Welcome to the Skeptical Investor Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today’s Interest Rate: 6.28%!

(👇.22% from this time last week, 30-yr mortgage)

This week, we’re talkin’ more shenanigans with our government employment data, interest rates, and the coiled spring that is the housing market.

Let’s get into it.

The Weekly 3 in News:

Housing Inventory has started to decline. “While national active inventory is still up YoY, the pace of growth has slowed in recent months… some sellers have thrown in the towel (Lambert).”

Tennessee News - Google announces Tennessee as site for small modular nuclear reactor. 50 megawatts could be coming by 2030 (Reuters).

Nashville News - What cities are growing and which are not so far in 2025? Take a look. Nashville is an all-weather economy, growing steadily (Eisen).

Labor Market Starting to Stumble

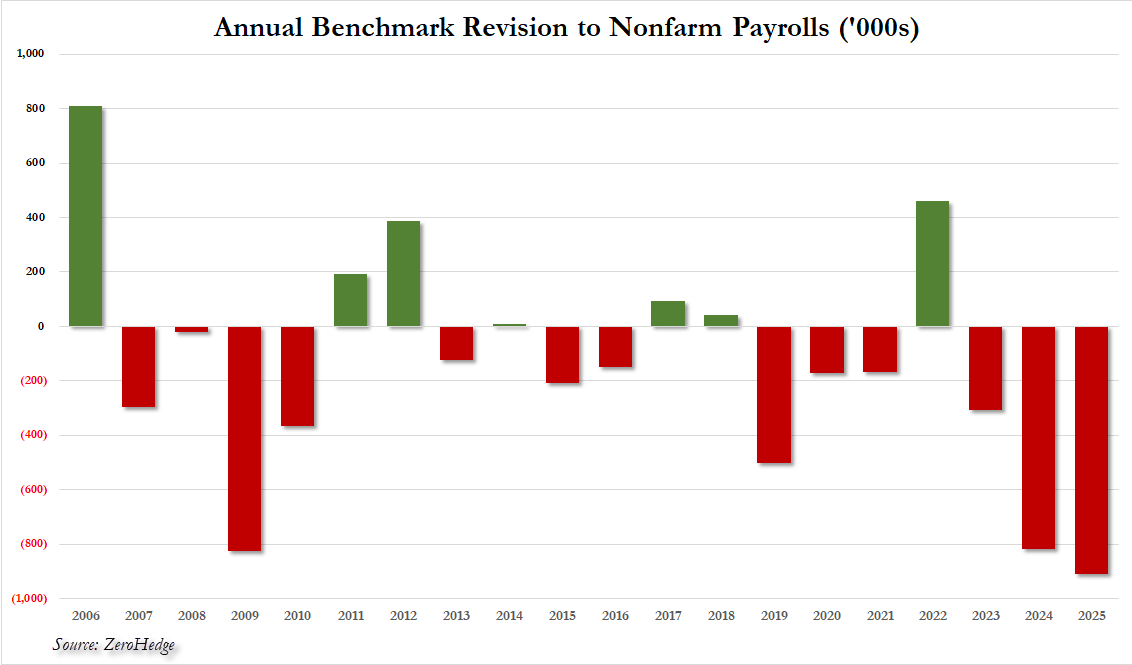

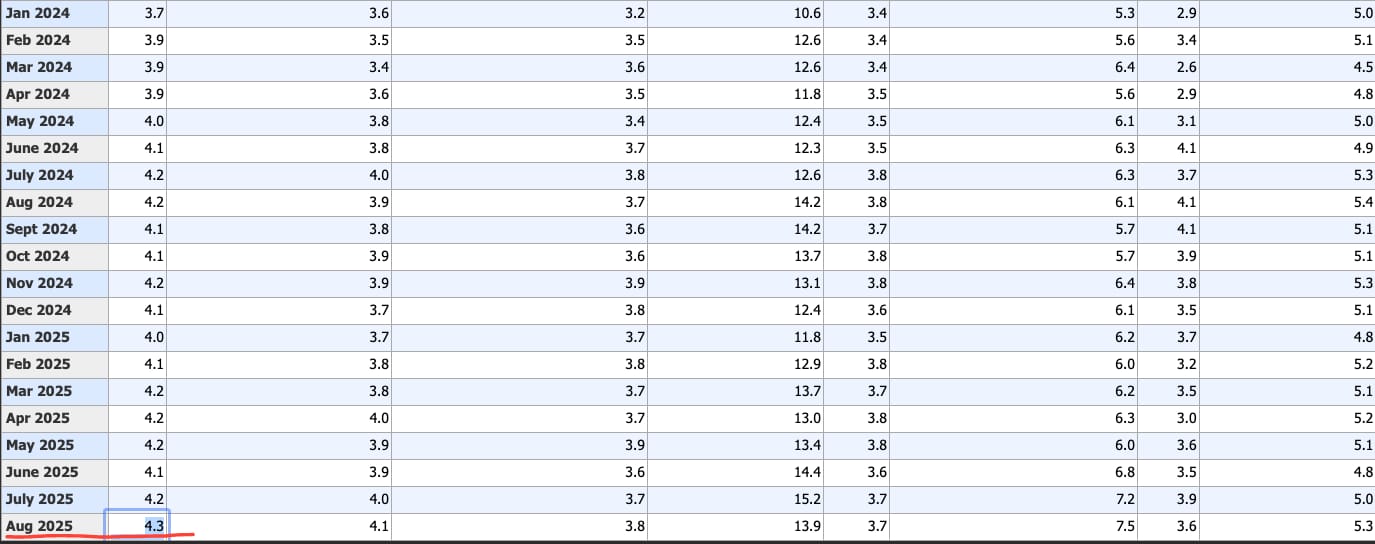

Hot off the presses this AM: the economy added -911,000 fewer jobs than initially reported during the 12-month period ending March 2025. The largest negative revision in 20+ years.

Yes, this is how the job data is collected, reported, and revised.

Yes. We are just finding this out now.

Yes, this is an insanely archaic process in 2025.

How inaccurate are we at reporting jobs data?

For historical sake, here is a chart showing just the revisions in the job numbers. The over at the BLS. Just look at how wrong they are, it often drastically overestimate jobs numbers, only to revise them down later.

This is the 3rd catastrophically large revision dating back to the Fall of last year. We have now erased ~2 million phantom jobs we thought had been created.

This is crazy.

Why the Revisions?

Each month, the BLS estimates job additions based on employer surveys. However, these initial figures are later refined using “better data” (known as the Quarterly Census of Employment and Wages (QCEW), which provides a clearer picture of employment trends. The preliminary estimate, released in August or September, offers a preview of revisions for the prior 12 months ending in March. A final revision follows in February, incorporating this data and adjustments to the BLS’s “birth-death model,” which accounts for the creation and closure of businesses.

This is why I have disdain for surveys; they do not produce accurate data.

A Quick Ad Break…

Ready to Start Your Next Construction Project?

May Construction is THE up-and-coming new construction builder making waves in the Nashville metro area.

Offering development and design/build consulting and focusing on residential new construction of all sizes and scales, May Construction is a strong contender for any investor looking for a sophisticated, repeatable builder relationship. Representative projects range from $135/SF 1600-2000 SF (approx cost) "nice builder grade" SF homes & townhomes to large-scale projects such as 14, 40, and beyond-unit townhome projects and large-format luxury specs in West Brentwood exceeding 8,000 SF.

Investor/client amenities of partnering with May include: industry-leading financial and project management & reporting tools, professional in-house interior design, unlimited residential/commercial licensure, & a proven, long-standing sub base.

May Construction clients praise their transparency, honest communication, and work ethic to perform at a high level on every project they take on.

A reliable contractor is worth its weight in gold. Call May Construction today

Unemployment Rate Unaffected

Importantly, these job revisions will not impact the unemployment rate, which is derived from a separate household survey…

Cool… more surveys. What could go wrong there?…

Why This is Important

Accurate data is extremely significant for businesses so they can make informed decisions on hiring, allocating capital, investing, research and development, etc. The same applies to how the government and the Federal Reserve react. Federal Reserve Chair Jerome Powell has reminded us time and time again that they are “data dependent.”

Well. What if the data is wrong? (And being late leads to the same outcome).

For example, we now know that there was virtually no job creation last year. So, the Fed would have very likely started cutting in February if it had accurate data.

This latest report gives credence to the White House firing the head of the BLS, illustrating their data collection methods as flawed. In fact, the White House is now preparing a report laying out alleged shortcomings of the Bureau of Labor Statistics’ jobs data, five weeks after President Trump fired the chief of the agency (WSJ). This is politically concerning and certain to stir more short-term uncertainty in the market, but it is also likely necessary. We can’t keep doing this.

+ Job Cuts Worse in August

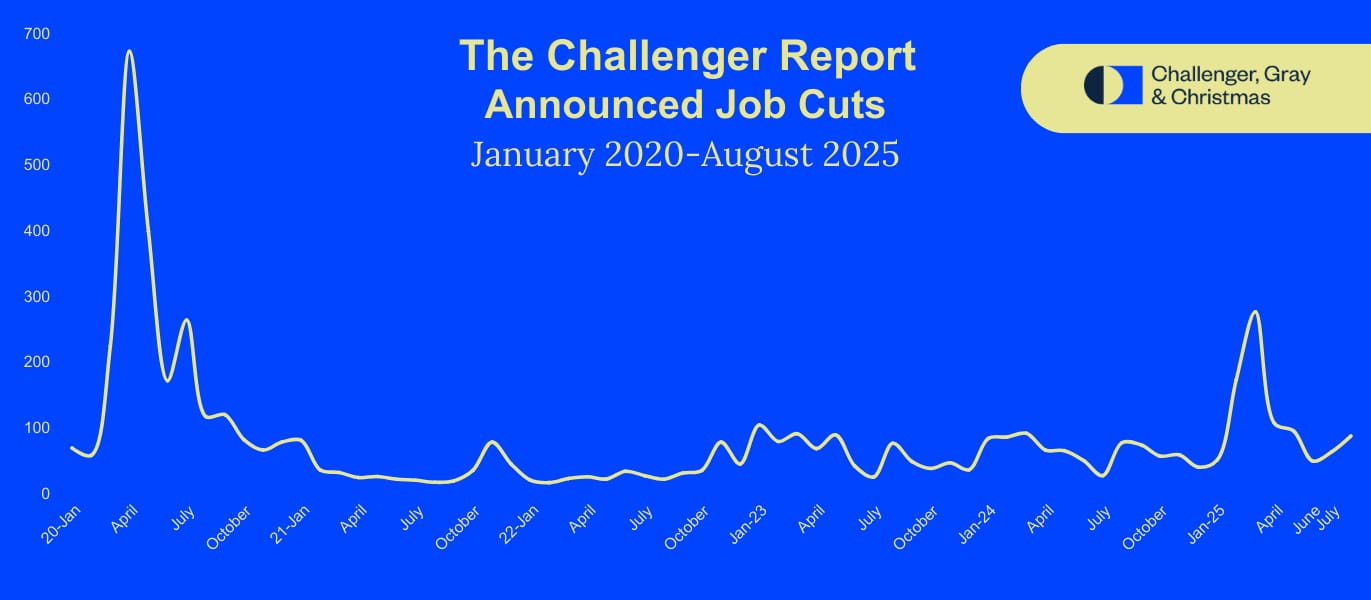

Numbers for job cuts were also recently released for August and they too add to the narrative of a weakening labor market.

U.S. businesses announced 85,979 job cuts in August, up 39% from July and up 13% YoY, according to executive coaching firm Challenger, Gray & Christmas. August’s total was the highest for the month since 2020 (115,762 job cuts). Before 2020, it was the highest August total since ‘08.

Year to date, companies have announced 892,362 job cuts, the highest YTD since 2020 (1,963,458). Importantly, YTD 2025 cuts are up 66%, vs the 536,421 job cuts announced through the first eight months of 2024.

Job Openings vs Unemployment

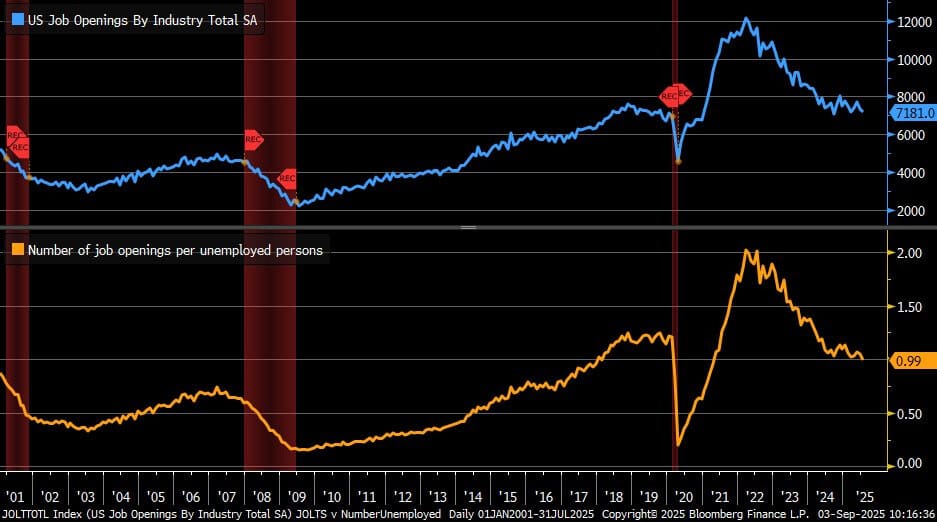

Lastly, we just crossed a significant line: the number of job openings per unemployed person just dipped below 1, for the first time since April 2021.

In other words, total unemployment may still be low, but the clear trend is to the downside.

A Quick Ad Break…

Cut Costs. Not Corners.

Economic pressure is rising, and doing more with less has become the new reality. But surviving a downturn isn’t about stretching yourself thinner; it’s about protecting what matters most.

BELAY matches leaders with fractional, cost-effective support — exceptional Executive Assistants, Accounting Professionals, and Marketing Assistants — tailored to your unique needs. When you're buried in low-level tasks, you lose the focus, energy, and strategy it takes to lead through challenging times.

BELAY helps you stay ready for whatever comes next.

Sector in Spotlight: Construction Workers

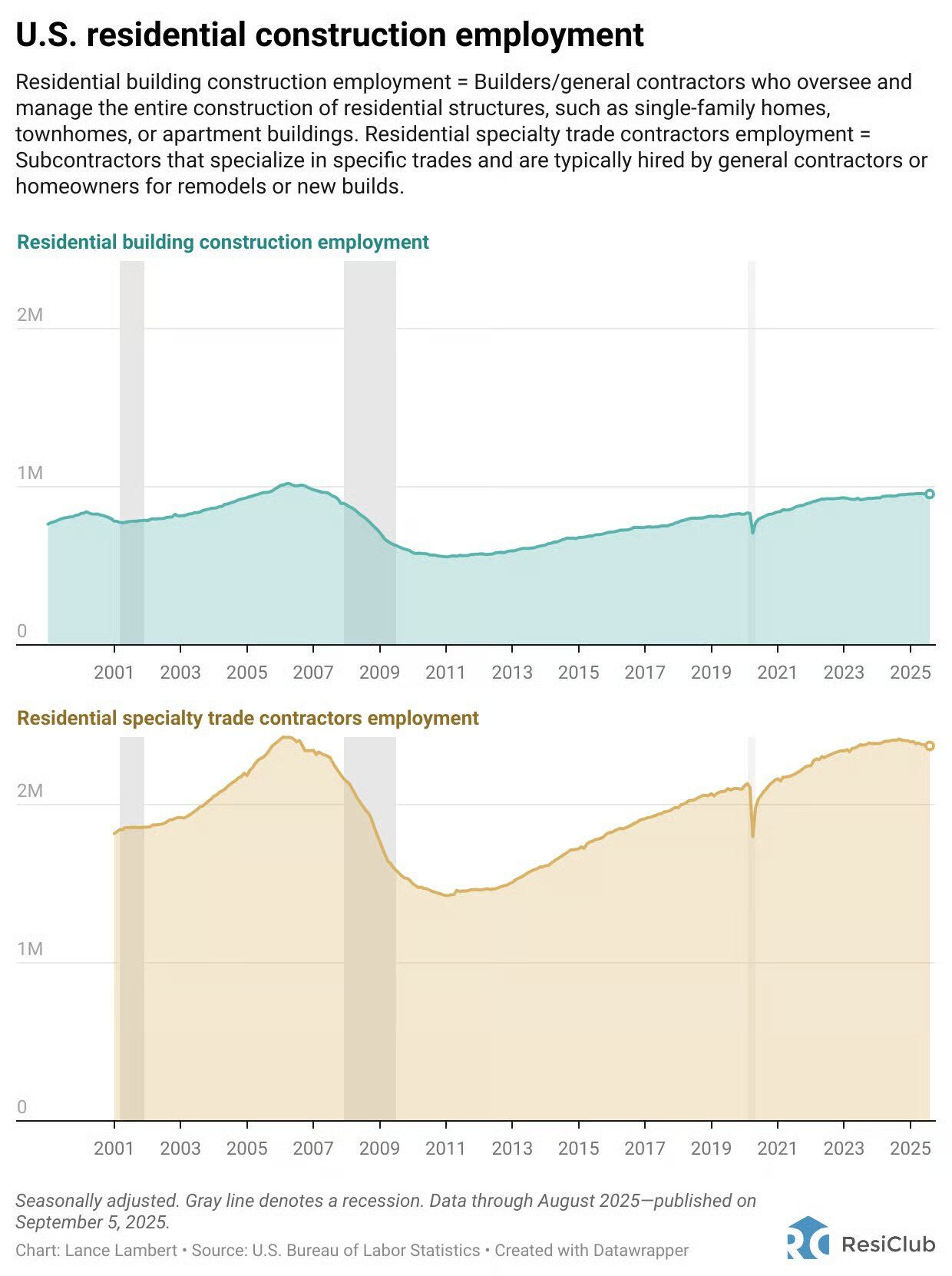

Construction workers are both important for us real estate investors to track, and are a bellwether data point. Cuts in construction jobs usually frontruns a recession.

Case in point: Construction workers are not feeling secure in their job today. Recent JOLTS data shows they are quitting at below 1%.

And perhaps for good reason. Construction labor just ticked down, ever so slightly, by 3800 jobs. Now, this is admittedly a very small number, but losses in construction jobs are a rare occurrence and again usually a leading indicator of overall economic weakness (ResiClub).

Ok, whew, that was a lot. Now, let’s look at the bright side, after that Doctor Doom labor market moment.

Silver Lining #1: Wages and the Consumer

Despite a slow uptick in unemployment to 4.3% (anything below 5% is considered “full employment”)…

…Wage growth has remained robust. Still growing at 3.7%, much faster than overall price inflation. In fact, wage growth has been higher than consumer inflation for 2+ years, even faster than shelter costs.

Silver Lining #2: Interest Rates and Bond Markets are Playing Ball

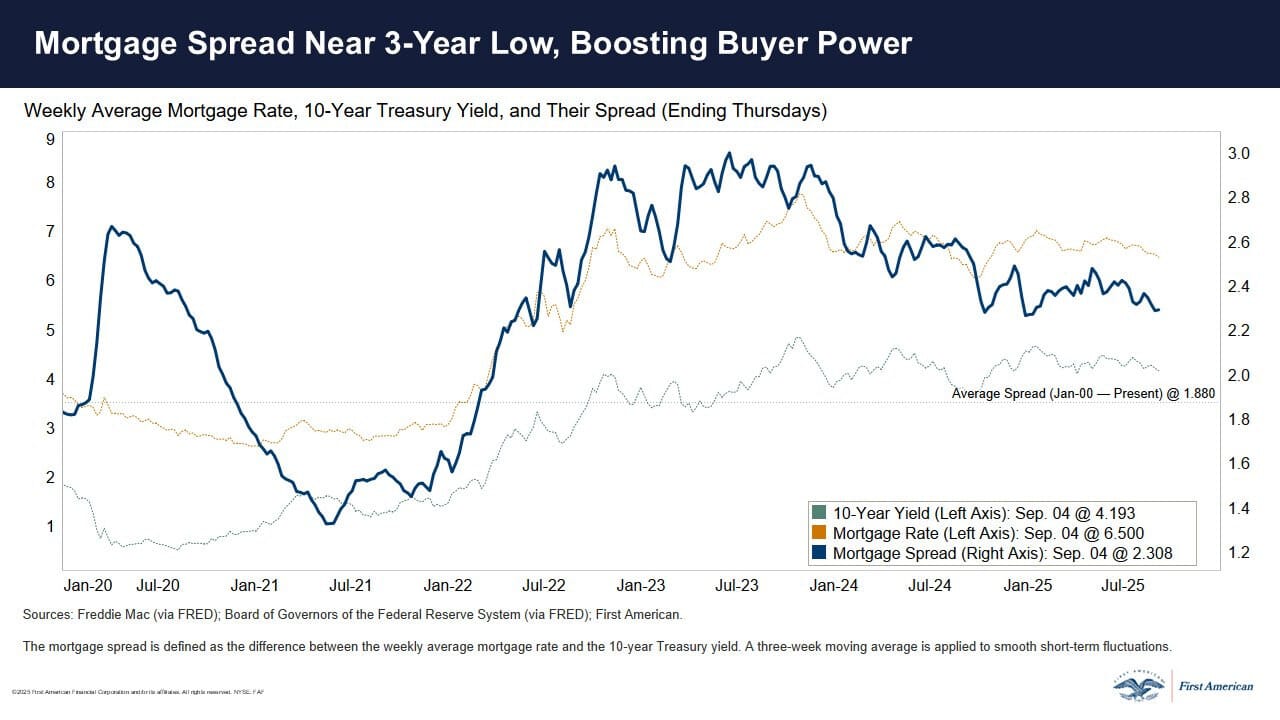

We have officially come full circle on interest rates, this without another rate cut from the Federal Reserve and amidst all the fun trade, tariff, international turmoil etc… We are now back to last year’s levels. A great chart (Robertson):

Today’s interest rate: 6.28%

A Quick Ad Break…

Invest in recession-resilient Mobile Home Parks with Vintage Capital

Invest in recession-resilient Mobile Home Parks with Vintage Capital. Invest direct or in a fund of 20+ underlying assets. 1031s are also available. Access stable, income-generating properties with consistent demand and low tenant turnover.

Now is the time to act: Current market conditions are creating opportunities to acquire properties at attractive valuations.

Our fund targets a 15%-17% IRR and makes monthly distributions, which provides a steady income stream alongside strong upside potential and tax-efficient benefits.

Recession-Resilient: Affordable housing demand drives stable returns in any economy

High Tenant Retention: The average MHP tenant stays 10-12 years (compared to 2-3 in Multifamily)

Proven Expertise: $100MM+ track record in mobile home park investments.

Tax-Smart Investing: Bonus depreciation offers tax advantages.

Want to advertise to the more than 20,000 weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

New Coffee Table - Part Zwei.

And I know you all want to see it. Here is my finished product from last week. Live-edge coffee table.

Sandpaper and poly are magical.

My Skeptical Take:

For us real estate investors, the implications of a softening labor market are relevant.

In short, we may finally see, after 3 damn years of high interest rates, the bond market and Federal Reserve work together and stop the vigilante infighting. They both care most about labor, even over inflation and it is starting to bring them together.

Just look at the spread between the 10-yr Treasury bond and mortgage rates (which track each other), today at a 3 year low, now dancing in tandem down the water spout.

And there is MUCH room to compress spreads. Today’s spread is 2.23%. The historical average is 1.76% (since the 1970s).

This means, even IF the Fed does not cut rates, and/or the bond market does not play ball, mortgage rates could normalize down to 5.81%!

What happens when the Fed starts to cut again, as I still expect them to do in September and likely again before year’s end?

We would be in the 5% range. Perhaps by Spring (as I predicted earlier this year 🤞).

Housing Demand is Coiled like a Cobra

There is plenty of pent-up demand from investors and homebuyers alike, coiling like a spring ready to be released once interest rates come down. And the longer the coiling, the bigger the jump when released.

We are now in year 3 of suppressed demand. That is quite the winding-up period.

Anecdote from the Arena - I had 2 real estate investor clients outbid this week on reasonable offers. The interesting thing, both were on properties that had been sitting on the market 90 days+. What are the odds that another higher offer would come in right when we were offering? What does this mean?

More investors are returning to the market now that rates are under 6.5%.

My advice: Start looking for your next deal.

The coil may be unwinding already.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. Want to start investing in real estate but are you STUCK? If you need a little push, read my new book! It is a must read for all investors. The 5 Ways Real Estate Investors Make Money and Build Wealth: Anyone can create wealth through real estate. Including You! (yes yes it’s a shameless plug, but I get ~$1/book, FYI. This is about education!). So pick your copy up today and get in the arena.

Please Share this Article!

We have passed 30,000 subs! Thank you for your support, next stop, 40,000!

Please help grow the community!

It takes me several hours to write this weekly article, and they will always remain free (but you get some pretty cool perks with premium, including a one-on-one with yours truly :). All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

What, did you think I was going to send you a Starbucks gift card? 😅

Subscribe Today! (and get some amazing perks)

Paid subscribers get the best stuff! Join the Skeptical Investor Community to access:

Premium content and NO paywall,

Every article we have published - a treasure trove of information and education,

Conversations with other investors in the Skeptical Investor community, and future meetups and special events,

Key insights and predictions on the latest financial news,

PLUS, subscriptions include an annual one-on-one call with me personally. So make sure to take advantage! Subscribe today.

Just $5 bucks a month.👇

Ready to Start Investing in Real Estate? Know someone who does?

We are real estate agents for investors, because we are investors. We specialize in helping investors find, analyze and negotiate great real estate deals, as well as manage their rental properties, here in Nashville, TN. We pride ourselves on being tough negotiators. We want our clients to get an amazing deal, we never let our clients pay retail.

Enjoying this newsletter? Know somebody looking to buy real estate? Send them to the best in the business, THE Nashville Investor Agent! Referring real estate business helps us keep the lights on and me keep pushing out fresh real estate analysis each and every week. Help peep this newsletter going for all you awesome folks out there; refer someone to us when you may hear they are in need. We promise to take great care of them and make sure they get a fantastic deal. They will thank you for it.

If you or someone you know are looking for an investment property, give us a call today!

You can also find out more about us and what we offer on our website: www.NashvilleInvestorAgent.com

Why Nashville? There is always a bull market somewhere, and one of them is Nashville. We have the lowest unemployment rate of the top 25 major cities and folks are moving here to take those jobs. Nearly 90+ people per day move to Nashville. And tourism continues to hit record levels. This past year 16.8 million folks visited our lively city. Plus we have 3 professional sports teams (hopefully a 4th soon), massive healthcare and entertainment industries, heavy manufacturing, more than a dozen colleges, no state income tax… to name a few amazing advantages. Come check us out, the water is warm :).