Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

Super quick on Interest Rates

5 Factoids for Today’s Real Estate Market

The Future is Bright!

My Skeptical Take

We have a new newsletter partner! The Rundown AI. Feel like you are falling behind on what’s happening in AI? Never fear, the Rundown AI is here 🙂

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

The Weekly 3: News, Data and Education to Keep You Informed

Today’s Interest Rate: 7.03%

(☝️.18, from this time last week, 30-yr mortgage)

It’s official, after a wild 30 day run of more than .80%, 30yr Mortgage rates have a 7 handle.

We have round-triped back to July levels.

30-yr rates back above 7%

Now, I don’t want to harp on rates today, there are enough folks writing on the subject. And I wrote extensively about interest rates and the dynamics in the bond market last week. You can read it today for free.

But before we dive into our topics today, it does deserve some of our attention.

So, let’s do a super quick up date on interest rates to see how we got here.

* Super Quick on Interest Rates *

Why are rates up again this week?

In short, the bond market (remember, mortgage rates follow Treasury rates) expects the Fed will not cut rates as fast as expected.

Why?

Bond market participants see a double threat:

a resilient economy significantly slowing the Fed’s expected rate-cutting plan, and

the threat of re-inflation from the federal spending wildfire.

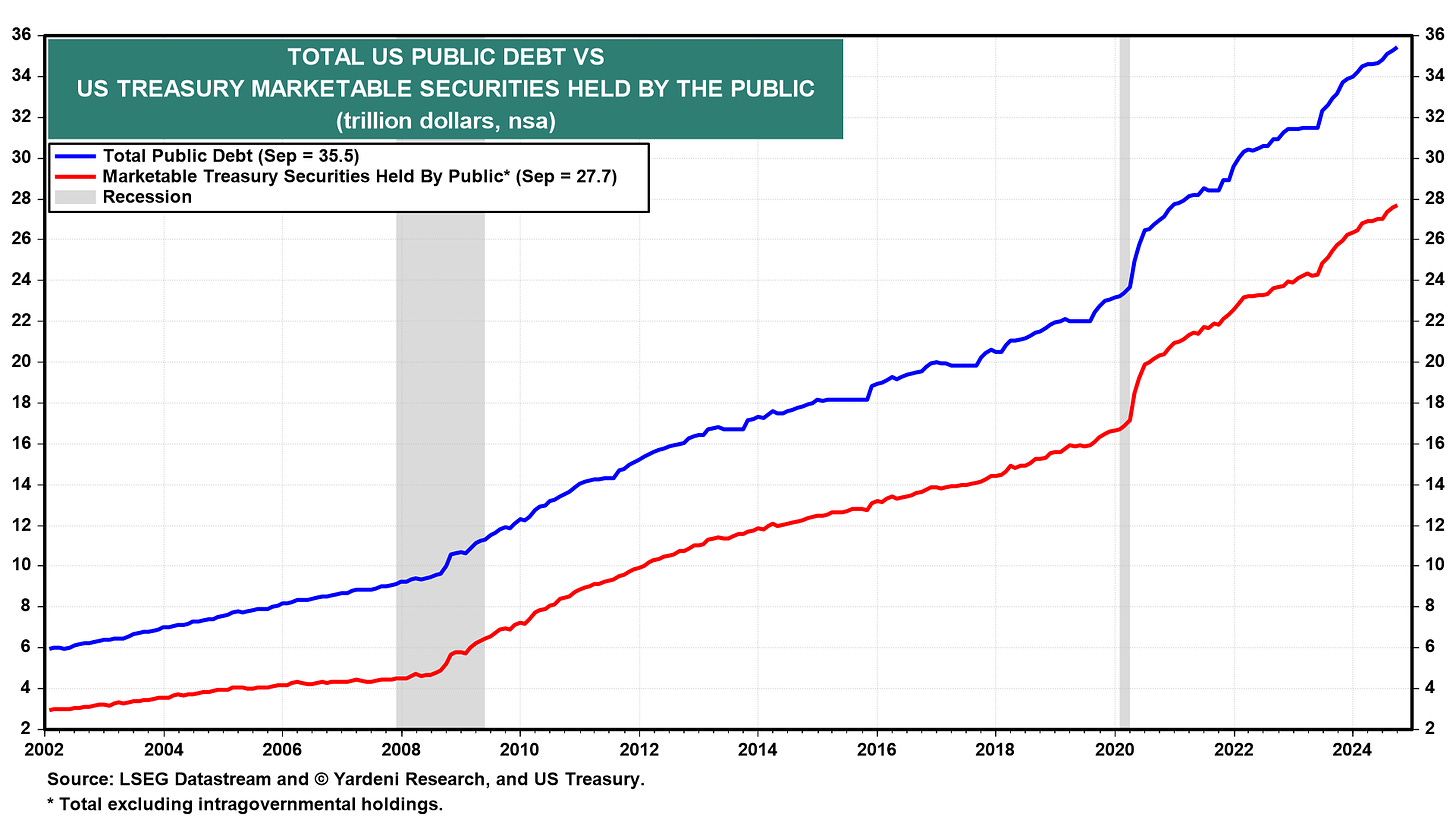

And when the Federal government spends more, it needs to issue treasury bonds to “pay” for that spending. More bonds in circulation mean lower price, during a time of restrictive monetary policy (which we are currently own). Fun fact, you know who is buying many of those treasury bonds? The Fed. So we are essentially printing and buying/financing our own debt. This is why inflation. Chart.

And the interest on that debt is a whole other story, at $1 Trillion / year.

Think our borrowing is slowing?

Nope.

Just yesterday, the Treasury announced its borrowing estimates today. The projected financing is $546 billion in Q4-2024 and $823 billion just during Q1-2025! Mind-blowing.

AI thinks US debt is mind-blowing too

Inflation erodes the interest rate returns of bonds. Thus, if you think inflation is a concern: sell bonds, buy assets = rates up go.

Add to this, the political spending and tax promises from both political candidates and you have a cocktail for potential re-inflation in 2025.

Well hell….

Again this is the risk, not the reality, yet. But we Skeptics must be paying attention and take appropriate action to protect our downside.

What I’m doing to guard against inflation and higher rates?

Buying real estate.

What’s your inflation protection plan?….

Whew, ok done with that gross topic.

Now, let’s get a little Positivvvve, Positivvvve! The data is actually looking decent for us real estate investors.

Let’s get into that!

5 Factoids for Today’s Real Estate Market

How is the real estate market doing? Here’s some hard data, which hopefully should be refreshing given our respective news feeds are inundated with negative rhetoric (I can’t wait of this election to be over!).

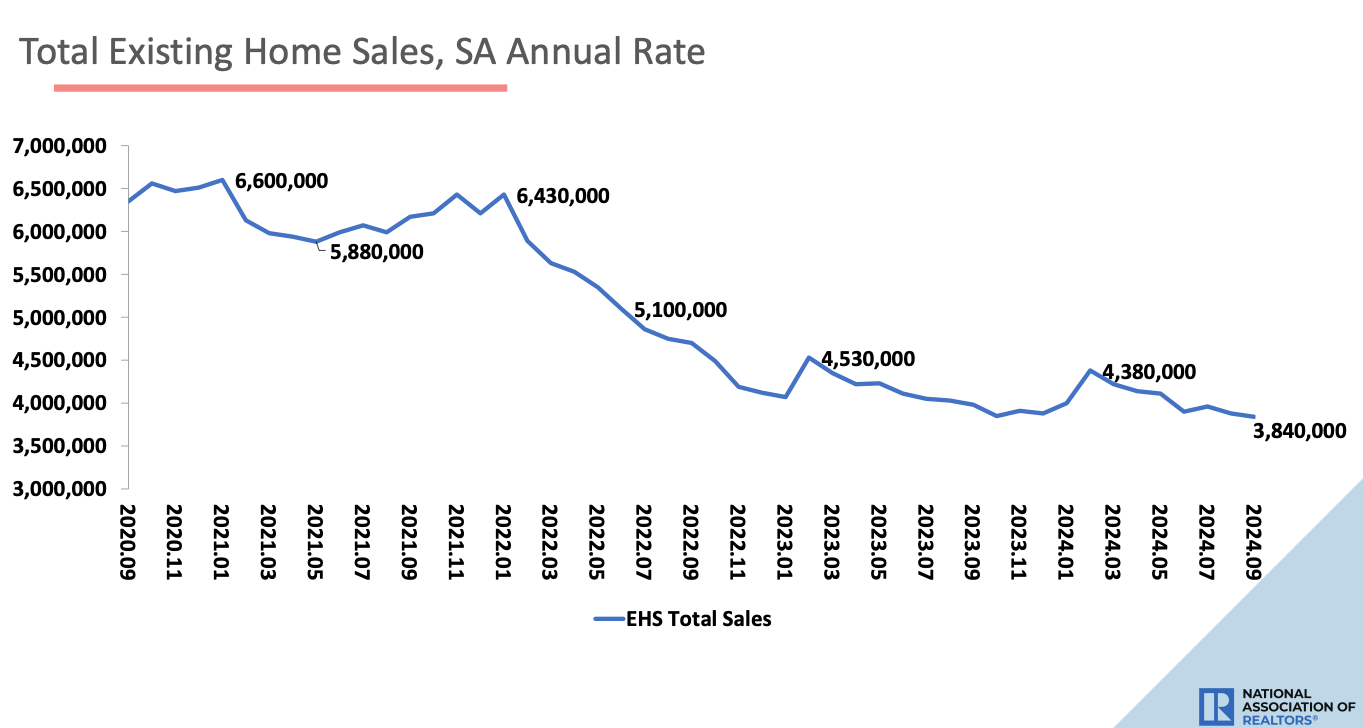

1) Existing Home Sales 👇 3.5%

Sales of exiting homes (September data) were down 1% MoM and 3.5% YoY to 3.84 million. Remember last September interest rates were 1% higher, above 7%. Yet sales this year were down.

We are still at historic lows, folks are staying put / locked into their interest rate with golden handcuffs. And with rates up in October (since the September dip down to low 6’s) the late Fall/winter sales numbers will likely be down more.

My Take: Folks are fine waiting, now that the Fed has announced it will begin cutting rates (even if slower than expected). Remember, the avg length of homeownership is 8 years, with the median being 13.2 years. And since prices are up up up + interest rates up up up, it’s harder to afford a home. Counterpoint: the median homeowner has a net worth that is 40 times higher than renters’, and twice as high as the median net worth of all U.S. households. This is not a coincidence, if you own a home you are likely richer. So I think folks are sitting on their savings. They are ready to buy, they have the down payment, but are being opportunistic, waiting for interest rates to come down. Watch out for Spring.

Still, some folks have to buy homes, and they started to pull the trigger last year. In 2023, 32% of homebuyers were first-time buyers, up from 26% in 2022.

Of note, the drop in home sales has nothing to do with the election. That’s click-bait. It’s the prospect of lower rates sometime next year. Again, likely in the Spring.

Positive Spin - There will be fewer folks in the market this Winter for homes and higher inventory (especially in “ugly” existing homes/fixer uppers), means more choices. If you have the $ for a down payment/cash, now is the time to go hunting. Eat that extra few hundred bucks in interest and pickup a deal for $25k, $50k, $100k below what it woful normally sell for!

It’s time to get your Woolly Mammoth.

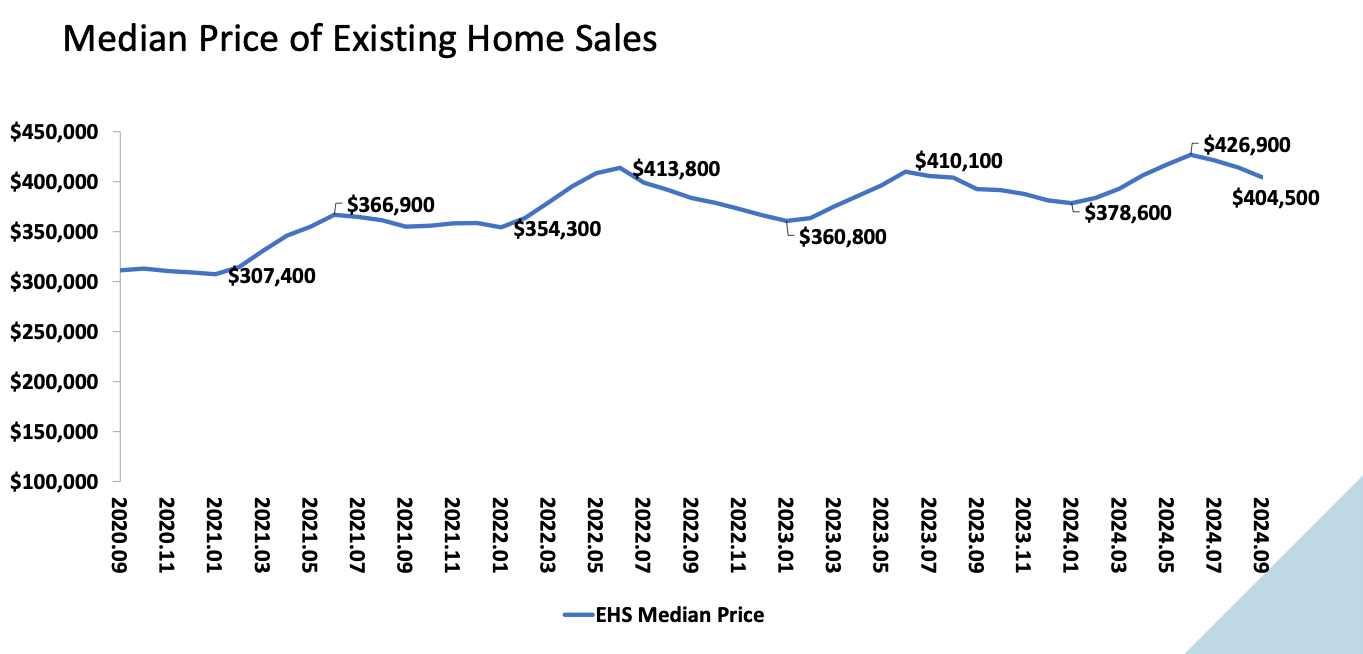

2) Real Estate Prices 👆3%

Median home price was up 3% to $404,500, the 15th consecutive month of price increases (seasonally adjusted).

Positive spin - Real estate is a fantastic inflation hedge. Inflation up = property values up more (on avg).

Remember, home sales are seasonal, so the above shows the up and down cycle. We are now in the slow (aka down) part of the year. Again, hot tip: investors like buying in the Fall/Winter for a reason regardless of the interest rate environment.

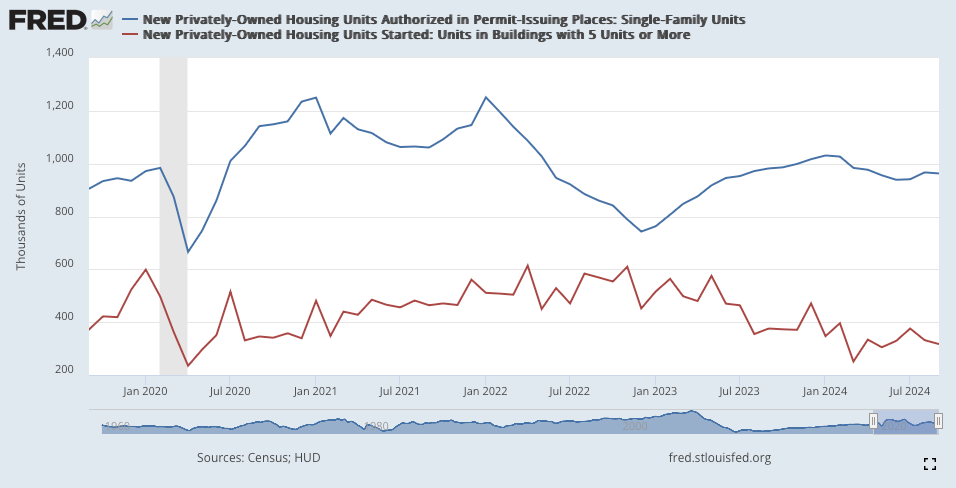

3) New Housing: A Tale of 2 Buildings Types

Multifamily new construction is falling, especially relative to single family home starts, down more than 50% since summer 2022.

Positive Spin - The Media’s warning earlier this year of an apartment glut was not true / unwarranted rhetoric for a fleeting state of affairs. Anecdotally we’re not having any trouble renting our properties in our mid-tier portfolio either. Folks need housing!

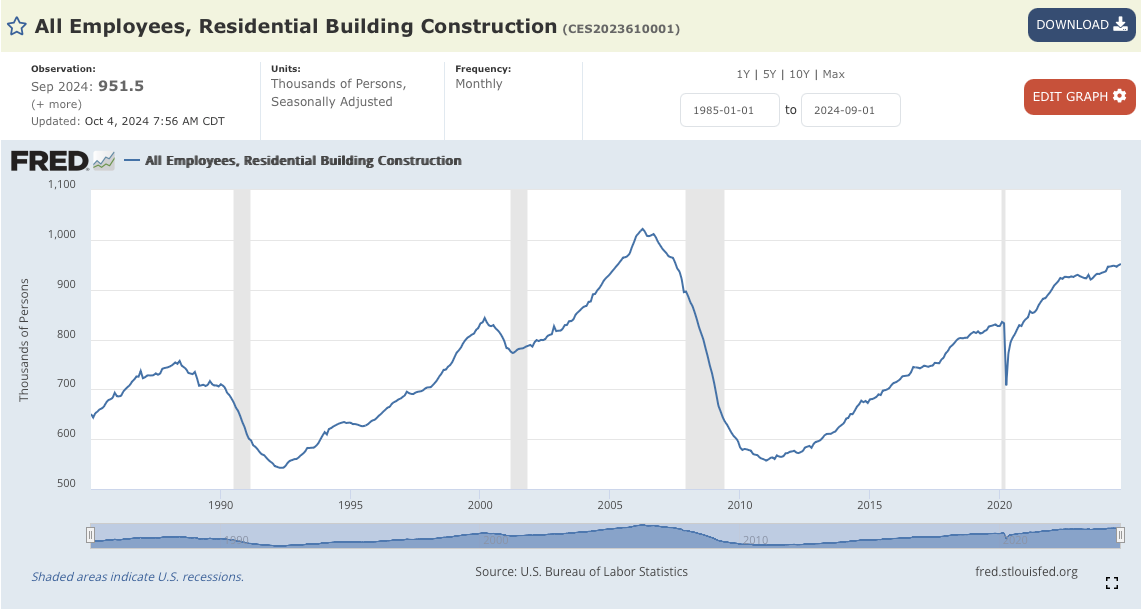

4) Construction Employment is a Fantastic Economic Indicator

Historically, construction employment weakening is a leading indicator of a recession. Then jobless claims start to rise, then we get a recession.

Positive Spin - Construction employment is strong. In fact, we are on the uptrend in the economic cycle. Recession is not on the horizon, so far.

And, for us real estate investors, there really has been only truly 1 worrisome crash in the last 30 years, and that was the Great Financial Crisis.

5) Consumer Sentiment is 👆

Consumer sentiment is up, for the third straight month, its highest reading since April 2024 and up 40% from the June 2022 low, according to the University of Michigan survey. Inflation expectations for 2025 were flat, at 2.7%.

The Conference Board's consumer confidence index also rose in October, more than 11%. It’s highest single month acceleration since March.

This, I did find a little surprising. It seems like folks are not paying attention to the bond market’s warnings and labor market tightening (or they don’t read this newsletter :).

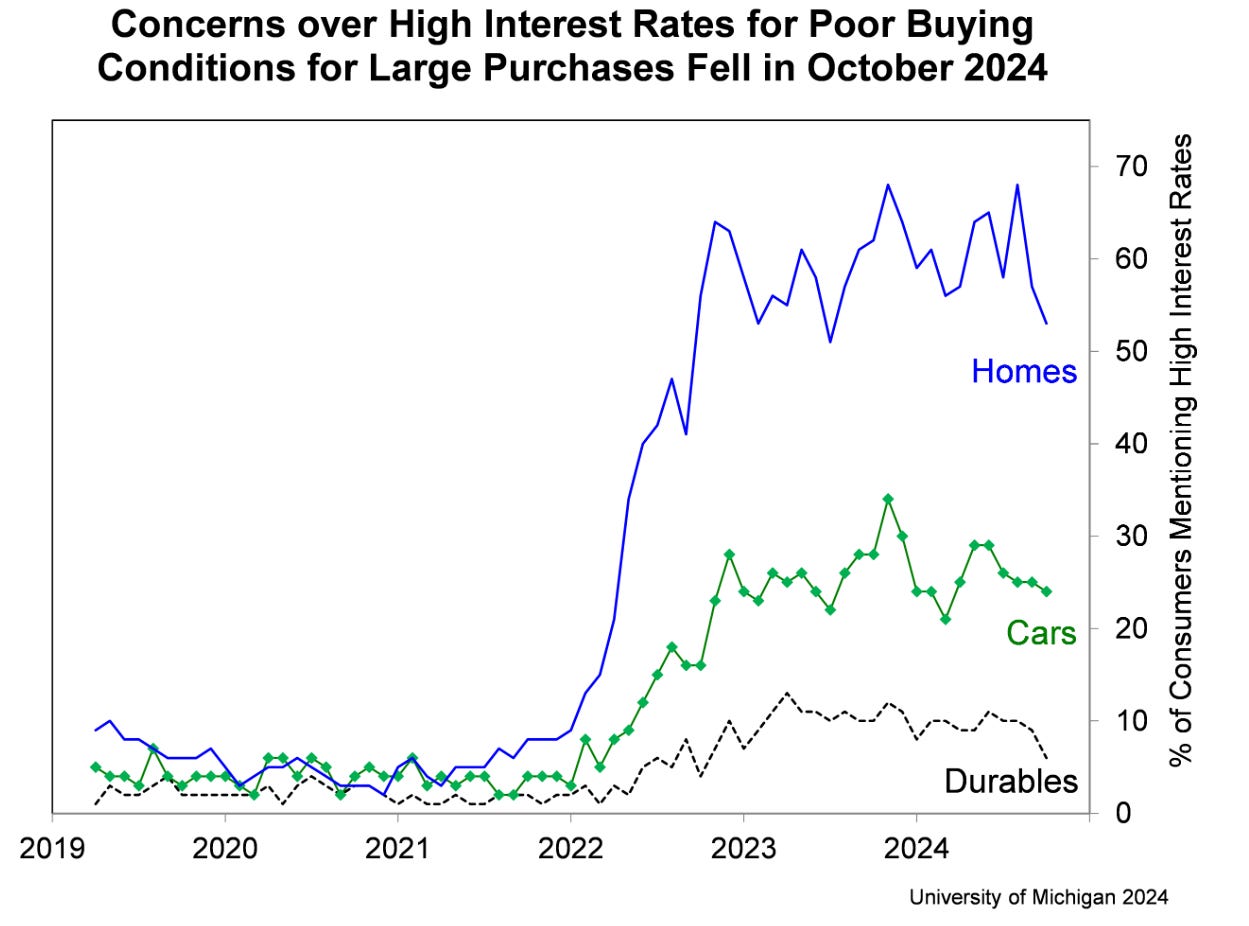

This is not to say consumers are not concerned about interest rates. Interest rates for homes, cars, durable goods are still top of mind. Folks are however feeling more positive than a few months ago.

My Skeptical Take:

Interest rates up.

Bond market worried.

But the environment for investors is positive.

And…..something awesome just happened.

I just changed my mind.

And by the way, changing your mind/posture/position/opinion in the face of new information should not be a novel occurrence. This is something required for any successful investor.

I love changing my mind. It means I learned something.

As of today (well, really 2 weeks ago, in hindsight) I am much less bearish on the economy, than I previously expressed and written. The data / setup for 2025 is looking good.

As we turn-into the post-election corner, I’m heal-toeing down to second gear, ready to clip that apex and explode out of the turn (car racing folks know what I’m talking about).

I picked up two more deals in the last 30 days. A small duplex and a single family, here in Nashville.

The future looks bright!

Just think about all the wild stuff going on it in economy. I think 2025 will be…

2025: Year of Cool $hit ! = 👆Productivity

2025 is just the beginning...

Driverless cars/taxis/busses, rockets to other planets, worldwide access to cheap satellite internet, AI assistants, custom medicine/medical treatments…. 2025 is going to be super exciting for new technology. In AI alone we could see some really cool drivers of labor productivity.

More importantly, for real estate, this could substantially boost GDP above current estimates = property valuations 👆.

I think we will look back in 10 years and mark 2025 as the start of a new industrial technology revolution.

Very exciting.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

It takes hours to write this weekly article, and they will always remain free. All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you think I was going to send you a Starbucks gift card? 😅

Ready to Start Investing in Real Estate?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great deals, as well as manage their real estate portfolio, here in Nashville, TN. If you are looking for an investment property, give us a call today!

For all the information on who we are and what we offer, visit our real estate website www.NashvilleInvestorAgent.com or setup a call today!

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. 90+ people per day move here and last year 16.8 million folks visited our lively city. We have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, and no state income tax, to name a few amazing perks.

* I write this myself and get it out for you all on the same day. Apologize in advance for the likely errata. Don’t have a team of editors, yet.

** The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and do not constitute financial advice.