Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 7.07%

(☝️.47% from this time last week, 30-yr mortgage)

What a wild ride!

Today, we’re talkin’ tariff tantrum, rental inflation, apartment demand, what the hell is happening with the bond market, and a full-scale attack on interest rates….we are packed with info today folks.

Let’s get into it.

The Weekly 3 in News:

They tried to sell their homes without a real estate agent. Here’s how it went. If you are not a real estate professional, hire an agent! You may think it went well, but you likely are not getting top dollar. Don’t step over a nickel to pick up a penny. Want to find a top agent anywhere in the US? (Just ask!).

NVIDIA has announced that, for the first time, the company will produce the most advanced AI supercomputers entirely in the U.S. (NVIDIA).

A new RAND study shows the difference in multifamily housing construction issues between California, Colorado, and Texas. News flash, it ain’t pretty on the west side (RAND).

** Want to Learn How to Invest In Small Multifamily? **

Let me introduce you to a friend of mine, Tony Stephan, a fellow Skeptical Investor and owner of Stephan Group Real Estate brokerage up in Detroit. Tony and his wife have built an impressive portfolio of 258 units between him and his wife. He actually owns the properties and is a wizard in doing 100% cash out refinances (aka the BRRRR method) on small multifamily - today - even with high interest rates.

He shares hundreds of hours of FREE lessons and knowledge for anyone who wants to learn how to get in the game of small multifamily investing. I can’t recommend him more highly. The quality of education he puts out is second to none.

Want to advertise to the more than 20,000 weekly readers of The Skeptical Investor? Advertise with us; we can help you grow your business. Email me directly.

Ok, back to business.

Folks are feeling richer again today with the stock market in recovery mode, up ~1% today (but by the time you read this may be down 10%, who knows! @#$%!). Since the tariff tanrum started, stocks are up almost 10%, yet still down ~4.5% from before “Liberation Day” and off the all-time highs by ~12%.

Why is the market up again? Over the weekend the Administration exempted most advanced electronics and semiconductors from China from hefty tariffs.

Big deal. This is saving the MAG7’s (our large tech companies) bacon.

And there was more good economic news in the last few days…

Inflation - Two March Measures 👇

Producer (PPI, wholesale) and Consumer (PPI) prices were both down in March. Producer prices decreased 0.4%, much of which can be traced to an 11.1% drop in gasoline prices. Prices for eggs, beef, and vegetables, as well as air travel, food retailing; apparel, jewelry, shoes, cars, and hotels also moved lower.

But, why am I not surprised….prices for legal services rose 1.5%. They always get their pound of flesh.

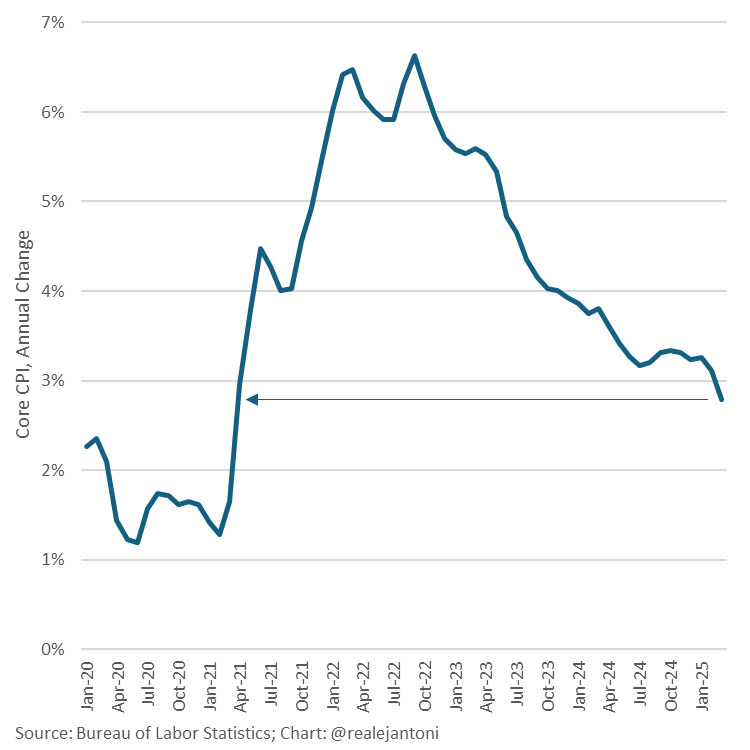

A better than expected PPI follows a decrease in consumer prices by 0.1% in March -after rising 0.2% in February - to a YoY 2.4%. Leading the way was energy prices falling, including a 6.3% decline in gasoline (BLS). Plus, Core inflation (without including volatile energy and food prices) fell to 2.8% - the best print since May 2021.

Now normally, all this would be fantastic news for the 10-yr Treasuries, which are skittish about future inflation.

But the bond market has other problems…

What the Hell is Happening in the Bond Market?

I thought interest rates were falling, what gives?!

Well, it’s complicated. The 10-yr Treasury (which mortgage rates closely track), after falling for several every week since January, spiked up violently to 4.5% in just a couple of days last week. 30-yr Treasuries hit 5% briefly, the steepest rise since 1981. These took mortgage rates to 7.07%.

Now, nobody knows exactly what is happening with bonds, but the smart money is on foreign countries selling. In fact, reactions in the Treasury market may likely have been attributed to large leveraged bets made by mainly Japanese hedge funds. In Japan, 30-year government bond yields reached a 21-year high, reflecting the spillover effects.

Why? Well in normal markets they can make an arbitraged return, a complicated set of bets called basis trading. Looks like someone got caught offsides and dumped their position, starting a sell off in 10-yr Treasury bonds. Additionally, the spread between 10-year U.S. Treasury yields and swaps widened to a record 64 basis points, signaling significant distress in the arbitrage space where basis trading operates. This dislocation results when folks sell Treasuries to meet margin calls or cover losses.

Further pressures on Treasuries are coming from the Federal Reserve, which was a buyer of bonds (to print money) a couple of years ago, but is no longer a net buyer. They are also slowly letting $5 billion a month in Treasuries roll off their balance sheet. This is more of a backdrop underlying the environment in the bond market, but is worth noting.

What will Happen with Interest Rates?

Become a Premium Subscriber

Become a paying subscriber to get access to the rest of this post and other awesome subscriber-only content, like a one-on-one with yours truly.

Upgrade for Just $5 Today!Subscription Benefits:

- Premium Content and NO Paywall

- Subscriber-only market insights

- Breaking News Analysis

- Every article we have published - a treasure trove of information and education

- Annual one-on-one coaching with me personally! ($1000 value!)