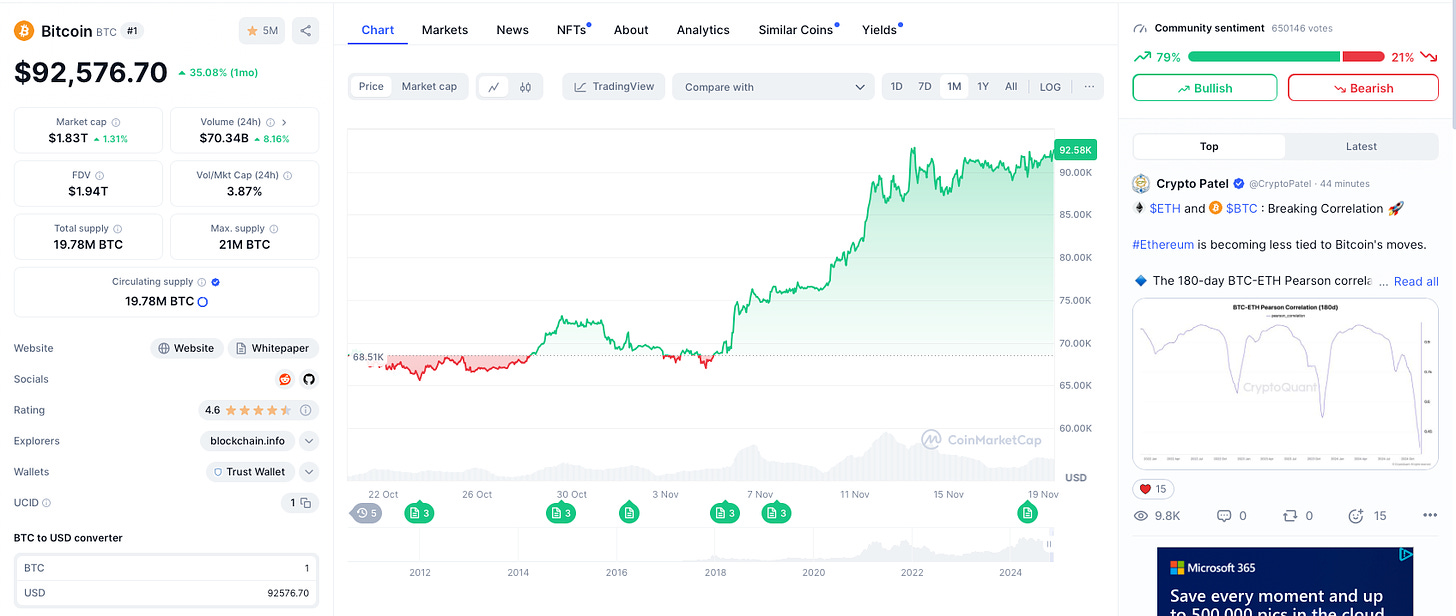

We see this in the stock and crypto markets. Bitcoin is on a tear.

This elation could contribute to (or perhaps may be a symptom of) existing re-inflation concerns, of which the bond market is warning. So much so that Former Treasury Secretary Larry Summers just said this:

“My own judgement is that the Fed and markets are still underestimating the overheating risk. I ask myself: Why is cutting rates a priority into that environment?”

Summers is likely concerned that the Fed could be repeating their 2021 error in response to rising inflation, cutting rates too late and insisting price increases were “transitory” when, in hindsight, inflation was roaring. “I am fearful that the Fed is going to be more like once burned, twice burned, rather than once burned, twice shy, on inflationary risks,” he continued.

On interest rates: CME Fed Watch has the chance of a Fed Rate cut in December at 62.1%. My intuition still tells me they pause in December (no cut), in the face of a hot Core CPI and strong labor market. I agree with Summers that they should not cut. The 10-yr treasury is at 4.375 today, the market sees a re-inflation risk.

Counterpoint: I would not be surprised if they do cut. Sentiment out there is dovish, investors and consumers think interest rates are coming down soon, despite the bond market saying otherwise. Did I mention the feeling of jubilation in the stock market? Again, markets move on perception, and as they say, ‘things are good.’

We could also just be amidst the last mile problem. Inflation could be kicked (heck we were above 9%!) but getting tosub-2.5%-3% could just be a very slow structural process down, with some bumps along the way. After all, ex-shelter, inflation is right about at the Fed’s 2% target….

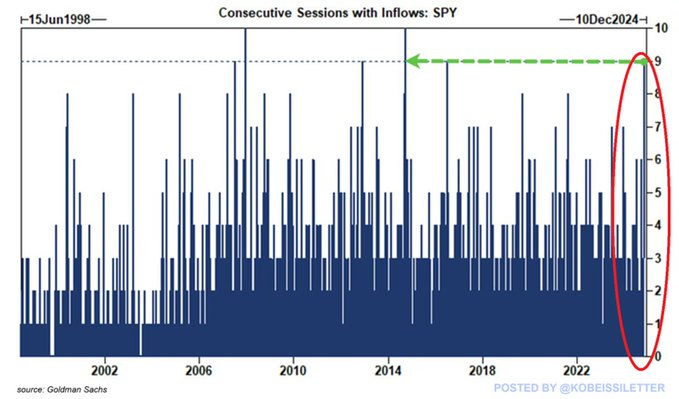

In closing, the sentiment of institutional and retail investors is hot right now, and folks are feeling rich from the recent stock and cypto market rally. Concerns exist, so remain vigilant. One short-term anecdote: the S&P 500 ETF just saw 9 consecutive days of money inflows, the longest streak since 2014. Investors have poured $18 billion into $SPY over these 9 days as post-election buying continues (Kobeissi).

Things are good. Now may be the time to take some money off the table and buy assets, especially if inflation re-ignites.

My asset of choice is Real Estate.

What’s yours?

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

We have passed 2500 subs! Please help grow the community!

It takes hours to write this weekly article, and they will always remain free. All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you think I was going to send you a Starbucks gift card? 😅

Ready to Start Investing in Real Estate?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great deals, as well as manage their real estate portfolio, here in Nashville, TN. If you are looking for an investment property, give us a call today!

For all the information on who we are and what we offer, visit our real estate website www.NashvilleInvestorAgent.com or setup a call today!

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. 90+ people per day move here and last year 16.8 million folks visited our lively city. We have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, and no state income tax, to name a few amazing perks.

* I write this myself and get it out for you all on the same day. Apologize in advance for the likely errata. Don’t have a team of editors, yet.

** The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and do not constitute financial advice.