Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.99%

(☝️.07% from this time last week, 30-yr mortgage)

Today, we’re talkin’ the downgrade of the US credit worthiness. What the heck does it all mean? How will it affect the real estate market? How should investors posture?

Let’s get into it.

The Weekly 3 in News:

Fannie Mae and Freddie Mac credit worthiness was downgraded Monday, as well as all eleven regional Federal Home Loan Banks. But it’s not their fault. Why? It’s the US Government Debt explosion (Moody’s).

Looking for a job? So is AI. Businesses are seeing more fake job seekers flooding the market. One in four job seekers could be fake by 2028 (CNBC).

JPMorgan has dropped its recession prediction, declaring the U.S. economy will likely grow in 2025 (Fortune).

* Today’s Newsletter is brought to you by Fireflies.ai *

Automate client notes, simplify portfolio reviews, and stay compliant — with Fireflies for Finance

Ditch the manual notes. Fireflies transcribes meetings, auto-generates summaries for estate plans, portfolios, and retirement talks, and syncs everything to your CRM. Compliance? Handled. Admin work? Gone. Now you have more time to focus on building trust with your clients.

So what is all the Hullabaloo with this whole US debt downgrade stuff??

It's a doozy.

US Debt Gets a Downgrade, Again

Credit rating agency Moody’s announced Friday evening that it was stripping the US government of its top credit rating and dropping the country to “Aa1” (the second highest possible rating) from its triple-A “Aaa” rating (the highest possible).

This has already happened before. Twice actually.

You see, there are three big credit rating agencies: Moody's Investors Service, Standard & Poor's (S&P), and Fitch Ratings. And Moody’s is late to the party. Fitch Ratings downgraded US debt in 2023 and S&P did so way back in 2011. All three now rate US debt at their second-highest notch. Historically, US Treasuries have been rated at the top tier (e.g., Aaa or AAA), reflecting their reputation as one of the safest investments globally due to the US's economic power and the dollar’s status.

Pop quiz! How many rating notches does Moody’s have? Answer: 21. Oddly specific number... Maybe they’re a blackjack fan, like me :).

The Why.

This happened, not because investors are afraid of potential inflation or economic slowdown, which is usually where our discussion on Treasuries leads. No, this is entirely different.

The credit rating agencies evaluate the likelihood that the government will default on its debt obligations. This is serious shit.

In their announcement, Moody’s said that the downgrade “reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns.”

And,

"We expect federal deficits to widen, reaching nearly 9% of GDP by 2035, up from 6.4% in 2024, driven mainly by increased interest payments on debt, rising entitlement spending, and relatively low revenue generation."

9%!? Holy Scheiße. That is no bueno, for those keeping score at home (I had to use 3 languages to emphasize).

Add to this that Congress likes to play with fire every year and threaten not to increase the debt limit, and that risk of default just got a little more likely.

Moody’s, to its credit, blamed successive administrations and Congresses for the ballooning budget deficit. And the current budget being debated, the Big Beautiful Bill, in Congress would widen deficits even more (see below).

Side bar and Background: These three entities are not government agencies, so why do we call them agencies anyway? They are for-profit companies that sell data.

These folks get the agency title because the SEC designates them as Nationally Recognized Statistical Rating Organizations (NRSROs), and that is a mouthful. NRSRO is a quasi-official status in the financial system. There are actually 10 SEC-designated NRSROs, including the three financial experts normally cited, but also smaller firms like A.M. Best and DBRS. Since a 2006 law was passed (some good that did, keep reading), NRSROs must meet SEC standards for methodology, conflict-of-interest management, and operational integrity, though they remain private, for-profit entities. Their ratings significantly influence financial markets, impacting borrowing costs and investment decisions. Being an “agency,” aka a coveted NRSRO designation, allows them to gain clients. Their business model typically involves charging corporate, financial and municipal entities a fee in exchange for debt ratings. Their agency membership also gives them prestige, allowing them to sell perceived higher-quality data to investors. It’s like your beef being labeled USDA Prime, instead of Choice or Select.

But that hasn’t meant these agencies are good at their job, far from it. In fact, they have been asleep at the wheel before, and frankly, have bordered on abetting bad (or even illegal) behavior. We saw this during the Great Financial Crisis. Don’t excuse me for saying this, Moody’s, you and the rest of the credit rating agencies have been pretty shady in the past. We must remember their part in the Great Financial Crisis (cue scene from the movie The Big Short):

This was a formative time in my government life as a young man working on Capitol Hill. As a result, I am extremely skeptical of the credit rating agency cabal. And you should be too. Hell, Standard & Poor's downgraded US debt,,,,checks notes,,,,14 years ago!

I would argue that these rating agencies should have been stripped of their NRSRO designation for their role in the GFC. If I’m being blunt. They were definitely Select beef.

US Debt is Out of Control.

We have to stop the out-of-control deficit spending.

Yes I’ve written about it many times before, but that doesn’t make it untrue.

And now, it’s starting to affect the mortgage market directly.

Case in point, on Monday, an errant bullet hit the home loan giants Fannie Mae, Freddie Mac, as well as all eleven regional Federal Home Loan Banks. All of their credit ratings were just downgraded. But it’s not their fault. These re-ratings are a direct result of growing debt. Speaking on the subject, Moody’s specifically said this, “The rating actions reflect the weaker capacity of the US Government to support [Fannie and Freddie]…”

And to be more specific…

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

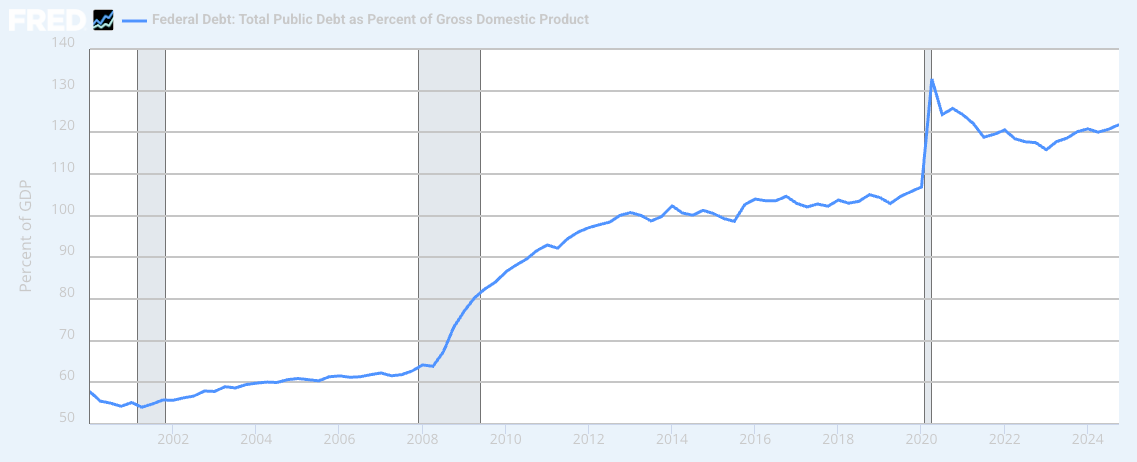

We are now spending close to $2 trillion a year more than we collect in taxes, $1.1 trillion in total spending just goes to pay the damn interest on our $36 trillion debt and the budget for the United States being debated in Congress would add an additional $2.5 trillion, on top of all this. Federal interest payments are set to equal ~30% of revenue by 2035, up from ~18% in 2024 and ~9% in 2021. And again, Moody’s said it expects “federal deficits to widen, reaching nearly 9% of GDP by 2035, up from 6.4% in 2024, driven mainly by increased interest payments on debt, rising entitlement spending, and relatively low revenue generation.”

I have to highlight this again. The potential for 9% deficit-to-GDP is a big fucking deal.

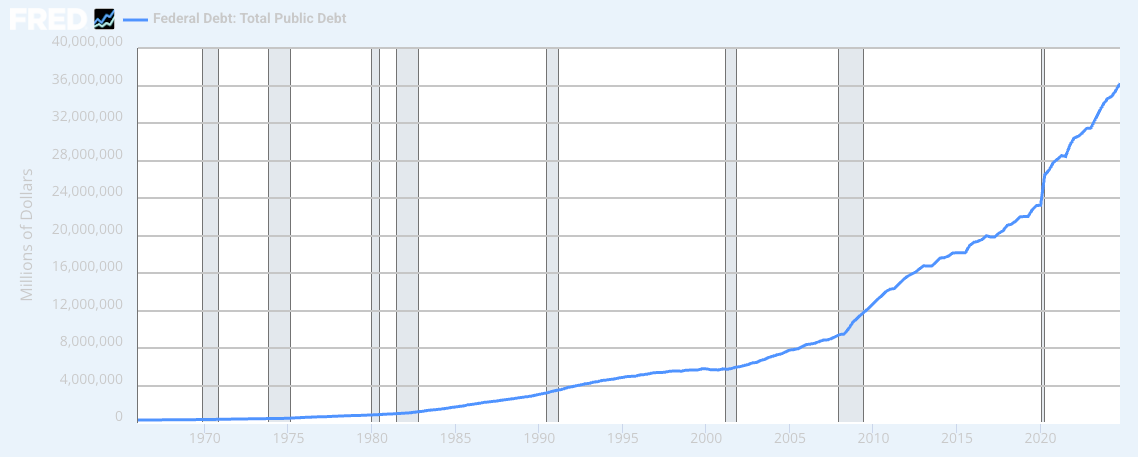

Look at that acceleration in 2020. Not good!

And as expressed as a % of our total economy (GDP), we are now at levels not seen since we really really had to, during WW2.

The US government’s fiscal house is in such disorder Marie Condo would rather perform seppuku than clean up this mess. (Joke! Don’t send me any hate mail, just admit that was a good one 😂).

To hammer in this point, this eloquent rant on drunken government spending by David Friedberg on the All in Pod this week was just awesome. A Chef’s kiss.

From David: “It’s fiscal emergency o’clock in America. There are only so many opportunities to do the hard things that need to be done. In this moment, it shouldn’t be a partisan consideration that the deficit needs to be radically reduced.”

I agree. The DOGE government efficiency effort can and should only do so much. At the end of the day, it’s Congress that really needs to define the path to fiscal sustainability.

In fact, at the current rate, the total debt-to-GDP burden will likely rise to ~134% by 2030-2035. Compared to 98% last year.

BUT wait! There is a simple solution.

Really?

Yes.

What is it?

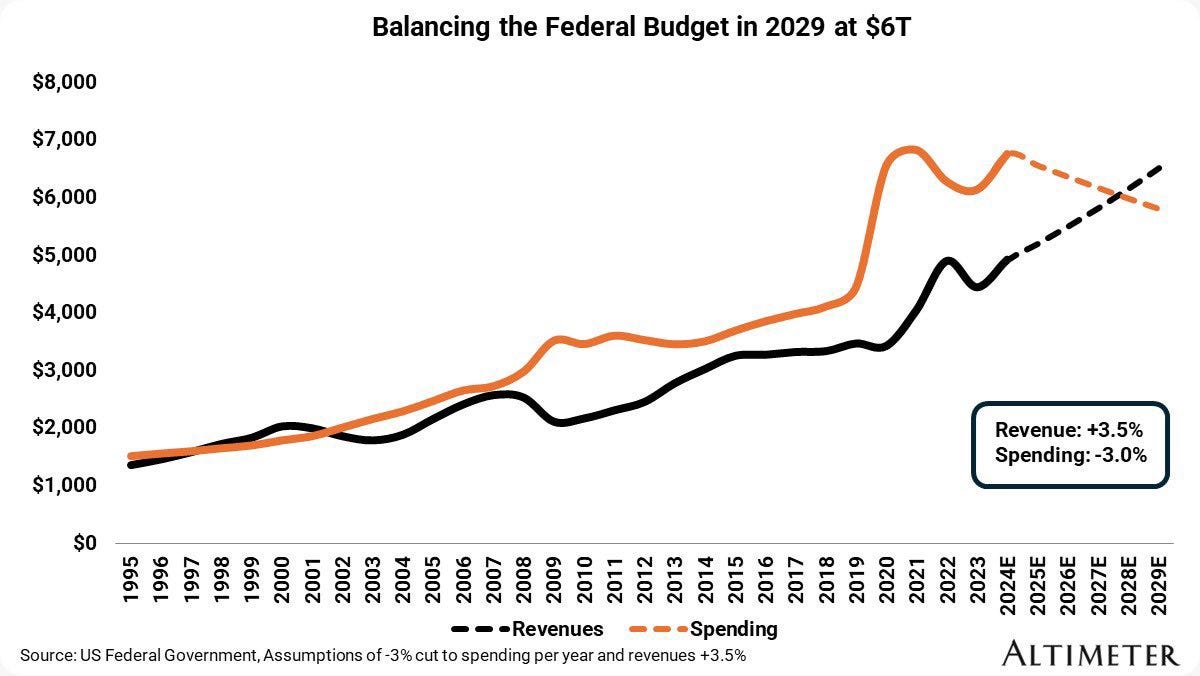

Just take spending back to 2019 levels.

Yep, that’s it….Chart on:

We lost our fiscal minds during COVID, like a drunken sailor being served by a blacked-out bartender (zing! I’m punchy today, 3 coffees down).

Federal spending jumped ~34%, from $4.447 trillion in 2019 to $6.752 trillion in FY24 (CBO). We spent so much damn money (which, again, I have written about many times before), during COVID that returning to more normal levels would mean 99% of the budget battle won. Doing so would get us back to ~3% deficit-to-GDP by 2029, which is sustainable over time, as we concurrently grow the economy at a modest, realistic 2%.

In other words, to borrow Secretary Scott Bessent’s recent media line, “we don’t have a revenue problem, we have a spending problem.”

It is now existential. And this is why Moody’s is gettin’ Moody.

I think Congress could get there by explaining to the American people that we just need to get back to normal. Back to 2019, back to 3% deficit-to-GDP (which is still slowly increasing spending over time, may I remind the reader). We should fix the current budget reconciliation bill and message it as a “return to normalcy,” and it would help if the opposition does not frame it as a “cut” in spending, to score political points. It’s not. It’s just returning to normal spending levels since diverging in 2019.

It’s time to get fit!

But the current spending bill does none of this. I’m disheartened to say."We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration," Moody’s also pointed out.

Sigh.

Why This Matters for Real Estate.

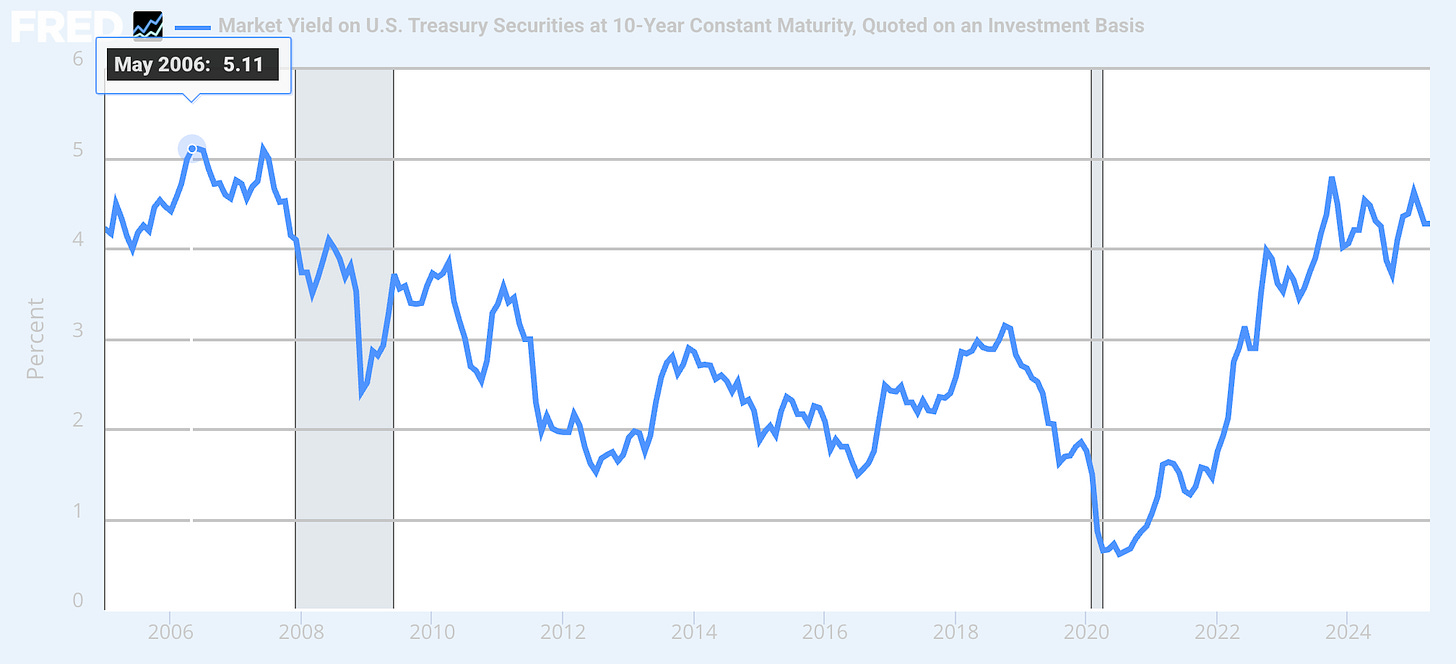

Not reigning in the debt will hit mortgage rates, via the 10 yr Treasury bond. This will be a significant short-term effect; yet, there is a range of severity depending on how the market reacts.

Markets shook off the Moody’s news Monday when the market opened, with the 10-yr traveling up past 4.5%, but by midday had settled back to below last week’s number. Chart on:

Tuesday, as I was writing, the 10-yr was down slightly, sitting at 4.481%, and the 30-yr mortgage at 6.99%. But the day has been volatile.

Wednesday, as I am finishing up, the 10-yr is back to roughly where it opened Monday, above 4.5%. Mortgage rates flat day-on-day.

In the short term, it’s going to be a bumpy interest rate ride.

*** Interested in real estate, but don’t know where to start? ***

Start by getting some coaching and mentorship. Elevate your real estate knowledge. Gain expert advice from someone who actually owns real estate.

No "guru" trying to sell you an expensive course.

No BS, just frank, brutally honest advice.

Ask anything you've always wanted to but were afraid to ask.

Starting at just $100 smackeroos. It will be the best money you've ever spent, if you don’t think so, full refund. You can’t find that guarantee anywhere else in the industry.

Join the investor-class, become an owner.

Plus, act now and get 10% off!!! Use my special Skeptical Investor link 👉. Join the Investor-Class!

Want to advertise to the more than 20,000 weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

All This Being said…Meh, For Now

In the medium term, I don’t think the 10-yr will rise above 5%, keeping mortgage rates in the 7s for now. But we are certain to get some serious volatility as a result of this Moody’s rating, both on Treasuries and on Fannie and Freddie. Remember, mortgage rates closely track Treasury bonds, specifically the 10-yr Treasury. So when interest rates on the 10-yr go up, so do mortgae rates. The Fannie and Freddie ratings could drive up mortgage-backed securities, which will also likely drive up mortgage rates. Again, in the short/medium-term.

But, if the 10-yr hits 5%, everything in the economy tends to slow way down. That would be no bueno and is a recession indicator. That high of a rate makes borrowing untenably expensive for most. A not-so-fun fact: the last time we hit 5% on the 10-yr was just before the Great Recession.

The Market Already Knew This. For the most part.

Moody’s being the last of the big three to more accurately categorize the existing debt crisis is not new information. We already knew our debt was at crisis levels (especially if you are an avid reader of this newsletter :). And, ticking down the credit rating from perfect to near perfect is not the end of the world. On this, Moody’s also said, "The U.S. retains exceptional credit strengths such as the size, resilience and dynamism of its economy and the role of the U.S. dollar as global reserve currency."

Wall Street seems to agree.

“A Treasury downgrade is unsurprising amid unrelenting unfunded fiscal largesse that’s only set to accelerate,” Max Gokhman, Franklin Templeton Investment Solutions.

Michael Schumacher and Angelo Manolatos - (Wells Fargo) - told clients in a report that they expect “10 year and 30 year Treasury yields to rise another 5-10 basis points (.05% to .10%) in response to the Moody’s downgrade.”

“Moody’s downgrade of the US isn’t a game changer for American assets. It doesn’t completely undermine US Treasuries given the depth and breadth of the market, but the underlying theme supporting diversification away from America remains intact.” - Mary Nicola, Macro Strategist

Strategically (long-term) Bullish, Tactically (short term) Cynical.

Does this change my investment thesis to buy more real estate?

On the contrary, it strengthens it.

The more short-term fear brings better investing opportunities. But I will make tactical adjustments, like any decent investor.

These predictions should not force folks to make strategic changes, especially for the long-term game of real estate investing. Moody’s move was very much anticipated by the markets, albeit a bit late. One would have thought this should have come after the spending spree of the last 5 years.

In January, the Congressional Budget Office warned that the budget deficit was running near $2 trillion a year, or more than 6% of gross domestic product. The US government is also on track to surpass record debt levels set after World War II, reaching 107% of GDP by 2029.

Treasury Secretary Bessent thinks so, and downplayed the agency’s downgrade, saying “Moody’s is a lagging indicator — that’s what everyone thinks of credit agencies.”

My Skeptical Take:

Become a Premium Subscriber

Become a paying subscriber to get access to the rest of this post and other awesome subscriber-only content, like a one-on-one with yours truly.

Upgrade for Just $5 Today!Subscription Benefits:

- Premium Content and NO Paywall

- Subscriber-only market insights

- Breaking News Analysis

- Every article we have published - a treasure trove of information and education

- Annual one-on-one coaching with me personally! ($1000 value!)