Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.36%!

(☝️.02% from this time last week, 30-yr mortgage)

Another Skeptical Investor article?

YES! This week you get TWO! Articles.

You luck ducks.

Why?

I’m doing a little travel, today I’m in Deutschland. Hamburg, home of the original hamburger. And then a hop and a skip to Istanbul for a bit. Back in the Nashville saddle in 1.5 weeks. So, next week you will get a break from my insights, inferences, implications, ideations and, of course, rantations.

This week, we’re talkin’ Fed interest rate cut, and I dive deep on assumable and portable mortgages. Like really deep.

Let’s get into it.

The Weekly 3 in News:

Lumber Prices Continue Downward. Lumber futures are trading around $535–546 per 1,000 board feet. Way, way down. -12% over the past month and year. For comparison, the peak was $1500/bf in 2021.

Embattled former Fed governor Adriana Kugler resigned from the central bank after preparing to submit financial disclosures for 2024 that Fed officials could not certify because they included several prohibited activities, including: buying individual stocks (not allowed), moving in and out of those stocks within weeks (not allowed), doing so in FOMC blackout periods (not allowed). Yet Congress can still do all of the above. Yuck (WSJ, Timiraos).

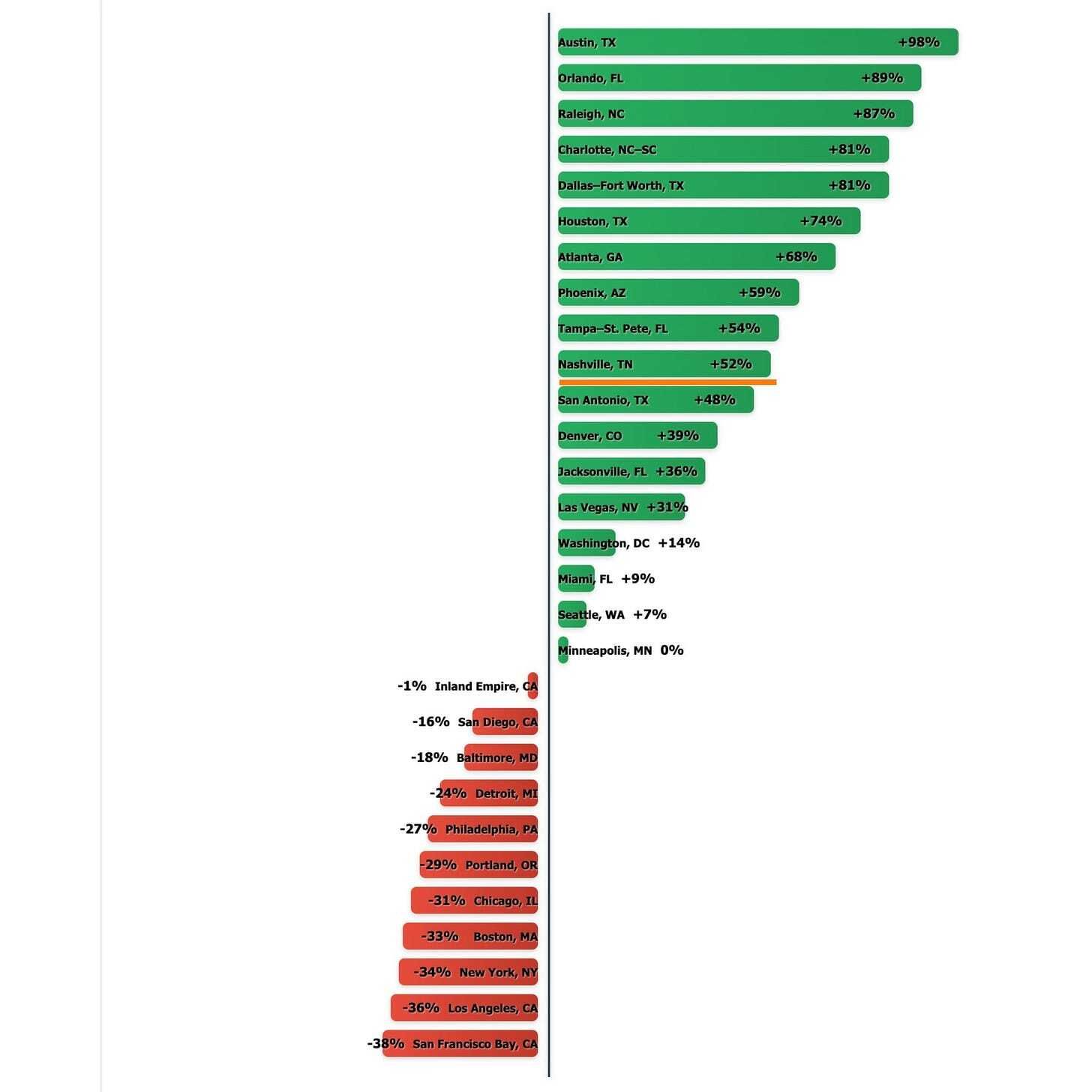

Nashville News - Nashville is Baby Booming! Not only have folks been flocking to Nashville to make a new home, they have been putting the bedroom to good use. The children under 5 population has exploded in Nashville, up 52%! A boon for future growth. And there are some even bigger winners: Austin +98%, Orlando +89%, Charlotte +81%. And losers: SF -38%, LA, -36%, and Boston -33%. Not coincidentally, the cities in the green are also where: unemployment is low, people are moving there, tenant/landlord laws are in balance, and, importantly, the most housing has been built. And the opposite for those in the red. (Fijan/Census).

In other words, Build Housing = Make Babies = Growth.

Über-Quick Fed Rate Cut Update:

We FINALLY got a jobs report yesterday, Yay! Which showed… well, it wasn’t totally clear. If you are a bear or a bull, Democrat, or Republican, there was something for everyone in this report.

In short:

The economy grew +119,000 jobs, beating Wall Street analysts’ whisper expectations by 2x! BUT the trend is stagnant since April with little net growth. And 119k is a low-ish historical number, the average since 1980 is 126k.

Unemployment held at 4.4%, up a tick (.12%) from some forecasts and rising gradually from 4.1% a year ago. Labor market appears to continue cooling. This number is what was expected.

We got more negative job revisions of (god, we are bad at estimates), downgrading the jobs we thought we had created in prior months.

Job gains were mostly in health care and food services, while transportation and warehousing saw losses.

Payrolls are continuing to grow faster than inflation, but growth itself is weak, and has shown little net change since April 2025 (aka stagnant, not expanding meaningfully).

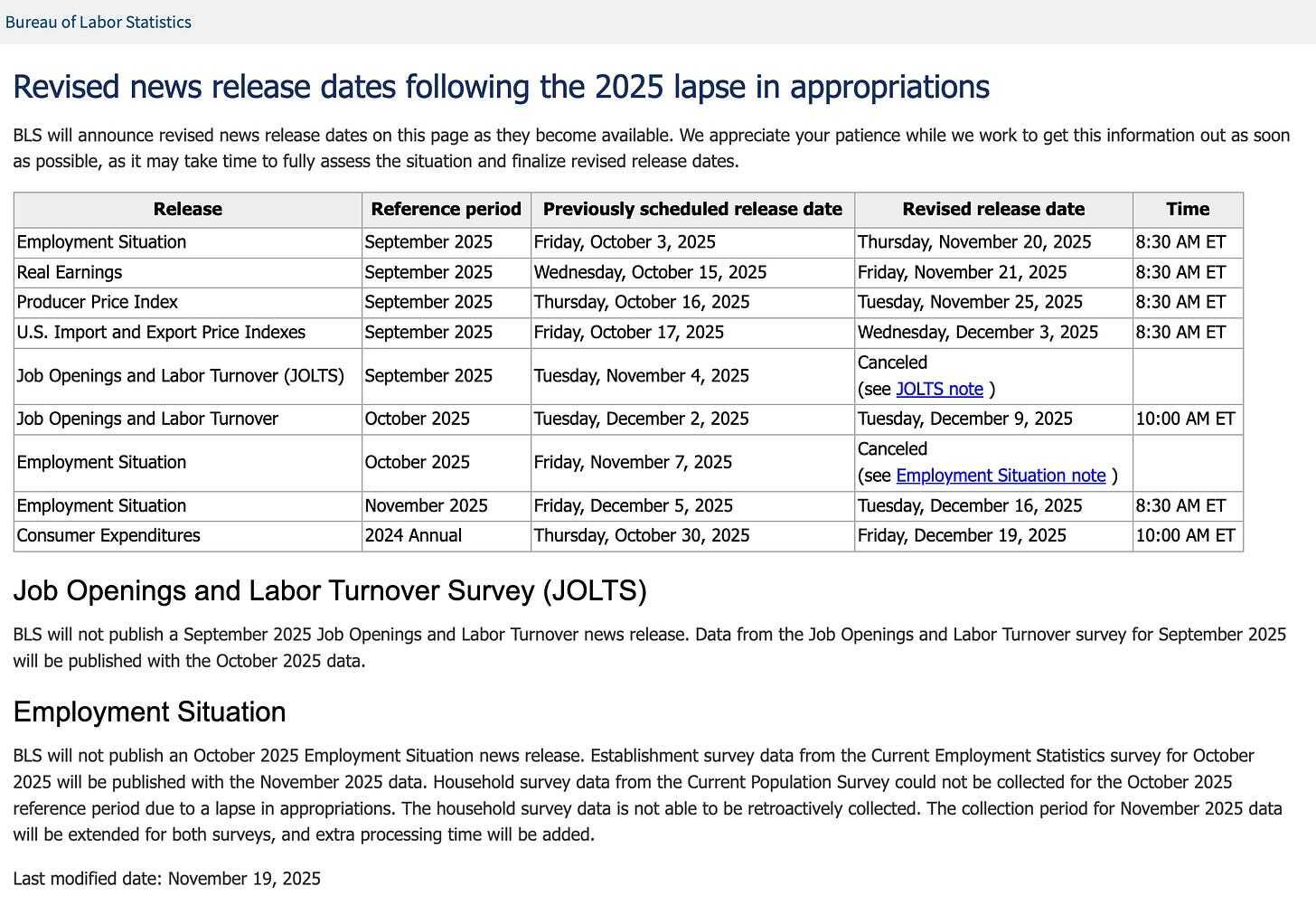

The only real problem? This was September’s data.

The second problem? (Ok I lied…) There won’t be another jobs report until after the next Fed meeting on Dec. 9-10 to determine whether or not to cut interest rates.

The BLS cancelled the October jobs report, and the November report won’t be published until Dec. 16.

The job openings/quits report (aka the JOLTS) for September is also cancelled. The Oct JOLTS will be published Dec. 9, so the Fed will have that just in time (they do get it a bit early tho) (Fed).

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 23 sales have delivered net annualized returns like 17.6%, 17.8%, and 21.5%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Does the Fed have Enough Data?

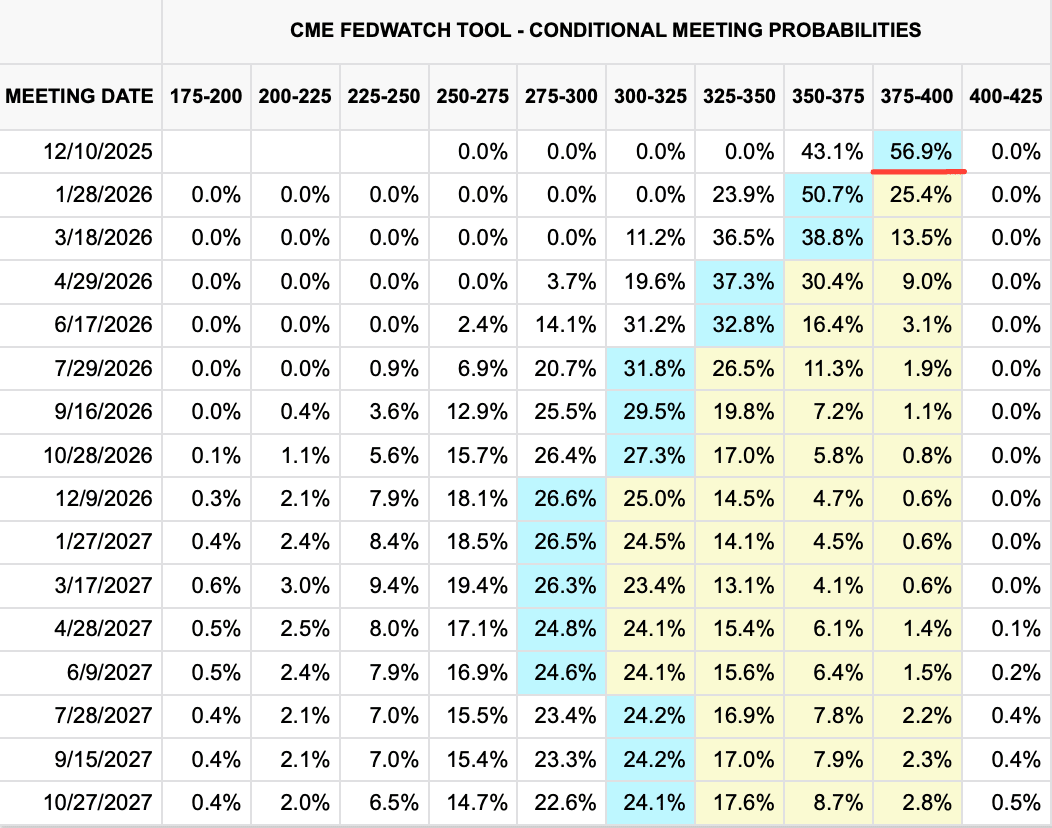

Now, to be fair, Fed officials have reiterated that they have enough information to do their job forecasting the economy and making interest rate decisions without this gov data. I’m skeptical, and the market agrees. Probabilities of a Dec rate cut fell on this news of “data decay.”

The Bond market is pricing in a 43.1% chance of a rate cut (56.9% no cut). This was the reverse just a few days ago.

The betting market too has flipped in recent days, now showing a slightly lower chance (32%) of a rate cut (66% no rate cut) (Polymarket).

Big Change Since Yesterday

The volatility in the stock market has spooked people. Just yesterday, the numbers were worse: Bond market was pricing in a 31.8% chance of a rate cut (68.2% no cut). Bettingmarket had a chance (28%) of a rate cut (69% no rate cut) (Polymarket).

What a difference a day makes.

Why Did This Happen?

Well, unless you were living under a rock - which I sometimes do, no judgment, it’s nice and cool - Congress was unable to fund the government for the start of the Oct 1st fiscal year and we were forced to endure a government shutdown for 43 days, which ended on Nov 12th.

The Bureau of Labor Statistics (BLS) staff were furloughed during this time. So they could not survey, tabulate, and analyze jobs data. And the report could not legally be published. The Establishment Survey and Household Survey were the primary sources of data, which could not be performed.

This is Why We Need Better Data

In my view, this only highlights the need for higher-fidelity reports from the private sector, not based on surveys but on real-time data from businesses.

It is a little ridiculous that we still rely on person-to-person surveys (literally 60,000+ phone calls) that must be performed to know how the labor market and economy are performing. What if Amazon needed to survey shoppers to know what sold on their platform, instead of software tracking it automatically?

We would think that is insane.

Well, that’s pretty much what the BLS still does.

Why not use software to capture real-time data? Why not contract to private industry operators to get anonymized / metadata? Why does this take thousands of BLS employees to perform these reports like a typewriter from when my parents were in middle school?

The entire process is antiquated and needs to go!

But I digress…

Ok, let’s switch gears to some related news: portable mortgages. Another way to keep interest rates and transaction costs down.

Portable and Assumable Mortgages?

Recently, Federal Housing Finance Agency Director Pulte made news when he said the agency was looking into allowing/facilitating mortgages that are portable.

So, what the heck is a portable mortgage? And what is this assumable mortgage I’m also hearing more about now?

A brief primer:

Assumable Mortgages

Want to buy a home?

Great, interest rates are ~6.3%. Yuck.

But the current owner/seller has a 3% mortgage, can I have that?

Oh, well it… no. Well…maybe. But, it depends.

Do they have an FHA / VA loan backed by the government? Then yes, you can you can assume that loan and that loan and get that %! Just pay us an $1800 assumption fee and the down payment.

If not, no. You have to get a new loan at current rates. And pay us a new loan origination fee (typically .5-1%).

The seller does not, they have a traditional, conventional loan.

Sorry, no dice.

In other words, an assumable mortgage is just that. In general, you can take over someone else’s loan, pay the bank (or title company) a down payment to replace the equity the homeowner has in the home (and/or a second mortgage if need to replace a large % of equity a homeowner may have), who, in turn, provides that to the seller so they can go on their marry way. FHA loans allow assumptions and charge an $1800 fee to do so.

Again, this is possible today, but only on certain kinds of existing home loans. Need help finding homes that have assumable mortgages? There is an app for that.

Check out Roam (not a sponsor). Most of the homes are basic starter homes, but it’s actually pretty cool.

Portable Mortgages

Have a mortgage on your home?

Want to buy a new home?

Well, getting a new loan involves considerable transaction costs and, because of the zero-interest-rate policies of 2020-2021, most folks have mortgages with interest rates in the 2-5% range.

So, if I already have a loan on my current home, can I just keep that loan and swap the asset that secures that loan, from my current home to the home I want to purchase?

If your mortgage was portable. You could!

But alas, it is not. Sorry.

:( …

The Case for a Portable and Assumable Mortgages

The core pitch: Most buyers are sellers, and vice versa.

If you’re locked into a 2.8% rate from 2021, why sell and jump to 7%?

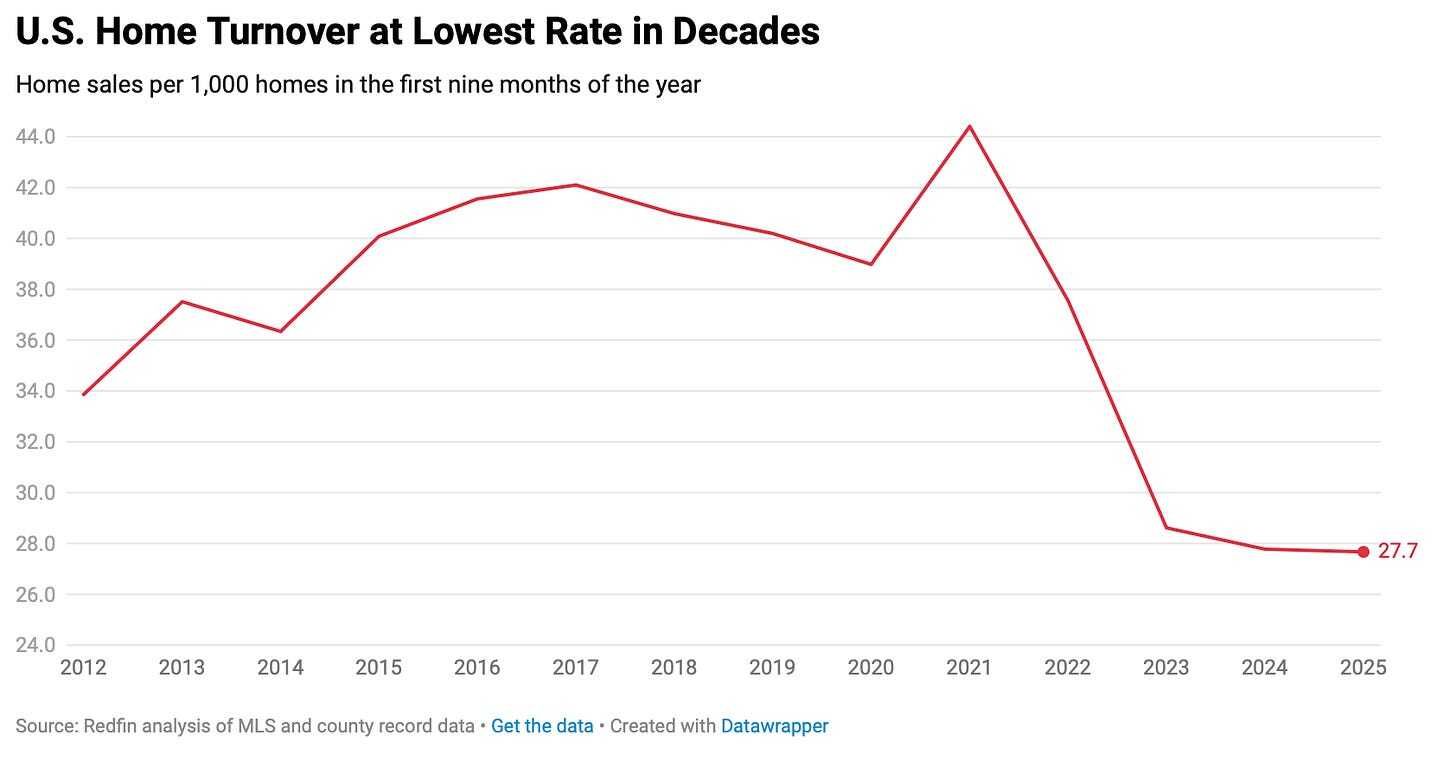

That hesitation is killing existing home supply—only 28 out of every 1,000 homes changed hands in the first nine months of 2025, the lowest turnover in decades per Redfin.

Portable/assumable loans would let you get far better terms so you can move were you want or upgrade to a better place, freeing up your old home for others.

The hope?

More existing inventory hits the market, easing the crunch for first-timers and boosting overall sales. Sure, inventory is higher today than last year, but we are still not back to normal. And in places like my home market of Nashville, that inventory is mainly new build/basic starter homes not value-add existing homes / multifamily we investors need. In fact, there is a dearth of existing homes for sale.

And in aggregate, including new households forming, we’re still short millions of units nationwide, with estimates around 4-5 million deficit (RedFin). This could help unlock some movement without waiting for massive new builds.

The Monthly Payment is King

Even if more homes flood the market, unaffordability stays high with high prices and rates. The median home price is $420k, up 2.2% year-over-year, per NAR. Inventory might rise, but without rate relief for new borrowers, it’s not a game-changer for entry-level folks. Rates are still at 6.3% and will likely levitate from here, as I have recently written about.

Assumable mortgages are a little tricky. Because a buyer wants to take over the loan from another person, who has a different credit rating, different savings amounts, different debt amounts, etc… their risk profile/actuary is different and thus, the bank should be allowed to charge an assessed amount and % rate based on the risk to the bank that the borrower defaults. Allowing all homebuyers to assume mortgages could then lead to a banking/housing crisis a la 2008 GFC. There is good reason to only allow this on loans that are already government-backed in case of default so as not to spread throughout the banking sector. As is done today. However, allowing a specific subsector of homebuyers to assume mortgages and providing government backing could make this an option for some, but not all. FHFA Director Pulte is “looking into this” but I bet they instead focus on less economically risky portable mortgages.

Speaking of which, the portable mortgage. These would be more viable. The buyer has already been qualified for the loan, already has the loan, and has been paying that loan every month (assuming they are in good standing of course). They are known to the bank as creditworthy. So why not allow them to hot swap the underlying asset that the loan backs from one home to another?

And if the new home is a higher price/more valuable, the buyer could simply put down more $ to secure the loan (or get a second mortage, if they qualify) and ensure the homebuyer has 20%+ equity in the new home, which a bank will want in case they need to default (note: there are also different types of portable mortgages, so this is a simplified process).

Portable Mortgage: The Case.

Well, if it wasn’t obvious, we are in the third year of the lowest home sales ever, driven by interest rates that are 2-3x what they were in 2020-2021…

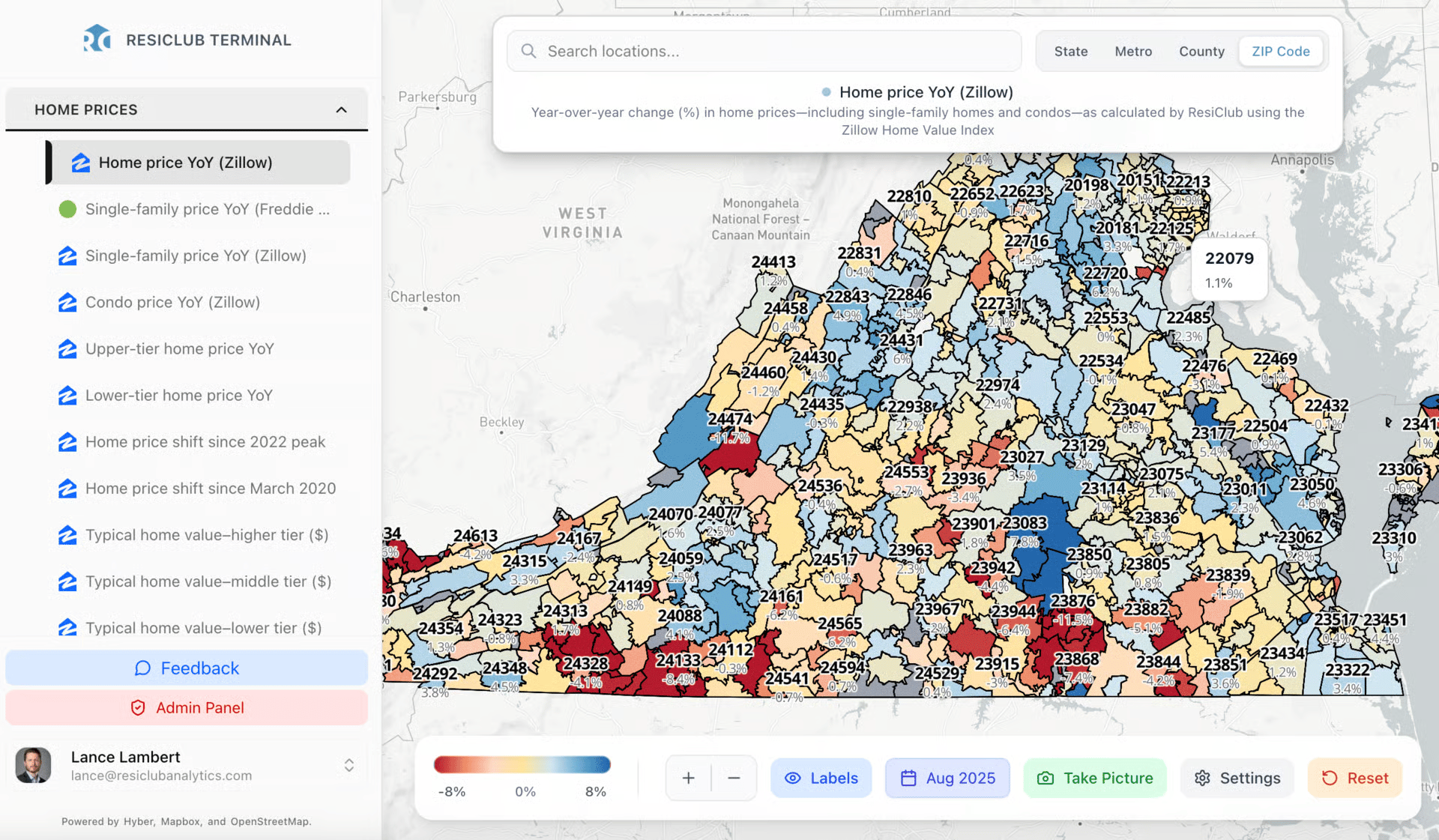

A Quick Ad Break….ResiClub Housing Analytics

Want the best housing data? Look no further than the new ResiClub Terminal. It’s the Bloomberg Terminal, for real estate professionals.

ResiClub is proud to introduce the ResiClub Terminal—a powerful new platform that brings together housing market data, analytics, and insights at the metro, county, and ZIP Code level—alongside our housing reporting and research.

Whether you’re evaluating a new land deal, modeling housing demand, tracking investor activity, or advising clients, the ResiClub Terminal helps you make better, faster, and more informed decisions.

And this is just the start—we’ll add much more analysis, data, and tools over time.

The ResiClub Terminal isn’t just a data platform—it’s the foundation for everything we’re building next. Future tools designed for this audience—like local market scorecards, forecasting dashboards, and interactive reports—will all live within the ResiClub Terminal environment.

Our goal is simple: to give housing investors, professionals, and executives the data and clarity they need to prepare for 2026, 2027, and beyond.

You can check out the ResiClub Terminal here!

Want to advertise to the more than 30,000+ weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

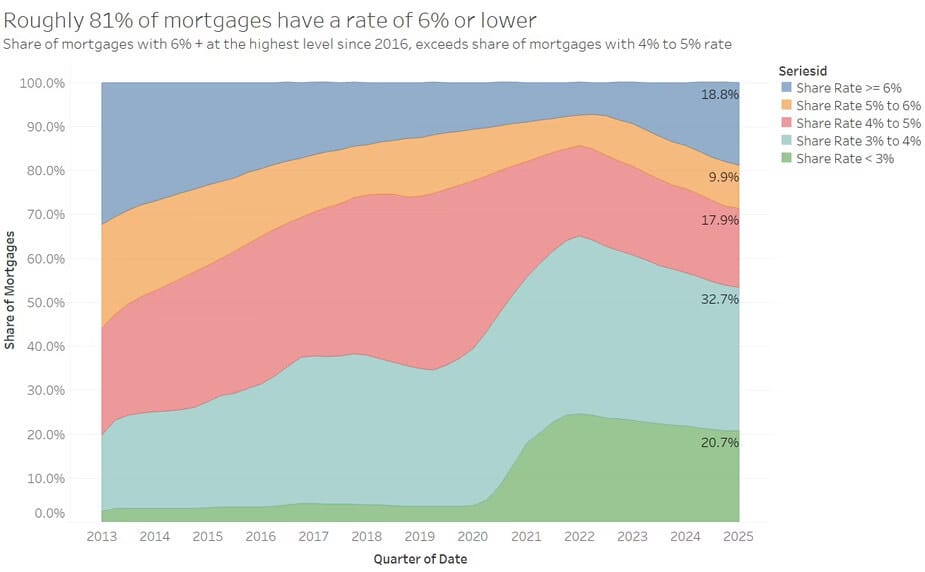

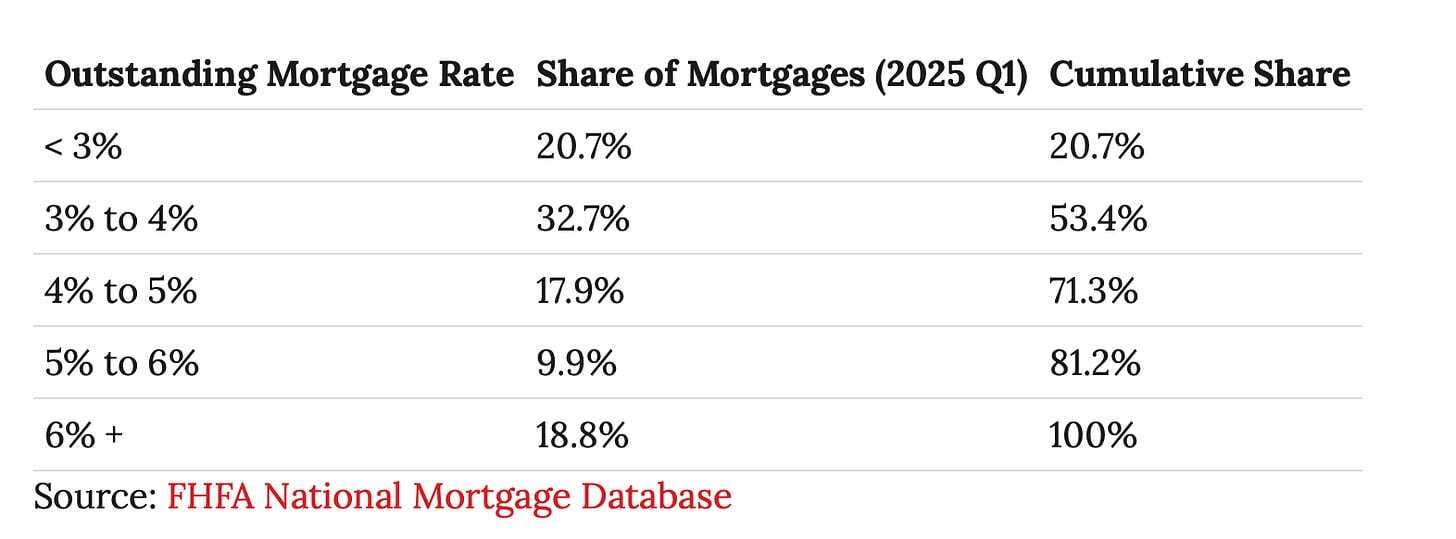

…And because of that zero-interest-rate policy of 2020-2021, most homeowners with a mortgage have one of those low interest rates. 81% have a rate lower than 6%.

Every Tom, Dick, and Harry refinanced in 2021 to a low rate.

71.4% of homeowners with a mortgage have a rate 5% or below!

Again, most buyers are sellers, so allowing them to take their mortgage with them is a very attractive prospect and would incentivize both demand and supply of existing homes

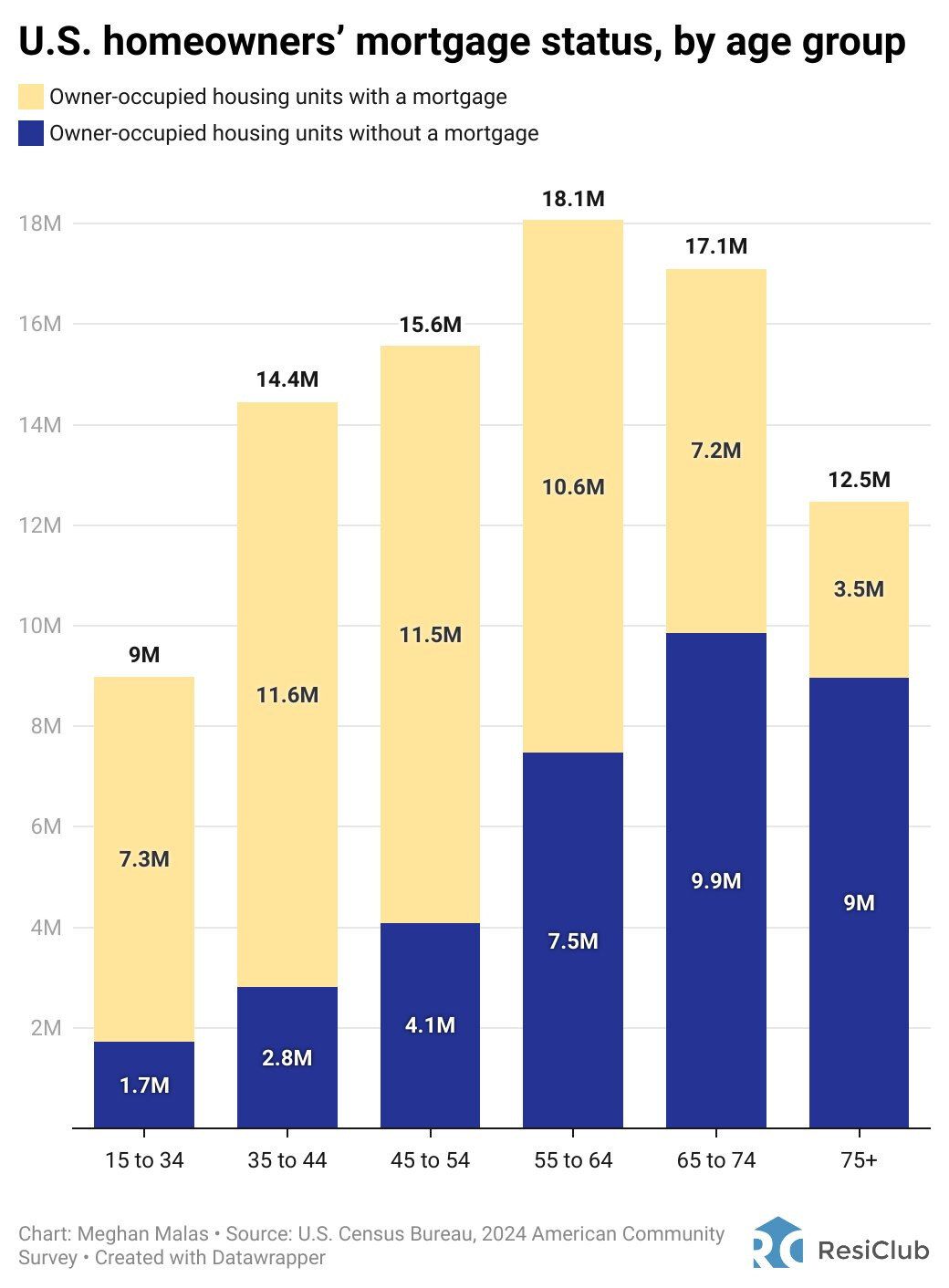

Yes, yes, I know many homeowners don’t actually have a mortgage on their home. 40.3% to be exact. They own it outright. So they couldn’t take advantage of this if they decide to move. But then again, they have no mortgage…

Bigger Issues for Lenders

This is where it gets ugly. Lenders price loans assuming an average life of about 7-8 years—not the full 30 on the mortgage —because most folks sell or refinance their loan in that time period (fun fact, this is also why mortgage rates track the 10-yr Treasury (NOT the Federal Reserve Funds Rate), they are competing assets sold to investors on the secondary market as Mortgage Backed Securities and 10-yr Treasury bonds).

Portable mortgages could stretch that closer to the full 30 yr term, sticking banks with low-yield loans as rates rise. Think 2% interest when markets’ at 7%—that’s a loss-maker that could strain bank balance sheets or even lead to failures without bailouts. Importantly, another result would be low bank liquidity to make new loans, as fewer investors would buy MBS if the interest rate were so low.

To offset, lenders might hike rates upfront for everyone, worsening the housing mess.

And here is why Director Pulte is talking about Portable Mortgages.

As the head of Fannie and Freddie, he wields the power to buy these loans off bank balance sheets so they can then make new loans to others (at the prevailing higher rate). And Fannie and Freddie don’t care as much if the return is 2-5%. They also could allow for a portable mortgage fee, as they do with assumable mortgages.

One issue: technically, doing so would violate the Qualified Mortgage law, so a new regulation would have to be put in place. It is unclear if Congress would be needed for that, or if the Administration could do so by decree (as is their preferred method of cutting through red tape).

My Skeptical Take:

As my dad used to say: “Things are good!”

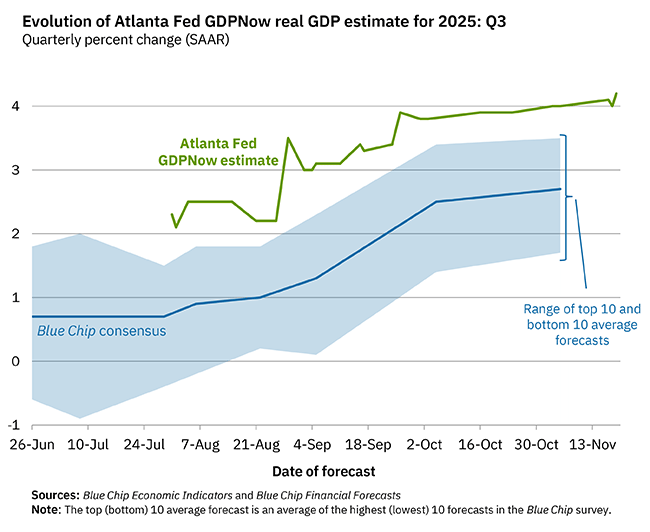

The Fed itself sees the economy growing like gangbusters. The Atlanta Fed is just out with their GDP predictions for this quarter three and, things are (still) looking good.

Q3 is expected to grow real GDP growth at 4.2%, up .1% in just a few days.

How about Interest Rates?

It is difficult to tell how the September jobs report will affect a seemingly fractured Federal Reserve FOMC board when they vote in December.

I do think they will cut .25% BUT, as the bond and betting markets are telling us, that is no longer to be expected.

One anecdote: another Fed Governor announced his retirement last week, adding fuel to the rate cut chances in the Spring.

Bostic will be retiring in the new year, removing another less dovish member from those who decide interest rates. Bostic actually used to be a mild dove (pro-growth and favoring lower rates), but has become more hawkish during this Administration. Unfortunately, his stance change appears to have been more political than data-driven. Good riddance.

This retirement is expected, but nonetheless, it will drive more enthusiasm at the Fed come Spring in favor of more dovish/pro-growth and lower interest rate monetary policy.

And a new 2026 Fed voting member, Philadelphia Fed President Anna Paulson, just publicly signaled her dovishness, saying “[she supported cutting rates at the last two meetings and remains] a little more worried about the labor market [than inflation.]”

She also noted, “Historically, when job gains are concentrated in acyclical sectors like healthcare, that is a precursor to a slowdown.”

Bullish for more rate cuts in 2026.

But, count my skeptical ears perked for further labor market cooling.

Rate Cuts: When A Portable Mortgage Makes Less Sense

I LOVE the idea of a portable mortgage.

Again, we are in year 3 of the lowest home sales activity on record.

This is because of high interest rates, combined with higher prices (which is a result of the government’s wild $10 trillion anti-COVID economic stimulus/spending response during 2020-2022, as I have written about many times before).

FHFA Director Pulte is actively researching how Fannie and Freddie could help incentivize banks to offer/allow portable mortgages.

Counterpoint: Of course, if rates continue to go lower, it makes less and less sense to concern ourselves with a portable mortgage. I have an 8% loan on a property I bought 2 years ago, which I am about to refinance. But I also may sell it, as I have just finished renovations and have a ton of equity accrued. If I do, I certainly would not want to port my mortgage. And neither would anyone who would be moving from an existing home they purchased in the last 3 years.

So as rates slowly tick down into the 5.xx%, we likely won’t need any of this fancy portable stuff. Not nearly as urgently, at least.

But for the foreseeable future (next 12+ months) a portable mortgage makes a LOT of sense, and will spark supply and demand of existing homes.

Importantly, to incentivize banks getting on board with allowing portable loans, the FHFA should allow/incentivize some bank transaction fees because the bank needs to pay loan officers and servicers to complete these transactions and offset some additional risk and opportunity costs associated with portable mortgages vs new loans they otherwise would have made.

So I say, let’s get portable!

BUT….My posture: Don’t bank on policy miracles. It will be hard for the Administration to get this over the finish line. Focus on smart investing now—house hack, buy right, focus on adding value (which is under your control, and always crunch the numbers assuming today’s high interest rates remain.

Oh, and hire a great real estate broker. One who is investor-friendly and can find you deals and strategies that cash flow. Drop me a note and I’ll help you find one, anywhere in the US.

And again, there will be no article next week. I know, I know, but you will survive.

Just remember…..

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. If you need a little push, here is my new book! It is a MUST for all real estate investors. The 5 Ways Real Estate Investors Make Money and Build Wealth: Anyone can create wealth through real estate. Including You! (yes yes, it’s a shameless plug, but we authors make ~$1/book, FYI. This is about education!). So pick your copy up today!

Please Share this Article!

We have passed 40,000 subs! Thank you for your support, next stop, 50,000!

Please help grow the community!

It takes me several hours to write this weekly article, and they will always remain free (but you get some pretty cool perks with premium, including a one-on-one with yours truly :). All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you want, a cookie? 😅

Subscribe Today! (and get some amazing perks)

Paid subscribers get the best stuff! Join the Skeptical Investor Community to access:

Premium content and NO paywall,

Every article we have published - a treasure trove of information and education,

Conversations with other investors in the Skeptical Investor community, and future meetups and special events,

Key insights and predictions on the latest financial news,

PLUS, subscriptions include an annual one-on-one call with me personally. So make sure to take advantage! Subscribe today.

Just $5 bucks a month.👇

Ready to Start Investing in Real Estate? Know someone who does?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great real estate deals, as well as manage their rental properties, here in Nashville, TN. We pride ourselves on being tough negotiators. We want our clients to get an amazing deal, we never let our clients pay retail.

Enjoying this newsletter? Know somebody looking to buy real estate? Send them to the best in the business, THE Nashville Investor Agent! Referring real estate business helps us keep the lights on and me keep pushing out fresh real estate analysis each and every week. Help peep this newsletter going for all you awesome folks out there; refer someone to us when you may hear they are in need. We promise to take great care of them and make sure they get a fantastic deal. They will thank you for it.

If you or someone you know are looking for an investment property, give us a call today!

You can also find out more about us and what we offer on our website: www.NashvilleInvestorAgent.com

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. We have the lowest unemployment rate of the top 25 major cities and folks are moving here to take those jobs. Nearly 90+ people per day move to Nashville. And tourism continues to hit record levels. This past year 16.8 million folks visited our lively city. Plus we have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, no state income tax… to name a few amazing advantages. Come check us out, the water is warm :).