Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.01%

(👇.18% from this time last week, 30-yr mortgage)

This week, we’re talkin’ housing affordability and what the Administration has planned to address the crisis. A plan is starting to form, with a few big announcements this week.

Let’s get into it.

The Weekly 3 in News:

The economy may already be booming. The Atlanta Fed now predicts that GDP grew in the last quarter by5.1%, far exceeding consensus estimates (Atlanta Fed).

Like hot water? Like Bitcoin? Your next water heater could make you money every time you draw a bath, using the heat from processing Bitcoin to heat your home’s water + much more new tech unveiled at this year’s Consumer Electronic Show (BA).

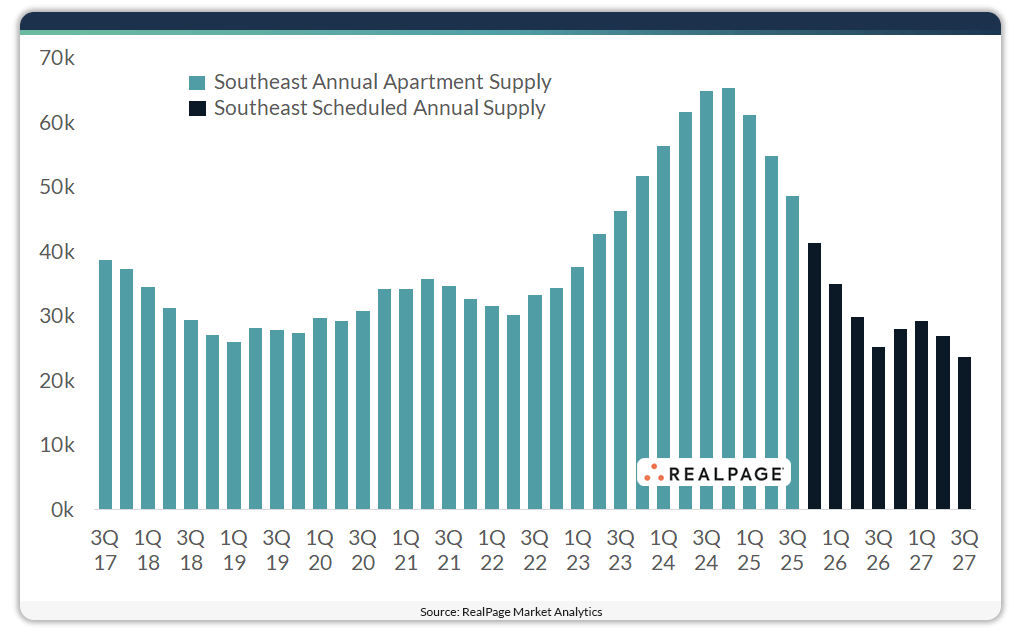

Southeastern US Multifamily Supply Will Hit Historical Lows in 2026. Apartment supply volumes across the Southeast have come down in recent quarters after peaking in 2024. Last quarter, fewer than 50,000 units were delivered across Southeast apartment markets (RealPage).

Housing and Mortgage Rates: A plan takes shape

After a 2025 year that was, say, active, the federal Administration appears to be turning the Eye of Sauron to housing.

Good.

Now, there have been several à la carte housing policy ideas thrown at the wall over the past 12 months. Most have been either inconsequential, never introduced, not feasible/practical, or were just plain poor policy ideas, such as:

The 50-year mortgage.

Potentially firing Jerome Powell / investigate him for potentially lying in testimony to Congress.

Portable/assumable mortgages.

Opening federal lands for housing development.

Restricting FHA-insured mortgages to citizens/legal residents.

But late last week, we got two more.

One political red meat, which will likely be insignificant.

And one potential banger. Which the Fed itself just stopped doing.

Let’s dive in.

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

It’s Starting to Get Interesting

A brief reminder.

Back at the beginning of September, Treasury Secretary Scott Bessant gave the first peek into the Administration’s forthcoming agenda.

Front and center: addressing housing costs.

During an interview that week, Secretary Bessant, off camera after an interview, said that the US “may declare a housing emergency.”

Bessent continued, again off camera, to talk about their push to lower mortgage rates, and shared his feelings on the tremendous inequality in both the rich benefiting from high interest rates (aka their stock/bond accounts), while the poor/middle class get crushed with higher housing costs and credit card costs when rates are high.

As a result, median mortgage payments are up 59% since 2020.

The Need for a National Housing Plan

This enthusiasm to do something big to address housing costs was repeated just the other day by White House economic director Kevin Hassett (a potential successor to Jerome Powell for Fed Chair), who said:

“We are going to have a plan, a big plan, to announce sometime soon in the new year that’s going to be very good news for the American people who feel like it’s not affordable to buy a home anymore (Fox).”

He also said that Cabinet officials plan to meet with the President in the days after Christmas to pitch and review policy proposals, adding, “We have a big list of housing ideas that have been vetted very carefully by the Cabinet secretaries to present to the president in a week or two and we will see which ones he picks.”

Well, we just got the first two pitches.

Pitch One: Stop Institutions from Buying Homes…Ball!

I rate this as a ball, a brush back on the inside corner. Sounds good but in reality it will be inconsequential.

The Administration announced that it would be “immediately taking steps to ban large institutional investors from buying more single-family homes…calling on Congress to codify it.”

“Yeah! Down with Blackrock!”

Uh, problem….BlackRock doesn’t own homes. You mean Blackstone…

“Yeah… I mean, no homes for Blackstone!”

Uh, second problem. They don’t own much, just .06% of the housing stock….

“Well…All institutions, homes are for people, not corporations!”

Eh, it’s still not significant. Entities that own 1000+ homes own just .5% of the housing stock.

Chart on:

It’s Sexy Politics

I get it.

It’s sexy for politicians to say this kind of thing.

But really, the institutional ownership of housing is mostly apartment buildings, not homes, and the number of homes they do own is quite a small %.

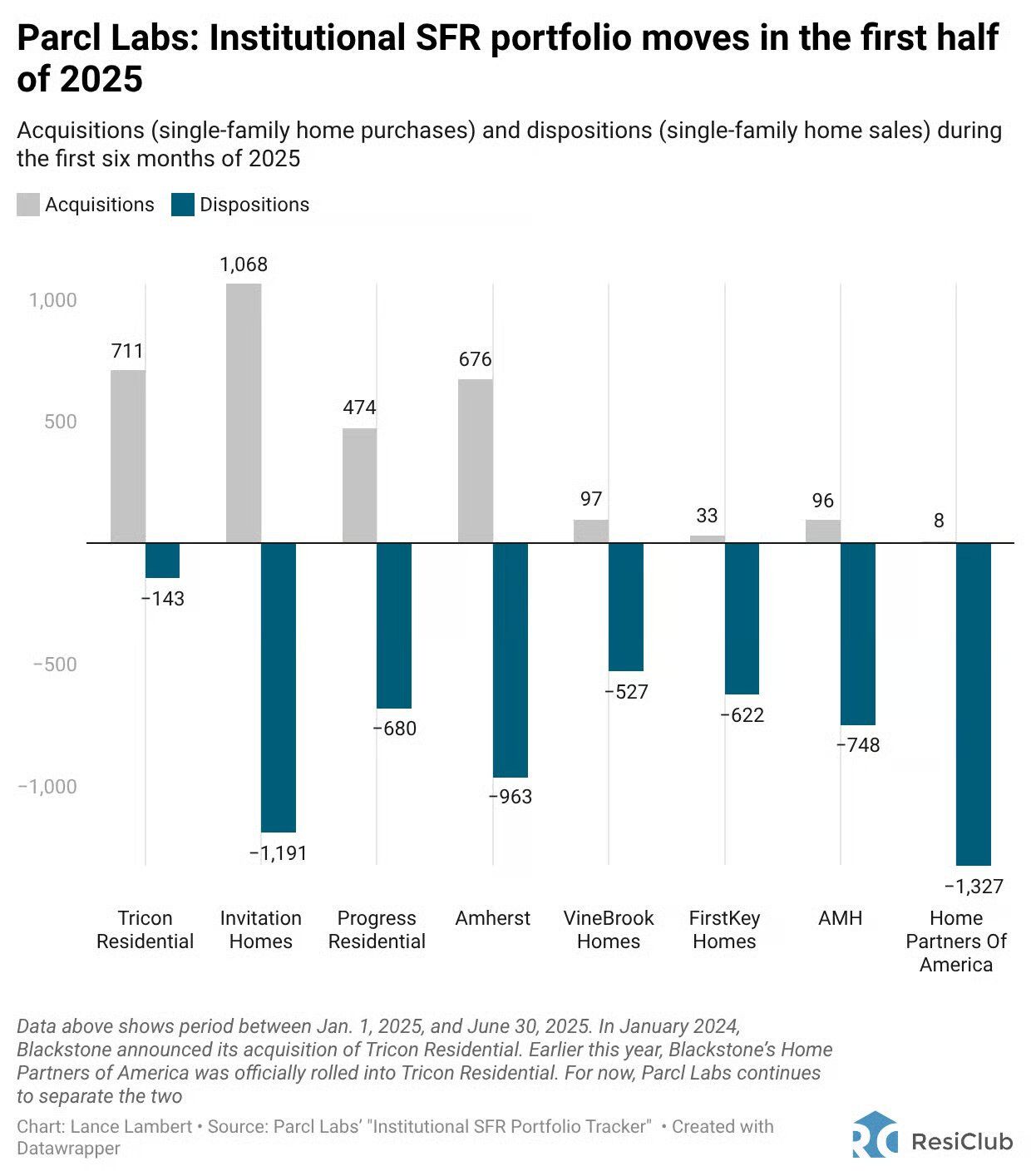

Additionally, fun fact, institutions have been recent net sellers, not buyers, of homes.

“During the Pandemic Housing Boom, there was a burst of institutional homebuying amid ultralow rates, soaring rents/home prices, and humming capital markets.

That has been over for three years (Lance Lambert).”

In fact, we still build double the number of homes per year that all institutions own in total. ~ 600,000 (Parsons).

Mom and Pops Rule

It’s mom and pop landlords (like many of you readers, and myself) who are the “king” of the single-family home market, as housing economist Logan Mohtashami puts it.

Remember, the American housing market is massive; it’s 18% of total GDP.

And the value of residential real estate just passed $55 trillion.

This is why it’s hard to control, turn or even sink this battleship.

Even the Great Financial Crisis couldn’t do that.

Of course, all housing is local, and there are markets where institutions do own a larger chunk of the homes. In Atlanta, for instance, institutions own about 4% of the total single-family housing stock (ResiClub).

Renters are People Too

Let’s also not miss the forest through the trees.

Renters are people too, so homes should be for renters too, right?

I rent a few homes to families, and because I see their background/financial history when they apply, I know most can’t afford to buy a home today.

So renting a lovely single-family home is a great option for them.

And since it’s hard to afford a home today, allowing build-to-rent development of single-family homes keeps rents down by increasing supply.

Why would we want to have fewer homes to rent?

Any federal policy should probably have a dual priority to increase rental stock + catalyze homebuilding.

Meaningful institutional home ownership is a myth.

Again, 1 ball, no strikes.

Oh and another thought. Many homes bought by investors, especially mom and pops, need significant repairs, which most home seekers do not want to take on and/or do not have the cash to pay for.

Investors provide this service, which helps sustain the rental stock.

Pitch Two: Start Buying Mortgage Bonds…Strike-ish.

I rate this a strike! (*but barely).

The President announced his intention to buy $200 billion in mortgage bonds in an effort to bring down mortgage interest rates, to be carried out by FHFA Director Bill Pulte.

Now, this financial tactic is tried and true, and can have a significant effect.

Let me do a quick explanation for context/background so we all understand what the heck is going on here.

A Brief Explainer of Mortgage Bond Buying

After you get a mortgage on your home, your bank typically doesn’t hold it on their books. They want to make more loans and collect more fees/interest.

So what they do is package loans together that meat, Fanny and Freddie standards, a key requirement since the great financial crisis, and sell them to investors.

Sometimes those investors are big government entities such as the Federal Reserve or Fanny and Freddie (F&F are still under government conservatorship, since the great financial crisis, although this should change in the future), which buy the packaged mortgages (known as mortgage-backed securities, or MBS) to provide liquidity to the bond market, while also allowing the bank to make more loans for more people to buy homes (yes yes this is simplified process, hold your emails people).

The mechanics of this process can also be used to affect long-term interest rates, including the 10-year Treasury yield and the 30-year fixed mortgage rate (they are competing bonds to buy for investors to buy), which hinge on supply and demand in the bond market. Bond yields move inversely to prices: stronger demand drives prices higher and yields lower, while weaker demand pushes prices down and yields up.

A big buyer of bonds will affect this demand.

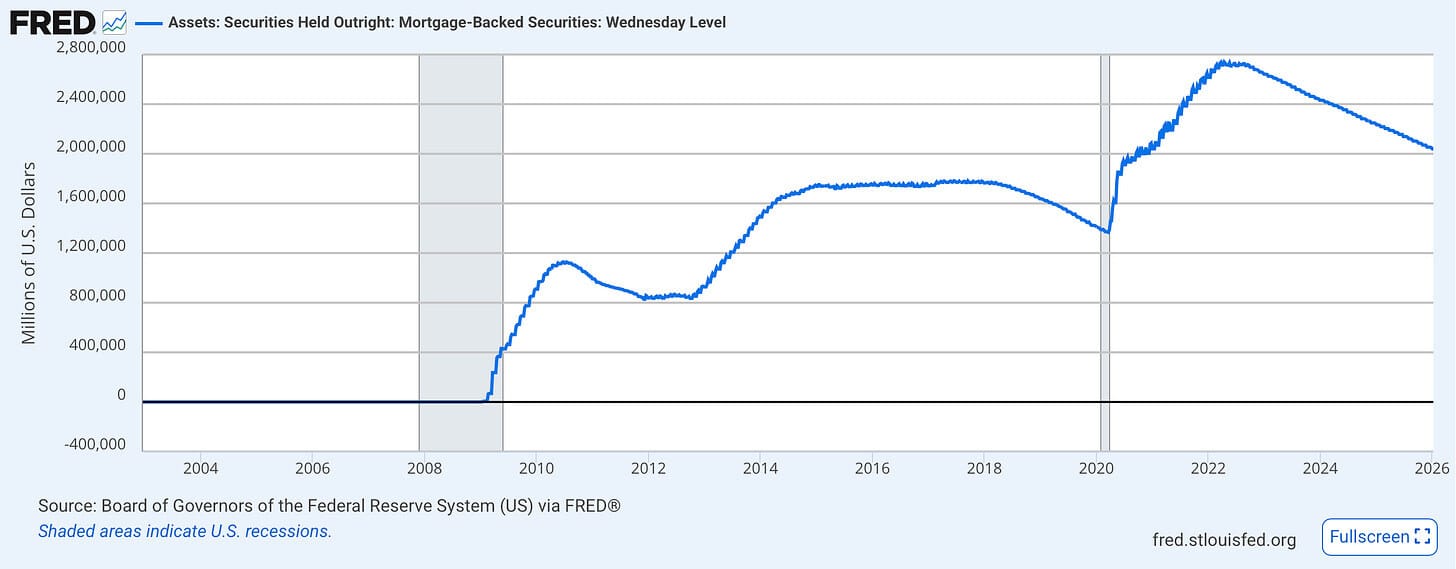

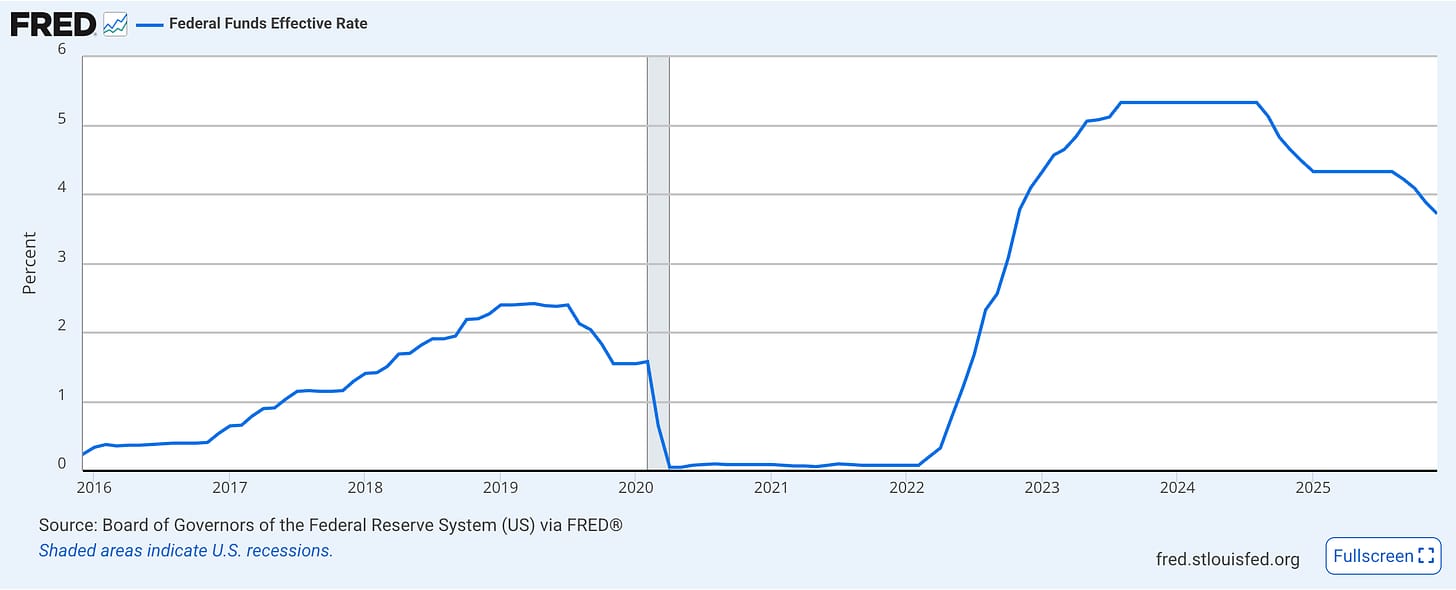

The Federal Reserve has directly influenced this dynamic in recent years. During the Covid-19 pandemic, its quantitative-easing (QE) program involved large-scale purchases of Treasuries and MBS, boosting demand, elevating bond prices, and suppressing long-term yields—including mortgage rates.

The Fed’s MBS buying exerted strong downward pressure on mortgage rates in 2020 and 2021. Since 2022, however, quantitative tightening (QT) has seen the central bank allow maturing MBS to roll off its balance sheet without reinvestment, effectively withdrawing a major buyer and contributing to upward pressure on mortgage rates.

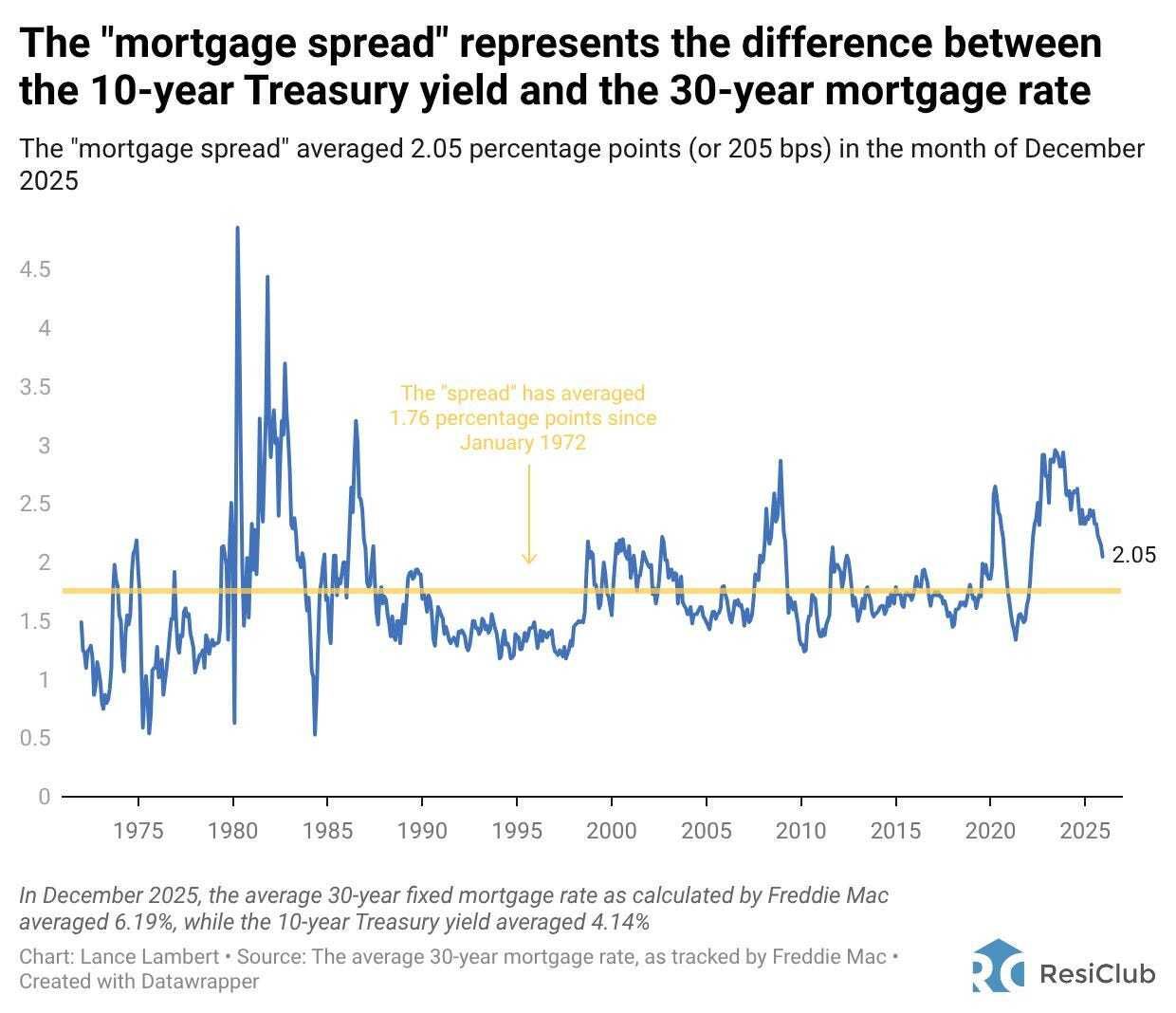

The President has now directed Fannie Mae and Freddie Mac—government-sponsored enterprises still under federal conservatorship since the 2008 financial crisis—to purchase $200 billion in mortgage-backed securities. The move aims to increase demand for MBS in the private market by having the GSEs absorb a larger share, which could modestly lift MBS prices in the near term, lower mortgage rates, and narrow the “mortgage spread”—the premium of 30-year mortgage rates over 10-year Treasury yields (as I have written about often).

The GSEs have already been expanding their retained MBS holdings, adding tens of billions in recent quarters, but the scale of this directive approaches their regulatory limits and represents a significant intervention. While the $9 trillion-plus agency MBS market dwarfs the $200 billion figure proposed, the purchases could accelerate recent compression in the mortgage spread, which stood at roughly 205 basis points in late 2025. Analysts differ on the ultimate magnitude of any rate reduction, with some estimating a modest drop potentially pushing average 30-year fixed rates slightly below current levels in the low-6% range, though broader factors like Treasury yields and Fed policy will continue to dominate.

To summarize: If a big player starts buying mortgage bonds in a major way, it can drive interest rates down.

A Quick Ad Break….RentRedi

Grow Your Portfolio — Without Growing Your Work

A smarter way to run rentals with RentRedi.

You built something valuable. Now give it the structure it deserves.

RentRedi brings your rental business into one clear system — so you spend less time managing tasks and more time building wealth.

In one place, you can:

Collect rent and see payments as they happen

Keep reminders and late fees on track

Screen applicants with consistent standards

Track maintenance with photos and updates

Store leases, inspections, and notices securely

One platform. A clear view of your portfolio. More confident investing decisions.

Plus, The Skeptical Investor readers get $100 off. Click this referral link and take it for a test drive today.

Want to advertise to the more than 30,000+ weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

Quantitative Easing: a favorite Fed tool

Before the 2008 crisis, Fannie and Freddie did a LOT more buying of mortgage backed secueities.

They were the market stabilizer.

But since 2008, the Fed has taken over, moving this function from private industry to government control, as Fannie and Freddie were put under government conservatorship.

Here is a great chart by ResiClub’s Lance Lambert showing this historic change in responsibility.

Now, the Fed has done a LOT of mortgage bond buying since 2009 as a way to stimulate the economy, provide market liquidity, and bring down interest rates - primarily when there was a crisis. But not always (2013-2018).

But since 2022, the Fed has been rolling MBS off its balance sheet, concurrently as it raised interest rates, to halt inflation (which it helped to cause).

And it still owns an astonishing $2 trillion in MBS!

And even though the Fed has been loosening its restrictive monetary policy since 2024, by lowering interest rates, it has not restarted buying mortgage bonds.

If You Can’t Beat Em, Join Em

Now, the President wants the Fed to lower rates faster, which they have been resistant to do.

So, if you can’t beat em, join em!

The Administration, through Fannie and Freddie, has restarted the QE party and is purchasing mortgage bonds.

This could bring down mortgage interest rates.

We have seen rates drop .15% since the announcement.

Caveat: this accelerated $200 billion MBS buy by Fannie and Freddie actually started last year. But the threat of buying more is also moving the bond market.

Moreover, and in my opinion, if the Fed does not lower rates this year to the degree the Administration would like, the US Treasury will step in and use their bazooka start buying more mortgage bonds to force rates down

QE is a Needle that Must be Thread

Now, will this fix housing? Of course not. Not even close.

Will it slam interest rates back down to 3%?

Nope. Not that either.

$200 billion is not enough; once again, you need much more to move this battleship.

And the Administration likely knows this, which is why we need to be careful here.

QE is inflationary, so doing too much could exacerbate high home prices.

But it will help and is a good little step, in my humble opinion.

This needle can be threaded as long as the treasury is nuanced in its approach.

And I think if there was a Treasury that could do this successfully, it would be the current Treasury Secretary Scott Bessent, who is a lifelong bond expert operating in the arena.

Interest rates are too high, and the Fed is taking too long and has been too cautious.

What else can we do here?

The question really is, on housing affordability, what else can the president really do here?

The President is limited in their power to affect interest rates, which are really a product of the bond market. So they are entering the bond market to nudge them down. But even the federal government can’t move the whole system on its own.

I rate this a strike! But barely, right on the outside line of the zone.

True, this may help lower rates somewhat, and I think it’s not a terrible idea if done short-term, as the Fed is still in a rate-lowering cycle and inflation is coming down.

But again, this will be helpful, not monumental.

We really need something much bolder, if we are going to tackle housing affordability.

The Administration is said to be working on sharing more details of its plan to boost housing, and the rumor is that they will divulge more at a speech in Davos during the week of January 19.

If they really want to get serious about it, there is one big step they can take….👇

My Skeptical Take:

All housing is local.

And the real crisis is not so much because of high mortgage rates, which targeted policies and Fed rate cuts will lower.

The real crisis is in the supply of homes.

The problem emerged out of the 2008 Great Financial Crisis, where developers and banks didn’t build and fund enough housing, leading to a lost 2 decades of limited housing supply coming on market, then following that with too much stimulus to restart things, spiking inflation and high prices mixed, then pouring more gasoline on the fire by accelerating demand via the Fed’s zero interest rate policy in reaction to the COVID pandemic scare.

Ahhhhh oh the humanity! (Seriously, please stop this seesaw @TheFED).

How we alter the supply of homes?

We have to tackle local building, zoning, over-engineered codes, impact fees and permitting regulations.

These are what’re strangling homebuilding.

According to the National Association of Homebuilders, regulatory policy accounts for….

…checks notes…

25% of homebuilding and 40% of multi-family development costs (NAHB)!

Ask any homebuilder.

Ask your local contractor.

Ask your neighbor, who can’t add 2 beds and baths over their garage for their expanding family because the permiting and time makes it cost-prohibitive, or, even worse, the city planning official is having a bad day and just wants to tell everyone “no” (I’ve experienced this firsthand, it’s bullshit).

They’ll all tell you.

Thus…

We will know that the Administration and Congress are serious about tackling housing affordability ONLY when they do one thing:

They threaten states and localities by withholding federal dollars until they change these insanely restrictive rat’s nest of home and housing building policies.

This is the cornerstone to fixing housing affordability. And it will take years to implement.

I hope the Administration takes this step, and utilizes it as the cornerstone of an “emergency declaration on housing.”

Options from this Administration could include:

Forced zoning/density reforms.

Standardize building codes and roll back over engineering in the same name of “safety.” Ironically, safetyism is dangerous.

Provide low-cost loans/guarantees to builders/banks.

Provide more significant incentives for homebuilders + for landlords to renovate and add square footage to existing properties.

Reduce closing costs and offer homebuyer assistance.

Release Fannie and Freddie from government conservatorship.

Provide Federal land to developers for housing.

Suspend or waive environmental and permitting regulations.

Continue to influence the Fed, and nominate more dovish Federal Reserve Governors.

I bet we can think of more, just give me another cup of coffee….

In short, we need a Manhattan Project for Housing.

A plan that is big and audacious.

Hell, we built the Hoover Dam and Golden Gate Bridge in ~5 years, at the same time, during the Great Depression, with 1930s technology!

Why aren’t we still doing this?!

It’s time to get building in America.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. If you need a little push, here is my new book! It is a MUST for all real estate investors. The 5 Ways Real Estate Investors Make Money and Build Wealth: Anyone can create wealth through real estate. Including You! (yes yes, it’s a shameless plug, but we authors make ~$1/book, FYI. This is about education!). So pick your copy up today!

Please Share this Article!

We have passed 50,000 subs! Thank you for your support, next stop, 60,000!

Please help grow the community!

It takes me several hours to write this weekly article, and they will always remain free (but you get some pretty cool perks with premium, including a one-on-one with yours truly :). All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you want, a cookie? 😅

Subscribe Today! (and get some amazing perks)

Paid subscribers get the best stuff! Join the Skeptical Investor Community to access:

Premium content and NO paywall,

Every article we have published - a treasure trove of information and education,

Conversations with other investors in the Skeptical Investor community, and future meetups and special events,

Key insights and predictions on the latest financial news,

PLUS, subscriptions include an annual one-on-one call with me personally. So make sure to take advantage! Subscribe today.

Just $5 bucks a month.👇

Ready to Start Investing in Real Estate? Know someone who does?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great real estate deals, as well as manage their rental properties, here in Nashville, TN. We pride ourselves on being tough negotiators. We want our clients to get an amazing deal, we never let our clients pay retail.

Enjoying this newsletter? Know somebody looking to buy real estate? Send them to the best in the business, THE Nashville Investor Agent! Referring real estate business helps us keep the lights on and me keep pushing out fresh real estate analysis each and every week. Help peep this newsletter going for all you awesome folks out there; refer someone to us when you may hear they are in need. We promise to take great care of them and make sure they get a fantastic deal. They will thank you for it.

If you or someone you know are looking for an investment property, give us a call today!

You can also find out more about us and what we offer on our website: www.NashvilleInvestorAgent.com

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. We have the lowest unemployment rate of the top 25 major cities and folks are moving here to take those jobs. Nearly 90+ people per day move to Nashville. And tourism continues to hit record levels. This past year 16.8 million folks visited our lively city. Plus we have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, no state income tax… to name a few amazing advantages. Come check us out, the water is warm :).