Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

Interest Rates are Threatening Even Higher

It’s Inflation Stupid: Federal Debt Matters

None and Done? The Fed be Done Cutting Rates for the Year

My Skeptical Take

We have a new newsletter partner! Are you a realtor? Looking for real estate agent-focused learning? Check out Coffee With Closers. It’s one of my favorites and is full of success case studies and top tips for growing your business.

The Weekly 3: News, Data and Education to Keep You Informed

Six major US metros have seen YoY home price declines. New Orleans (-4%), Austin (-4%), San Antonio (-2.7%), Tampa (-.5%), Jacksonville (-.3%) and Dallas (-.3%) (Nixon).

The US government now spends just as much on interest payments as it does on defense expenses. The latter defends our country, the former destroys it (Pomp).

Home Affordability is Difficult, and it’s Not Getting any Better. To return to pre-2020 housing affordability 1) incomes would have to spike 60%, or 2) home prices would have to fall 38%. Neither seems likely (Lambert).

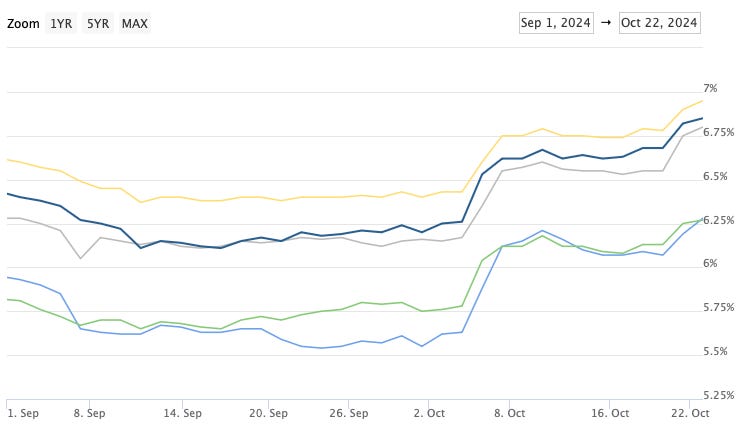

Today’s Interest Rate: 6.85%

(☝️.23, from this time last week, 30-yr mortgage)

Interest Rates are Threatening Even Higher

Well, what a difference 30 days makes.

The Fed cut interest rates by a larger than expected .5%, and after a few days of celebration (yay!), the market is now calling their bluff (boooo!).

Specifically, the bond market. It does not believe we are out of the recession/inflation woods yet.

So, it has grabbed the wheel and turned this car around, like a frustrated dad with 5 kids on the way to the amusement park!

Mortgage rates, which track the 10yr Treasury bond, have reacted in kind, up .73% from their September lows, following the Fed rate cut.

Mortgage Rates Sept-Oct, 2024

Why?

Investors have sold off Treasuries over resurgent inflation concerns and reckless fiscal spending (also inflationary). If you are a bond/debt investor, you hate inflation because it erodes your interest rate earnings.

The Fed Can’t Repair the Housing Market

As a reminder, the Fed does not control mortgage rates.

Mortgages are predominantly influenced by the market demand for 10yr Treasury bonds, not the Federal Reserve's adjustments to its short-term Fed-Funds rate (that’s actually what they do when they “cut interest rates.” The 10yr Treasury and 30yr mortgage are competing assets investors buy in the marketplace, expecting a return for their expected risk. If investors expect higher risk to the economy, they buy 10-yr Treasuries. If the future seems less risky, they buy 30-yr mortgages. Investors also sell Treasuries if they see inflation on the horizon, which would erode their returns (yes yes, this is all oversimplified, hold your comments angry-web).

The Housing market is a difficult issue, with many moving parts. The two primary drivers for a healthy market are the supply of homes and the cost of debt to purchase those homes. So, the Fed can’t unilaterally repair the housing market, but it can assist with cheaper debt (ie interest rates).

Last month Fed Chair Powell made some salient points on this topic precisely, saying:

“The real issue with housing is that we have had, and are on track to continue to have, not enough housing… and where are we going to get the supply? And this is not something the Fed can really fix.”

And he continued:

“But as we normalize rates, I think you’ll see the housing market normalize. Ultimately by getting inflation broadly down and rates normalized and getting the housing cycle normalized, that is the best thing we can do for householders. And the supply question will have to be dealt with by the market, and also by the government.”

So, in short, while they can’t repair the broken housing market, they are a major piece. This is likely a relatively short-term problem, but unfortunately homebuyers / sellers are caught right in the middle.

It’s Inflation Stupid: Federal Debt Matters

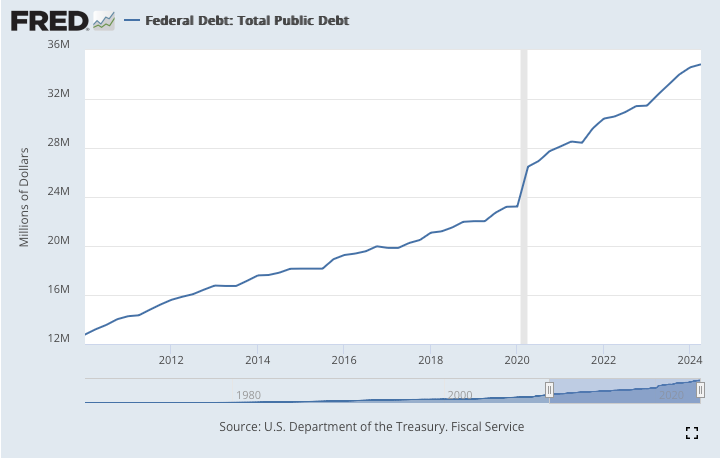

US federal debt is absolutely out of control. Unquelled, it will bring higher inflation and higher mortgage rates. The number is staggering: $35 trillion and growing, faster than our economy.

And as I am reminded daily on my news feeds, we are in a Presidential election cycle. Even without any additional spending, the next president is on track to spend an additional $10+ Trillion over 4 years. Add that number to the wild spending promises from both Presidential Candidates, which are stacking up under the Christmas Tree, and you have a recipe for inflation disaster.

Each of those nicely wrapped boxes is a future fiscal time bomb, ready to explode.

Why does Good Economic News Mean Bad Market News?

All this being said, for now, the overall US economy looks to be holding strong, especially when compared to the rest of the larger world economies.

But back in August, a doddery jobs report may have spooked the Fed after sending markets sharply downward. Yet, in the months since, most jobs and inflation reports have come up roses.

And we just had a very positive jobs report. Employers added 254,000 jobs in September and unemployment ticked down to 4.1%, both better than expected. Plus, this past month's employment was revised up. As was gross national income, personal income and the personal savings rate. September 2024 CPI inflation now sits at 2.4%, close to the Fed’s 2% target.

Now most folks would think: “yay, more jobs!,” but, again, the bond market interpreted this news as either: a potential return to inflation or an extended timeline for the Fed to cut rates. After all, why cut rates quickly if the economy is doing well and jobs are plentiful? This risk is driving the sale in 10yr Treasuries; and thus, mortgage rates.

Bonds are selling off again today.

We are still in a precarious economic time, so good economic news may be “too good,” and bad for debt markets. And mortgages are debt.

Muah! Now that’s some real economics charcuterie for ya.

None and Done? Is the Fed Done Cutting Rates for the Year?

The bond market’s concern with future inflation is likely shared by the Fed. Perhaps they even slightly regret cutting rates by a full .5% in September.

So, could the Fed decide to pause here for a while?

Economist Ed Yardeni (one of the talented ones :) ) believes the Fed is on a path for “none and done,” no more rate cut rates for the rest of 2024.

This is a seemingly bold prediction, but I would argue it is looking increasingly less so.

In a concise presentation, he asserts that the economy is performing better than expected and the sentiment amongst investors is positive. There is no impetus to cut rates.

My Skeptical Take:

Is a return to elevated inflation a real risk?

Yes. It’s not likely, but yes it’s a real risk. And a dramatically higher risk if the Federal Government doesn't stop the printing press. We will have a new President in 2025. It’s up to them, working with Congress, to determine our fiscal future.

For the Fed, a return to high inflation is a worst-case scenario; I think they will be measured over the next 12 months.

Does the Fed have regrets about being so aggressive? I don’t think they are regretful, per se, but they may adjust their posture. The Yardeni piece (above) swayed me. So, I’m changing my mind. I’m now a little more bullish on the economy, and thus bearish on the pace of rate cuts. I’m revising my prediction of two more cuts this year to just one (.25%), likely in December. I think the economy continues its on-trend growth, oil prices are still low (albeit threatened by geopolitical tensions), and the job market continues to surprise to the upside. There will be noise in the stock market and in the press, especially in the next 3 weeks of election season, but the trend will remain positive for the next 5-6 months.

Former Treasury Secretary Larry Summers is also cautiously skeptical on rate cuts. He sees the Fed taking the cautious/slow approach to rate cuts, even going so far by calling the larger .5% cut a “mistake,” while pointing out that wage growth is strong, above 2019 levels, which could risk inflation returning.

So What’s Next for Mortgage Rates?

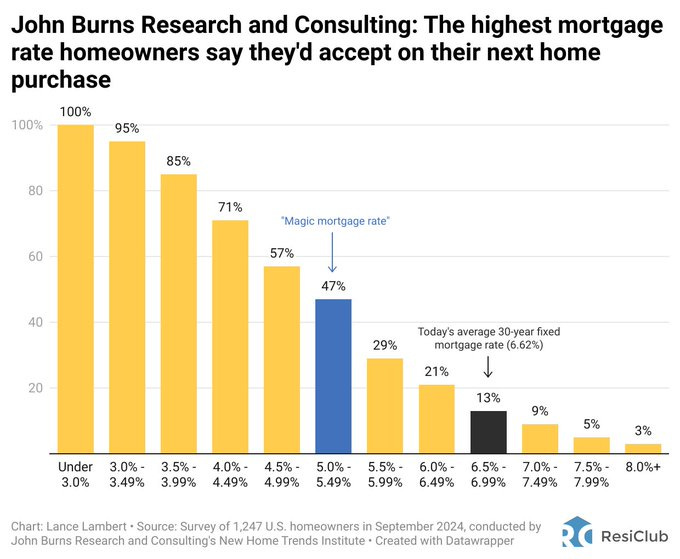

My prediction for rates in 2025 has not changed. I think we hit hit 5.5%. I am more bullish on lower rates than most investment banks / economists, many of whom are calling for ~5.9% by Q4 2025. IMO, 5.5% is the “magic” mortgage rate, where folks are no longer sitting on the sidelines of homebuying using rates as a main reason for waiting. A recent survey of homeowners seems to agree.

With rates maintaining their elevated position, homebuyers and sellers are likely to hibernate for the Winter and Skip till’ Spring. Activity this late Fall and Winter will be suppressed and inventory should rise more.

BUT….If you are an investor, you can hack your way through all the noise and find that deal. Those selling a property today will be waiting 2x as long for a buyer. Sharpen your pencil and find that deal that is sitting on the market.

Be greedy when others are fearful.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

It takes hours to write this weekly article, and they will always remain free. All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you think I was going to send you a Starbucks gift card? 😅

Ready to Start Investing in Real Estate?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great deals, as well as manage their real estate portfolio, here in Nashville, TN. If you are looking for an investment property, give us a call today!

For all the information on who we are and what we offer, visit our real estate website www.NashvilleInvestorAgent.com or setup a call today!

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. 90+ people per day move here and last year 16.8 million folks visited our lively city. We have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, and no state income tax, to name a few amazing perks.

* I write this myself and get it out for you all on the same day. Apologize in advance for the likely errata. Don’t have a team of editors, yet.

** The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and do not constitute financial advice.