Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.16%

(👇.02% from this time last week, 30-yr mortgage)

This week, we’re talkin’ state-to-state migration and population growth. New Census numbers show us who is a grower and who is a giver. This is a major league issue for us real estate investors, especially when overlayed with housing unit supply levels and unemployment levels.

Let’s get into it.

The Weekly 3 in News:

A New Fed Chair Nominated! The President is nominating Kevin Warsh to replace Jerome Powell this Spring as Chairman of the Federal Reserve, who is seen as a pro-lower interest rate policy dove (Bloomberg). And he probably said something like this pro-growth message to get the job (Fox). (I’ll dive more into this next week).

Florida Housing Inventory is Finally Falling. Florida now has 0.5% fewer homes on the market, vs a year ago. Inventory down -14% from the peak last May.Still elevated, but hopefully normalizing. However, the condo market down there is still in the swamp (Altos).

Deadly Freeze in the Sunbelt. Historically cold winter storms are still sweeping across the US, including the Sunbelt, claiming the lives of 70 people thus far. In my home market of Nashville, power to much of the city was knocked out by trees heavy with ice falling on more than 100 powerlines. I’ve gotten a lot of use out of my Husqvarna chainsaw this week! (NBC, News5Nashville).

US Census: US Population Growth is Slowing…

…But not all states are.

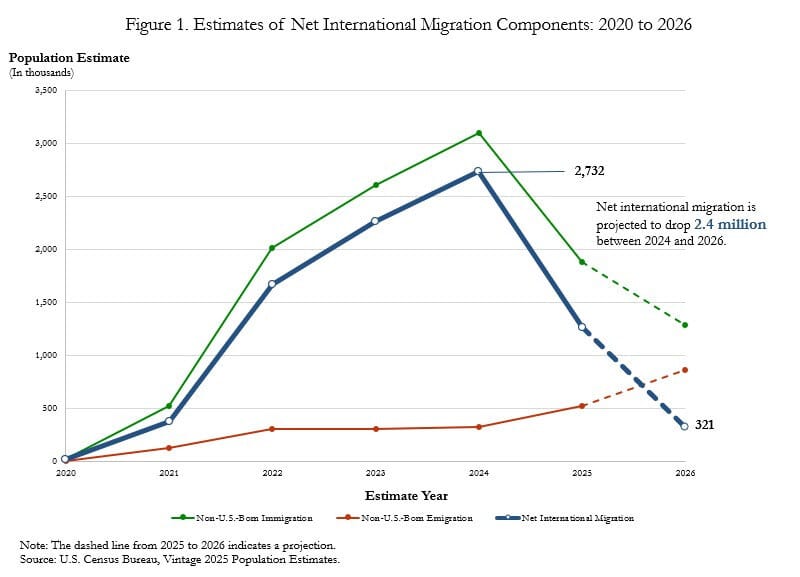

According to new US Census numbers, US Population growth slowed significantly last year, with net international migration plummeting more than 50%.

Wow.

More specifically, the U.S. added just 1.8 million people (+0.5%) between July 1, 2024, and July 1, 2025, reaching a total population of ~341.8 million — the slowest growth since the early COVID era (0.2% in 2021).

However, this was from a heightened base. The previous year (2023-2024) saw a record 3.2 million (or ~1.0% of the total US population) legal immigrants, which was the most since 2006.

The US still allows far more immigrants than any other country. Rounding out the top 5 are (OECD):

United Kingdom — ~417,000 (Note: they had gross inflows at a record high, up 52%, so this may be an anomaly).

Canada — ~369,000

United Arab Emirates — ~278,000

Australia — ~139,000

Note: these are net inflows, which could include both folks permanently coming and leaving. Germany and Spain fell off the list after being dramatically after Ukrainian refugee immigration fell off.

Clearly, the Administration’s crackdown at the border last year is having a meaningful effect on population growth; international migration fell from 2.7 million to 1.3 million (-53.8%).

States: The Winners and Losers

Unlike spreading peanut butter, some states are winning population share, and some and serioulsy hemeraging.

Let’s take a look.

When it all clicks.

Why does business news feel like it’s written for people who already get it?

Morning Brew changes that.

It’s a free newsletter that breaks down what’s going on in business, finance, and tech — clearly, quickly, and with enough personality to keep things interesting. The result? You don’t just skim headlines. You actually understand what’s going on.

Try it yourself and join over 4 million professionals reading daily.

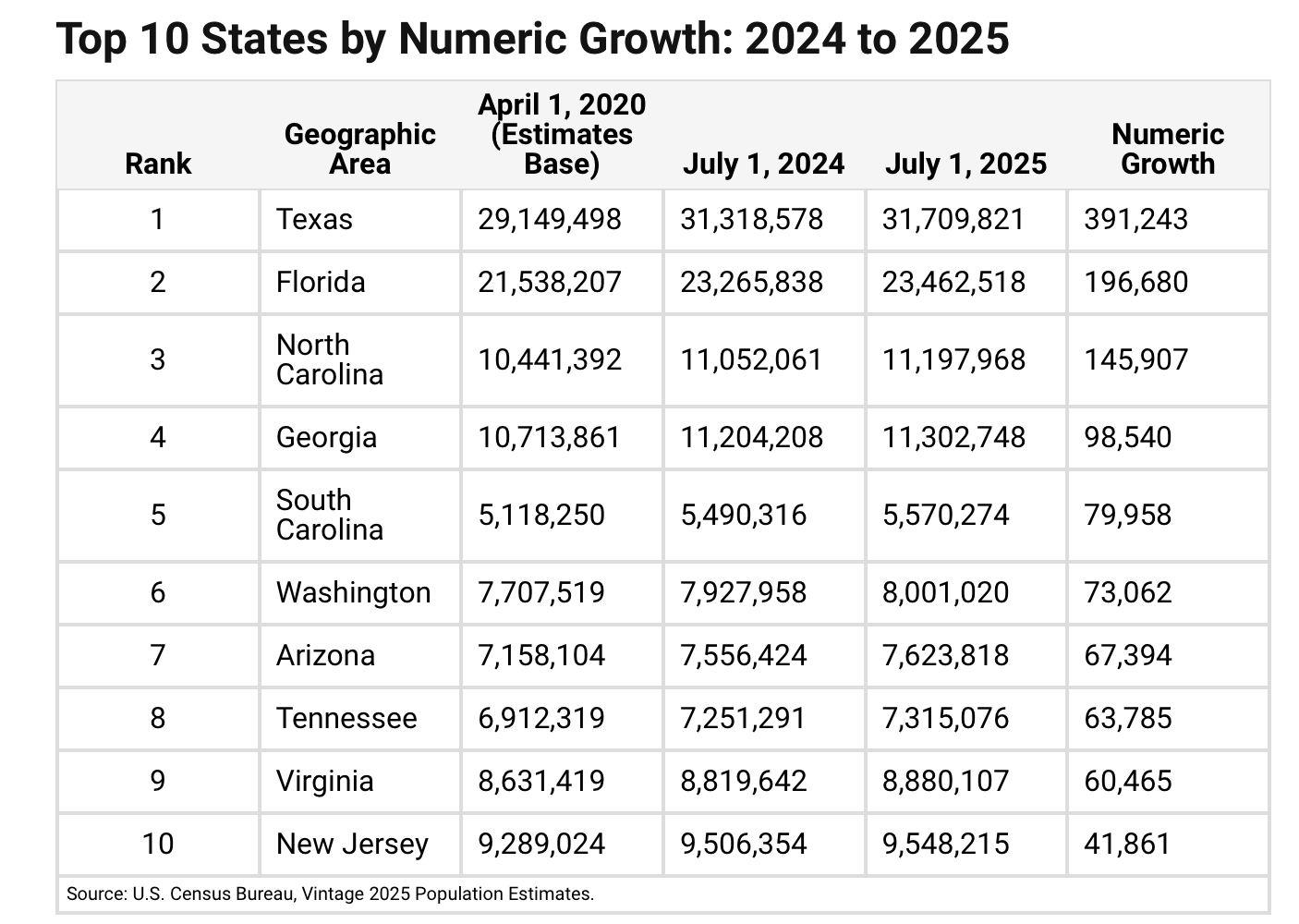

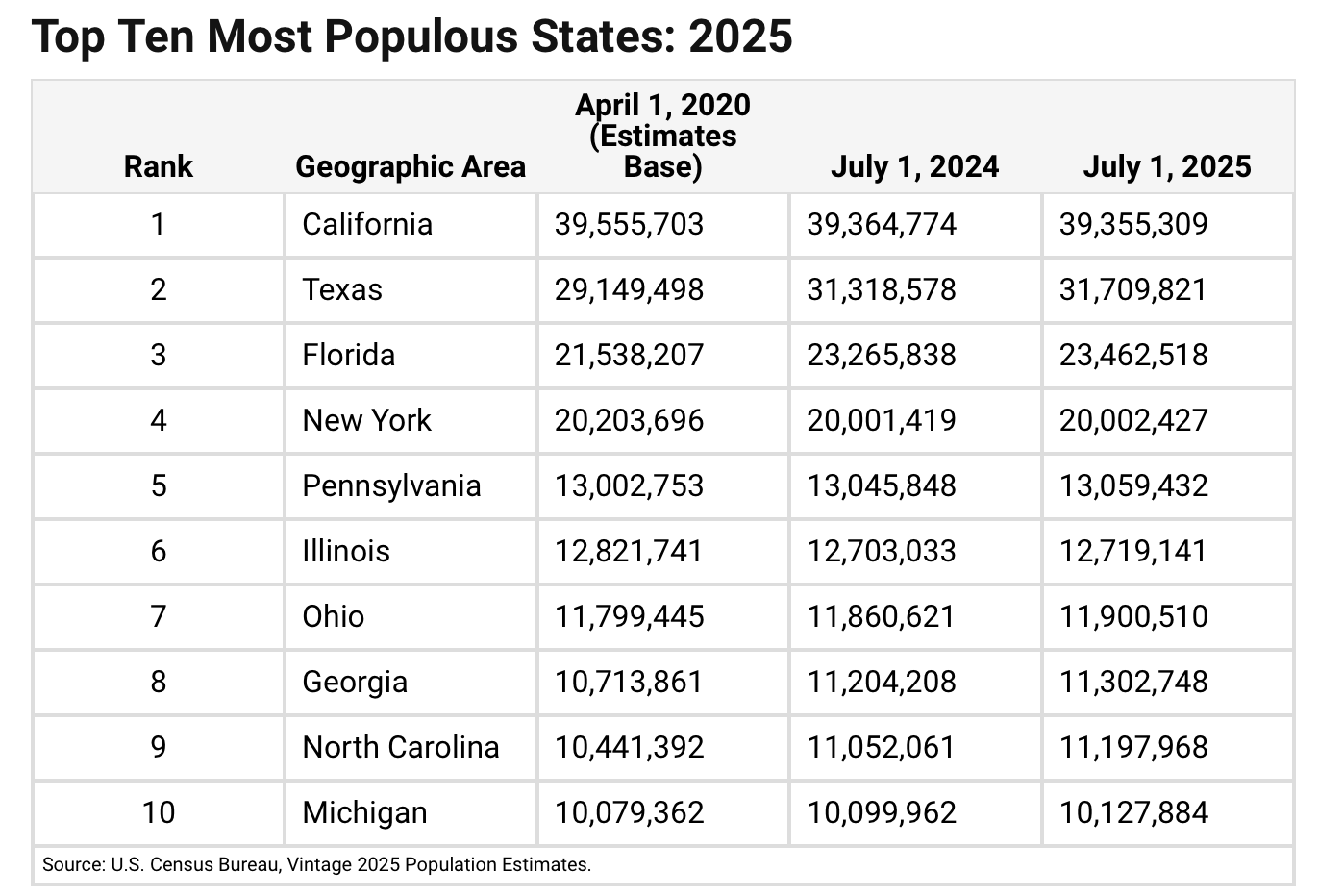

In fact, nine States gained more than 60,000 residents last year from total net migration, which includes net domestic migration + net international migration.

Led by Texas, Florida, and North Carolina, these states saw the largest net growth by the numbers.

Interesting Florida Anecdote: Florida’s net domestic migration (22,517 in 2025) was down sharply from 2023 (183,646) and 2022 (310,892). While Florida has often ranked at or near the top state for net domestic migration, in 2025, it ranked 8th. Much of it’s 2024-2025 growth was from international migration.

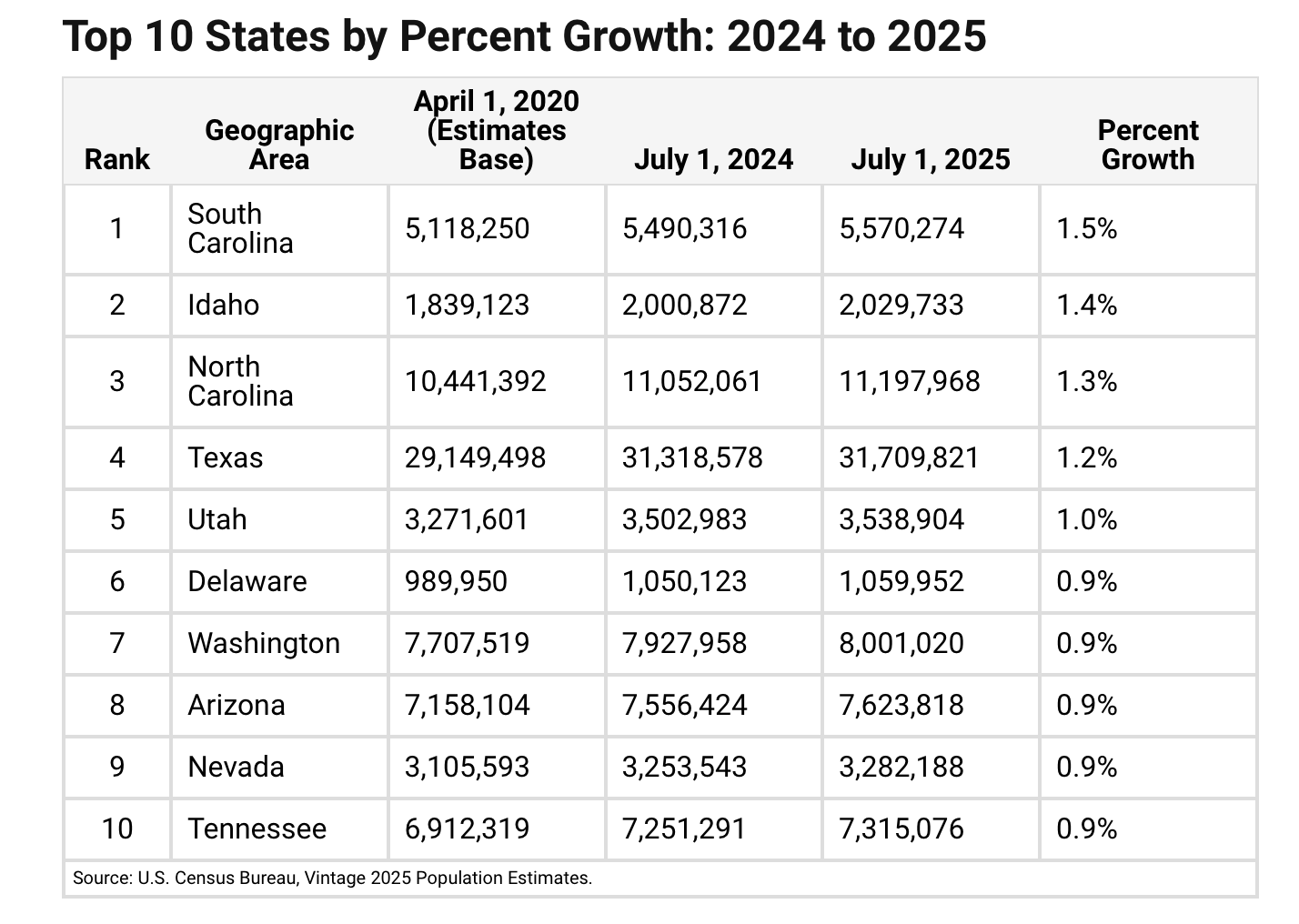

And as a percentage of the population, it was South Carolina that took home the gold, growing 1.5%, followed by Idaho and North Carolina, with my home state of Tennessee rounding out the top 10 % growers.

Only 5 states were top 10 growers by raw numbers and as a % of their population, with my home state of TN being one. Looks like a few states need a little more volunteering in the babymaking department to catch up to us. Yes, I’m a homer :).

Domestic U-Hauling: What is Driving this?

Sun Belt states posted large net domestic migration, but these gains were far smaller than the 2021–2023 boom years during COVID, when low rates, remote work, pandemic fears, and affordability gaps drove massive inflows.

What we are seeing here in the post-COVID era is a normalizing of domestic migration state, with the standout population shifts likely based more on:

costs of living,

insurance cost spikes and difficulty in obtaining it,

on-site job relocation (a return to in person work),

state taxes, and

political preferences, in my opinion.

The U-Haul Numbers

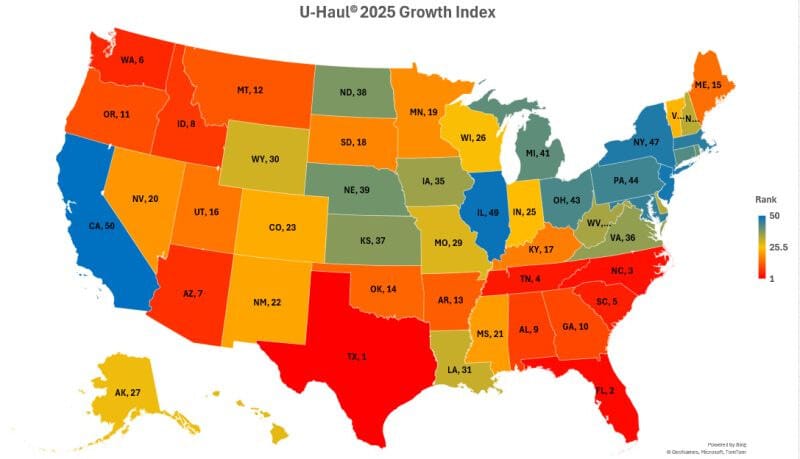

Fun fact: the cost to rent a U-haul is often seen as a proxy for population growth trends. For example, the cost to rent a one-way truck from CA to TN far more expensive than the reverse.

Texas reclaimed the top spot as the #1 U-Haul destination state, followed by Florida (#2), North Carolina (#3), Tennessee (#4), and South Carolina (#5).

8 of the top 10 growth states are in the South, with WA(#6) and ID(#8) remaining quite popular too.

Regional and State Trends

Getting back to the Census data, all four US regions grew more slowly (or saw accelerated losses) year-on-year.

The booming South still boomed, but less: going from 1.4% to 0.9% growth.

The Northeast went from 0.8% to 0.2%.

The Midwest stood out as a new entrant, reversing course from years of stagation: every state gained population, and the region recorded its first positive net domestic migration this decade (+16,000), reversing losses of –175,000+ in 2021–2022. Modest natural increase gains helped, too. Ohio, for instance, was +11,926 (vs. –32,482 in 2021). A major reverse.

Looks like a lot of Netflix and Chill happining up there in Ohio. ;)

Who Won?

South Carolina.

It was the nation’s fastest-growing state by population % (+79,958 people, +1.5%), driven primarily by +66,622 net domestic migration (down slightly from 1.8% prior year). Idaho (+1.4%) and North Carolina (+1.3%) followed, also powered by domestic gains.

Texas (+391,243 people, +1.2%) led in raw numbers, relying more on natural change and international migration (167,475) after domestic inflows cooled.

Florida grew by ~196,680 people (~0.8%), but net domestic migration fell to +22,517 (to 8th) — down from 183,646 (2023) and a peak of 310,892 in 2022. Neighboring Alabama (+23,358) actually outpaced Florida in domestic gains.

Fun fact, Florida owes last year's growth to international migration (178,674), which remained Florida’s biggest driver and bucked the trend of lower US immigration.

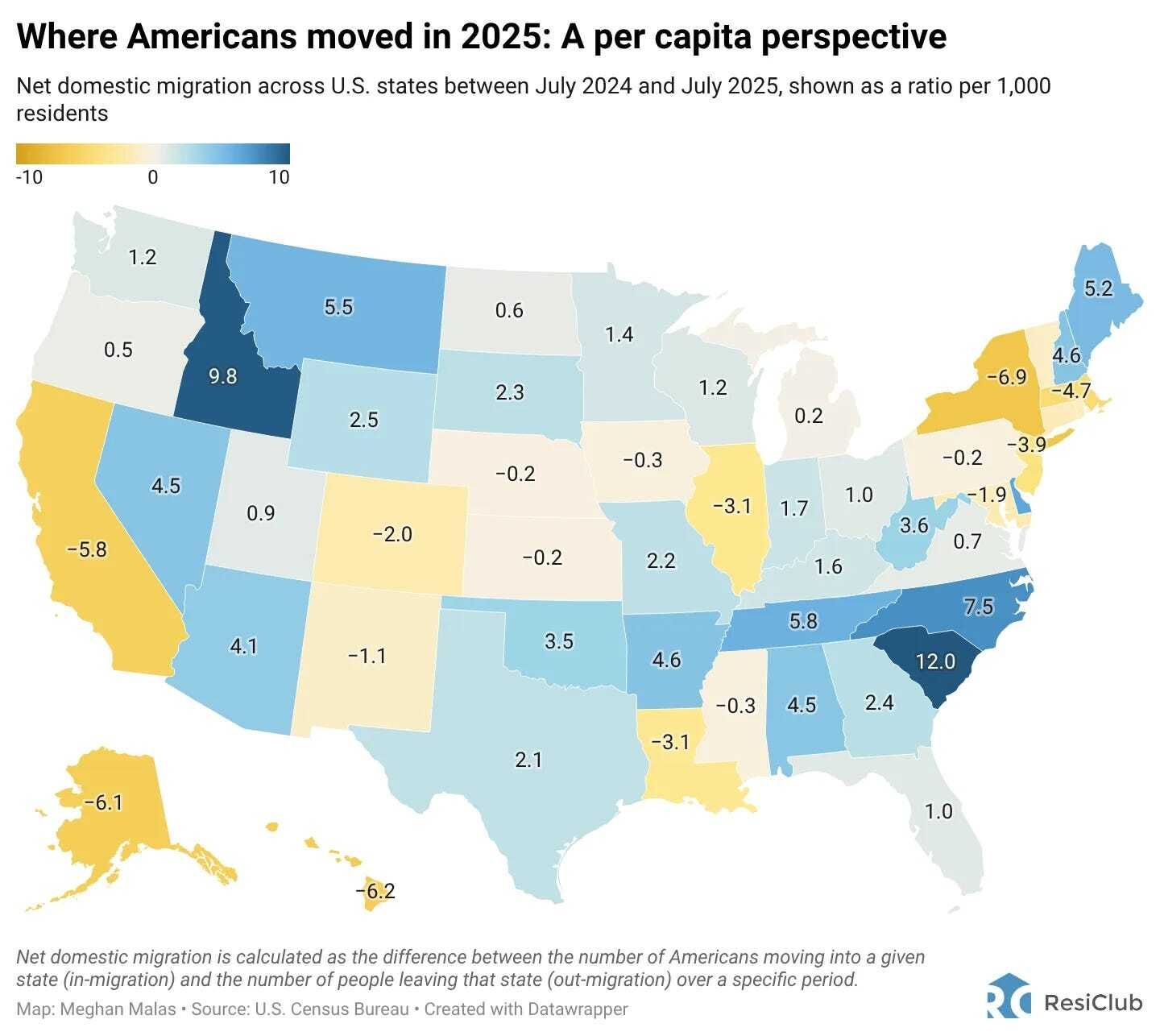

To illustrate this further, let’s look at a visual of just domestic migration but on a per-capita population % basis. A chart here from ResiClub Analytics:

Again, we see South Carolina, Idaho, and North Carolina emerge as the top destinations for net domestic migration.

A note on international immigration:

Again, to be clear, people are still immigrating to the US. Despite the news ginning us all up into a political fervor (see the data above). Net international migration remained positive in all states, but the rate of growth also fell in all states.

The top states for net international migration were:

Florida (178k)

Texas (167k)

California (109k)

New York (96k)

What Were the Donor States?

I think we can imagine the answer now. Five states declined:

California (-229,077)

New York (-137,586)

Illinois (-40,017)

New Jersey (-37,428)

Massachusetts (-33,340).

But don’t count California out yet. The Golden State is still by FAR the most populous state, at just shy of 40 million people, that’s ~7.4 million more than #2 Texas.

But the gap is narrowing.

A Quick Ad Break….RentRedi

Ready to Take Your Property Management to the Next Level?

Enter RentRedi. Built by landlords, for landlords

Inspired by people like you, RentRedi makes managing properties smarter, simpler, and more human. Many members of our team also own and manage rental properties.

Plus, The Skeptical Investor readers get $100 off. Click this referral link and take it for a test drive today.

Want to advertise to the more than 30,000+ weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

Some States Losing Political Capital

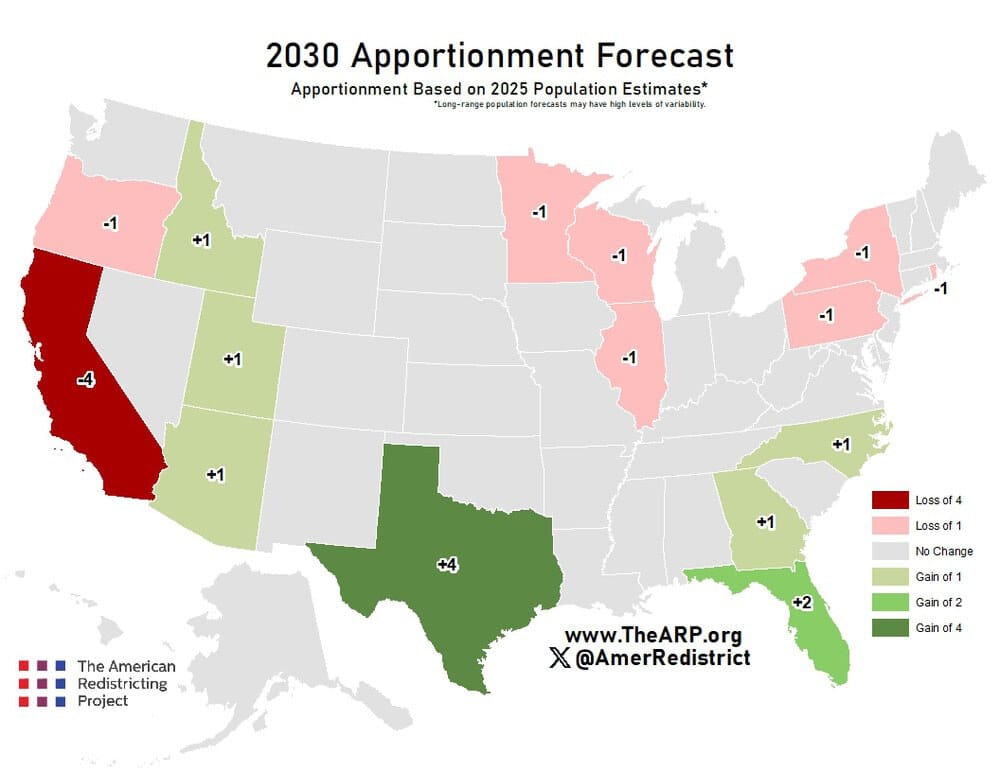

Remember, per the US Constitution, the Census population numbers dictate something else: political power.

The number of congressional seats and electoral votes a state has is directly determined by its population. Based on these numbers, and if current trends continue, several states will lose or gain congressional seats after 2030.

For example, California could lose an additional 4 seats due to waning population numbers. Again, California lost 229,077 people to net domestic migration between July 2024 and July 2025. Texas and Florida could gain 2-4 seats each. Here is a map of the potential electoral losers and gainers in 2030.

Chart on:

This will affect presidential elections as well, post-2030.

Of course, a lot can happen in 4 years, but this trend is likely not to change drastically given curent political climate and the Federal Government’s immigration posture.

My Skeptical Take:

For real estate investors, population dynamics matter profoundly as they directly influence housing demand, labor availability, and policy environments.

We want to landlord where population is growing and jobs are plentiful (low unemployment, keep reading).

The pandemic housing boom amplified net domestic migration into Texas and Florida, where inflows often involved higher-income households outbidding locals, exacerbating home price surges in metros like Austin (up 35.22% over 5 years through Q2 2025), Tampa (up 68.01%), and Cape Coral (up 51.34%).

Dramatically higher prices and softening migration numbers have exacerbated housing inventory swells in certain parts of the country, contributing to demand softening and price corrections.

For investors, this cooldown has tempered real estate investing exuberance in Florida and Texas, where we could see further price softening in overbuilt pockets (like Cape Coral and Austin), where inventory is up +30% YoY.

But…

…in reality, what one should focus on is growth and jobs.

As long and area is attracting more residents and unemployment is low (5% or under is considered full employment), these are what matters most.

Frankly, even the cities that exploded during COVID will be just fine. They are growing into the inventory that was built for that same reason. This absorption is rapidly happening now.

New Labor Market Data is Positive

Speaking of unemployment, the BLS released new December labor market numbers, and the results were encouraging.

Unemployment was higher month on month in just 6 states, and stable in 44 states + DC.

Let’s look at those growth states again for context and market targeting.

Cross-referencing the state-level data for population growth and the national unemployment rate of 4.4%, we can see the performance among the top growth states:

(*Paid subscription cut off - Subscribe to see the rest of this article!*)