Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.19%

(👇.05% from this time last week, 30-yr mortgage)

This week, we’re talkin’ inflation, inflation, inflation. And why we are likely already be at the Fed’s 2% target.

Let’s get into it.

The Weekly 3 in News:

Inflation: Objects in the Mirror May be Closer than they Appear…

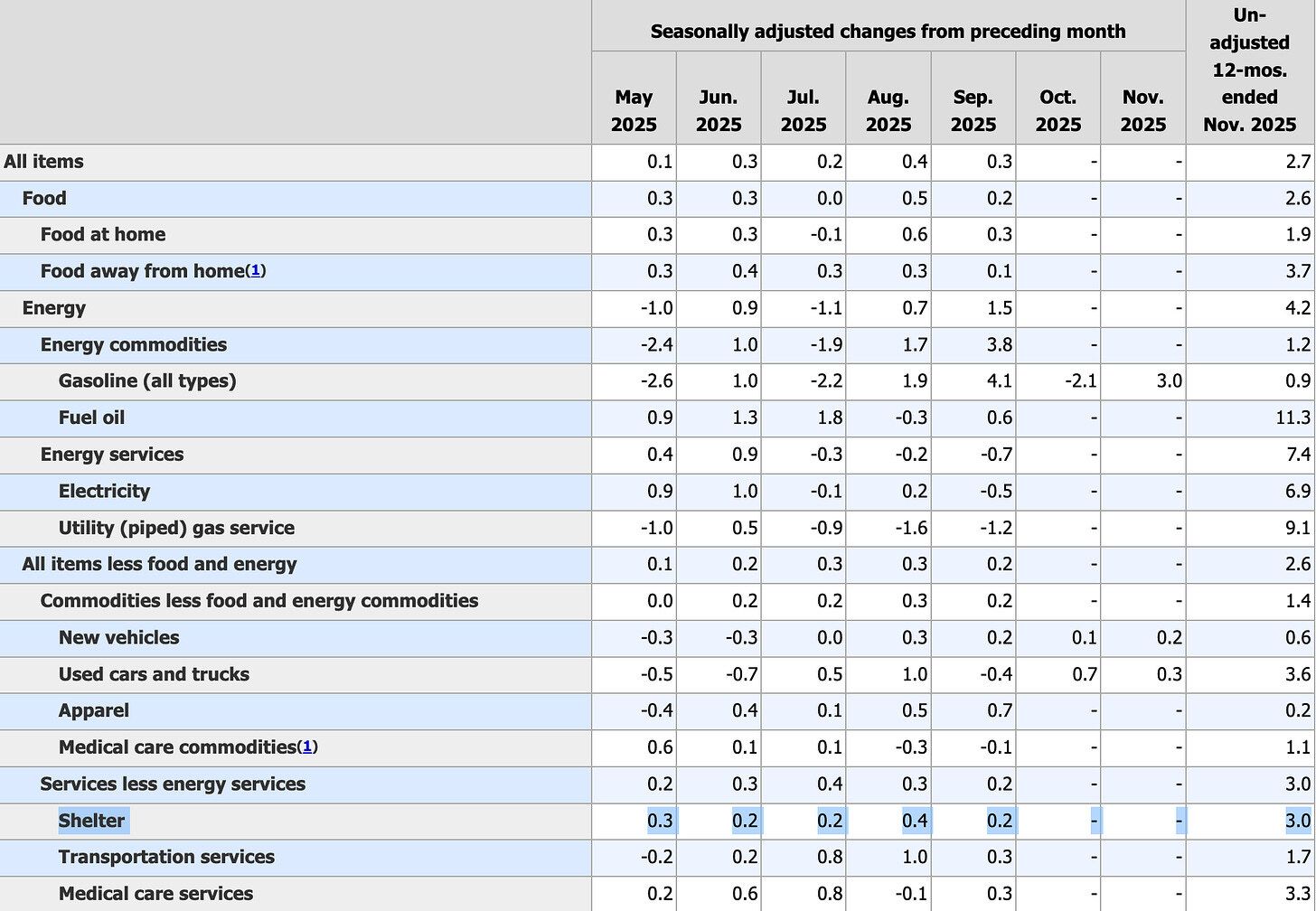

We finally got an “official” inflation reading from the Bureau of Labor Statistics (BLS), and admittedly, it was quite positive:

The consumer price index (CPI) came in at .2%, or 2.6% annually, an unexpected deceleration for November after hitting 3% in September.

It was the first CPI report from the BLS since the October government shutdown. So for October, we don’t have any data to compare.

Warning Label: The inflation numbers should be interpreted with caution due to spotty data collection during the shutdown.

However, inflation data does show a cooling off again, after months of gradually increasing.

Nevertheless, count me skeptical.

And it’s not because of the spotty data during the shutdown.

It’s that the largest weighted number, shelter, is complete bull$hit.

What’s Wrong with the BLS Shelter Number?

Now, even IF you believe the shelter number of ~3%, it would be a 2020 and 2013 low.

This would be positive. So why are my gears grinding?

Because it’s actually even better. Much better.

And I’m sick and tired of the data from the BLS that is absolute shit.

We are absolutely not growing shelter inflation at a 3% clip. Not even close.

Why?

No, it’s not just an anecdote from my rental properties (which averaged 0-1% increases this year).

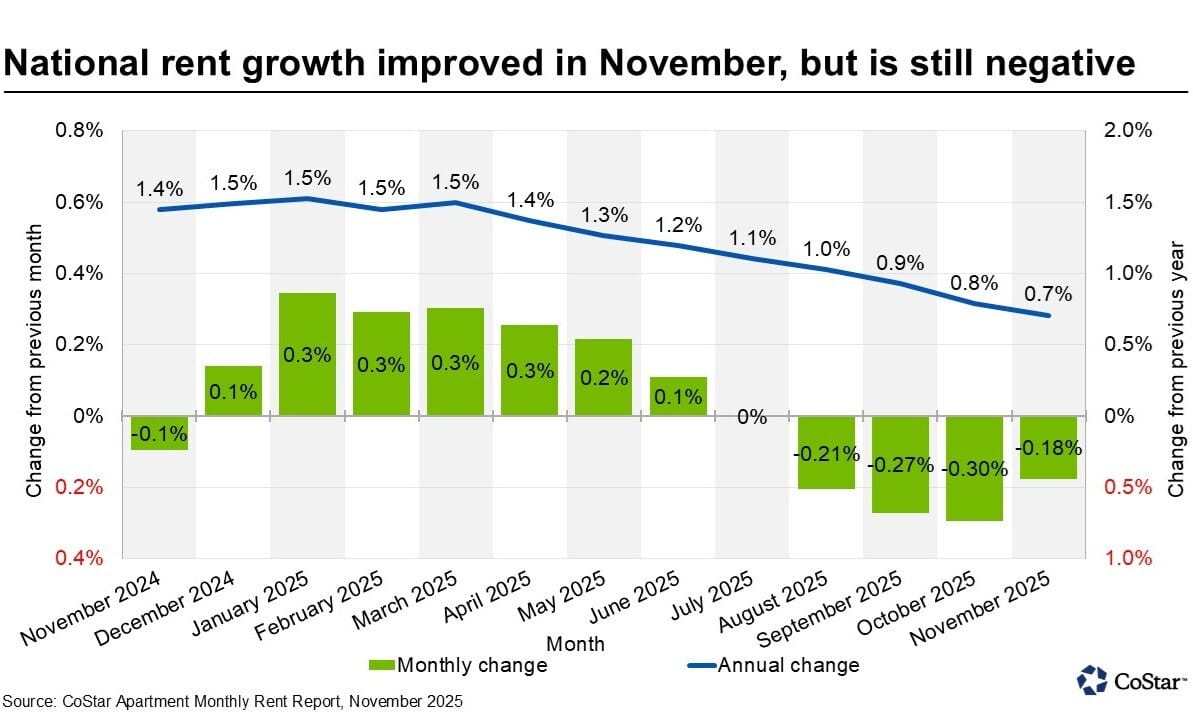

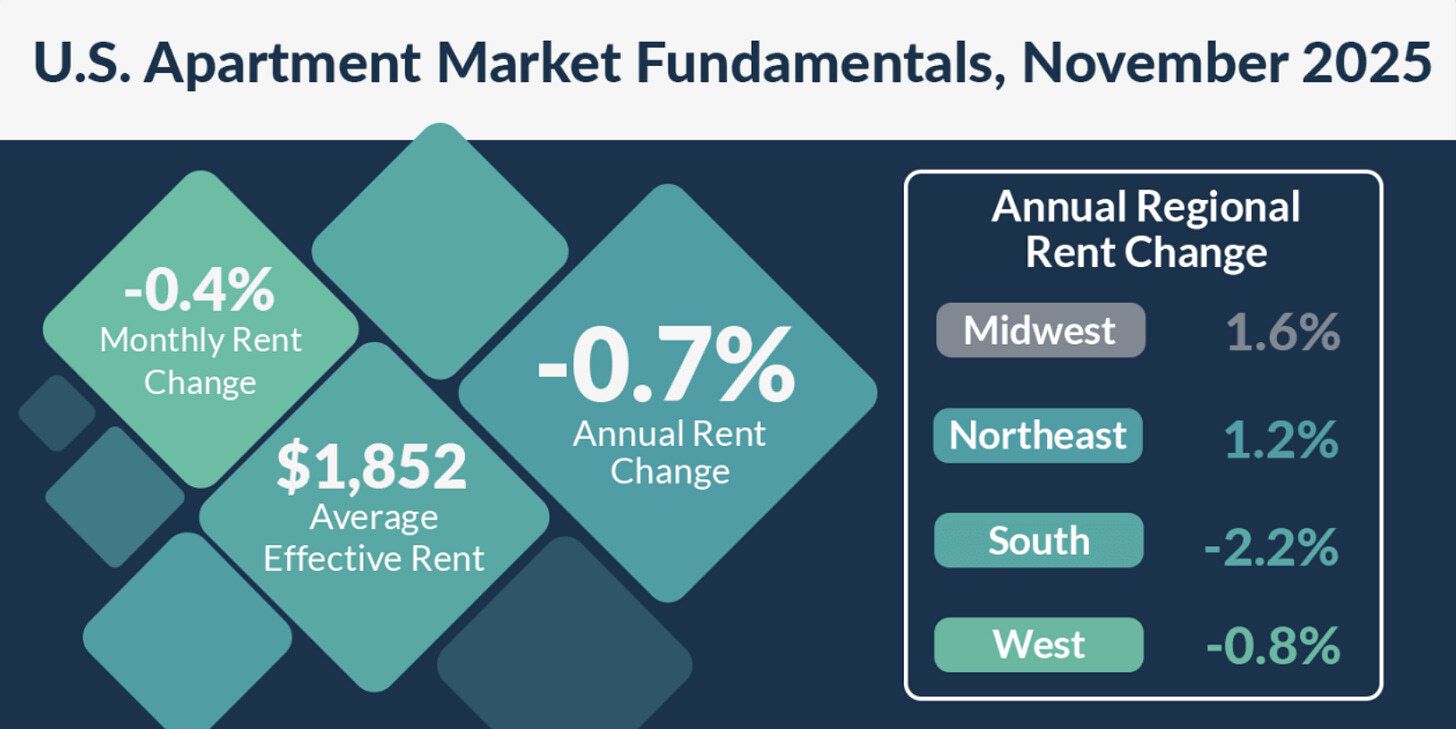

The aggregate data collected in near real-time from the private operators’ data tells a different story: rental growth is NOT happening.

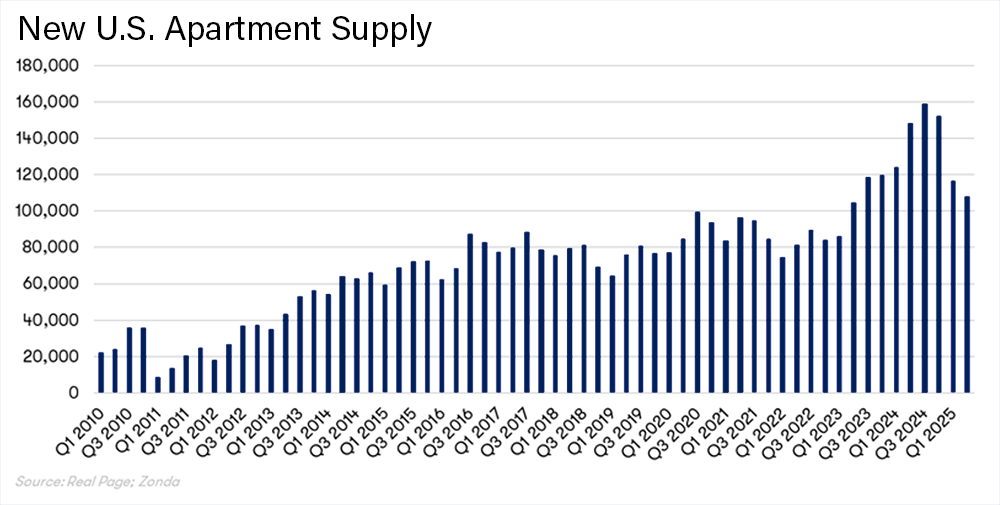

Yardi Matrix November report shows national multifamily asking rents flat, around a median $1,740, up just 0.2% YoY but down MoM—the fourth straight monthly decline. Lingering deliveries + weakening jobs/consumer confidence = muted demand. But the supply pipeline is easing, so we will likely see a modest rebound in 2026 of ~1-2%.

Apartment List’s latest report on multifamily rentals shows asking rents down 1.1% YoY. The national vacancy rate remains at 7.2% this month, a record high for their index. We are “now past the peak of a multifamily construction surge, but a healthy supply of new units is still hitting the market and colliding with sluggish demand, causing vacancies to continue trending up.” They continued, “While it’s expected to see rent prices dip slightly at this time of year… Monthly rent growth peaked at +0.7% in March this year, but then began to gradually trend down during the peak moving months, when rent growth is normally fastest. The flip to negative MoM growth also came a bit earlier than what we saw in pre-pandemic years, making this the third straight year that prices have begun to dip in August.”

Zonda’s reports echo this: rents are flattening or dipping in many markets as supply catches up.

CoStar. Rents were down .7% YoY in November. This is 5 straight months of flat or declining rents, with seasonal weakness amplified by lingering new housing unit deliveries.

Zillow’s Observed Rent Index has been signaling rent deceleration since mid-2023, and for November it shows rents basically flat YoY -.2%. Zillow expects rents to stay muted through winter, with stabilization ahead as new housing unit completions drop off in 2026.

Real Page. Slowing rent growth turned slightly negative to -.7% YoY in November, with vacancy staying strong but also dipping slightly .1%. They note that after 3 months of declines, the pace of cuts held steady in November, due to lingering lease-up pressure from the 2024-2025 apartment supply peak. But, supply is slowing sharply, setting up a rebound (likely modest, ~2-3% national in 2026) as new apartment unit absorption catches up.

This supply cliff is exactly what we have been talking about the last few months. Article here.

Real Page November Report

The theme seems pretty damn clear: If you build lots of housing, rents don’t inflate.

Hint hint, government leaders...

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

The Big Whammy: Inflation Is Likely Below 2% Today

A high shelter number throws off the entire inflation number.

Why?

Shelter makes up about 35.5% of CPI, the largest weight in the index by far.

CPI shelter data lags 12+ months behind actual rents. The BLS captures continuing leases, not just new ones, so it lags market rents by 12-18 months. For example, when rents spiked in 2021-2023, CPI shelter kept climbing long after market rents cooled.

And the Fed knows shelter data is lagging.

Here is a paper the Richmond Federal Reserve put out acknowledging that shelter data lags 12+ months from private market shelter data.

So, here is some serious food for thought.

What if we dropped shelter inflation from the CPI’s 3% to match the most conservative number above, Yardi’s +0.2% YoY?

Inflation would fall to….checks notes…..

1.3%!

And if rents keep declining (as the other forecasts further moderation into 2026), shelter could go negative YoY soon, pulling headline CPI under 1%.

That’s what inflation really is today.

Wow. Just wow.

And, again, why has rent been cooling? Because we started building more apartments during the “ZERP” low-interest-rate environment of 2020-2022 than at any time in the last 50 years.

Alternative Analytics Also Has Inflation Close to 2%

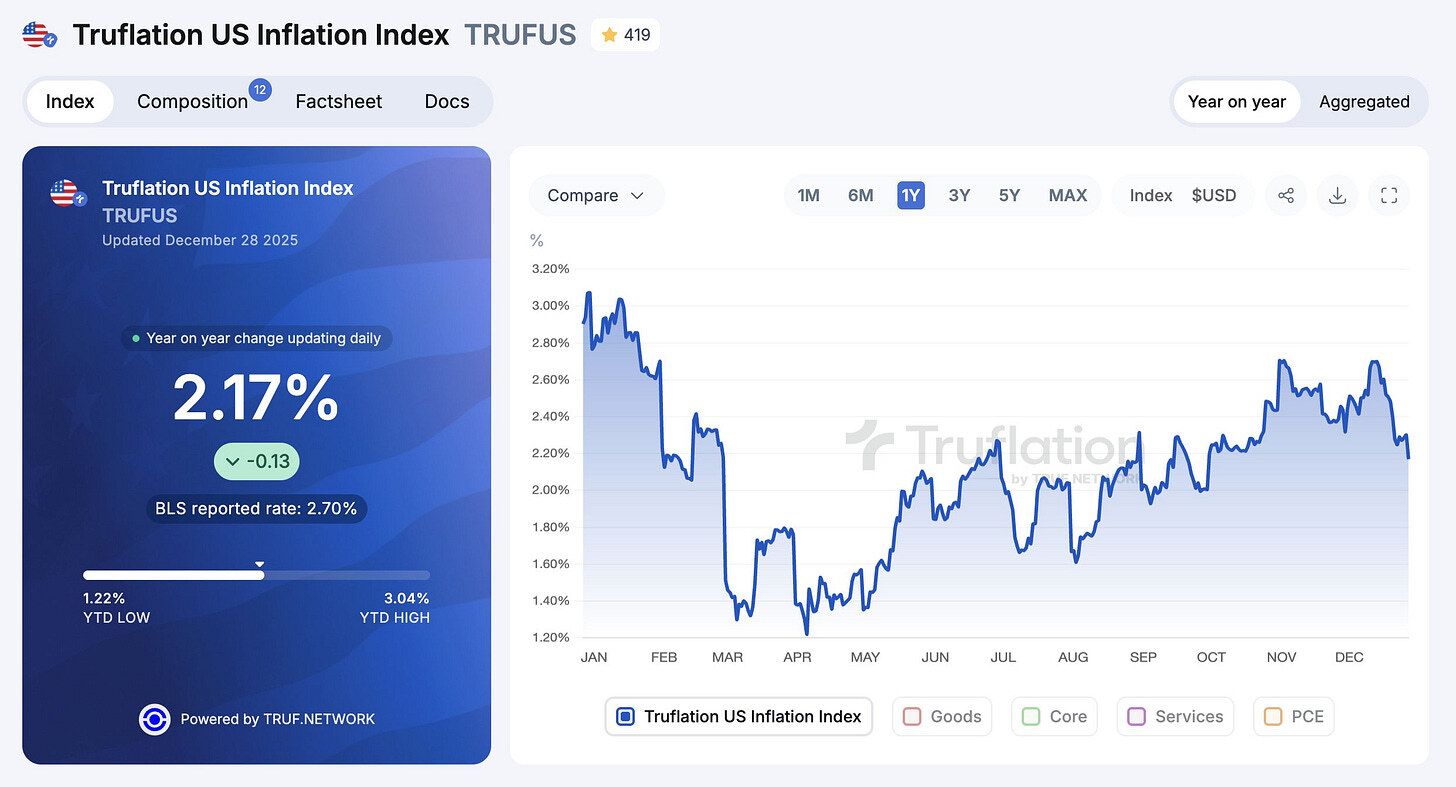

Independent analytics firm Truflation has CPI at 2.17%, as of today.

Remember. The lower inflation, the more interest rate cuts possible.

2026 could be a banner year.

A Quick Ad Break….RentRedi

RentRedi: Built by landlords, for landlords

Ready to take your property management to the next level?

Enter RentRedi.

Inspired by people like you, RentRedi makes managing properties smarter, simpler, and more human. Many members of our team also own and manage rental properties.

Plus, The Skeptical Investor readers get $100 off. Click this referral link and take it for a test drive today.

Want to advertise to the more than 30,000+ weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

Some more food for thought.

The Housing Market is NOT “Frozen”

That’s right, I said it!

Transactions are still happening. We have had nearly 5,000,000 home sales in 2023, 2024, and 2025, this, despite rates at 6% - 8%. The peak in the last decade was near 6,000,000 (Mohtashami).

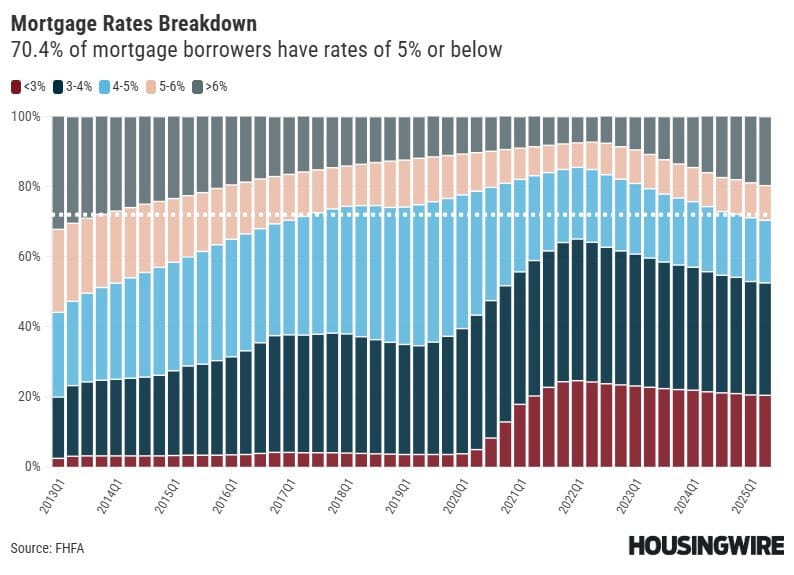

And every home sale contributes to the slow healing of the great mortgage rate divide, or “lock-in” as folks like to call it.

Fun fact, in 2026, more homeowners will have a rate over 6%, than below 3%.

Time is all healing.

My Skeptical Take:

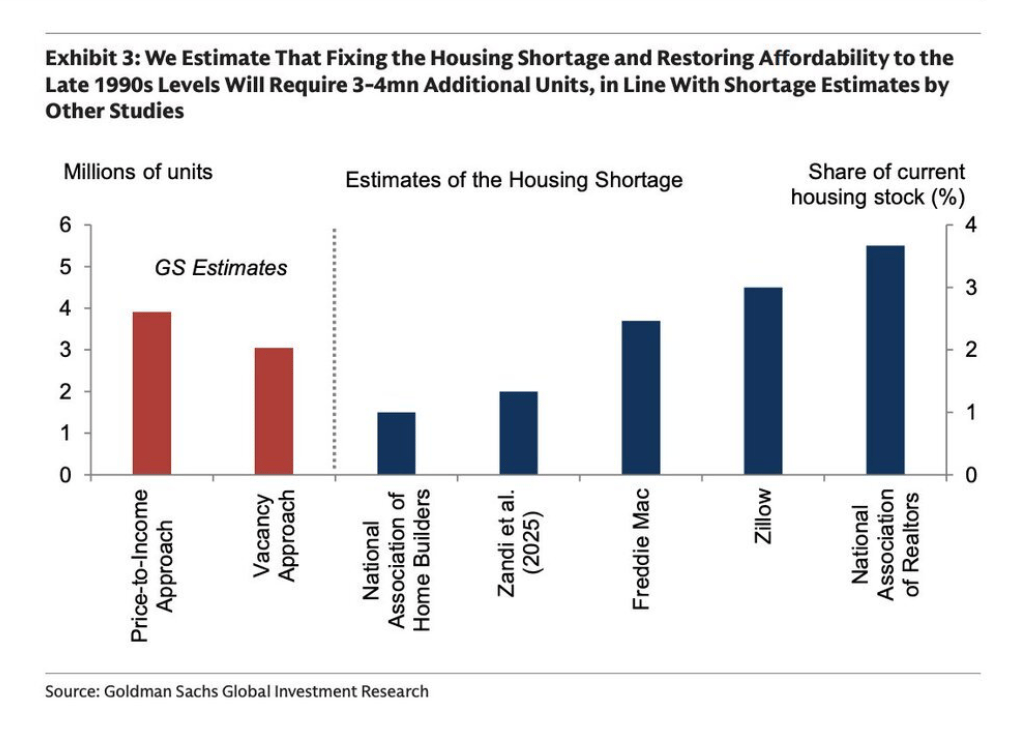

Affordability is driven by availability.

And Affordability is not where we want it to be.

But is it?

And has there every been a time when folks said “I love how everything is affordable!?”

No.

And today, it’s a tale of two cities.

True, Census data tells us that most people pay over 1/3 of their income on housing

But this is highly misleading.

Why?

Because, for folks who make more than $50,000, they actually spend on average only 22% of their earnings on housing.

But for folks earning under $50,000? They spend a much higher percentage, upwards of 50% on housing.

Hell, 22% of folks who live in an apartment make under $20,000 a year! That really skews the numbers.

So, affordability is a problem, and it falls heavily on the poor.

As we can see above, the only solution is to build more housing units. A lack of available homes props up prices, even despite cooling rents.

Home prices are not and will not cool like rents are.

Because, we are still short around 3 million homes.

Goldman Sachs

What are our leaders doing about it???

So far, nothing. Every year, it gets more and more difficult to build / renovate your home.

To their credit, the White House has acknowledged this issue and is reportedly planning for some housing policy changes in 2026.

Speaking on the subject, White House economic director Kevin Hassett said the other week that: “Everybody in the whole Cabinet is working on trying to get housing to be more affordable.”

And

“We have a big list of housing ideas that have been vetted very carefully by the Cabinet secretaries to present to the president in a week or two and we will see which ones he picks,” he added (FOX).”

Count me skeptical.

I’m dubious that they can make a meaningful dent.

The Federal Government would have to gather state and local governments for a total revamp of permitting and regulatory policy.

We shall see…

But unlike other issues, I think we’d ALL like to see us build baby build.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. If you need a little push, here is my new book! It is a MUST for all real estate investors. The 5 Ways Real Estate Investors Make Money and Build Wealth: Anyone can create wealth through real estate. Including You! (yes yes, it’s a shameless plug, but we authors make ~$1/book, FYI. This is about education!). So pick your copy up today!

Please Share this Article!

We have passed 40,000 subs! Thank you for your support, next stop, 50,000!

Please help grow the community!

It takes me several hours to write this weekly article, and they will always remain free (but you get some pretty cool perks with premium, including a one-on-one with yours truly :). All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you want, a cookie? 😅

Subscribe Today! (and get some amazing perks)

Paid subscribers get the best stuff! Join the Skeptical Investor Community to access:

Premium content and NO paywall,

Every article we have published - a treasure trove of information and education,

Conversations with other investors in the Skeptical Investor community, and future meetups and special events,

Key insights and predictions on the latest financial news,

PLUS, subscriptions include an annual one-on-one call with me personally. So make sure to take advantage! Subscribe today.

Just $5 bucks a month.👇

Ready to Start Investing in Real Estate? Know someone who does?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great real estate deals, as well as manage their rental properties, here in Nashville, TN. We pride ourselves on being tough negotiators. We want our clients to get an amazing deal, we never let our clients pay retail.

Enjoying this newsletter? Know somebody looking to buy real estate? Send them to the best in the business, THE Nashville Investor Agent! Referring real estate business helps us keep the lights on and me keep pushing out fresh real estate analysis each and every week. Help peep this newsletter going for all you awesome folks out there; refer someone to us when you may hear they are in need. We promise to take great care of them and make sure they get a fantastic deal. They will thank you for it.

If you or someone you know are looking for an investment property, give us a call today!

You can also find out more about us and what we offer on our website: www.NashvilleInvestorAgent.com

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. We have the lowest unemployment rate of the top 25 major cities and folks are moving here to take those jobs. Nearly 90+ people per day move to Nashville. And tourism continues to hit record levels. This past year 16.8 million folks visited our lively city. Plus we have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, no state income tax… to name a few amazing advantages. Come check us out, the water is warm :).