Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.31%!

(👇.01% from this time last week, 30-yr mortgage)

This week, we’re talkin’ a massive reverse in interest rate predictions, how the consumer is doing this holiday, and….. Lower Rents? Not so fast. What is happening in the housing supply and rental market.

Let’s get into it.

The Weekly 3 in News:

Property taxes are an increasing way states and localities generate much of their revenue (Census).

Redfin 2026 Interest Rate Predictions: “The 30-year fixed rate will average 6.3% for the entire year, down from its 2025 average of 6.6%.” Too conservative, I am highly skeptical of this narrative, which underestimates the power of politics and midterm elections next year (RedFin).

Nashville News - Nashville lands at #6 in the top 10 real estate markets for 2026! “Attractive real estate markets are determined by a combination of demographic growth and supply constraints, with the Northeast and Southeast regions currently seen as particularly favorable (CityNowNext).”

Quick Interest Rate Update

Just 2 weeks ago, Fed governors had flipped, the talk on the street was hawkish, and markets got spooked.

Everyone thought a rate cut was no longer in the offing on December 10th.

The Bond market went from an 80%+ chance of a cut, to 40%.

Governors Hammack, Logan, and Schmid were signaling their preference for policy hold.

There was blood in the streets, oh, the agony!

Fast forward to today.

The bond market is pricing in an 87.6% chance that the Fed cuts rates.

What a difference a day makes.

And betting markets led the way, sniffing out the round-trip change in Fed sentiment.

Just look at that reversal.

What Happened?

It was New York Federal Reserve President John Williams’s speech that got people back on the straight and narrow, saying:

Learn how to make every AI investment count.

Successful AI transformation starts with deeply understanding your organization’s most critical use cases. We recommend this practical guide from You.com that walks through a proven framework to identify, prioritize, and document high-value AI opportunities.

In this AI Use Case Discovery Guide, you’ll learn how to:

Map internal workflows and customer journeys to pinpoint where AI can drive measurable ROI

Ask the right questions when it comes to AI use cases

Align cross-functional teams and stakeholders for a unified, scalable approach

“…it is imperative to restore inflation to our longer-run goal on a sustained basis. It is equally important to do so without creating undue risks to our maximum employment goal. I view monetary policy as being modestly restrictive, although somewhat less so than before our recent actions. Therefore, I still see room for a further adjustment in the near term to the target range for the federal funds rate to move the stance of policy closer to the range of neutral.”

Fed Watching Sucks

Fed watching has now become much like watching the announcer slowly bellow the results of the judges’ scorecards during a split decision boxing match.

We are on bated breath before each meeting.

And everybody has a strong opinion.

It shouldn’t be like this, and historically it has not been. The Fed (post-Greenspan) has always tried to signal (or overtly tell) the market what their FOMC rate-cut decision will most likely be beforehand. Absent this, the uncertainty is why there is volatility in markets. We can see this most pronounced in the stock market as of late.

I do not like this.

I can’t wait until we are all cut out, it’s 2027, and the Fed can go back to its hobbit home on the Shire, knitting sweaters, or whatever they do when they aren’t ruminating over the next rate cut.

Let’s make the Fed Boring Again.

So, where exactly are we on rate cuts?

The current tally of Fed Governor opinions, based on public comments, looks like this:

5 Governors (voting) have signaled they do not want to cut rates next month (Barr, Musalem, Schmid, Goolsbee, Collins).

5 have signaled they want to cut rates (Miran, Waller, Bowman, Williams, Cook).

2 are not known (Powell and Jefferson).

So, as you can see…

… Pardon this interruption for BREAKING NEWS:

As I write, we have an announcement from the President, speaking on the next Fed Chair:

“I know who I am going to pick...”

AND word on the street is the President could make the pick official as early as today!

Get ready to rumble folks, the era of Shadow Fed Chair is about to begin.

As I’ve written about before, once a new Fed Chair is named, then begins Powell’s term as a lame duck. Markets will no longer follow his lead after Dec. 10th, instead hanging on every word of the forthcoming Fed Chair.

Rumormill has the pick being current White House National Economic Council Director Kevin Hassett, who has also said publicly he would take the job if offered it (a bold take if he didn’t already know). Barring some curveball during confirmation (which is unlikely since he's already been vetted and is in the White House), he will be the next Fed Chair.

And he is dovish, just like the President.

Both want the Fed to cut interest rates by “3 or 4 points…”

Investors are thinking….

As long as we don’t reignite inflation that is…

Back to the December Decision

The Fed is likely to cut in December, markets have already reversed their selloff as a result, and the bond market is pricing in this as fact, which means,,,,, mortgage rates won’t change much from now to the Spring.

Wait, what?!

That’s right, the bond market has already done much of the Fed’s dirty work for them, lowering rates to near 6%. And because this next .25% is priced into current bond rates, we likely won't see much shift from here until the next larger announcement or a wild change in that policy stance.

So… if the Fed does cut in December, rates won’t change much.

But, if the Fed doesn’t cut in December, rates will spike up. Because that would be a surprise to what is already priced in. Markets trade in the future, on what is expected to happen.

Get it? Got it?

Good.

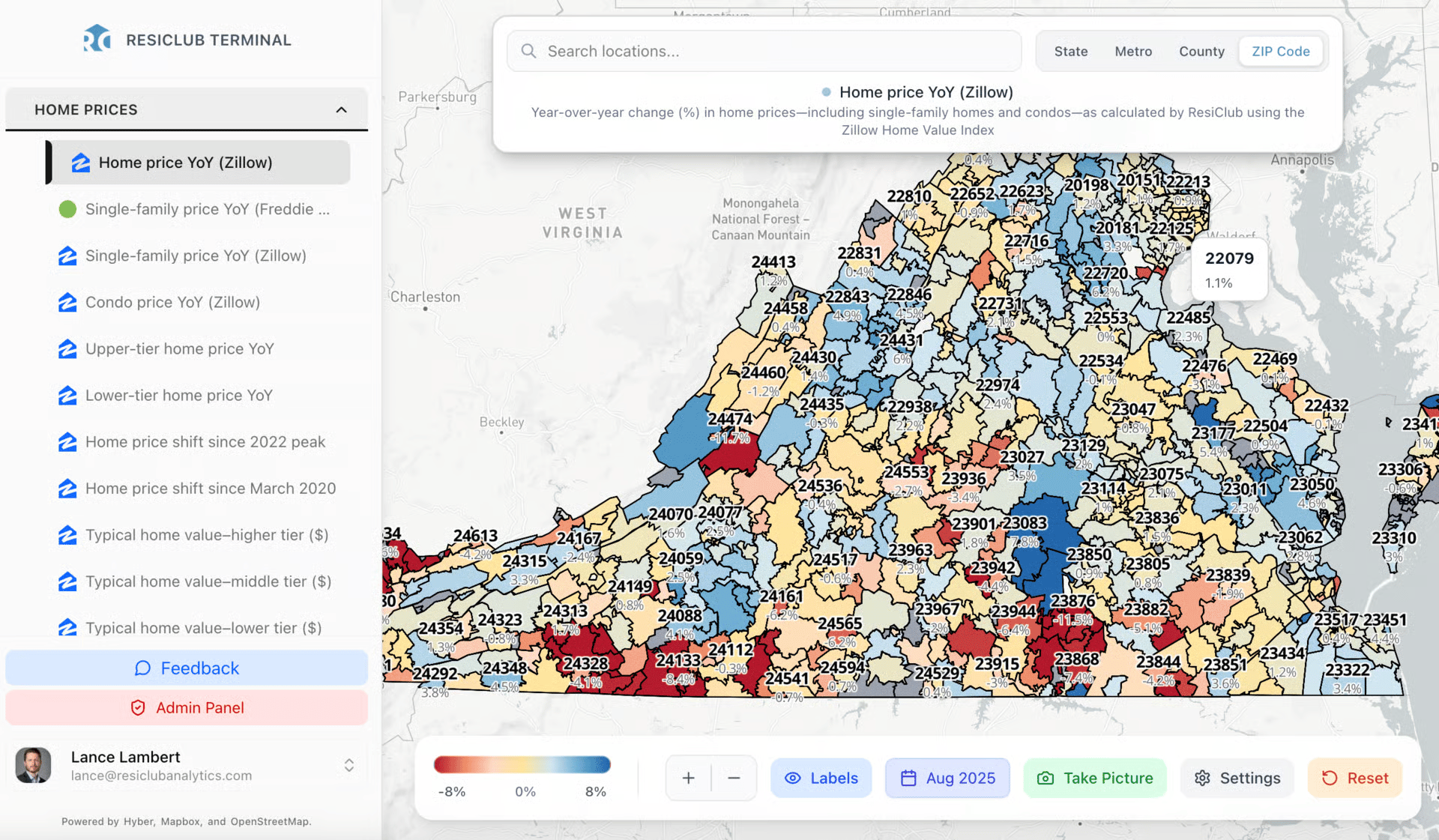

A Quick Ad Break….ResiClub Housing Analytics

Want the best housing data? Look no further than the new ResiClub Terminal. It’s the Bloomberg Terminal, for real estate professionals.

ResiClub is proud to introduce the ResiClub Terminal—a powerful new platform that brings together housing market data, analytics, and insights at the metro, county, and ZIP Code level—alongside our housing reporting and research.

Whether you’re evaluating a new land deal, modeling housing demand, tracking investor activity, or advising clients, the ResiClub Terminal helps you make better, faster, and more informed decisions.

And this is just the start—we’ll add much more analysis, data, and tools over time.

The ResiClub Terminal isn’t just a data platform—it’s the foundation for everything we’re building next. Future tools designed for this audience—like local market scorecards, forecasting dashboards, and interactive reports—will all live within the ResiClub Terminal environment.

Our goal is simple: to give housing investors, professionals, and executives the data and clarity they need to prepare for 2026, 2027, and beyond.

You can check out the ResiClub Terminal here!

Want to advertise to the more than 30,000+ weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

A Look at the Consumer this Holiday

So far, the holiday shopper is looking robust. This, according to sales data from Mastercard.

Surprisingly, it is online sales that are pushing even further upward, growing 10.4% this Black Friday from 2024.

Spending growth on apparel was particularly strong. From the Mastercard report:

Apparel climbed +5.7% (online +6.1%, in-store +5.4%), as chilly temperatures and seasonal deals encouraged spending on new fashions. Jewelry also rose +2.75% (online +4.2%), as consumers opted for gifts that shine.

E-commerce retail sales excluding autos jumped +10.4%, as shoppers increasingly value speed and convenience. In-store sales grew more modestly (+1.7%) but were well attended and remain essential to consumers for tactile experiences.

Restaurants grew +4.5%, as dining out has become part of the holiday ritual to celebrate the season and underscores consumers’ continued desire for experiences.

Growth in spending outperformed in certain pockets of the country, including New England, Midwest and Southeast.

More Holiday Spending Growth Numbers

This growth corroborated predictions from Adobe Analytics, which forecast online holiday shopping to be way up.

From the Adobe report:

“Adobe expects U.S. online sales to hit $253.4 billion this holiday season (Nov. 1 to Dec. 31, 2025), which represents 5.3% growth year-over-year (YoY). A record 10 days will see consumers spend over $5 billion in a single day (up from 7 days last year). Cyber Week (the 5-day period including Thanksgiving, Black Friday and Cyber Monday) is expected to drive 17.2% of overall spend this season, at $43.7 billion (up 6.3% YoY).”

AI is in charge

An interesting tidbit I found in the data: ahead of Black Friday, many consumers asked their favorite AI chatbot about where to shop, what was in style/popular, gift ideas for the family, and especially, where the discounts to retail price were.

Traffic from AI sources (LLMs) to retail sites is expected to rise a whopping 515–520% from the 2024 holidays. And so far, that prediction is outperforming.

AI traffic on Black Friday was up up up.

This held across the same categories Mastercard reported.

Buy Now Pay Later

The consumer is also taking advantage of 0% “loans” aka Buy Now Pay Later. Which could be read as concerning for the health of holiday shoppers.

From the Adobe report:

“Consumers are looking for greater flexibility in managing their budgets this holiday season, with Buy Now Pay Later (BNPL) expected to drive $20.2 billion in online spend (up 11% YoY). This is roughly $2 billion more than the 2024 holiday season.”

BNPL Provider Klarna Reports 45% Black Friday Growth

BNPL provider Klarna saw a 45% year-over-year increase in U.S. sales from November 1 through Black Friday.

What are people buying today and putting off payments for?

Footwear, tech, beauty, and home goods all performed strongly on BNPL platoforms. Birkenstock, Apple AirPods, PlayStation 5 models led gaming, and Baccarat Rouge 540 ranked first in beauty. Ninja products dominated home goods, with mattresses jumping to second place.

Looks like folks are decking out their home this holiday, and are choosing BNPL platforms to do so.

But who can blame them? These zero-interest loans are pretty attractive.

Hell, about 6 months ago I bought an 8-Sleep mattress, which heats and cools. They ain’t cheap. And at checkout, the company gave me an option to pay BNPL. I was offered to pay in installments, with no fee, at the same price, and with no interest.

I’d never done that before; but, why wouldn’t I do that?

I can keep the cash in my brokerage account, which I would have otherwise used to buy it outright, and earn interest on that money, as I make $200 payments for the next several months.

Pretty sweet deal if you ask me.

So I don’t see this as signaling a weak consumer, as the news headlines are trying to scare folks with.

So far.

Counterpoint: The consumer is looking quite robust, trading up in $ amount.

Shoppers are actually grabbing a larger percentage of higher ticket items. And, they have AI to thank. LLM searches are showing that AI that is helping shoppers “get more value out of their dollar,” according to Adobe’s analysis.

“The share-of-units-sold for the most expensive goods is set to rise by 56% in sporting goods, 52% in electronics, 39% in appliances, 32% in personal care, and 26% in tools/home improvement.”

But, the trend does “reverse [slightly] in groceries (down 3%) and furniture (down 8%), as shoppers embrace lower-priced items in these categories.”

And to be fair, high-priced car purchases too are showing weakness, according the Wall Street Journal. “…increasingly stretched consumers are starting to draw the line on what they will pay for a new car, according to dealers, analysts and industry data (WSJ).

Or…counter-counterpoint, car prices appreciated out of control and they're coming down to earth.

Another Counterpoint: Wage growth > Inflation

I know it may not feel this way for many, but wages are still outpacing inflation.

And this has been the case now for 29 straight months, although this gap is less pronounced (Bilello).

Conclusion: while the labor market does continue to show weakening, with unemployment ever so slightly ticking up to 4.4% (in September, the most recent data available), it isn’t yet slowing the average consumer.

In fact, despite the headlines, the average household is not leveraged with too much debt (JPM, Mohtashami).

Foreclosures and bankruptcies are still below 2019.

Part of this is owning the wealth battery that is the American home.

Ok, switching gears to housing supply, rents and real estate.

Lower Rents? Not so fast.

There has been a lot of talk about rents coming down, or at the very least, the pace of rent growth slowing.

Yes, it is true, rents are not appreciating as they were over the last few years, and especially not as fast during the zero-interest-rate policy of 2020 through the first part of 2022.

But the devil is in the details.

It is in cities that are growing, where homebuilders have been building.

And in these cities, rents are stagnating.

But this is a sign of a healthy housing market, supply coming to fill demand.

Is this “a bubble?”

Hell no, get that out of your head, that is nothing but fleeting, salacious headlines.

Supply is just now back to 2019 levels, and is about to crater back down again, despite robust demand.

Supply to the Rescue in Some Markets, but then Off a Cliff

For example: “Homebuilding activity right now, relative to population, is 15 times higher in Raleigh, NC—a fast-growing population market—than in Hartford, CT (ResiClub Analytics.”

Chart on:

In my home market of Nashville, we also saw a large influx of housing units to support the tremendous population growth.

BUT as readers of this newsletter know, housing supply is about to fall off a cliff.

We hit peak supply earlier this year in Nashville, and in the next 6 months most major cities that grew supply will too, dropping supply back down to unhealthy COVID levels (pun intended).

Chart on:

Completions of housing units are now turning over. Demand will soon greatly outpace supply in most all markets (Parsons).

Regulations Making it Difficult in Some High Priced Markets

NYC and LA Landlords are in trouble.

In cities that were unable to build more housing, disincentivized by rent controls, they could have a very different problem. We will see this in NYC and LA (WSJ).

Rent controls are threatening to force landlords into foreclosure, unable to charge market rent to stabilize their housing developments.

As housing economist Jay Parsons puts it “[This would be] ironic if Mayor-elect Mamdani backs a $1 billion bailout of New York’s rent-stabilized apartment owners at risk of default.”

🤦

Well Done SF

But in SanFrancisco, to the credit of the new mayor, they are starting to take some proactive steps. Baby steps, but steps nonetheless. The City is providing incentives to landlords for filling their housing units at market rates.

This is a positive step in leadership. Well done SF.

The takeaway?….

My Skeptical Take:

Ok, so a lot to unpack here.

The takeaway from today’s onslaught of info is:

The consumer is having a robust start to the holiday shopping season, led by strong growth in most categories, with some concerns over the low-end consumer using buy now pay later platforms at a much higher rate.

AI is helpful for holiday shopping/finding discounts/deals.

Mortgage interest rates will likely stagnate, and may even levitate from here, until a new Fed Chair is named.

The COVID/Zero Interest Rate Policy housing boom is over. Housing supply has peaked in most markets.

If you are a renter, sign that lease now while their growth is suppressed; 2026 will be the start of another rent growth cycle. It’s already happening in my home market of Nashville, where supply peaked in the Spring.

The savvy real estate investor, from Now → the Spring, will be buying their next deal.

Anecdote: I’m back from my holiday abroad and wow, holiday shoppers were out in force in Hamburg, Germany on my trip. I saw packed boutiques/stores/malls looking to pick up deals all week long (it’s called Black Week over there).

Winter market-goers were also bustling with activity.

And eating.

And of course drinking…a little warming Glüwein. :)

That’s how I like to stay warm while I run numbers on my next deal.

2026 is going to be a banger year, but you have to be preparing today.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. If you need a little push, here is my new book! It is a MUST for all real estate investors. The 5 Ways Real Estate Investors Make Money and Build Wealth: Anyone can create wealth through real estate. Including You! (yes yes, it’s a shameless plug, but we authors make ~$1/book, FYI. This is about education!). So pick your copy up today!

Please Share this Article!

We have passed 40,000 subs! Thank you for your support, next stop, 50,000!

Please help grow the community!

It takes me several hours to write this weekly article, and they will always remain free (but you get some pretty cool perks with premium, including a one-on-one with yours truly :). All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you want, a cookie? 😅

Subscribe Today! (and get some amazing perks)

Paid subscribers get the best stuff! Join the Skeptical Investor Community to access:

Premium content and NO paywall,

Every article we have published - a treasure trove of information and education,

Conversations with other investors in the Skeptical Investor community, and future meetups and special events,

Key insights and predictions on the latest financial news,

PLUS, subscriptions include an annual one-on-one call with me personally. So make sure to take advantage! Subscribe today.

Just $5 bucks a month.👇

Ready to Start Investing in Real Estate? Know someone who does?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great real estate deals, as well as manage their rental properties, here in Nashville, TN. We pride ourselves on being tough negotiators. We want our clients to get an amazing deal, we never let our clients pay retail.

Enjoying this newsletter? Know somebody looking to buy real estate? Send them to the best in the business, THE Nashville Investor Agent! Referring real estate business helps us keep the lights on and me keep pushing out fresh real estate analysis each and every week. Help peep this newsletter going for all you awesome folks out there; refer someone to us when you may hear they are in need. We promise to take great care of them and make sure they get a fantastic deal. They will thank you for it.

If you or someone you know are looking for an investment property, give us a call today!

You can also find out more about us and what we offer on our website: www.NashvilleInvestorAgent.com

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. We have the lowest unemployment rate of the top 25 major cities and folks are moving here to take those jobs. Nearly 90+ people per day move to Nashville. And tourism continues to hit record levels. This past year 16.8 million folks visited our lively city. Plus we have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, no state income tax… to name a few amazing advantages. Come check us out, the water is warm :).