Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.38%

(☝️.04% from this time last week, 30-yr mortgage)

This week, we’re talkin’ a big change at the Fed that will affect real estate, interest rates and beyond. Not many folks are focusing on this.

Let’s get into it.

The Weekly 3 in News:

Fed Governor Waller on tariffs not causing inflation and his fellow Fed Governors not wanting to cut rates, “People said tariffs are going to cause a bunch of inflation. It ain’t happening. It should have already happened… So start giving me a lot better reasons for not cutting rates. (Geiger)”

High schoolers in Great Falls, MT, are building actual houses. Not birdhouses or doll houses – real homes, built to code from the ground up for real people, and move-in ready. Now THAT is what you call shop class. Why aren’t we funding more of this? (MRowe).

Nashville News - New Tennessee Titans stadium completes roof’s ‘ring beam.’ The project is starting to come together on time for 2027 (BizJournal).

The Fed is Cutting Rates and ending Quantitative Tightening, but Rates will Rise.

I’m about to catch a flight out of Nashville to a far off land to… well, why ruin the surprise?

So, I have a hot take.

Mortgage interest rates are going to levitate from here.

At least for the next few months.

This, after the Fed announced changes to its balance sheet (aka assets - mostly debt - it bought back in response to COVID to stimulate the economy).

And boy did they ever get that ol economy movin. In fact, it’s one reason why home prices leaped up 2020 through 2021.

Why?

This sounds crazy.

Let me tell you a story.

Crash Expert: “This Looks Like 1929” → 70,000 Hedging Here

Mark Spitznagel, who made $1B in a single day during the 2015 flash crash, warns markets are mimicking 1929. Yeah, just another oracle spouting gloom and doom, right?

Vanguard and Goldman Sachs forecast just 5% and 3% annual S&P returns respectively for the next decade (2024-2034).

Bonds? Not much better.

Enough warning signals—what’s something investors can actually do to diversify this week?

Almost no one knows this, but postwar and contemporary art appreciated 11.2% annually with near-zero correlation to equities from 1995–2024, according to Masterworks Data.

And sure… billionaires like Bezos and Gates can make headlines at auction, but what about the rest of us?

Masterworks makes it possible to invest in legendary artworks by Banksy, Basquiat, Picasso, and more – without spending millions.

23 exits. Net annualized returns like 17.6%, 17.8%, and 21.5%. $1.2 billion invested.

Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

QT vs QE

The Federal Reserve announced on October 29th that it will conclude the reduction of its aggregate securities holdings effective December 1, 2025. In other words, in 2 weeks the Fed will end aggregate quantitative tightening (QT), a policy initiated in July 2022 to shrink the Fed’s balance sheet from its pandemic-era peak of nearly $9 trillion. QT involved allowing a capped amount of Treasury securities and mortgage-backed securities (MBS) to mature and roll off their balanace sheet, without buying more, effectively removing liquidity from the financial system. The Fed balance sheet has already contracted by about $2.4 trillion, now standing at roughly $6.631 trillion.

And now, the Fed has seen enough. They are going to maintain ~$6 trillion in holdings. No more reductions.

The move comes amid rising short-term funding costs and signals from money markets that liquidity is tightening.

However, the end of QT isn’t a simple halt—it’s structured in a way that maintains the overall balance sheet size while altering its composition. And it’s the HOW they do this that will have an adverse effect on the real estate market.

Anticipating this policy change, the bond market is already selling off, driving mortgage interest rates up .15% in the last 30 days.

But why?

I’'ll get to that. But first, a primer.

Understanding Quantitative Tightening and Its Evolution

Quantitative easing (QE), QT’s counterpart, involved the Fed purchasing Treasuries and MBS to inject liquidity, lower long-term interest rates, and stimulate economic activity. During the 2008 financial crisis, after the crisis and then again for COVID response, QE ballooned the balance sheet from under $1 trillion to nearly $9 trillion (much of this done for COVID response, which is frankly insane).

Then, as inflation raged, in June 2022 the Fed implemented QT, reversing their buying frenzy.

The historical trajectory of the Fed’s balance sheet illustrates this expansion and contraction:

As shown, the balance sheet peaked during the pandemic and has been declining through two phases of QT, shedding trillions in assets.

The Specifics of Ending QT: A Rebalancing Affecting Real Estate

Starting December 1, 2025, the Fed will cease shrinking its Treasury holdings (QT), reinvesting/repurchasing maturing Treasuries to keep its overall holdings stable.

However, a massive rebalance will start to take place.

While the $ of Teasuries will no longer decrease, the Fed will contiue to reduce it’s MBS holdings, using those proceeds to purchase new Treasury bills. This shift has direct implications for mortgage interest rates, and is likely to not only keep them elevated, but should push them higher.

Roughly 1/3 or $2.069 trillion of the Fed’s balance sheet is MBS, which much of the rest, 4.192 trillion, US Treasuritses (as of 11-13-2025).

In other words, the Fed is about to embark on a new campagn to unload a massive $2 trillion supply of mortgages into the secondary mortgage market for purchase, driving down their price, as well as the appetite for investors/institutions to purchase them. At the same time, they are going to take their Treasury holdings up 50% from $4.2 to 6.2 trillion.

Wow.

In other words, the Fed is really starting QE by buying US Treasuries and continuing QT by rolling off $2 trillion in MBS.

So QT really isn’t “ending” at all. As with much in life, the devil is in the details.

The Effect?

short-term mortgae rates levitate higher

mid-term 10-yr treasury rates lower.

mid-term mortgage rates lower. Eventually.

Critically, a $35 billion monthly cap on MBS runoff appears to be effectively removed, meaning the Fed will be able to more quickly get the MBS off their books, especially if prepayments surge (ie, when a person sells a home with a mortgage or refinances their existing mortgage). This aligns with the Fed’s long-term goal of holding a portfolio dominated by Treasuries, reducing its footprint in the mortgage market.

This is a good overall goal for them to have. They don’t need to be in the mortgage business unless there is a market in crisis.

BUT, we have wildly high interest rates, so is it the right time to do this?

No. No. No…in my humble opinion.

This is not the time to put upward pressure on mortgage rates.

We are in year 3 of recessionary-level housing sales activity because of high interest rates, which was driven by inflation that the government, including the Fed, caused!

Case in point, just look at the Fed getting into the game of buying mortgages.

The wild thing about this MBS holdings chart?

They just kept buying mortgages, even after the Great Financial Crisis and COVID response was done.

They didn’t need to. The mortgage/housing market was going like gangbusters.

But they did.

IMO, this is a primary reason for housing price inflation far exceeding overall inflation.

Further Implications for Mortgage Interest Rates

Remember, mortgage rates are primarily influenced by the 10-year Treasury yield, plus a spread that accounts for credit risk and market dynamics. The Fed’s QE historically compressed this spread by directly buying MBS, supporting demand and lowering rates. QT reversed that, widening spreads and contributing to higher mortgage rates.

With QT ending but MBS runoff continuing without replacement in MBS, the Fed is withdrawing as a buyer in the mortgage securities market. This could keep mortgage rates levitating or slow any downward trajectory, as private investors must absorb the supply. If mortgage rates fall (e.g., due to further Fed funds rate cuts), refinancing could spike, increasing MBS prepayments and accelerating runoff. Further, without the $35 billion cap limiting this, excess supply hits the market, potentially widening spreads and pushing rates back up—a self-correcting mechanism.

Analysts project that ending QT overall might ease bond yields slightly, but the targeted MBS runoff could offset this for mortgages, leading to rates in the mid-6% range rather than lower.

Broader Economic Effects

Stabilizing the balance sheet injects liquidity back into markets, potentially boosting asset prices like stocks and crypto, as seen in historical QE periods. However, for housing, the impact is less bullish. Homebuyers facing sustained high rates may see slower affordability improvements, dampening demand. The Fed’s pivot to T-bills also eases short-term funding pressures, but it doesn’t directly lower long-term rates that anchor mortgages.

If inflation reaccelerates or economic data softens, the Fed could adjust further—perhaps resuming MBS purchases—but current signals point to a neutral stance.

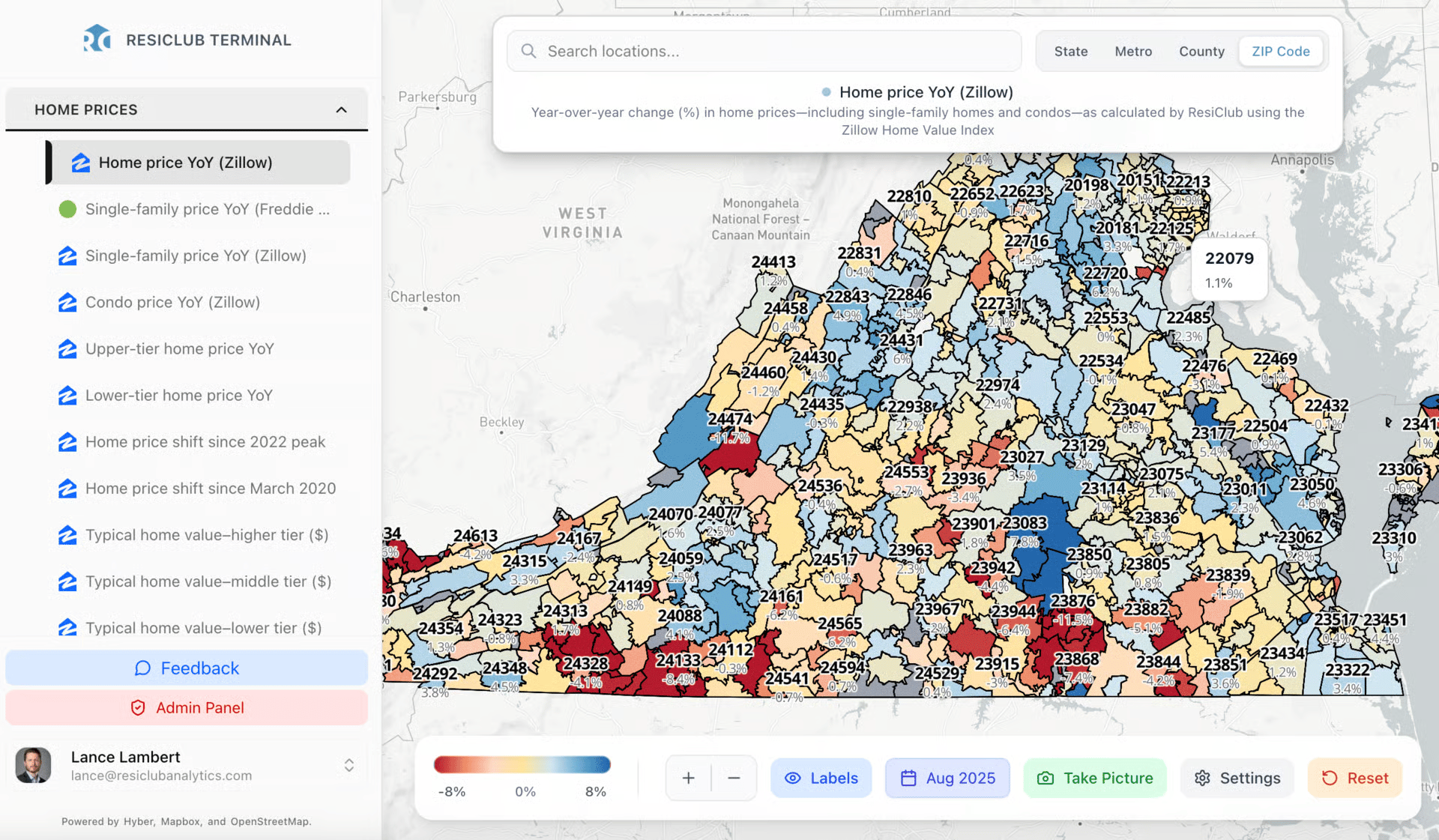

A Quick Ad Break….ResiClub Housing Analytics

Want the best housing data? Look no further than the new ResiClub Terminal. It’s the Bloomberg Terminal, for real estate professionals.

ResiClub is proud to introduce the ResiClub Terminal—a powerful new platform that brings together housing market data, analytics, and insights at the metro, county, and ZIP Code level—alongside our housing reporting and research.

Whether you’re evaluating a new land deal, modeling housing demand, tracking investor activity, or advising clients, the ResiClub Terminal helps you make better, faster, and more informed decisions.

And this is just the start—we’ll add much more analysis, data, and tools over time.

The ResiClub Terminal isn’t just a data platform—it’s the foundation for everything we’re building next. Future tools designed for this audience—like local market scorecards, forecasting dashboards, and interactive reports—will all live within the ResiClub Terminal environment.

Our goal is simple: to give housing investors, professionals, and executives the data and clarity they need to prepare for 2026, 2027, and beyond.

You can check out the ResiClub Terminal here!

Want to advertise to the more than 30,000+ weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

My Skeptical Take:

I’ll keep it short, as I’m about to catch a flight to…Hamburg Germany. And my german is pretty damn rostig!

Scheiße.

The Fed’s overall QT is logical and warranted, both for liquidity management and to normalize their intervetion in bond market forces.

But.

They really aren’t simply ending QT. It’s starting QE for Treasuries and continuing QT for mortgages.

Many are hoping that their co-effort to lower overall Fed Funds interest rates would bring lower overall interest rates.

Unfortunately, by continuing QT for MBS, the Fed won’t deliver the mortgage rate relief many are hoping for.

In fact…

The Fed’s dual QE/QT actions prioritize portfolio normalization to the detriment of housing market support.

This will keep mortgage rates higher for even longer.

I still do think we are on a path trending downward for interest rates but this action may mean a 6-12 month pause on that momentum. What remains to be seen are how fast the Fed rolls off the MBS, what maturity of Treasury bills they buy to replace them, and how fast they cut overall interest rates (Fed Funds).

A small adjustment in either of these will drastically affect mortgage rates, and I hoep the Fed can find a good way to manage through this effort.

If I had to put a number on it, I’d say we are below 6% 30-yr mortgage rates near the end of next year, and our terminal % resting place will be ~5.5%. Long term.

But don’t quote me :).

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. If you need a little push, here is my new book! It is a MUST for all real estate investors. The 5 Ways Real Estate Investors Make Money and Build Wealth: Anyone can create wealth through real estate. Including You! (yes yes, it’s a shameless plug, but we authors make ~$1/book, FYI. This is about education!). So pick your copy up today!

Please Share this Article!

We have passed 40,000 subs! Thank you for your support, next stop, 50,000!

Please help grow the community!

It takes me several hours to write this weekly article, and they will always remain free (but you get some pretty cool perks with premium, including a one-on-one with yours truly :). All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you want, a cookie? 😅

Subscribe Today! (and get some amazing perks)

Paid subscribers get the best stuff! Join the Skeptical Investor Community to access:

Premium content and NO paywall,

Every article we have published - a treasure trove of information and education,

Conversations with other investors in the Skeptical Investor community, and future meetups and special events,

Key insights and predictions on the latest financial news,

PLUS, subscriptions include an annual one-on-one call with me personally. So make sure to take advantage! Subscribe today.

Just $5 bucks a month.👇

Ready to Start Investing in Real Estate? Know someone who does?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great real estate deals, as well as manage their rental properties, here in Nashville, TN. We pride ourselves on being tough negotiators. We want our clients to get an amazing deal, we never let our clients pay retail.

Enjoying this newsletter? Know somebody looking to buy real estate? Send them to the best in the business, THE Nashville Investor Agent! Referring real estate business helps us keep the lights on and me keep pushing out fresh real estate analysis each and every week. Help peep this newsletter going for all you awesome folks out there; refer someone to us when you may hear they are in need. We promise to take great care of them and make sure they get a fantastic deal. They will thank you for it.

If you or someone you know are looking for an investment property, give us a call today!

You can also find out more about us and what we offer on our website: www.NashvilleInvestorAgent.com

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. We have the lowest unemployment rate of the top 25 major cities and folks are moving here to take those jobs. Nearly 90+ people per day move to Nashville. And tourism continues to hit record levels. This past year 16.8 million folks visited our lively city. Plus we have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, no state income tax… to name a few amazing advantages. Come check us out, the water is warm :).