Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.35%!

(☝️.05% from this time last week, 30-yr mortgage)

This week, we’re talkin’ multifamily real estate softening, rents down, and what to expect in multifamily in 2026.

Let’s get into it.

The Weekly 3 in News:

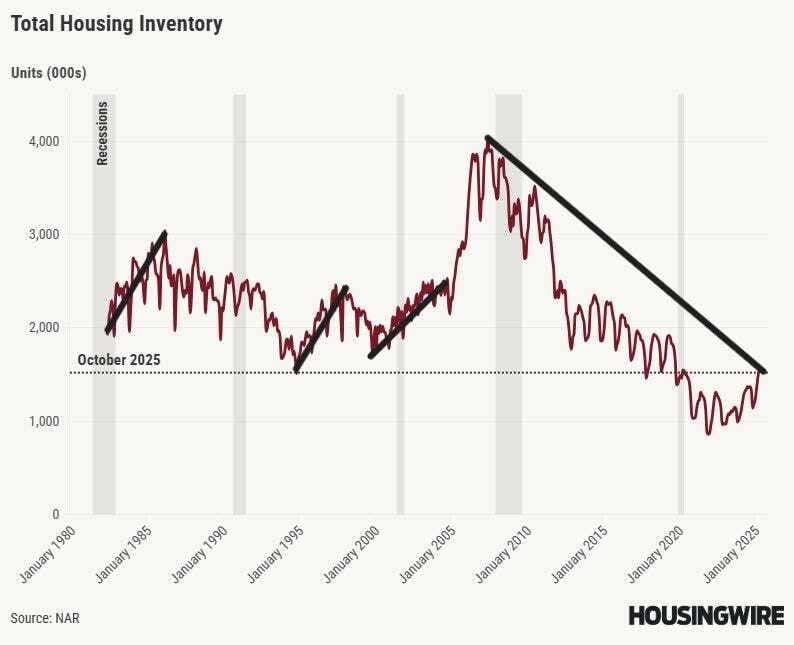

Housing Supply: putting things in perspective. Yes, housing supply is up and rents are down. This is a good thing for a healthy housing market. Especially after years of anemic supply (HousingWire).

NY Fed Household Survey: The share of households who think their financial situation will be better in a year matched a new 2-year low in Nov. Fewer than 26.5% of households expect their situation to improve. I am highly skeptical of surveys, but we shouldn’t ignore them either (NY Fed).

Nashville News - The Boring Company has released an update on the tunnel it’s building in Nashville. The initial airport-to-downtown tunnel will carry 20,000-30,000 people per hour and have 20 stations! Out of 45 necessary permits, 27 have been approved, and 10 are under review, while the remainder relate to proposed route expansions. Now that is pro-business. Tunneling to start Dec 15th (Merritt)!

Fed Day Tomorrow

The Federal Reserve FOMC Committee is meeting today and tomorrow to decide whether to cut interest rates.

I’m frankly bored with this.

Rates are almost certain to be shaved by 0.25%. This, after multiple comments from Fed officials signaling this decision (although, it is likely not to be unanimous, as we talked about last week).

Here is all you need to know about the Fed and interest rates for the next 6 months.

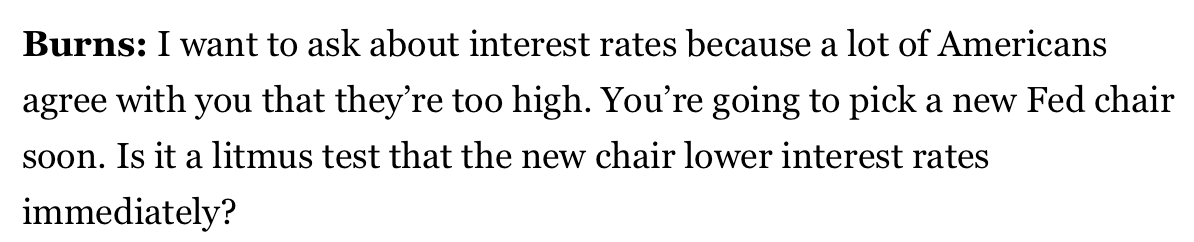

Yesterday, in a wide-ranging interview with Politico, the President was asked about interest rates and the Fed:

Nuff’ said.

Let’s move on to something more interesting.

The State of Play: Multifamily Real Estate

Pour yourself a strong coffee.

Go ahead, i’ll wait….

…Ok, done waiting.

For this review, I’m pulling from November data / reports over at Yardi Matrix, a commercial real estate data and analytics platform (they are fantastic, more on them here).

Apartments: The Good, Bad and the Ugly

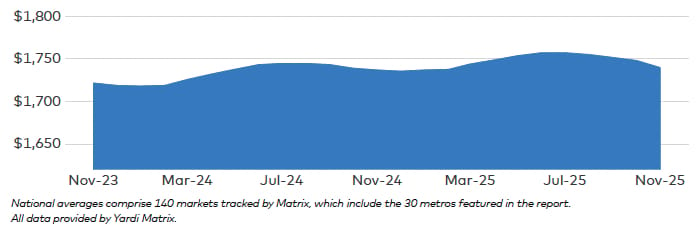

Advertised rents for multifamily apartments dropped $8 in November to $1,740, marking the fourth straight month of declines. That’s a $17 haircut from the summer high. YOY was still positive, but growth scraped by at 0.2%—the lowest growth since Q1 2021, when post-pandemic stagnation set in.

So, average Year on Year rents are basically flat.

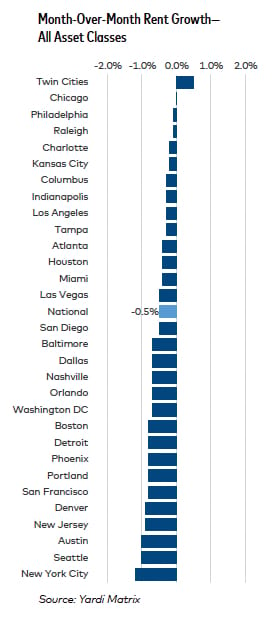

Top YOY performers: New York (5.7%), Chicago (3.8%), Twin Cities (3.2%). Bottom: Austin, Phoenix, Denver.

But this doesn’t tell the real story. The concern for us real estate investors, is a pervasive footprint into our market, and momentum shifts as signals.

Where is weakness spreading and where is it holding up?

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

Sunbelt markets like Austin, Denver, Phoenix, and Dallas have posted negative rent growth for over a year. Higher supply has hit occupancy rates.

This makes sense, build more, rent is more affordable (what a concept).

And absorption of that inventory has been robust, squashing any large concerns of problematic occupancy rates.

This is a strong positive signal of a healthy housing market.

The Winter Shift

But, we are starting to see this shift in some markets.

In November, recent higher-performing markets flipped negative: as we see in Columbus, Indianapolis, New Jersey, San Jose, and San Francisco.

These areas recently led rent increases and maintained occupancy at or above the national average, so “weak demand” doesn’t explain it.

A Quick Ad Break….Market Minds

Clear Real Estate News — Without the Noise

Market Minds is a weekly real estate news brief that filters out noise and highlights what actually matters in housing and macro. Built for investors who want clarity, context, and a cleaner signal each week.

Want to advertise to the more than 30,000+ weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

Two Logical Causes:

First, seasonality.

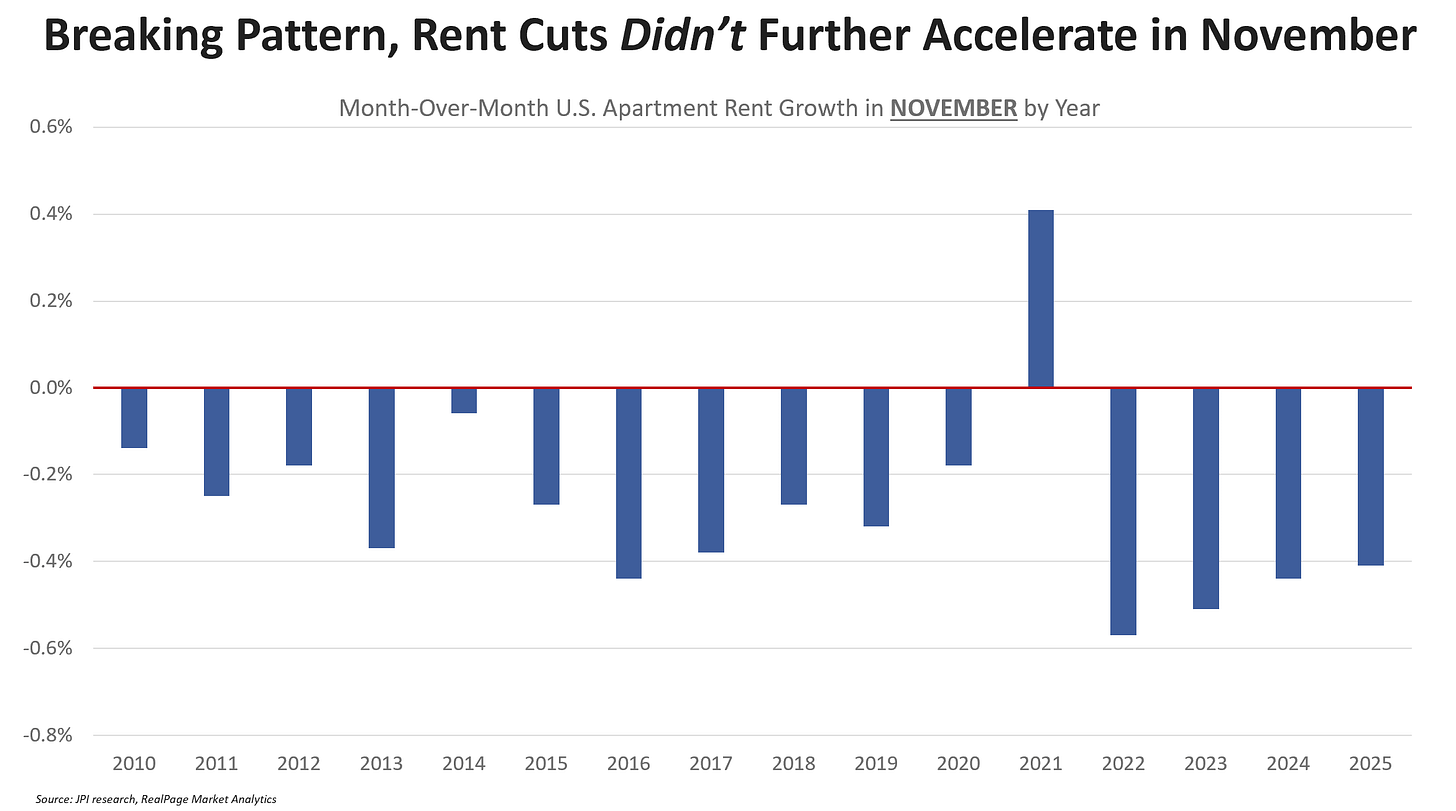

November historically drags growth, with all four post-pandemic Novembers showing dips followed by Q1 rebounds.

Second, structural imbalance.

As we know, new supply is still flooding in faster than demand can absorb all of it.

Add to this: tighter immigration, eroding consumer confidence, and faltering job growth have throttled household formation. Year-to-date absorption holds up, but October’s unit uptake hit a multi-year low.

Hell, immigration crackdowns alone could be responsible for 700k+ fewer renters and homebuyers in the market (JBREC).

But wait wait, there’s more….

Counterpoint November: A Potential Positive Inflection Point?

Yes, rents fell in November, but, according to housing economist Jay Parsons:

1) “…it was the smallest Nov cut in 4 years.

2) From March to October, monthly rent change numbers came in as at/near the weakest since 2009. That streak was snapped in November.

3) Additionally, November snapped a 7-month streak of weakening year-over-year rent change. It wasn’t much, though, shifting from -0.70% in October to -0.66% in November.”

The takeaway?

Rents are sliding, but the baserunner may be about to touch home. Remember, housing supply has already peaked; the mini-COVID policy-driven construction boom is over.

My Skeptical Take:

Picture this.

You’re an investor eyeballing a shiny new multifamily deal in Charlotte or Raleigh.

YoY rents? -0.9% and -0.7%.

But completions as % of stock? 7.4% and 5.3%.

That’s a flood of units still hitting a market with job growth at 2.3% and 1.7%—decent, but not enough to absorb the glut.

An investor seeing this should take note, and hit the pause button on that purchase.

And the forecast for year-end 2025?

Still negative, or flat in high-supply spots.

Yes, multifamily’s in a very soft patch. Supply’s overwhelming demand, and YoY growth at 0.2% is anemic. Top performers like NYC (5.7%) and Chicago (3.8%) are outliers—coastal stability, sure, but even they dipped MoM.

Sun Belt’s in worse shape.

All this signals caution.

But….

…we should always be asking ourselves, what information would make me change my thesis/posture?

And we have some….

Enter 2026 (we are just 20 days away FYI).

As readers of this newsletter know, housing supply is about to fall off a cliff.

Yes yes, I said this the last 2 weeks, but it IS the most important thing in real estae that folks are sleeping on.

We are passing through peak supply right now.

In my home market of Nashville, we already passed through the matrix.

And in the next 6 months most major cities that boomed and have appeared as “weak” markets" will too. Housing supply will drop back down to the undersupplied Pre-COVID levels.

Chart on:

But wait wait wait, there’s more!

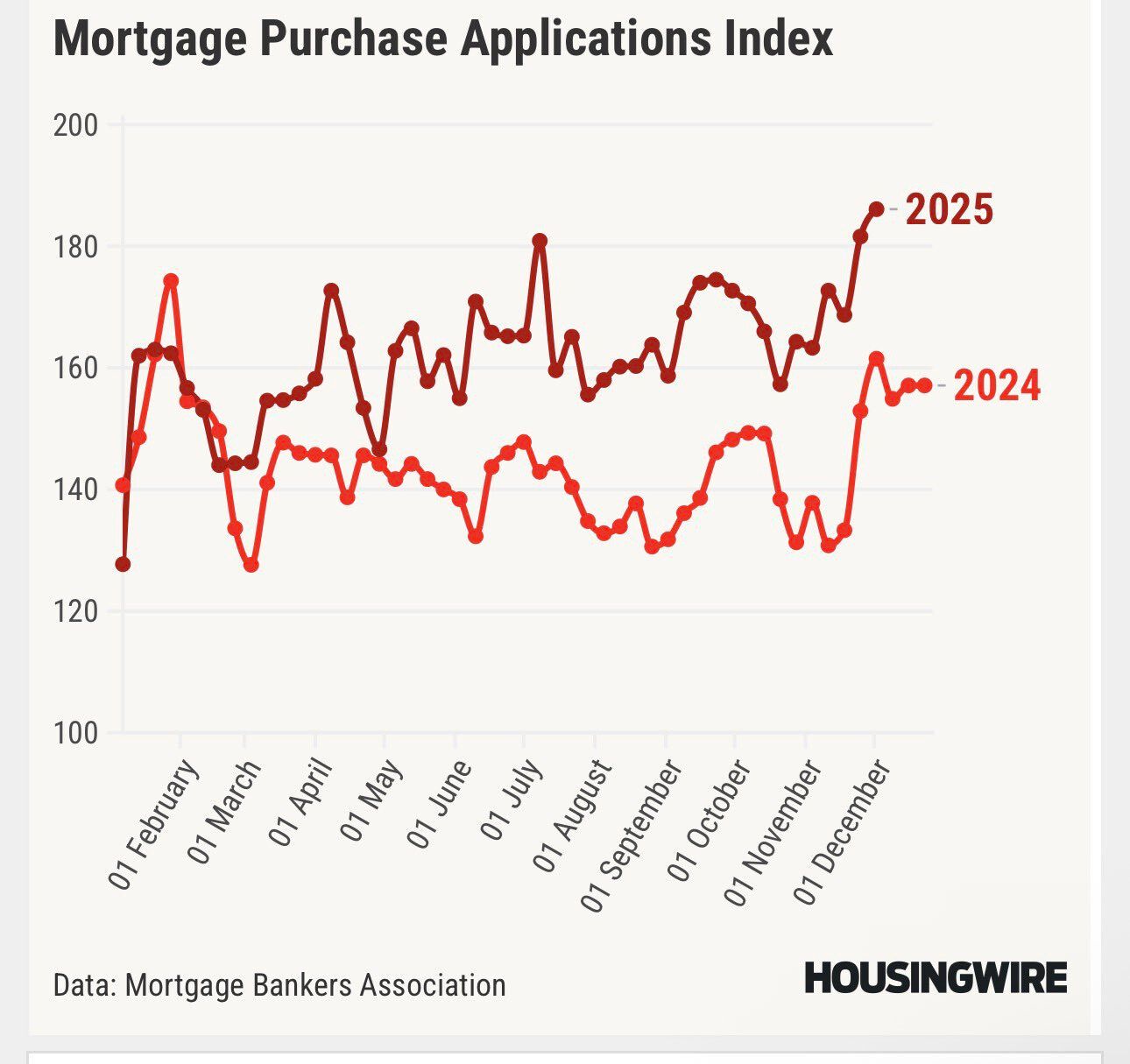

Forward demand is picking up.

Applications for a new mortgage just hit a new yearly high, in November?

Yes.

Frustrated potential homebuyers are capitulating, and I think I know what they are thinking…

“Fuck it, we need a house.”

Ignore the doom in the media and on social.

Sharpen your pencils, 2026+ is going to be a banger in Multifamily.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. If you need a little push, here is my new book! It is a MUST for all real estate investors. The 5 Ways Real Estate Investors Make Money and Build Wealth: Anyone can create wealth through real estate. Including You! (yes yes, it’s a shameless plug, but we authors make ~$1/book, FYI. This is about education!). So pick your copy up today!

Please Share this Article!

We have passed 40,000 subs! Thank you for your support, next stop, 50,000!

Please help grow the community!

It takes me several hours to write this weekly article, and they will always remain free (but you get some pretty cool perks with premium, including a one-on-one with yours truly :). All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you want, a cookie? 😅

Subscribe Today! (and get some amazing perks)

Paid subscribers get the best stuff! Join the Skeptical Investor Community to access:

Premium content and NO paywall,

Every article we have published - a treasure trove of information and education,

Conversations with other investors in the Skeptical Investor community, and future meetups and special events,

Key insights and predictions on the latest financial news,

PLUS, subscriptions include an annual one-on-one call with me personally. So make sure to take advantage! Subscribe today.

Just $5 bucks a month.👇

Ready to Start Investing in Real Estate? Know someone who does?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great real estate deals, as well as manage their rental properties, here in Nashville, TN. We pride ourselves on being tough negotiators. We want our clients to get an amazing deal, we never let our clients pay retail.

Enjoying this newsletter? Know somebody looking to buy real estate? Send them to the best in the business, THE Nashville Investor Agent! Referring real estate business helps us keep the lights on and me keep pushing out fresh real estate analysis each and every week. Help peep this newsletter going for all you awesome folks out there; refer someone to us when you may hear they are in need. We promise to take great care of them and make sure they get a fantastic deal. They will thank you for it.

If you or someone you know are looking for an investment property, give us a call today!

You can also find out more about us and what we offer on our website: www.NashvilleInvestorAgent.com

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. We have the lowest unemployment rate of the top 25 major cities and folks are moving here to take those jobs. Nearly 90+ people per day move to Nashville. And tourism continues to hit record levels. This past year 16.8 million folks visited our lively city. Plus we have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, no state income tax… to name a few amazing advantages. Come check us out, the water is warm :).