Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

The Weekly 3 in News:

Today’s Interest Rate: 6.75%

(flat % from this time last week, 30-yr mortgage)

What a wild ride!

Today, we’re talkin’ stock market chaos, trade, tariffs, lower prices and what real estate investors should be doing to come out ahead. I go deep here, you don’t want to skip this week’s newsletter!

Let’s get into it.

Investor Pep Talk

I’m not happy with what is happening in the market. If you own stocks, this is not fun.

I do. It doesn’t feel great.

But let’s be honest. Most folks in the market are wealthy, relative to others.

Sorry, it’s true.

An anecdote: in the summer of 2024 “[a record number of Americans both vacationed in Europe and were forced to get meals at food banks] (Bessant).”

Remember, the top 10% of Americans own 88% of stocks, the next 40% owns just 12% of the stock market. The bottom 50% does not own much if any stocks, or any other asset for that matter. They have debt: car loans, student loans, credit card loans.

Fellow investors, these are your tenants.

So while the stock market is down, so are interest rates, which is more impactful for most Americans who are unfortunate debtors.

It’s also particularly impactful for real estate investors.

For the wealthy, it’s not actually about money. It’s the mood. The wealth effect for them is quite pronounced. They will pull back aggressively with their spending/buying/ investing.

When the stock market plummets it makes them feel poor.

So for you fellow investors, real estate owners, and landlords I say to you:

This too shall pass.

(It might be like passing a kidney stone, but it will pass).

You only lose money when you sell. Remind yourself of this.

I’m not changing my investment thesis. Real estate is the survivor asset, when times get tough, it gets better.

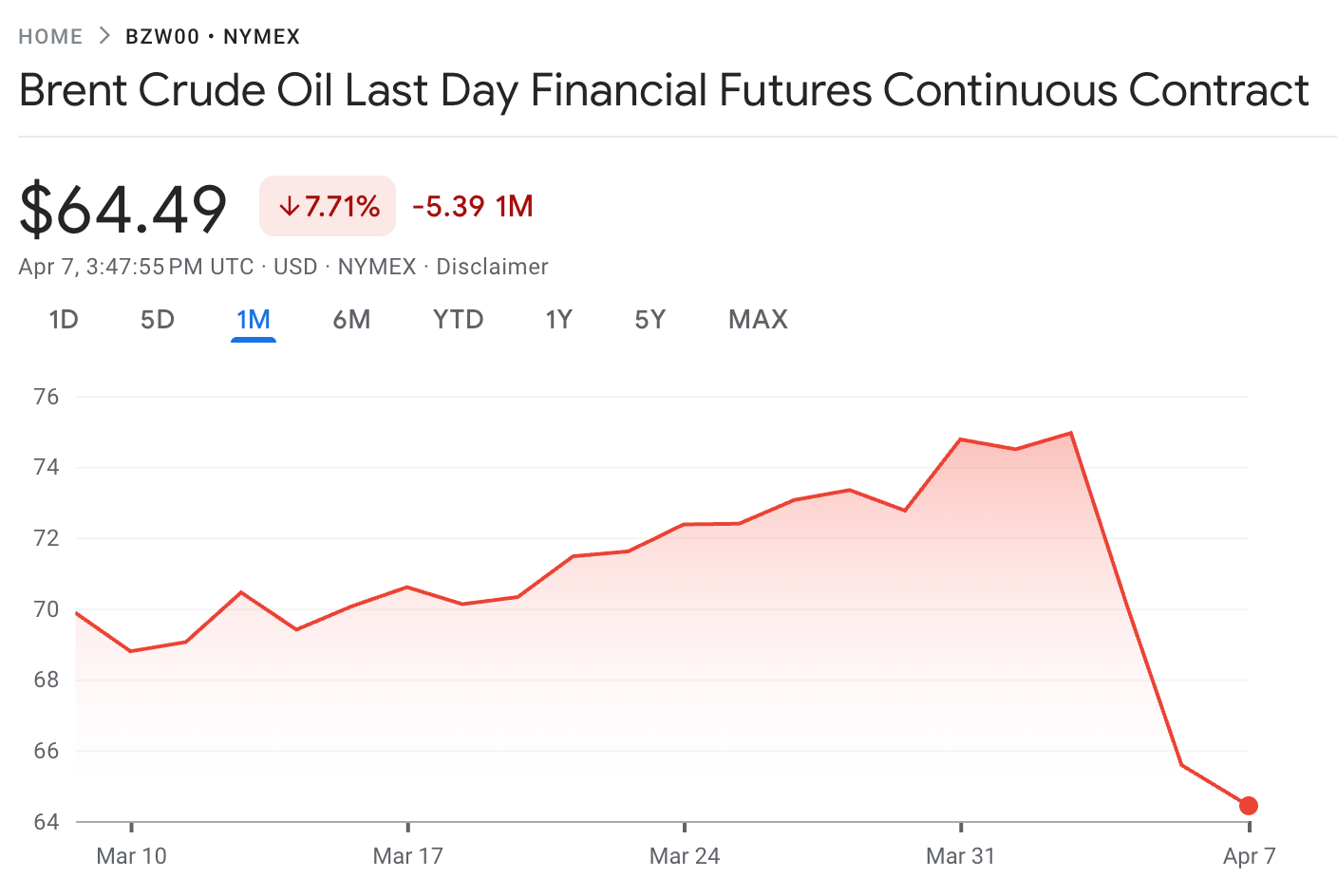

And guess what else is way down? Prices.

Eggs, gas/energy, bacon, milk….all down.

This is great for your tenants.

Ok, had to get that out of my head. Now buckle up, I have a TON of great information for you today.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Let’s Get Some Perspective

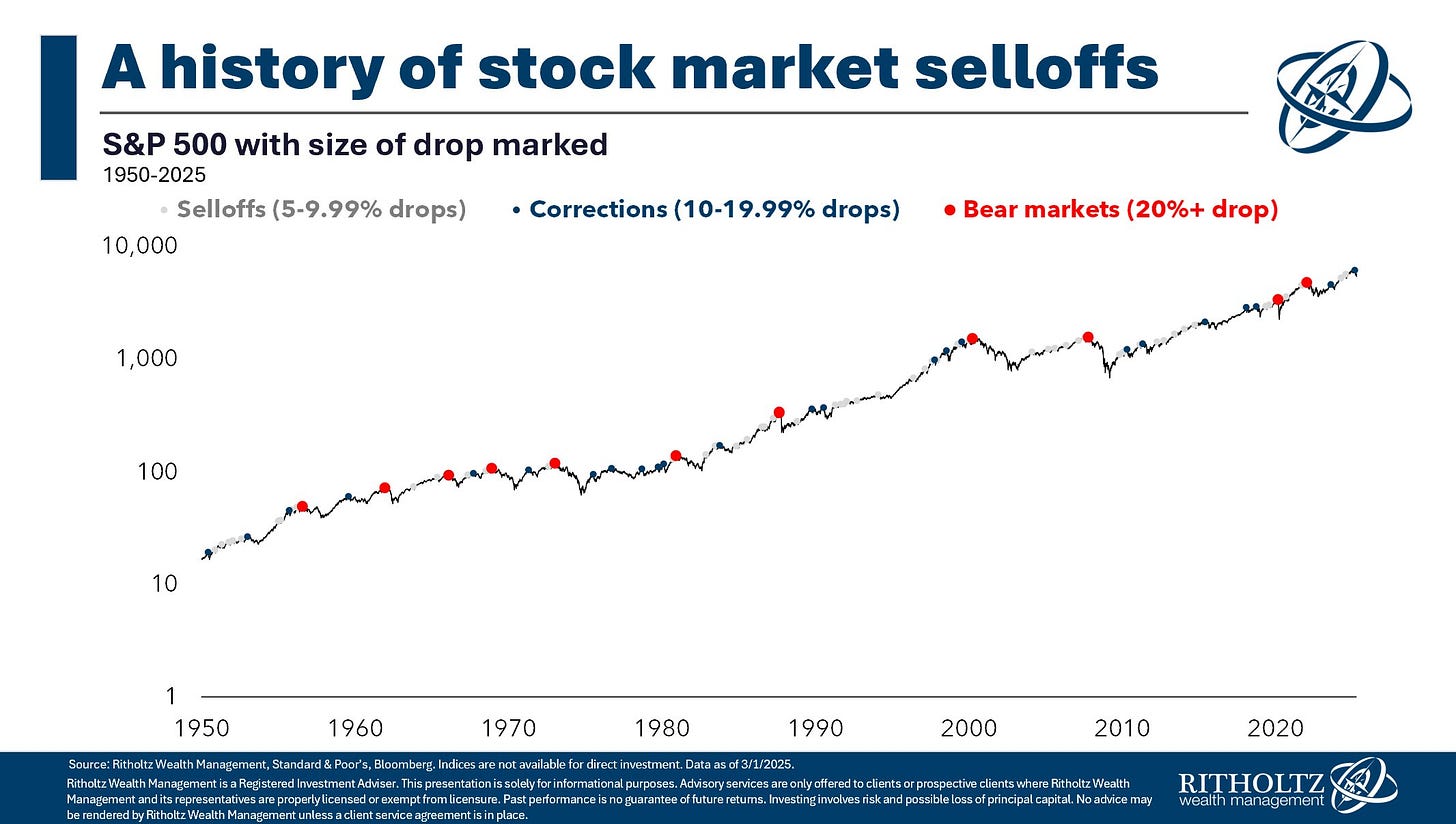

We (the news, people online, nervous investors…) are talking mainly about the stock market reaction over the last 7 days.

Again, remember stockholders, you only lose money when you panic and sell.

The truth is, this is not a historic moment.

There have been 6 bear markets (down 20%) in my lifetime. This is likely the 7th.

A-Political Politics

I try not to get political here, and I’m not starting now.

But because the market reaction is fomenting so many of my readers and investors, I’m going to draw on my time on Capitol Hill to address what is happening with tariffs, trade, negotiations, and how all this affects the housing market, ie us real estate investors. Importantly, I am going to pass judgment. I’m sticking to the facts I see from the data while providing predictions on the results.

My first thought is: nobody, including Mr. Market, should be surprised that the President (POTUS) followed through with implementing tariffs on imported goods, even if they were more robust than a bunch of pencil pushers on Wall Street were expecting.

He talked about it constantly. Hell, here he is decades ago talking about it on Oprah:

What is Happening Anyway???

A brief summary of the week: “[POTUS announced sweeping new import tariffs, including a baseline 10% duty on virtually all imports with higher rates for certain countries. In response, China immediately implemented 34% tariffs on all U.S. goods while tightening export controls on critical minerals, the EU announced counter-tariffs up to 25% on select U.S. products, and Canada imposed 25% tariffs on select U.S. products. In addition to China, the EU, and Canada, numerous other countries, including U.S. trading partners across Asia and Latin America, have signaled readiness to impose retaliatory tariffs or trade restrictions. These measures triggered a severe market response, with the S&P 500 declining 10.5% over two days, erasing around $5 trillion of market value (chamath).]”

Why is this Happening?

First and foremost, I still view tariffs not as an end state, but as a means. A high ceiling has been set. This is where negotiations start.

And, dare I say, this POTUS very much enjoys a good negotiation.

What the Administration is doing is turning their world upside down, rewriting the financially-stimulated global economy. Case in point: We spent $10 trillion to try to avoid a recession during COVID, only to cause extreme inflation and indebtedness to the tune of $36 trillion that we must now refinance. As a result, we now spend $1.1 trillion / year just on the national debt’s interest payments. Again, not passing judgment, that is what happened.

The aim of these actions is “less financialization, less Wall Street and more “Main Street,” boost manufacturing in America and reduce global integration, with a focus on China and its subsidized economy and, yes, slave labor.

It’s a big gamble.

And we will eventually have to figure out how we trade and interact with the global economy. America First maybe, but it can’t be America Only.

The Administration has implemented a Dual Mandate.

Their North Star is: reduce interest rates so that:

The non-wealthy / “main-street” / “tenant-class” must pay less for consumer goods & energy (Bessant) and get out from under their tremendous debt load, and

The country’s $36 trillion debt can be refinanced at lower rates without bankrupting the country.

And I do have to say the method to this madness has been a bit, shall we say, brash. The execution is reckless. Perhaps that is the intent? Will they be right? I don’t know. But so far…

It’s working…

Oil prices:

10-Yr Treasury:

30-yr Mortgage:

Prices are cratering and the 10-yr treasury / 30-yr mortgage is cookin.

The Negotiation to Critical Mass Begins…

Become a Premium Subscriber to read the rest.

Become a paying subscriber to get access to this post and other subscriber-only content, like one-on-one calls with yours truly.

Upgrade for Just $5 Today!Subscription Benefits:

- Premium Content

- Market Insights

- One-on-One Call with me!